The two-year long transnational palace duel drama has come to a grand finale. On May 5, 2022, the official microblog of anmou Technology (China) Co., Ltd. ("anmou technology") issued a statement that the board of directors of the company had passed a unanimous resolution in accordance with the articles of association and relevant laws and regulations, and decided to appoint liurenchen and Chen Xun as the joint chief executive officer of anmou technology from April 24, 2022, and formally registered liurenchen as the legal representative and general manager of the company at Shenzhen market supervision administration on April 28**

Author / Zhong Wen

Anmou technology immediately held an online general meeting for employees in multiple offices, and the new co CEO liurenchen and Chen Xun officially appeared.

According to PinWan, after the "transition period" in May, the new management team has taken over the offices of anmou technology in Shenzhen, Shanghai, Beijing, Chengdu and other places. At the same time, according to the previous Caixin weekly report, "wuxiongang is also facing the threat of another legal lawsuit. Several people told Caixin that on May 6, anmou has sued wuxiongang for damaging the interests of the company." A few days ago, PinWan got similar news again from another way.

Wuxiongang and the companies under his control are still acting as the general partner (GP) to control Anchuang growth equity investment partnership (limited partnership) ("Anchuang growth"), arm ecosystem Holdings (Hong Kong) Limited, tl1016 technology limited and anmou investment management partnership (limited partnership) ("anmou investment") of Ningbo Meishan free trade port, The above four SPVs hold 13.3%, 1.6983%, 1.2% and 0.4715% of the equity of anmou technology respectively, so the subsequent disposal of Wu xiongang's equity is of particular concern.

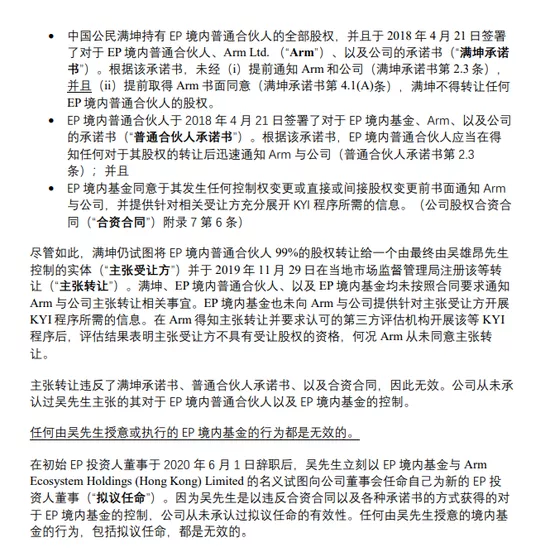

PinWan recently noted a lawyer's letter from Softbank group to the relevant LP shareholders of anmou technology about the invalid transfer of equity and control of its GP (general partner) Shenzhen Anchuang Technology Investment Management Co., Ltd. ("Anchuang investment"), Softbank stressed in the letter that the transfer of equity and control of the general partner (i.e. Anchuang investment) of EP domestic fund (i.e. Anchuang growth) previously obtained by wuxiongang from man Kun was invalid.

Figure source: Lawyer's letter from Softbank group to relevant LP shareholders of anmou Technology

"Since Mr. Wu obtained control over EP domestic funds in violation of the joint venture contract and various letters of commitment, the company has never recognized the validity of the proposed appointment. Any act of domestic funds inspired by Mr. Wu, including the proposed appointment, is invalid."

A series of events in the past two years can be divided into three stages. The first stage, from June 2020 to April 2022, is the stage of "removing Wu xiongang". The second stage, April and may 2022, is the stage of completing the industrial and commercial change and actually "dismissing Wu xiongang". At present, it seems that it has entered the closing stage of "removing Wu xiongang" in anmou technology.

With the end of the two-year dispute over the governance chaos and management rights of anmou technology company, the doubts about the future of anmou technology have not been completely dispersed - how will anmou technology continue to develop, how to undertake the huge demand of China's semiconductor industry, and whether the past self-research strategy will continue?

