Buffett Revealed Over The Weekend That Berkshire Increased Its Holdings Of Apple Shares By $600 Million In The First Quarter. "Unfortunately, Apple's Share Price Rebounded Later, So I Stopped. Otherwise, Who Knows How Much More We Will Buy?" Some Analysts Said That Apple's Share Price Fell Back To The Low Of $150 In Mid March, Which Means That Buffett Now Has A Chance To Copy The Bottom Again.

As Summarized By Wall Street, In The First Quarter Of This Year, At The Time Of The Sharp Decline Of U.S. Stocks, The 92 Year Old "stock God" Buffett, Adhering To The Investment Philosophy Of "others Fear My Greed", Wildly Bought $41 Billion In Net Stocks.

As For The Biggest Position He Has Always Loved - Technology Giant Apple, Buffett Went Straight To The Bottom And Lamented That "if The Share Price Didn't Rise Back, I Could Have Bought More".

At The Just Concluded Shareholders' Meeting Of Berkshire Hathaway In 2022, Buffett Personally Revealed That After Apple Recorded A Three-day Decline In The First Quarter, Berkshire Immediately "bottom" Bought $600 Million Worth Of Apple Shares.

He Also Said That If Apple's Share Price Remained Low, He Would Have Continued To Buy In The First Quarter:

"Unfortunately, Apple's Share Price Rebounded Later, So I Stopped. Otherwise, Who Knows How Much More We Will Buy?"

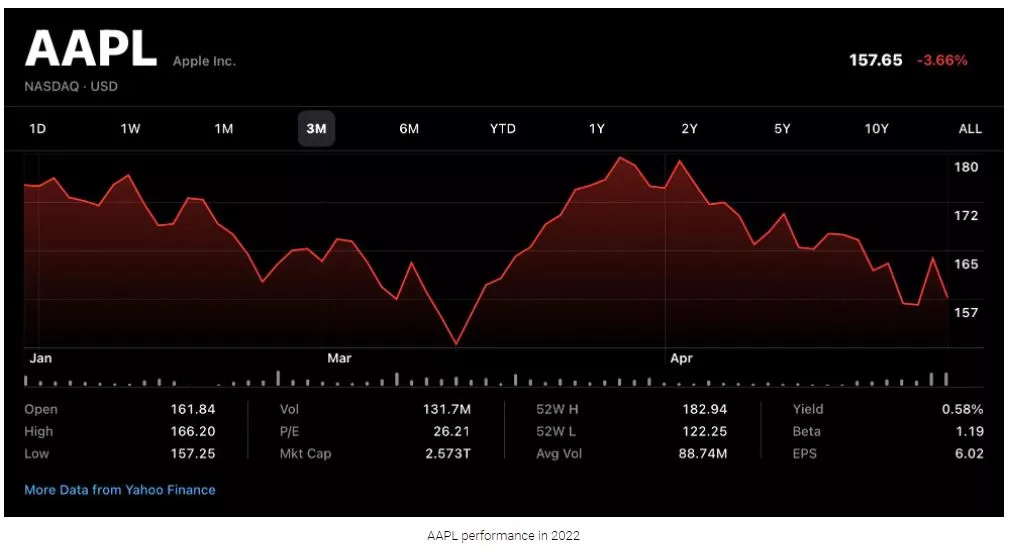

Apple's Share Price Fell 1.8% In The First Quarter Due To Concerns About The Federal Reserve's Radical Interest Rate Hike And Supply Chain Interference. During This Period, Apple's Share Price Fell Several Times For Three Days, And Fell For Eight Consecutive Days In January This Year.

Among Them, In Mid March This Year, Apple's Share Price Fell To A Low Of $150 From Nearly $180 At The Beginning Of The Year. Although The Share Price Returned To Around $180 At The End Of March, It Fell Again Since April, With A Cumulative Decline Of 9.7% In The Month.

On Monday, The Stock Fell Another 1.4%, Bringing The Share Price Down Nearly 11% Since The Second Quarter And Returning To The Lowest Level Of $155 Since March 15.

Some Analysts Said That This Showed That Apple's Share Price Fell Back To The Low In March. If Berkshire's Buying Range Was $150 In The First Quarter, Buffett Now Has The Opportunity To Buy More Apple Shares.

