I

After knowing that I might not be able to return to the United States for a long time, I have cancelled many paid services, such as broadband and Xbox /Uplay / Blizzard game members, Amazon Prime, etc. However, several organizations, including the gym, several American newspapers and a car club, are still charging me money. Because it was difficult to get through by phone, I first contacted by email, but was told that I had to cancel the subscription service through telephone customer service - and even some institutions told me that if I wanted to cancel, I could either face-to-face or write a letter - it was not email, it was surface mail!

These non cancellable paid subscription services have sucked almost $100 a month from me over the past two years. I can't do anything.

In recent years, the subscription charging model has become more and more popular. The commercial institutions adopting this model are not only limited to Internet services, but also pure offline commercial institutions such as various applications, traditional media, newspapers and even gyms. This payment method looks very cheap on the surface and is friendly to new users who want to try it first.

For example, many traditional media transformed into digital media have set up a pay wall. It doesn't matter if you can't see the article. First come a new user benefit, which is free for the first week at $5 / month. However, if you are not careful enough, you will fall into a trap: the prices of these services will rise after the benefit period of new users, and they will be automatically renewed without notice.

The result is that at first you just want to be cheap, but later you forget to cancel, you will be deducted for one more month, one quarter, or even half a year / year.

What's more outrageous is that even if you find out and want to cancel the stop loss in time, you will encounter the situation I introduced at the beginning of the article: many institutions adopting this mode will deliberately set a high cancellation threshold, such as having to call, waiting for customer service seats, even sending surface mail, or even canceling face-to-face. Here, most people will feel trouble and may have given up directly at that time, but in fact, this is the deliberate calculation of unscrupulous businesses in order to make more money from you for even a month.

II

As we all know, many countries adopt the system of credit society. The charging mode of commercial institutions and the consumption habits of ordinary people are also very different from those of other developing countries.

In this context, some "unscrupulous" business models have also been born. For example, in the early years, the mail order membership mode of records and books, which was once popular in Europe and America, was to constantly send users new products and collect money from them - unless users specifically want to cancel the membership and contact the charging party, they can complete the cancellation.

This business model is called "negative option billing" in the West

With the changes of the times and the innovation of business model and payment technology, the definition of nob has been extended to paid subscription services and various related operations and means, including but not limited to: automatic silent renewal, free trial, default conversion to paid subscription, monthly paid book fair, etc.

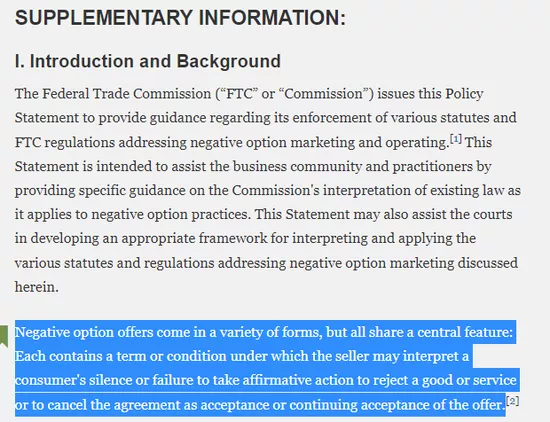

According to the definition of the Federal Trade Commission (FTC), it can be defined as nob as long as it includes the case that "user silence / inaction represents permission to continue charging"

FTC said in a policy interpretation document released last year that the nob model can provide greater value to both sellers and consumers. However, if consumers no longer need corresponding products or services, sellers do not fulfill their responsibilities of informed consent and information transparency, and forcibly increase the difficulty of cancellation, consumers will suffer greater losses.

FTC also clearly pointed out that although nob itself is a business model with a long history, the gray illegal business activities around nob have been too rampant in the past few years, which has brought great harm to consumers.

A typical example is the traditional media industry in the United States.

In the past, silicon star people have reported that the media industry in the United States is undergoing a difficult transformation. Many traditional media are facing bankruptcy and bankruptcy, and many unscrupulous businessmen (many are hedge funds) choose to copy the bottom at this time, and then "optimize asset allocation", lay off staff and sell buildings to make a lot of money.

At the same time, in order to save themselves, some traditional media are also trying digital transformation and launching online version / app And online subscription. These unscrupulous people also see business opportunities. On the surface, they support the digital transformation of media, but behind the scenes they use the aforementioned nob model to harvest subscription fees and try their best to make things difficult for readers when they want to unsubscribe.

A survey of more than 500 news media organizations in the United States shows that only 40% of the media do not deliberately set unsubscribe barriers, and more than half of the media will specifically train customer service personnel on "anti unsubscribe strategies" to try their best to deceive users not to unsubscribe.

For example, as follows:

"I'm sorry to hear that you have been deducted again and want to cancel. Are you sure you really want to cancel? Can we consider giving you another free week? How about two weeks? Or can't we?"

Then, the customer service seat asks you to wait for a while. You listened to the elevator music for 15 minutes, and the other party still didn't respond.

