Is it justified or groundless? Recently, Tesla CEO Elon Musk's public criticism of ESG rating has heated up sharply. ESG is the abbreviation of environmental, social and governance in English. It is an investment concept and enterprise evaluation standard that pays attention to enterprise environmental, social and governance performance rather than financial performance.

Not only did musk bombard the enterprise ESG rating on Twitter as the "incarnation of the devil", but Tesla also pointed out in the recently released 2021 influence report that the current ESG evaluation method on the market has essential defects, and ESG needs to improve its ability to measure and evaluate the real situation.

Tesla pointed out that the most critical thing is that these ratings are used by fund managers to help determine the investment direction, focusing only on measuring the dollar value of risk or return. In other words, many investors only rely on ESG report to invest, without really considering whether the investment will make the world a better place, which blinds the eyes of some individual investors betting on ESG funds.

At the same time, Tesla did not get high scores in multiple ESG ratings, even worse than the two oil companies, making musk even more angry.

Musk attacked the ESG scoring standard of enterprises

In chronological order, musk replied to netizens on twitter in early April that "enterprise ESG rating is the embodiment of the devil". He said that ESG's investment principles "should be deleted if they are not amended".

On April 23, musk blasted Microsoft founder Bill Gates on twitter for spending $500 million short Tesla, but invited musk to participate in his charity activities on climate change. Musk refused, saying it was hypocritical.

"When you short Tesla, I can't take your philanthropy on climate change seriously. Tesla is the company that has done the most to address climate change," Musk said

