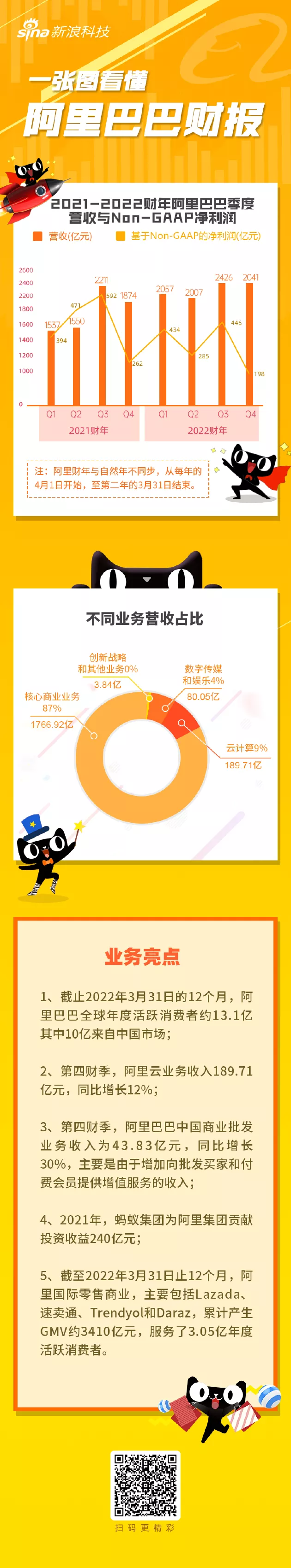

Alibaba (NYSE: Baba; HK: 09988) today released the fourth quarter and full year financial statements of fiscal year 2022 as of March 31, 2022 (Note: Alibaba's fiscal year is out of sync with the natural year, starting from April 1 of each year and ending on March 31 of the second year). According to the financial report, the company's revenue in the fourth quarter was 204.05 billion yuan (about US $32.188 billion), a year-on-year increase of 9%.

The net loss attributable to common shareholders was 16.241 billion yuan (about US $2.562 billion). Not calculated according to US GAAP, the net profit was 19.799 billion yuan (US $3.123 billion), a year-on-year decrease of 24%.

In fiscal year 2022, Alibaba's total revenue was RMB 853.062 billion (US $134.567 billion), a year-on-year increase of 19%; The net profit attributable to common shareholders was RMB 61.959 billion (US $9.774 billion), a year-on-year decrease of 59%. If not calculated according to US GAAP, the net profit was RMB 136.388 billion (US $21.515 billion), a year-on-year decrease of 21%.

Fourth quarter results:

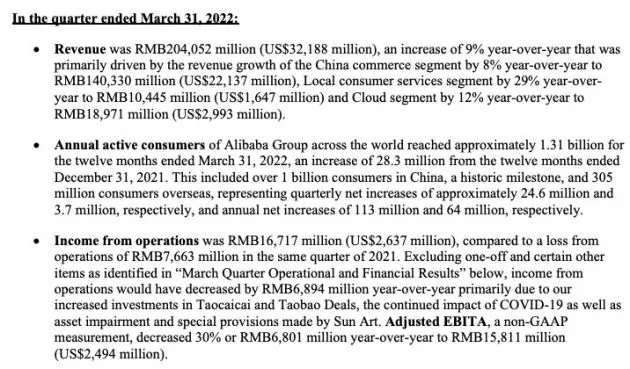

The revenue was 204.052 billion yuan (about US $32.188 billion), an increase of 9% compared with 187.395 billion yuan in the same period last year.

The revenue from China's commercial retail business was 135.947 billion yuan (about US $21.445 billion), an increase of 7% over 127.021 billion yuan in the same period last year.

The revenue from China's commercial wholesale business was 4.383 billion yuan (about 692 million US dollars), an increase of 30% over 3.37 billion yuan in the same period last year.

