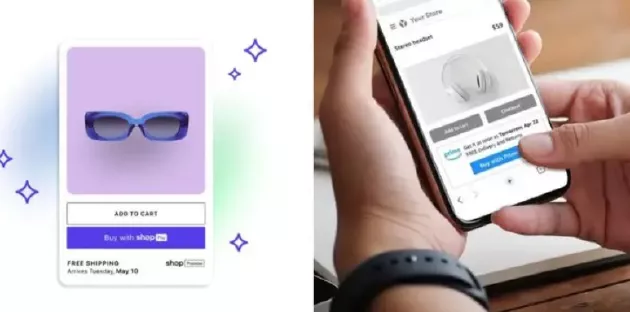

It is reported that Shopify and Amazon have recently announced a new function, that is, the expected arrival time of packages to consumers, and the consumer competition between the two e-commerce giants is more intense. At the end of April, Amazon launched the buy with prime service, which allows online sellers to provide prime related services to customers shopping on websites other than Amazon, such as rapid transportation, free delivery and free return.

Just last Thursday, Shopify also launched a similar service while publishing its financial report. The new service is called shop promise, which will provide shoppers with the expected delivery dates of merchant stores and other sales channels (such as Google, Facebook and instagram). Shopify also provides package tracking service through its shop app, allowing users to know the status of packages and their current location at any time.

The deployment speed of shop promise depends on the construction speed of Shopify performance center network (SFN), because this new feature is only available to U.S. merchants using SFN. Shopify confirmed that it plans to buy deliverr, a light asset performance start-up, for $2.1 billion. Shopify said the deal will help them speed up their plan. Nevertheless, Amy shapero, chief financial officer of Shopify, confirmed on the earnings conference call that SFN would not reach sufficient scale until the end of 2023 at the earliest. In contrast, Amazon has been providing transportation services under the Shopify plan for more than a decade.

The launch of new services marks that the competition between Shopify and Amazon is becoming more intense. For a long time, the two enterprises have a competitive relationship, but this relationship is rarely mentioned.

Dan Romanoff, senior equity research analyst at Morningstar, said: "Amazon will certainly notice Shopify's move, which is the latest in a series of measures to improve its competitive position."

On Thursday's earnings conference call, William Blair analyst Matthew pfau asked Shopify CEO TOBI L ü tke whether buy with prime would affect Shopify's overall business or its more specific delivery plan. L ü tke's answer to this question lasted three minutes, diluting the potential impact of competitors and buy with prime on Shopify.

Shopify currently does not allow merchants to use other checkout options in their online stores, such as buy with prime. However, lutek said on the earnings conference call that Shopify would be willing to integrate buy with prime into its services, just as they have cooperated with meta, Google and tiktok.

Shopify spokesperson did not respond to requests for comment from the media. The company said l ü tke's speech on the phone was his personal point of view and the company still needed to collect details.

In the past, l ü tke has set Shopify's goal to fight Amazon, an e-commerce empire.

Rick Watson, CEO of RMW business consulting, said: "in a sense, it does show that l ü tke is obviously becoming more mature, and there is no doubt that Shopify's view of Amazon has changed. Three years ago, Shopify would never 'transport its troops with Amazon ships'."

Angelo Zino, senior investment strategist at CFRA research, said that although lutek showed a positive response at the company's earnings conference call, buy with prime did "increase the intensity of competition in Shopify".

Buy with prime may not be Amazon's last product that may pose a threat to Shopify. According to the report in early April, Amazon has a mysterious team, internally called project Santos, whose main task is to resist the threat of Shopify to Amazon's dominant position in e-commerce.

It is reported that in the past two weeks, the launch of buy with prime has triggered a heated debate within Shopify. Product team members discussed whether to develop relevant tools to let other businesses use buy with prime.

Shopify's earnings in the last quarter were lower than investors' expectations, and the financial reports of Amazon, Etsy and eBay also showed signs of slowdown in the growth of e-commerce business. Shopify's revenue rose 22% year-on-year to $1.2 billion, while analysts expected it to be $1.25 billion. Total merchandise sales, the total value of goods purchased through Shopify, rose 16% to $43.2 billion, compared with analysts' previous estimate of $46.5 billion.

After the financial report, Shopify's share price fell by more than 14%. Since the peak of the epidemic in the autumn of 2021, the company's share price has fallen by about 70%.