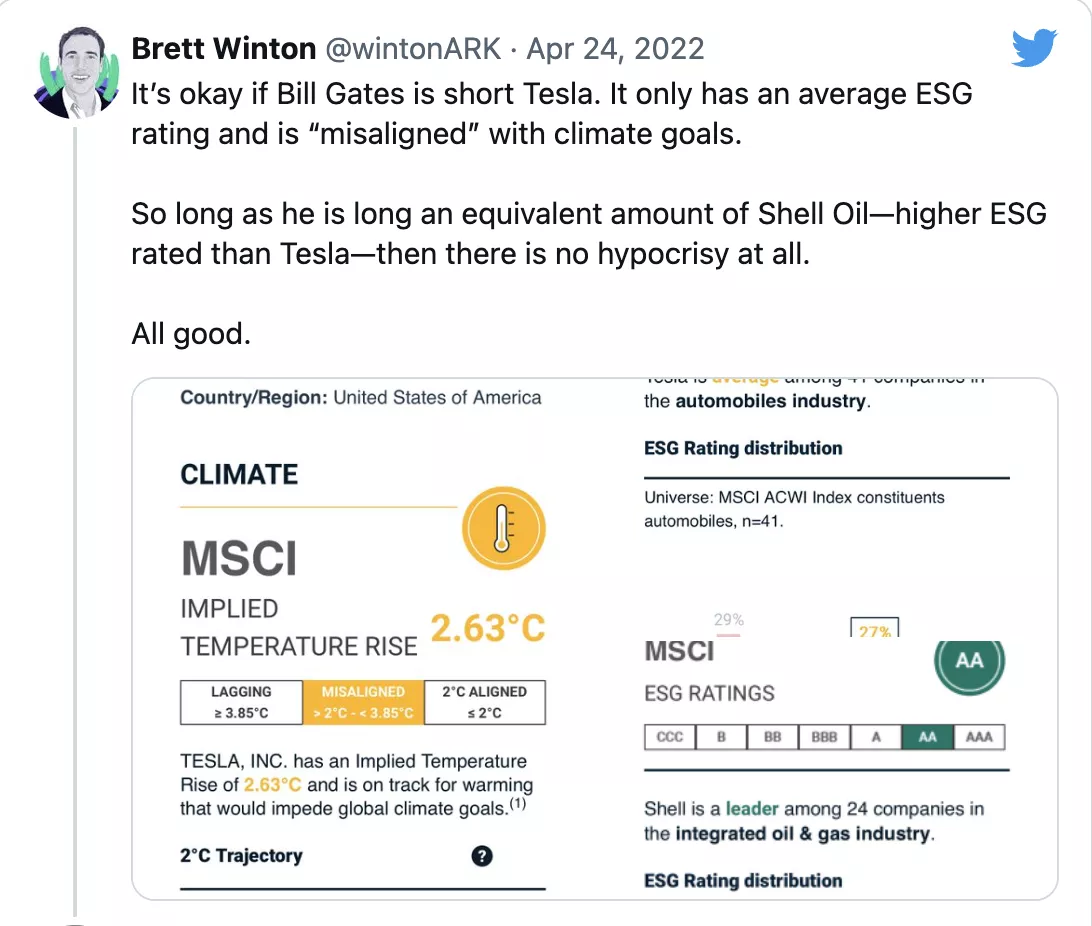

Interestingly, Brett Winton, an analyst at ark investment management, joked that it doesn't matter if Bill Gates shorted Tesla. It has only a very ordinary ESG rating, which is "inconsistent" with the climate goal. So as long as he does more than shell oil company with ESG rating higher than Tesla, there will be no hypocrisy.

Musk criticized that the ESG rating was meaningless.

But it is ironic that Tesla is the heaviest share held by ark so far. At present, Tesla's shares account for 10% of the company's flagship fund ark innovation ETF, and its shares are worth more than $968 billion.

Moreover, Winton is very optimistic about Tesla. After an analyst said that "Tesla's market share may peak in 2021" and compared the company with Netflix, Winton defended Tesla, saying that the situation he described did not apply to the electric vehicle industry, especially Tesla.

Tesla: the current ESG evaluation method "has fundamental defects"

On May 6, Tesla raised the issue of ESG score in its 2021 impact report. In the preface, Tesla pointed out frankly:

The current ESG evaluation methods on the market have essential defects. ESG needs to improve its ability to measure and assess the real situation.

The report said that the current ESG rating is based on the impact of ESG related factors on corporate profits, rather than measuring a company's impact on society and the environment in the real world, and does not analyze the company's positive impact on the global environment.

These ratings are used by fund managers to help determine the direction of investment, focusing only on measuring the dollar value of risk or return. In other words, many investors only rely on ESG reports to invest, without really considering whether investment will make the world a better place.

Tesla suggests that, in fact, individual investors who invest in ESG funds managed by large asset management companies do not know that their funds are being used to buy stocks of companies that exacerbate rather than mitigate the impact of climate change.

Tesla also said:

We need to establish a system to measure and review the actual positive impact on our planet, so that unsuspecting individual investors can choose to support companies that can make and give priority to positive impact.

Large investors, rating agencies, companies and the public need to promote the reform of the rating system.

Tesla also cited a specific example of unreasonable ESG rating. When scoring ESG in the automotive industry, generally, the larger the proportion or quantity of tram sales, the higher the score should be. However, they continue to produce large quantities of car manufacturers with high fuel consumption. As long as they reduce greenhouse gas emissions slightly, their ESG rating will also rise.

Most of the emission data of cars are generated when customers drive cars. These data are often wrong, or not reported at all, or based on "unrealistic assumptions". These scores often ignore or miscalculate the impact of carbon emissions during vehicle use on the environment. Under this scoring system, some oil and gas companies get higher scores than Tesla.

