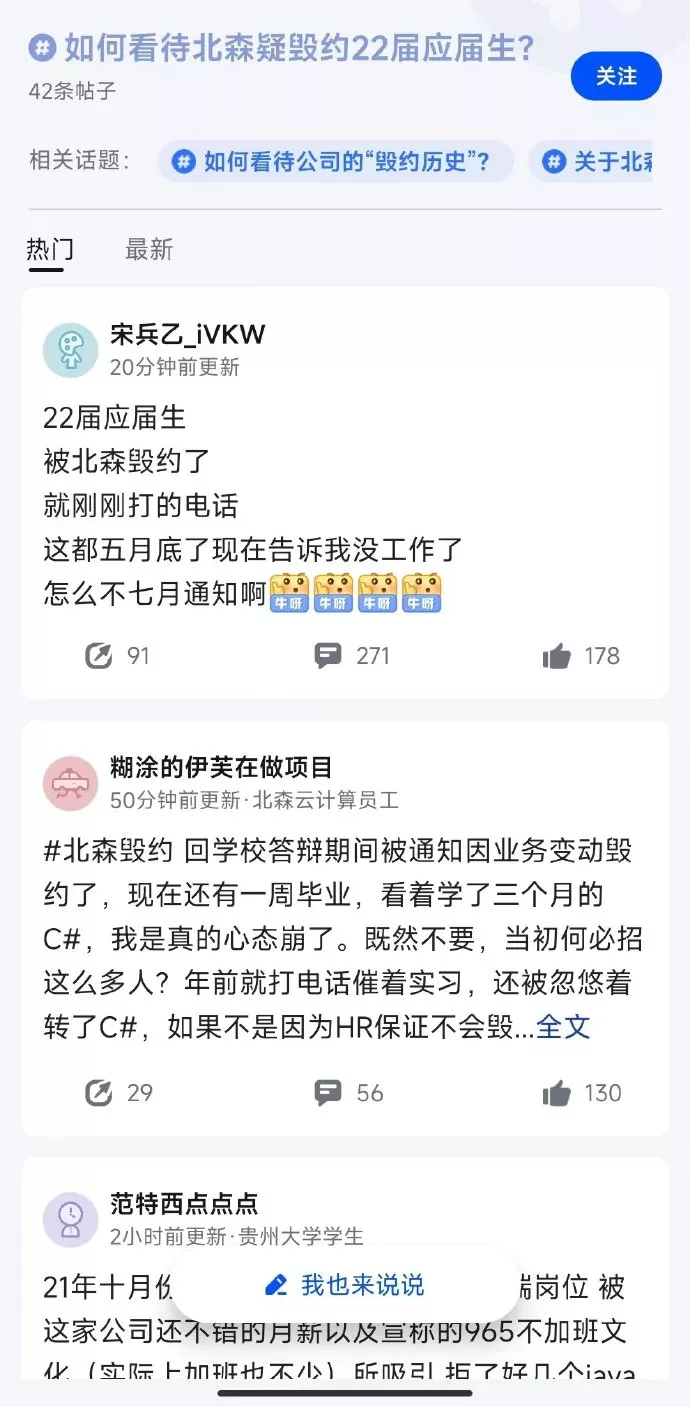

Recently, the breaking of contract school enrollment events have been exposed continuously, which has triggered a heated discussion on the Internet. After ideal car, Xiaopeng car and hello bike were exposed to breach of contract school enrollment one after another, Beisen cloud computing, known as the first share of HR SaaS, was also exposed to large-scale breach of contract school enrollment A large number of netizens reflected on the pulse of the social platform that they were broken as the 22nd fresh student and only got 3000 yuan of liquidated damages.

In addition, screenshots of chat records show that among the school recruitment group, 22 and 23 sessions are forbidden.

According to netizens, almost one-third of Beisen's fresh students have been terminated. On the working day before being laid off, the boss vowed at the meeting that there were so many employees in the company, and each employee had their family behind them. Layoffs were always the worst choice in the face of crisis. As a result, he received a layoff notice call from fresh students. What's more funny is that in order to prevent a storm, all the staff of the 22nd and 23rd school recruitment groups were banned.