After the two-year impasse over the recall, "the GP control obtained by Wu is invalid"

On June 10, 2020, arm company and Hopu capital jointly issued a statement saying that the board of directors of anmou technology held on June 4 voted 7:1 to dismiss Wu xiongang because his behavior had a conflict of interest with anmou technology, and appointed two temporary joint CEOs at the same time. However, anmou technology, which was actually controlled by Wu xiongang, issued a negative statement, thus opening a two-year "recall tug of war". As Wu xiongang took control of the company's official seal and business license, the recall action was at an impasse. After you sang, I came on stage, which opened the eyes of people in the semiconductor industry.

Wuxiongang, an American, joined arm USA in 2004; In 2009, he became the general manager and vice president of sales in China; President of China in 2011; In 2013, he was promoted to President of Greater China; Joined the arm Global Executive Committee in 2014. In 2018, he became the leader of anmou technology.

Arm and Hopu have disclosed to the public that Wu xiongang established an investment fund alphatecture in his personal capacity during his tenure as chairman and CEO of anmou technology. The fund raised funds by taking advantage of arm's industry position and invested in some downstream customer projects. But the arm board didn't know.

According to the manuscript of the media Caijing Tianxia, Wu xiongang has carried out complicated foreign investment, and these companies have formed a direct conflict of interest with anmou technology. Wu did not respond to Caijing Tianxia's comments.

According to the inquiry of PinWan, as of press time, the equity structure of anmou Technology: arm limited 47.3285%; Amber Leading (Hong Kong) Limited 36.000%; Anchuang growth equity investment partnership (limited partnership) ("Anchuang growth") in Ningbo Meishan free trade port 13.3008%; Arm Ecosystem Holdings (Hong Kong) Limited 1.6983%; TL1016 Technology Limited 1.2000%; Ningbo Meishan bonded port area anmou investment management partnership (limited partnership) ("anmou investment") 0.4715%. The GP managers of Anchuang growth and anmou investment are Shenzhen Anchuang Technology Investment Management Co., Ltd. ("Anchuang investment").

According to the report of Caijing Tianxia, when taking a stake in anmou technology in 2018, Anchuang investment was 100% owned by man Kun, a Chinese citizen. However, on November 29, 2019, the equity and control of Anchuang investment were transferred, and the actual controller became Kosen information technology consulting (Shanghai) Co., Ltd., which was 100% owned by Wu xiongang. On april24,2020, Wu xiongang transferred all the equity of Kosen information to acorn spring Limited, a company established in Hong Kong.

After the transfer, the control rights of 13.3% and 0.4715% equity of anmou technology held by Anchuang growth and anmou investment have been completely transferred, which is also the statement that Softbank group wrote to the shareholders of anmou technology LP about the invalidity of the transfer of equity and control rights of Anchuang investment.

Some people believe that Wu xiongang's move seems to be to maximize his interests in anmou technology during the arm IPO. Some media broke the news that Wu xiongang had asked to get $200million for his withdrawal.

Softbank first denied Wu xiongang's effective status as the GP (General Manager) of Anchuang investment in the document, "for the avoidance of doubt, no one can serve as a director of EP investor before completing the Kyi procedure specified in the joint venture contract. The Kyi procedure has determined that Mr. Wu is not qualified to serve as a director, so Mr. Wu cannot serve as a director of EP investor. Therefore, Mr. Wu has never been legally appointed as a director of EP investor."

Softbank subsequently expressed the possibility of IPO Exit of other shareholders in the document, "Softbank is discussing with the board of directors of the company various ways for shareholders to exit at an appropriate time, including the possibility of potential initial public offering (IPO). According to the basic requirements of relevant regulatory bodies, the premise for IPO or major transactions is that corporate governance is legal, compliant and reasonable."

Although there are still some "finishing" work, it is certain that Wu xiongang's drama of threatening the future prospects of China's semiconductor industry, launching a dispute with arm and a scuffle over management rights is coming to an end. It seems that the change of legal representative and the appointment of new management also represent the final attitude of the regulatory level.

Mutual achievements of anmou "two wheel drive" and China Semiconductor

In addition, it is worth paying attention to the "two wheel drive" strategy that anmou technology has implemented in the Chinese market in the past. Will this strategy continue?

In August 2021, anmou technology officially released the "two wheel drive" strategy, which on the one hand continued to promote the localization and ecological development of ARM CPU architecture; On the other hand, the company launched a new business brand of "core power", focused on independent research and development, and created XPU products with independent architecture and diversified ecology. The former is the continuous external authorization based on ARM technology architecture, and the latter is the self-developed IP launched by anmou technology under the leadership of Wu xiongang. The workshop believes that this is actually the "arm China de arm" led by Wu xiongang.