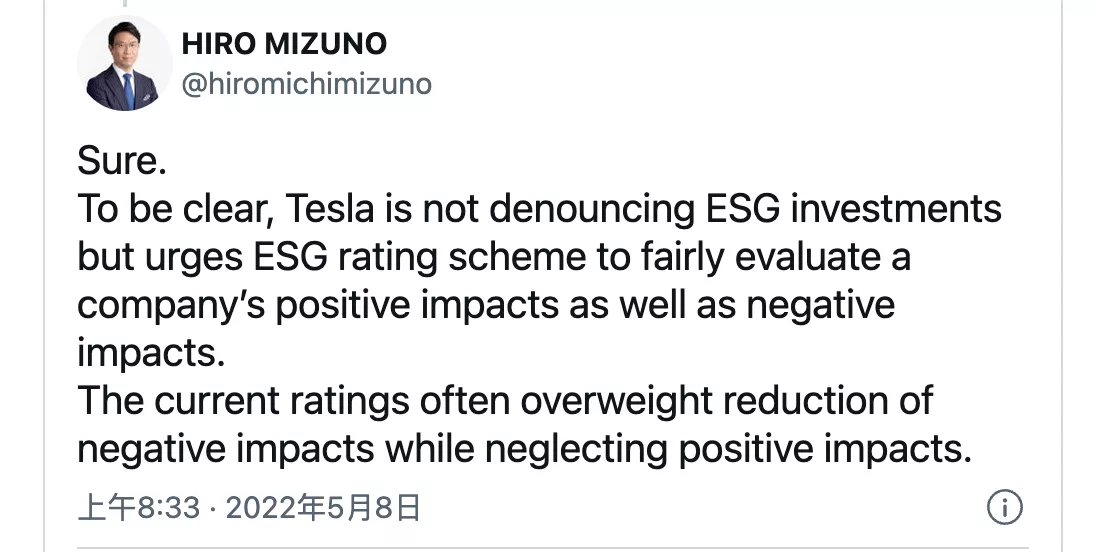

Hiromichi Mizuno, a board member of Tesla, also commented. He added that Tesla is not condemning ESG investment, but hopes that the rating scheme is fair, including paying attention to the positive impact of more companies on the world, not just the negative impact.

Some analysts believe that these rating systems really need to consider both the positive and negative effects of the company. Through Tesla's 2021 impact report, we can see that Tesla has made more contributions to the environment. Tesla's mission is to accelerate the transition to sustainable development. If the ESG score includes more companies' positive and negative impacts on the environment, it may encourage oil companies and other companies with lower scores to commit to more positive impacts on the environment.

Tesla's ESG rating is "average"

Tesla did not get high scores in several ESG ratings, which may also be one of the reasons why musk is angry with it.