In Addition To Index And ETF Fund Providers, Berkshire Is Currently The Largest Single Owner Of Apple Stock, Holding More Than 5% Of Apple.

Apple Is Also Berkshire's Most Valuable Common Stock, Accounting For 47.5% Of Its Portfolio, With A Value Of $159 Billion As Of The End Of March. At The End Of Last Year, Berkshire Held 908 Million Shares Of Apple Stock, Which Was Worth $161 Billion At That Time.

Some Analysts Said That Given That Apple's Share Price Fell Nearly 2% In The First Quarter, While Buffett's Shareholding Value In Apple Fell Only 1.2% In The Same Period, Which Really Shows That Berkshire Increased Its Holdings Of Apple Slightly In The Quarter. Berkshire Will Provide An Update Of Its Stock Portfolio As Of March 30 In Mid May. At That Time, We Will Know How Much Apple Buffett Increased His Holdings In The First Quarter.

Berkshire Began To Build Positions In Apple In 2016 Under The Advice Of Buffett's Investment Deputy Todd Combs And Ted Weschler, And The Main Period Of Increasing Positions Continued Until 2018. Berkshire Spent $36 Billion On Apple Shares In Two Years. With Apple's Share Price Soaring From About $37 At The End Of 2018 To $155 Today, Berkshire's Shareholding Value Has Quadrupled.

Buffett Repeatedly Praised Apple CEO Cook's Attitude And Executive Management Ability Of "treating Product Users As First Love". He Once Said At The Berkshire Shareholders' Meeting In 2021: "cook Really Doesn't Have Jobs' Creative Talent, But Jobs Can't Do What Cook Does In Many Ways." He Also Bluntly Said That Selling Nearly 10 Million Apple Shares To Cash Out $11 Billion At The End Of 2020 May Have Been Wrong.

In Addition To Recognizing That Apple Products Have Been Successfully Embedded In All Aspects Of People's Lives, Buffett Also Likes Apple's Massive Stock Repurchase, Saying That As A Shareholder, He Can Improve His Ownership Of Apple Without Effort. In His Letter To Shareholders In February This Year, Buffett Called Apple One Of The "four Giants" Of Berkshire's Value, Second Only To The Insurance Business:

It Is Important To Understand That Only Dividends From Apple Are Included In Berkshire GAAP Profits, Of Which Apple Paid US $785 Million In 2021. However, Our "share" Of Apple's Profits Reached A Staggering $5.6 Billion. We Appreciate That Most Of The Assets Retained By Apple Are Used To Buy Back Apple Shares.

When The Quarterly Report Was Released Last Week, Apple Also Authorized A Stock Repurchase Of US $90 Billion, Maintaining Its Record As The Listed Company That Spent The Most On Repurchasing Its Own Shares. In 2021, The Company Spent US $88.3 Billion On Stock Repurchase. In Addition To Repurchases, Apple Pays Berkshire An Average Of About $775 Million A Year In Dividends.

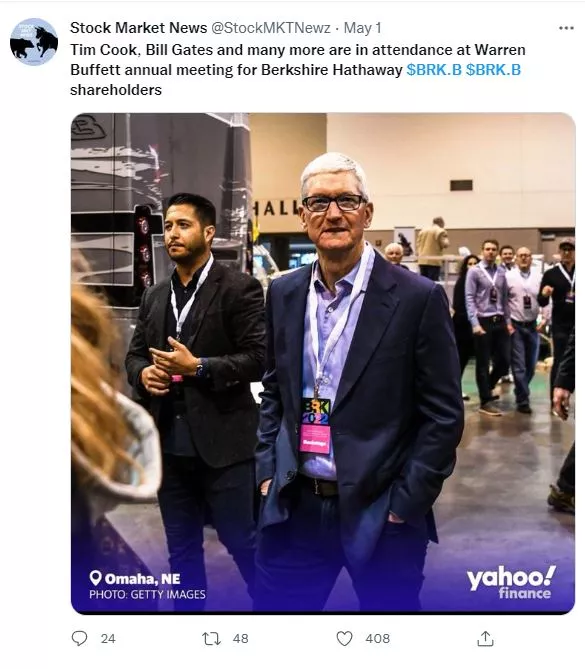

The Media Also Found That Cook And Bill Gates Attended Berkshire's Annual General Meeting At The Weekend.