The revenue from international commercial retail business was 9.887 billion yuan (about US $1.56 billion), an increase of 4% over 9.496 billion yuan in the same period last year.

The revenue from international commercial wholesale business was RMB 4.448 billion (about US $701 million), an increase of 13% over RMB 3.92 billion in the same period last year.

Revenue from local consumer services was 10.445 billion yuan (about US $1.647 billion), a year-on-year increase of 29%.

The revenue from rookie logistics services was 11.582 billion yuan (about US $1.827 billion), a year-on-year increase of 16%.

The revenue from cloud computing business was 18.971 billion yuan (about US $2.993 billion), a year-on-year increase of 12%.

Revenue from digital media and entertainment was 8.005 billion yuan ($1.263 billion), down 1% year-on-year. Revenue from innovation strategies and other sources was 384 million yuan (about US $60 million), down 35% year-on-year.

The revenue cost was 138.945 billion yuan (about US $21.918 billion), accounting for 68% of the revenue. The revenue cost in the same period last year was 125.454 billion yuan, accounting for 67% of the revenue.

Product development expenditure was 10.94 billion yuan (about US $1.726 billion), accounting for 5% of revenue. The product development expenditure in the same period of last year was 13.302 billion yuan, accounting for 7% of revenue.

Sales and marketing expenses amounted to 27.2 billion yuan (about US $4.291 billion), accounting for 13% of revenue. The sales and marketing expenditure in the same period last year was 25.153 billion yuan, accounting for 14% of the revenue.

General and administrative expenses amounted to 7.415 billion yuan (about US $1.169 billion), accounting for 4% of revenue. The product development expenditure in the same period of last year was 27.734 billion yuan, accounting for 14% of revenue.

The equity incentive expenditure was a net reversal of 3.737 billion yuan (about 590 million US dollars), compared with 8.632 billion yuan in the same period last year.

The amortization of intangible assets was 2.831 billion yuan (about US $447 million), down 17% from 3.415 billion yuan in the same period last year.

The operating profit was 16.717 billion yuan (about 2.637 billion US dollars), accounting for 8% of the revenue; The operating loss in the same period last year was RMB 7.663 billion, accounting for - 4% of the revenue.

Adjusted EBITDA was 23.373 billion yuan (about US $3.687 billion), down 22% from 29.898 billion yuan in the same period in 2021.

Adjusted EBITA was 15.811 billion yuan (about US $2494 million), down 30% from 22.612 billion yuan in the same period in 2021.

Interest and investment income was a loss of 36.708 billion yuan (about US $5.791 billion), compared with 111 million yuan in the same period last year.

Other income was 1.62 billion yuan (about US $323 million), compared with 2.115 billion yuan in the same period last year.

Income tax expenditure was 2.079 billion yuan (about US $328 million), compared with 7.049 billion yuan in the same period in 2021.

The net loss was 18.357 billion yuan (about US $2.996 billion), compared with a net loss of 7.654 billion yuan in the same period last year. Not in accordance with non GAAP, the net profit was 19.799 billion yuan (about US $3.123 billion), a year-on-year decrease of 24%.

The net loss attributable to ordinary shareholders in the same period of last year was RMB 16.25 billion (about RMB 4.15 billion).

The diluted loss per American depositary share was 6.07 yuan (about US $0.96), and the diluted loss per ordinary share was 0.76 yuan (about US $0.12 or HK $0.94).

Not in accordance with non GAAP, the diluted earnings per American depositary share is 7.95 yuan (about US $1.25), and the diluted earnings per ordinary share is 0.99 yuan (about US $0.16 or HK $1.22).

The net cash outflow from operating activities was 7.040 billion yuan (about US $1.111 billion), compared with an inflow of 24.183 billion yuan (about US $3.691 billion) in the same period last year.

The net cash used in investment activities was 87.254 billion yuan (about 13.764 billion US dollars), and the net cash used in financing activities was 10.614 billion yuan (about 1.675 billion US dollars).