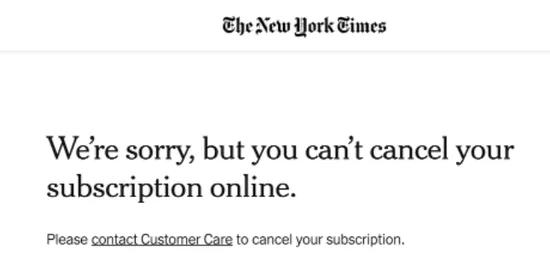

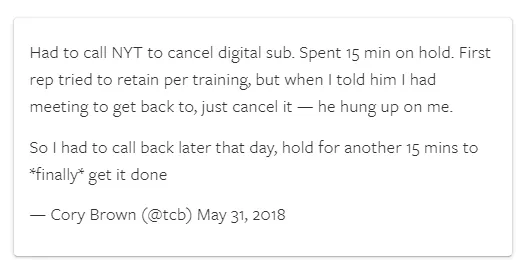

Don't think that only the management behind the local media does so - even the famous New York Times, as a national media with tens of millions of subscribers and the most successful digital transformation, has the above or similar disgraceful practices in the nob model.

Source: U / traviswilbr | reddit

Source: Nieman Lab

III

Recently, a new local bill in Pennsylvania wants to completely ruin the abacus of these unscrupulous businesses.

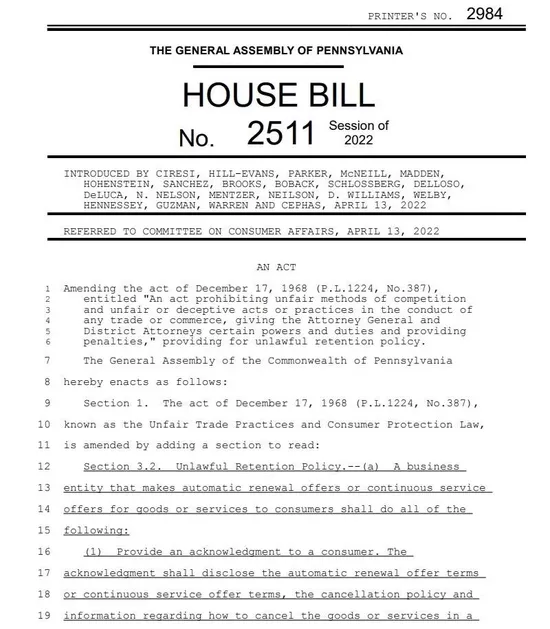

Last week, Joe ciresi, a local state councilor, drafted a draft law code named hb2511. The bill is called Click to cancel. As its name suggests, it allows people to directly cancel subscriptions to paid items with one click.

In addition, the bill will also force providers of paid subscription services to notify users of the upcoming renewal before each automatic renewal / renewal, leaving them enough time to decide whether to renew.

*At present, when most people receive a renewal notice (if the service provider will really send such notice), it is often after the credit card has been deducted.

Moreover, the bill also requires service providers to inform users of the terms of renewal in a sufficiently clear manner.

*At present, many subscription service providers will write huge words such as "new user benefits", "7-day free" and "50% off in the first month", but write very small monthly / quarterly / annual fees at that time.

Of course, the bill is not too broad, but sets some restrictions: it only requires service providers to provide one click cancellation for users who initially start their services through online channels.

"Today, many consumers are facing the same situation: the paid subscription contract is automatically renewed without receiving any notice. What's worse, some subscription services deliberately create trouble for users when they want to cancel their subscription, such as forcing them to call or contact online customer service," ciresi said, "I think the subscription service should be more transparent and easier for ordinary consumers to understand, and consumers should be able to unsubscribe by opening their subscription."

Ciresi is right: if one of my member services is opened online with a low threshold, then I should also be able to click a few buttons online to complete the cancellation operation, rather than being fooled by these businesses as monkeys - will the conscience of these businesses really hurt when they treat consumers like this?

However, it is worth mentioning that hb2511 is not the first similar act or policy in the United States to establish the right of "one click cancellation" and protect the rights and interests of consumers. Of course, it is by far the most radical one.

At the end of October 2021, FTC issued a policy implementation document, which directly declared that the specific behaviors around nob business model were illegal, and the government would strengthen its supervision and crackdown.

Source: FTA chairman Lina Khan | twitter

Source: FTC website

The document points out that if commercial institutions adopting nob mode do not provide straightforward and clear information in the process of user registration and renewal, do not obtain the user's clear informed permission before renewal, and deliberately set the cancellation threshold, these companies will bear the legal consequences, even the prosecution of the U.S. government.

FTC has recently filed a lawsuit against companies that adopt a variety of nob gray / illegal acts. Samuel Levine, director of the agency's Consumer Protection Bureau, said that the illegal acts that can resort to the court include but are not limited to: concealing the subsequent payment price of the free trial, converting the free trial into a paid subscription too early, making consumers wait too long when they call to cancel their subscription, and so on.

