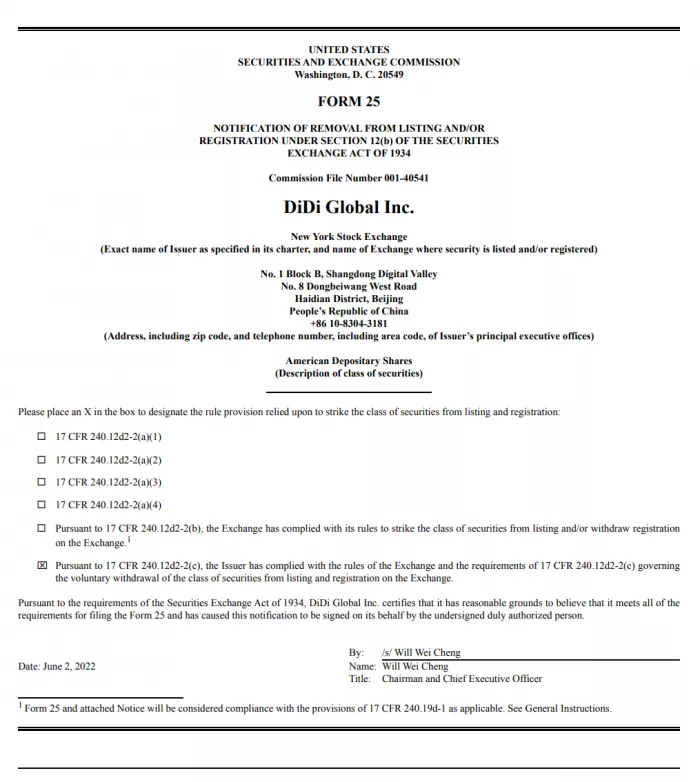

On June 3, according to the documents on Didi's official website, Didi officially submitted its delisting application yesterday (June 2). According to the regulations, Didi's delisting decision will officially take effect 10 days after submitting the application documents. On the evening of the 23rd of last month, Didi trip held an extraordinary shareholders' meeting to vote on whether to voluntarily delist from the New York Stock Exchange. The voting results showed that didi confirmed that it would officially promote the delisting from the New York Stock Exchange.

The agreement adopted by the extraordinary general meeting of shareholders indicates that didi confirmed to delist the company's American depositary receipts from the New York Stock Exchange as soon as possible. In order to better cooperate with the rectification measures of the network security review, the company's shares will not be listed on any other stock exchange before the delisting is completed.

Since its listing on the New York Stock Exchange last year, Didi has faced scrutiny from Chinese security departments and relevant US departments.

Within less than a year of listing, Didi's market value has evaporated by tens of billions of dollars, Didi's latest share price was $1.91 (about RMB 12.72), which plummeted nearly 90% according to its highest point * *, with a total market value of $9.271 billion (about RMB 61.747 billion).

Regarding Didi's delisting, the CSRC previously responded that this is an independent decision made by enterprises according to the market and their own conditions.

"The CSRC has always insisted that the overseas listing activities of enterprises should comply with the laws, regulations and regulatory rules of the place of listing and operation, and required listed companies to effectively protect the legitimate rights and interests of investors, especially small and medium-sized investors.

The specific case of Didi's independent delisting has nothing to do with other Chinese stocks listed in the United States, has nothing to do with the ongoing Sino US audit and supervision cooperation consultation, and does not affect the cooperation process between the two sides. "