As the Federal Reserve is shrinking its nearly $9trillion balance sheet, the speculative darling of the era of easy money - technology stocks and cryptocurrencies - are now extremely vulnerable. At the same time, from Canada to Europe, major central bank governors are about to shrink their balance sheets on a large scale. They followed in the footsteps of American hawkish policymakers and began to implement the task of reducing liquidity, ending the bond buying boom during the epidemic. The Federal Reserve began to reduce its asset holdings this month, a process known as "quantitative tightening".

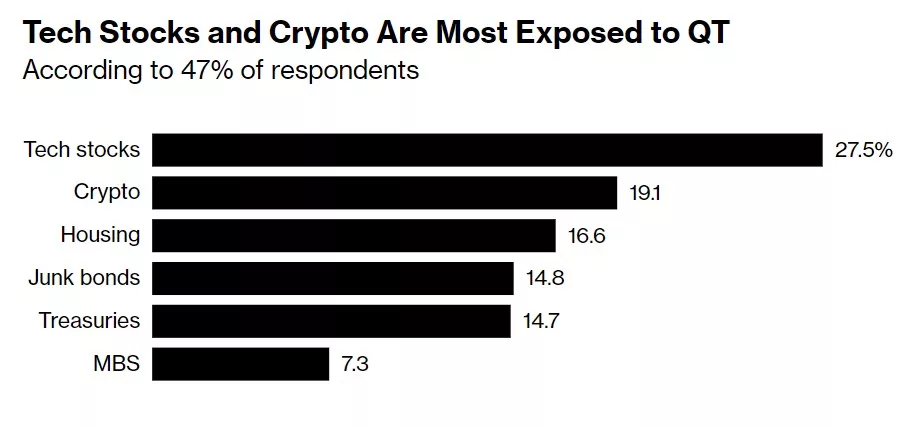

This is the most popular answer given by 687 participants in the latest MLIV pulse survey.

This historic shift is seen as a huge threat to technology stocks and digital currencies, two risk sensitive assets that soared in the market frenzy during the outbreak and plummeted in this year's Cross asset crash.

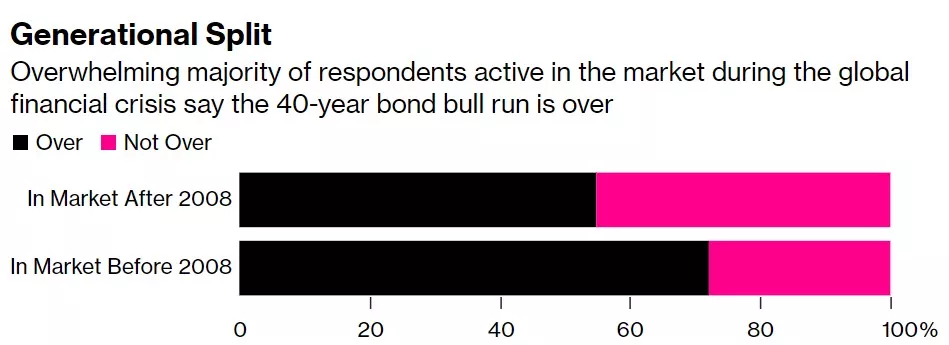

The era of ultra cheap money now seems to be over. The Fed's balance sheet is expected to shrink for more than a year, and nearly two-thirds of respondents said that the 40 year bull market in US Treasury bonds has ended.

The background of all this is that the Federal Reserve is raising interest rates at the fastest rate in decades to combat burning inflation, and officials are trying to quell the rumors that the interest rate hike in September will be suspended.

Recent fluctuations in the stock market, bond market and other markets have failed to prevent the fed from taking a tough stance. Zhitong finance understands that the market generally expects that the Federal Reserve will raise interest rates by another 50 basis points on June 15. The Federal Reserve began to shrink its balance sheet this month, allowing assets to mature without reinvestment, with a monthly scale of $47.5 billion, and increased to $95billion in September.

Lisa shalett, chief investment officer of Morgan Stanley wealth management, said: "it is in those areas with the most favorable amount of capital and liquidity that people will continue to feel its withdrawal - this is the area with the highest degree of speculation in the market."

