Paytm mall, India's largest e-commerce enterprise, announced that Alibaba group and ant group withdrew from the company's shareholders recently. As its strategic focus shifted from traditional physical commodity e-commerce to B2B export and open network digital commerce (ondc), with the strategic adjustment, the shareholders of pepl also changed, and Alibaba group and ant group withdrew from pepl.

At the same time, one 97 Communications Limited, the listed entity of paytm, the "Indian version of Alipay", has no direct or indirect equity relationship with pepl in the announcement, and Alibaba and ant group's shareholding in paytm remains unchanged.

At present, paytm e-commerce has proposed to reduce the company's share capital and securities premium account, and said it will hold an extraordinary general meeting on May 23.

According to the company's documents, paytm e-commerce repurchased all the equity of Ali (28.34%) and antfin (Netherlands) Holdings (14.98%) at the price of 420 million rupees, totaling 43.32%.

With the exit of ant financial and Alibaba, the valuation of paytm mall decreased from US $3 billion to US $13 million, a decrease of 99.5%. In July 2019, the company's valuation was once as high as $3 billion. According to the valuation, the shareholding value of ant financial and Alibaba in paytm mall was about $483 million and $684 million respectively.

Paytm mall was once the third largest electronic company in India. 14 months after its launch, paytm mall received a total investment of US $450 million from Softbank and Ali in Japan, with a valuation of US $2 billion, which promoted it to the list of e-commerce unicorns in India.

When paytm mall was founded, the Indian market was dominated by Amazon and flipkart, which had not been acquired by Wal Mart at that time. Therefore, paytm mall was once regarded as the leader of Alibaba and Amazon in the fight in India.

However, paytm mall's money burning rebate model puts it in a dilemma of growth.

It is reported that paytm mall had a net loss of US $245.65 million (Indian rupees 18 billion) in fiscal 2018, almost 150 times the net loss of US $1.86 million (Indian rupees 136.3 million) in 2017. The company's financial costs also doubled, from US $66852 (rs. 4.9 million) to US $6 million (rs. 440 million).

However, burning money did not help it make progress in the large e-commerce field dominated by flipkart under Amazon and Wal Mart. On the contrary, the market share of paytm mall in India decreased from 5.6% in 2017 to 3% in 2018, shrinking by nearly half.

These huge losses and unequal returns made paytm mall's board of directors and major investor Ali realize that paytm's trading volume is largely driven by cash back activities, which is not a sustainable business.

Under the pressure of investors, paytm mall began to take remedial measures, including closing India's e-commerce freight service and reducing rebate activities.

This change inevitably leads to the loss of users. Since then, the daily delivery volume of paytm mall has shrunk from 150000 pieces in October 2018 to 35000 pieces in March 2019.

As the number of orders and market share began to decline, paytm mall began to restructure its senior management team in early 2019, and a total of more than 100 employees were dismissed or transferred.

Among them, Amit Sinha, the chief operating officer of paytm mall, resigned from his position in the wholesale business. Other old employees of the company, including Amit bagaria, Saurabh vashistha and Shankar Nath, also resigned and founded a social e-commerce enterprise simsim.

According to a report released by Forrest Inc., after experiencing huge losses in 2018-2019, Alibaba refused to further inject capital into paytm mall, but shifted its investment focus to paytm's cloud computing and payment platform. In July of this year, eBay injected US $150 million into paytm mall, but Ali was not seen, and Softbank did not continue to follow.

In recent years, the Indian market has been regarded as a pastry, and Chinese enterprises were once very optimistic about it, with a huge amount of investment.

From the perspective of industry distribution, India's unicorns are mainly concentrated in the fields of e-commerce, financial technology, logistics and life services. Behind more than half of the Indian unicorns are the golden father from China, especially Alibaba and Tencent. Softbank is the largest investor in the Indian market.

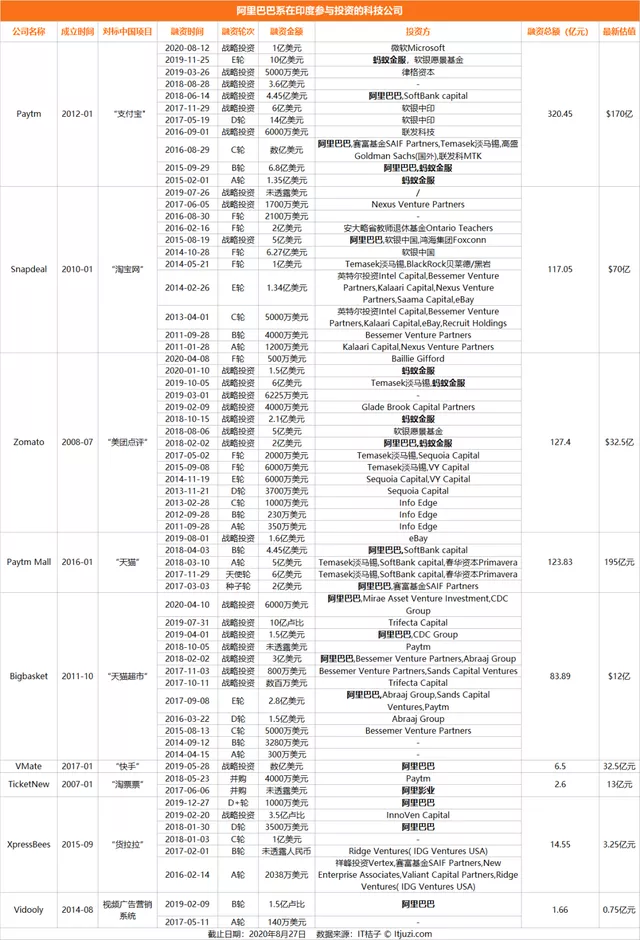

According to incomplete statistics, Ali has invested in 9 local technology companies in India and sold them 21 times. These companies are involved in high-frequency fields such as e-commerce, government, entertainment and travel. Among them, three projects are mainly invested by Ali for more than four times, including paytm, its online retail website paytm mall, online grocer bigbasket, restaurant review and takeout distribution platform zomato; These companies have also developed into Indian unicorns.

It orange data show that in 2020, Ali publicly disclosed only two investments in India. In January, ant financial invested $150 million in zomato, the "meituan review" in India; In April, Alibaba invested $60 million in bigmarket, an Indian "online supermarket".

But in the past two years, due to geopolitical reasons, the Indian market is facing uncertainty.

For example, Xiaomi was once detained for several billion yuan, and Huawei and ZTE were forced out of 5g network bidding.

As early as 2020, there was news in the market that Ali had temporarily stopped its investment plan in Indian companies and would not invest any more money in India for at least six months.

In addition, due to the government's boycott, Alibaba also stopped the services of UCWEB and other innovative businesses in India, reduced Indian employees and even completely dissolved the relevant teams.