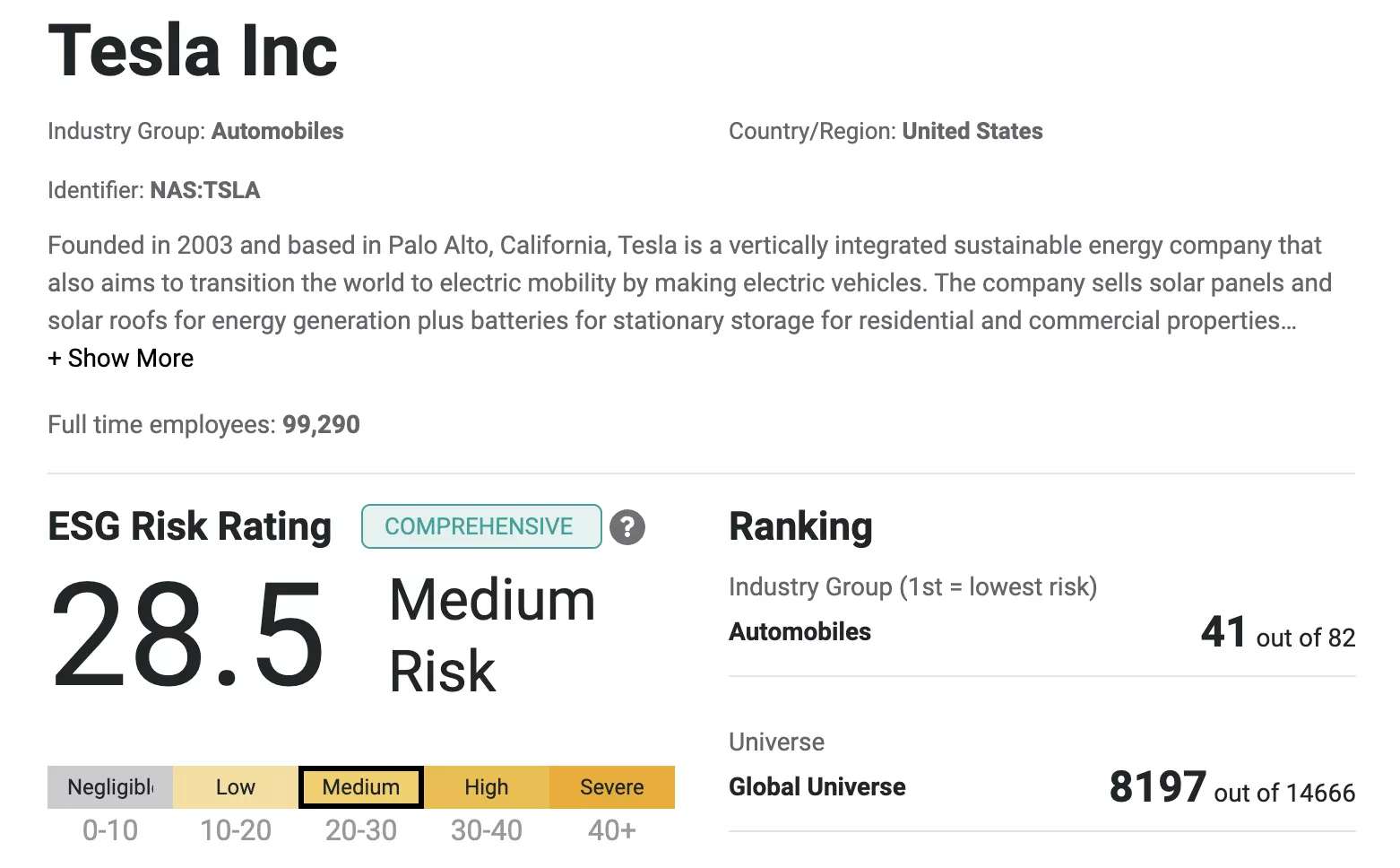

Last November, Morningstar sustainability, an ESG rating and research company, released a rating report. In this report, Tesla's ESG score is 28.5 (the lower the score, the better), with "medium risk". Tesla ranks 41st among 82 automobile companies in the world and 8192 among 14666 automobile companies in the world. Tesla's score is based on two things: risk exposure and management.

Sustainalytics wrote:

Risk exposure refers to the extent to which the company faces different major ESG problems. Our scores take into account sub industry and company specific factors, such as its business model. Tesla's exposure is moderate.

Management refers to the extent to which the company manages its relevant ESG issues. Our management score assesses the robustness of the company's ESG projects, practices and policies. Tesla's management of major risks of ESG is general.

Among the 41 auto industry companies rated by MSCI, Tesla is only rated as "average" and is considered to be hindering the global climate target of 2 degrees Celsius.

Last year, Investopedia, an international financial education website, published an article introducing the top four oil companies that have done the most in protecting the environment, namely Royal Dutch oil shell, totalenergies Sa of France, Repsol Sa of Spain and equinor of Norway. Their ESG scores were 35.1, 29.2, 26.7 and 32, respectively.

It is worth noting that two oil companies scored better than Tesla - OMV Ag and Repsol, both below 28.5. Among carmakers, Mercedes Benz and BYD also scored better than Tesla.

But Tesla's score is still in line, not worse than people expected. The GRC Global Research Council published an article in February this year. The author put forward an interesting view that musk himself may be the reason for Tesla's relatively good score:

But in terms of transparency, labor relations and governance, for example, if there is a CEO who will not tweet at will, Tesla's score will be even worse.

The author added that Tesla's ESG rating is indeed higher than that of most oil companies and other carmakers (such as Volkswagen and Toyota), which is an improvement compared with last year. However, if the implementation is not done enough, the rating will be reduced:

Musk helped create an electric car victory, but he must remember that he is a mortal, and his good deeds can't make him do what he likes - because like skating, you may lose points because of insufficient execution.