How to understand the relationship between arm IP and self-developed IP?

Anmou technology has the exclusive sales agency right of arm IP in Chinese Mainland, Hong Kong and Macao. Arm IP can be compared to "raw materials". Many "chefs" with R & D ability are only willing to purchase "raw materials" and "cook" with their own skills; The self-developed IP of anmou technology is more like a packaging scheme based on ARM IP, which is provided to customers in a simpler way of "prefabricated dishes".

In January this year, anmou technology summarized its achievements through a retrospective manuscript: "in 2021, the company's domestic customers' shipments based on self-developed IP chips exceeded 100million, the number of domestic customers' self-developed IP licenses exceeded 100, the number of new core technology patents exceeded 70 in 2021, and the number of streaming and mass production exceeded 30". "Based on the arm architecture, the cumulative shipments of Chinese chips exceeded 25billion. At the same time, the shipments of domestic customers grew by more than 250 times in the past 10 years.".

In the past, it can be said that arm IP supported the rapid development of China's SOC chip design industry, and was often regarded as a "chess piece" by conspiracy theory in a larger context. In terms of the pyramid structure of the industry, IP is a top-level technology, which is very critical. In the past few years, companies such as Hisilicon, zhanrui, and pingtouge have achieved similar "building block" development by purchasing such IP, greatly shortening the chip development cycle and saving design costs. For example, the Yitian 710 server chip launched by pingtouge last year was designed based on ARM technology.

Source: anmou China

Wuxiongang often likes to "closely link" the development of anmou technology with the destiny of China's semiconductor industry. He has always emphasized that anmou technology is an independent company that serves the development of China's semiconductor industry. Due to the special status of his company and the current special background, it can be said that he has "broken his heart" for China's semiconductor industry. In fact, there are different attitudes towards this statement. Everything today is the result of the development and evolution of arm architecture, the opening of the Chinese market, the rapid development of China's semiconductor industry in the past few years and other factors, which belong to mutual achievements.

For two years, the "internal struggle" of anmou technology has shown an uncertain state. At the latest employee conference, the legal representative and co CEO liurenchen emphasized four points:

First, the independence of anmou technology remains unchanged. The change of the company's legal representative and CEO is not a unilateral act of any foreign shareholder. Therefore, the external statement that "some foreign shareholders withdraw the joint venture" is completely empty.

Second, the strategy of anmou technology remains unchanged. The change of leadership will not affect the positioning and development of anmou technology as an independent company with majority equity held by Chinese investors, and will continue to maintain independent development in the future and continue to provide services and support for the development of relevant industries in China.

Third, the commitment of anmou technology to employees remains unchanged. As for the employee stock ownership plan (ESOP), the board of directors of the company promised that under the leadership of the new leadership, the company would immediately implement ESOP and grant options to the existing anmou technology employees after the smooth transition and normal operation.

Fourth, the organizational framework of anmou technology remains unchanged, and there is no so-called forced layoff plan. The new leadership will continue to deepen the talent strategy, continue to attract, train and make good use of talents.

Co CEO Chen Xun is also optimistic about the development of China's semiconductor industry. China is now the most active market for semiconductor and core computing technologies in the world. With an annual output of more than 100 billion yuan, the chip design industry is unparalleled in terms of market scale.

Several shareholders also jointly promised to maintain the independent operation of anmou technology as a company with majority shares held by Chinese investors, and the strategic cooperation, IP licensing agreement and business model between arm and anmou technology will remain unchanged. Anmou technology will still be the exclusive commercial distribution channel for arm to provide IP authorization to Chinese companies. Anmou technology will also continue to develop its own IP.

For the statement of anmou technology, we would like to see that: when selling arm IP, we continue to increase the investment in local self-developed IP. On the one hand, we attach importance to the development of China's local chip market; In addition, the establishment and improvement of the local IP supply chain is also due to the R & D environment and prospects in China. Only by truly supporting China's chip market from the aspects of R & D, design, production and talents, can we obtain greater market value. This should also be the unswerving development direction of anmou science and technology in the new stage.

Anmou technology finally ended the turmoil. "This is what customers and partners most want to see," said an analyst.