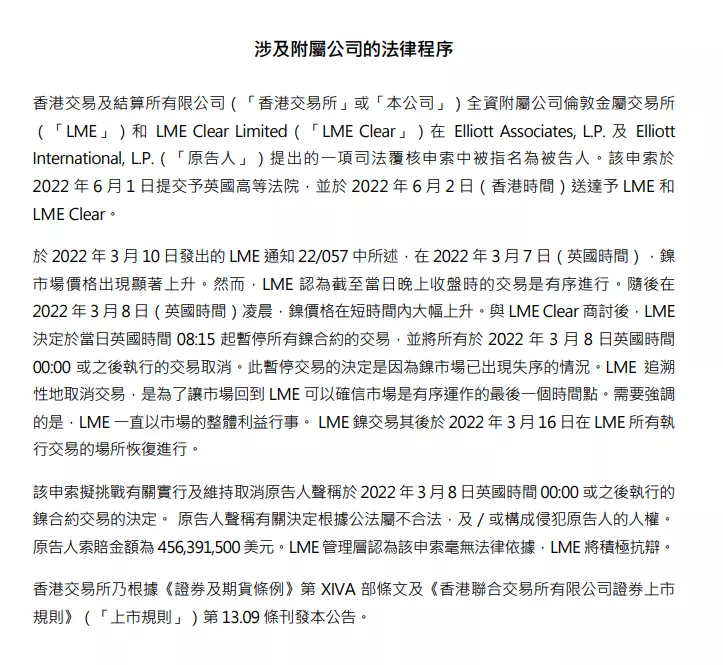

On the morning of June 6, the Hong Kong Stock Exchange (0388.hk) disclosed the latest announcement that LME (London Metal Exchange), a wholly-owned subsidiary of the Hong Kong stock exchange, and LME clear Limited ('lme clear ') had been sued by Elliott associates, L.P. and Elliott international, L.P. to the British High Court and demanded that LME compensate it for $456million.

The origin of this litigation dispute is related to the lunni futures storm that attracted high attention at home and abroad three months ago.

In the afternoon of June 6, LME said in reply to an e-mail interview with the reporter of the daily economic news: "at any time, LME and LME clear are acting for the interests of the whole market. Therefore, LME believes that Elliott's complaint has no legal basis, and LME will actively respond to any judicial review procedures."

Set the time back to three months ago.

On March 7 (London time), the nickel market price suddenly rose significantly, and Lun Ni futures soared to US $55000 / ton. On March 8, the price of LME nickel futures continued the previous day's rise, and once exceeded the $100000 / ton mark. After the extreme event, LME announced the suspension of nickel trading, and the nickel price was set at US $80000 / ton. In the two trading days, the price of nickel futures rose by 240%, breaking the price surge record of LME since its establishment 145 years ago.

The London Metal Exchange suspended nickel trading on March 8, 2022 local time in London, England. The rise and fall trend of nickel price in one day is displayed on the screen. Source: visual China -vcg111372382510

According to the announcement of the Hong Kong stock exchange, in the early morning of March 8, 2022 (UK time), nickel prices rose sharply in a short time. After discussing with LME clear, LME decided to suspend all nickel contract transactions from 08:15 UK time on the same day, and cancel all transactions executed on or after 00:00 UK time on march8,2022.

However, for this move of LME, the plaintiff Elliott associates, L.P. and Elliott international, L.P. held that the relevant decision was illegal under public law and / or constituted a violation of the plaintiff's human rights.

However, the HKEx claimed that the decision to suspend trading was due to the disorder in the nickel market. LME cancels the transaction retroactively in order to return the market to the last time when LME can be sure that the market is operating orderly. "It should be emphasized that LME has always acted in the overall interests of the market. LME nickel trading was subsequently resumed at all LME trading venues on march16,2022."

Therefore, the management of LME believes that the claim has no legal basis and LME will actively defend it.

It is understood that Elliott associates, L.P. and Elliott international, L.P. are hedge funds under the investment management company Elliott management. Elliott management was founded in 1977 by Paul singer, a well-known hedge fund manager in the United States. As of December 31, 2021, Elliott managed about $51.5 billion in assets. The company has 480 employees at its Florida headquarters and offices in the United States, Europe and Asia, nearly half of whom are dedicated to portfolio management and analysis, trading and research.

In the afternoon of June 6, In response to the e-mail interview of the reporter of the daily economic news, LME said: "As the world's leading industrial metal exchange, LME plays an important role in ensuring that the market is fair and orderly for all participants. In LME's view, the nickel market has become disorderly in the early morning of March 8, 2022. After negotiating with LME clear, LME decided to suspend the trading of all nickel contracts from 08:15 UK time and cancel all transactions executed after 00:00 UK time, so that the market can return to LME to ensure The credit market is at the last time point of orderly operation. At any time, LME and LME clear act for the benefit of the whole market. Therefore, LME believes that Elliott's complaint has no legal basis, and LME will actively respond to any judicial review procedures. "

On June 6, as of press time, LME Lun nickel price was reported to be USD 29080 / ton, up 3.42%. It is worth noting that since April, the price of LUNI nickel has been hovering around us $30000 / ton.

On June 2, some media quoted shaowanyi, a senior researcher of Guotai Junan Futures nonferrous metals, as saying that the liquidity of nickel futures contracts at home and abroad fell to a low level. The trading volume and positions of both Shanghai nickel contracts and LME nickel futures contracts were at historical lows, and the overall liquidity risk of the market was high.

From the perspective of fundamentals and transaction, shaowanyi said that the transaction contradictions of lunni have not been completely eliminated. Under the low inventory pattern, the concentration of LME warehouse receipts remained above 50%. Since the abnormal fluctuation of LME nickel price in March, the margin of LME position inventory ratio has been declining, but it has not yet recovered to the normal range. The risk of contradiction in overseas transactions should be vigilant.

On June 6, in a telephone interview with the reporter of the daily economic news, jiangxinbin, a senior analyst of non-ferrous metals of Zheshang futures, analyzed that with the release of high nickel matte production capacity produced by Qingshan and other enterprises in Indonesia, many raw materials of new energy can be shifted from pure nickel to intermediate products such as high nickel matte, which also indirectly affects the supply and demand of the nickel futures market. It is expected that in the second half of the year, the price of lunni futures is more likely to go down than up.

At the same time, jiangxinbin said that due to the high nickel price before, nickel salt enterprises even had the situation of upside down profits. After the demon nickel storm in March, some enterprises reduced the use of pure nickel in order to maintain profits.

As for the current poor liquidity of lunni futures, jiangxinbin believes that overseas traders may maintain a wait-and-see attitude towards the participation of LME nickel futures for a long time. In this context, CME (Chicago Mercantile Exchange) of the United States intends to launch nickel futures contracts to make up for the market vacancy. Domestic traders are also expected to increase the trading volume of Shanghai Futures Exchange, so as to further enhance the pricing power of domestic commodities.

In the afternoon of June 6, the reporter also sent an interview email to the Hong Kong stock exchange to inquire about relevant matters of the case. The Hong Kong Stock Exchange replied that for details, please refer to the announcement previously issued by the Hong Kong stock exchange. As of the closing on June 6, the Hong Kong stock exchange closed at HK $347.6 per share, up 1.64% on the same day, with a total market value of HK $440.7 billion.