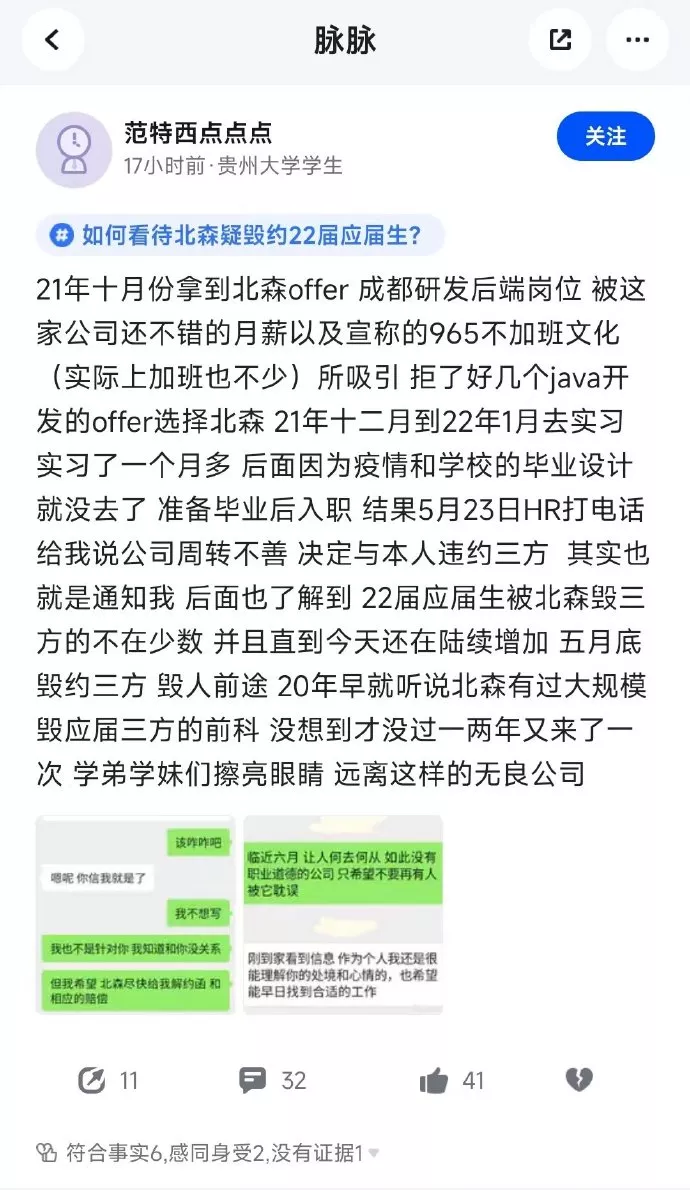

A fresh student from Guizhou University said that he got Beisen's offer of Chengdu R & D back-end post in October of the 21st year. He was attracted by the company's good monthly salary and the declared 965 no overtime culture. Therefore, he rejected several offers developed by iava and chose Beisen. As a result, HR called on May 23 and said that the company's turnover was poor and decided to default with me. Later, I learned that there are not a few of the 22nd fresh students who have been destroyed by Beisen, and they are still increasing until today. Breaking the contract by the end of May is tantamount to destroying people's future.

The student also revealed that this was not the first time Beisen broke the contract. In 2020, Beisen had heard that Beisen had a large-scale criminal record of destroying the current three parties. Unexpectedly, it came again in a year or two.

Statistics show that Beisen is an HR SaaS enterprise, founded in 2002 and listed on the new third board in 2016. But only two years later, he chose to delist.

After delisting, in October 2018, Beisen announced that it had completed the round e financing of US $100 million. Subsequently, Beisen plans to launch an impact on the Hong Kong stock exchange again.

On January 10, 2022, Beisen officially submitted a prospectus to the Hong Kong Stock Exchange and planned to be listed on the main board. Morgan Stanley and CICC served as co sponsors.

After listing, Beisen is also known as the first share of local HR SaaS.

It is understood that the investors behind Beisen have a strong lineup. The largest institutional investor is Jingwei venture capital, with more than 20% shares. In addition, there are many well-known investment institutions, including Sequoia China, CICC, Shenzhen Venture Capital, Goldman Sachs, Fidelity International, Softbank vision fund and Chunhua capital. Before listing, Beisen announced in July last year that it had completed the round f financing of US $260 million, which was jointly invested by Softbank vision fund phase II, Goldman Sachs, Chunhua capital and Fidelity International.

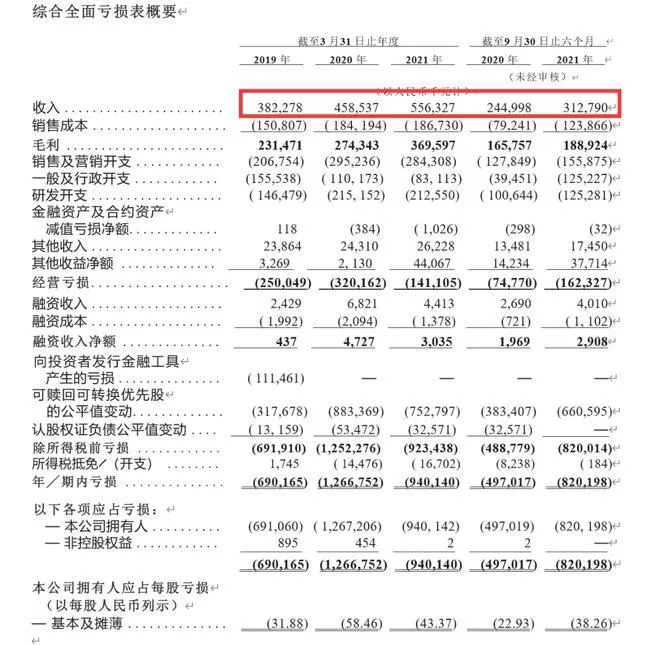

Although Beisen seems to be favored by investors, from the financial report data, Beisen's losses have never stopped.

According to the prospectus, in the fiscal years ended March 31, 2019, 2020 and 2021, Beisen's revenue was 382 million yuan, 459 million yuan and 556 million yuan respectively; The net losses were 690 million yuan, 1.27 billion yuan and 940 million yuan respectively. In addition, in the six months from April 1, 2021 to September 30, 2021, Beisen's loss range further expanded, reaching 820 million yuan.

That is, in the past three fiscal years, Beisen has accumulated losses of more than 3.7 billion yuan.

From the financial report data over the years, the net profits of Beisen in 2013, 2014, 2015, 2016 and 2017 were -7.0289 million yuan, - 12.0955 million yuan, - 41.82 million yuan, - 110 million yuan and - 146 million yuan respectively.

In other words, 20 years after its establishment, Beisen has not made a profit, and the loss has been increasing.

In addition to the problem of loss, Beisen's gross profit is also lower than that of the head company.

In fiscal years 2019, 2020 and 2021, and from April 1, 2021 to September 30, 2021, Beisen's gross profit margin is 60.6%, 59.8%, 66.4% and 60.4% respectively.

From the data, the gross profit margin is relatively stable. However, compared with many SaaS enterprises, Beisen's gross profit margin is low.

For example, the gross profit margin of salesforce in the past four quarters has exceeded 70%, and the gross profit margin of workday, a foreign HR SaaS industry leader, has already reached 70%.