MLIV conducted a survey on the most risky assets in the era of quantitative tightening, including retail investors and market strategists. Only 7% chose mortgage-backed bonds, and nearly half chose technology and cryptocurrency.

Under the same other conditions, withdrawing funds from the system will often tighten the financial situation, thus inhibiting economic growth. This could reduce the valuation of technology stocks, as they rely on optimism about future profits.

The end of the Federal Reserve's bond purchase program also forces the US Treasury to sell more bonds in the open market, which may put upward pressure on bond yields. Bond yields play an important role in Wall Street's valuation of listed companies, especially against so-called growth stocks.

Driven by the loose policies during the epidemic period, the Nasdaq 100 index dominated by technology stocks rose by more than 130% from the low point in march2020, and began to plummet this year.

At the same time, cryptocurrency is increasingly affected by fluctuations in technology stocks. Since march2020, there has been a strong positive correlation between bitcoin and Nasdaq 100 index, which has been further strengthened in this year's selling.

Their idea is that when money is cheap, traders can speculate on future digital trends. But as the liquidity binge fades, the cost of these bets becomes higher.

Matt Maley, chief market strategist at Miller Tabak + Co., said: "I don't think people are fully aware of the extent to which quantitative easing has led investors to increase a lot of leverage in their positions. Now we are experiencing quantitative tightening, and the leverage must be lifted."

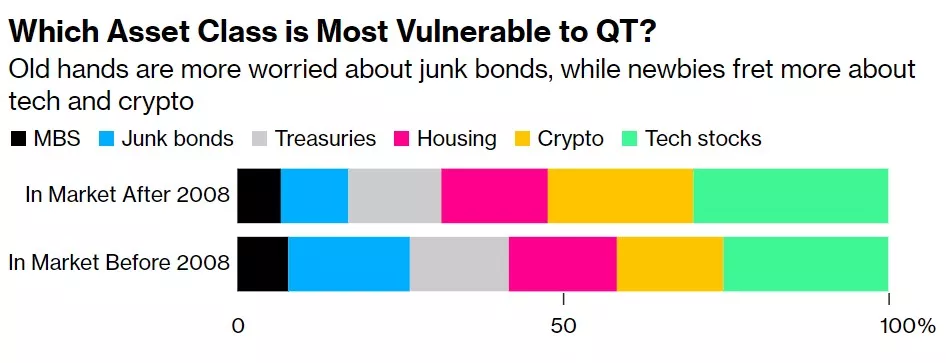

Respondents active in the market during the financial crisis more than a decade ago were particularly worried that the contraction of the Federal Reserve's balance sheet would damage junk bonds. New entrants to financial markets are more likely to worry about its impact on cryptocurrencies and technology stocks.

As central banks such as the European Central Bank and the Bank of England seek to control the expansion of their balance sheets, a wider range of MLIV respondents are warning about global trading conditions. Nearly 53% of respondents said they were worried that the market underestimated the importance of non US central banks in liquidity.

Only 8% thought that quantitative tightening was exaggerated in general. However, the main concern of MLIV readers remains how much the Federal Reserve will raise the benchmark borrowing cost in this cycle. About 61% believed that the peak level of the terminal federal funds rate was more important than the contraction of the balance sheet.

As for the final strategy of quantitative tightening, about two-thirds of the surveyed participants believe that the main catalyst is more likely to come from negative development than from victory in inflation. About 38% said that the economic pain would cause the balance sheet to end shrinking, while 20% thought that the market would be turbulent.

For many people, the era of ultra-low interest rates and the huge balance sheet of the central bank are all they know professionally. About 46% of MLIV respondents were not active in the market before the global adoption of quantitative easing policy in 2008.

In the past few decades, fewer people have participated in the long-term bull market of US Treasury bonds. The vast majority of readers (64%) said that the 40 year bull market was finally over, and the experienced market participants were significantly tougher than the young participants.

Ed Moya, senior market analyst at OANDA, said: "whenever you see a major change in liquidity, there may be some confusion in the market, which may lead to some violent trading behavior."