This policy document of FTC is consistent with the proposition of the Pennsylvania act mentioned above: if users initially start their subscription online, businesses must provide them with methods to cancel their subscription online, rather than forcing them to cancel by telephone, surface mail or even face-to-face.

It was California where I lived that challenged nob behavior earlier than FTC.

In 2018, the California local Senate introduced bill 313, which is basically the same as the FTC document and the Pennsylvania bill last week. It clearly requires that online subscriptions can be cancelled online. Act 313 also belongs to the long arm Jurisdiction Act of gdpr type. Even if the company's registered place is not in California, as long as there are users in California, it is within the scope of regulation.

However, the implementation effect of FTC policy documents and California act is not satisfactory. There are several main reasons: 1) many companies (especially media organizations) only do the minimum compliance operation, including payment reminder and informed consent, but it is still not obvious enough; 2) Many ordinary consumers still do not realize that they are actually victims of violations and will not resort to law.

IV

I hope many readers will realize that they are the victims of these unscrupulous businesses after reading this article.

So, in addition to looking forward to more stringent national laws to actively crack down on such acts in the future, what methods and tools can we use to protect our wallets?

1. DoNotPay

We reported this amazing app in 2020. Its main function is an automatic legal document drafting tool, which can help you effectively fight against all kinds of Telecom fraud, traffic tickets and large companies with poor service quality (such as Comcast, United Airlines, etc.), which is vividly called "palm rights protection master" by users.

Source: donotpay website

Donotpay is also constantly launching new functions, including services that help you cancel your subscription, such as planet fitness gym members, various media and newspapers, six flags amusement park season tickets, CVS carepass and so on. A simpler way is to use its app Connect your bank and email account and it will automatically find known subscriptions.

But if you don't want to give the bank email information to donotpay, it's OK: its website and app There are a large number of strategies to cancel subscription services, which are free, involving hundreds of different services.

Source: donotpay website

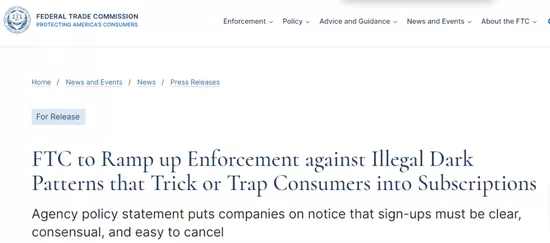

It is worth mentioning that donotpay also has some paid subscription functions (for example, it can generate a one-time credit card, telephone number and register things that will not be used later), but it makes its own unsubscribe function very straightforward: it has a simple interface to tell you when the next deduction will occur and a cancel button to cancel after clicking, without any additional process and burden.

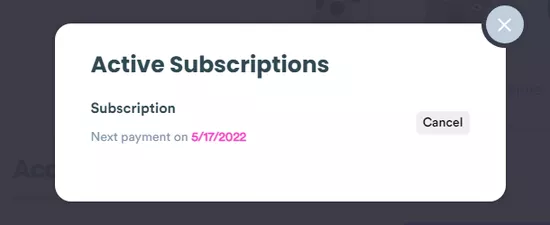

2. Truebill

Truebill can be understood as an enhanced accounting software. It doesn't require you to input it yourself, but directly extract information from your bank account and record what items and how much money you spend each month.

Managing a variety of subscription services is also one of truebill's main functions. It provides a relatively clear interface to help you find subscription services that you may have forgotten but are still paying; It can also directly act as a proxy for unsubscribing to avoid your own trouble.

Image source: truebill website

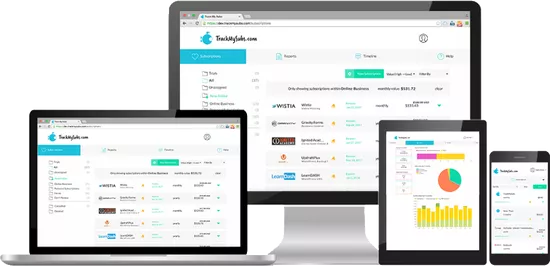

3. TrackMySubs

As the name suggests, trackmysubs helps you track your subscription service. Compared with the two tools described above, trackmysubs has no automation function. Instead, it is like a manual accounting software. You need to enter the information about which services you have subscribed to, how much each month and which day to deduct the fee.

Source: trackmysubs website

Doesn't sound as powerful as donotpay and truebill? But in fact, trackmysubs's sense of "low technology" is the reason why I want to introduce it: you have to look for email notices and bank statements by yourself, and know how much you spend on what projects every month - it's easier to form a good habit of financial tracking.

Of course, trackmysubs is also suitable for users who are not very confident in giving their bank account data to third-party companies. In terms of charging, tracking within 10 subscription services is free, 20 $5 per month and 50 $10 per month. To be honest, this charging model is more reassuring than those services that are free (but may sell your data).

What do you think of the chaos in these industries? Do you find that you also have hidden deduction items you don't know? What tools and methods are you using to manage your subscriptions and reduce your monthly bills? Welcome to share with us through message!