After the share price peaked, Midea's market value has fallen by 300 billion yuan, but Midea is far from the worst. In response to the online layoffs, Midea Group recently responded that "in view of the judgment of the internal and external environment, the company has orderly contracted its non core business and suspended non operating investment". Prior to that, at a Midea Group Management Exchange Meeting in early May, when explaining the company's strategic plan for 2022, Fang Hongbo, chairman and President of Midea Group, said pessimistically: "the next three years will face great difficulties, which is an unprecedented cold winter."

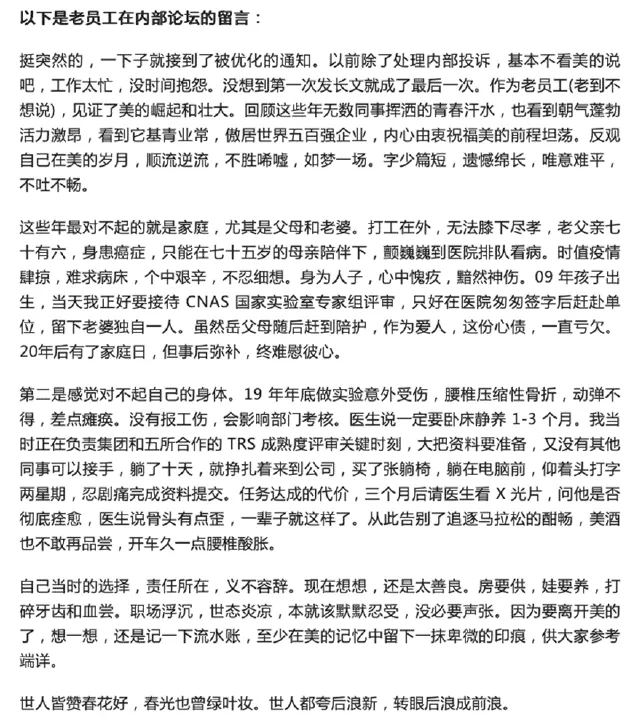

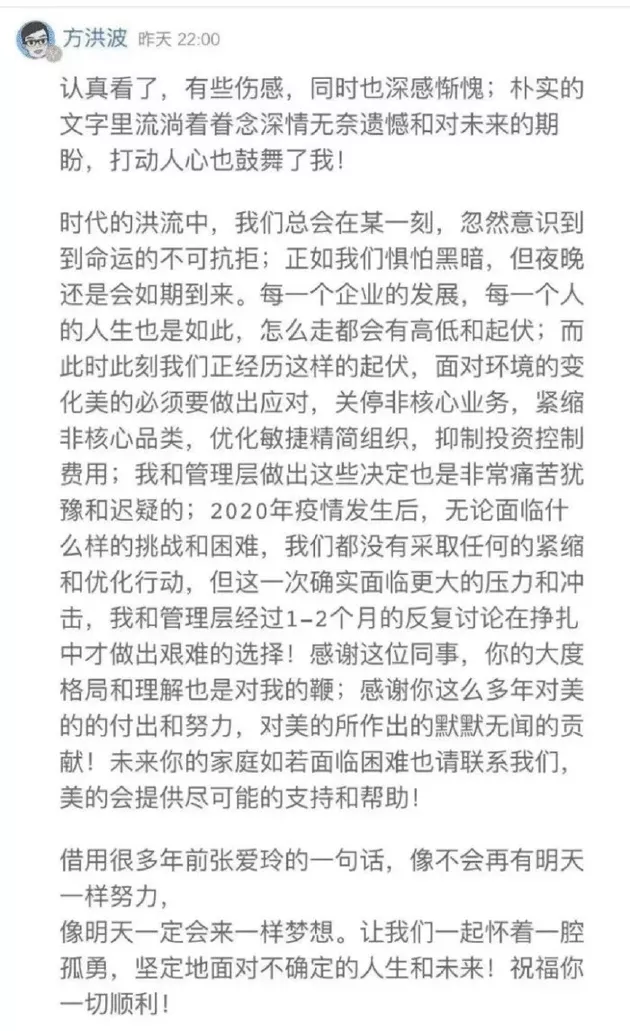

What is more worth pondering is that the internal speech of a laid-off employee has also attracted the attention of the industry and public sentiment. In this regard, Fang Hongbo, chairman and President of Midea Group, sent a document in response, saying: some sad, but also deeply ashamed, is a difficult choice made in the struggle.

What is the cold wave that Midea is also worried about in the next three years?

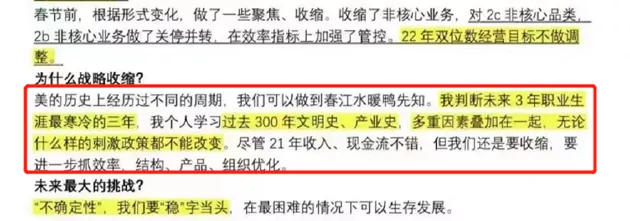

Household appliance price increases inhibit consumers from replacing

"Midea has experienced different cycles in its history, and we can be the prophet of spring river water warming duck. I judge that the next three years will be the coldest three years of my career. I personally study the civilization history and industrial history of the past 300 years. Multiple factors are superimposed together, and no matter what kind of stimulus policy can be changed." This is what Fang Hongbo said when answering reporters' questions at the above-mentioned management exchange meeting. His pessimism about the home appliance industry in the next three years is obvious.

On the one hand, the COVID-19 is still having a sustained impact on a global scale. On the other hand, the international situation is changing all the time. The prices of bulk commodities, maritime logistics and energy have soared, pushing up the cost of manufacturing.

In an analysis report, Guojin Securities pointed out that the main raw materials for household appliance production are steel, copper, aluminum and plastics. As of March 18, 2022, the spot prices of copper, aluminum and steel were US $9944 / ton, US $3233 / ton and RMB 8952 / ton respectively, up 86%, 116% and 40% respectively compared with the second quarter of 2020. The price of steel also increased by 36%, all at an all-time high.

Affected by the continuous rise in the price of raw materials, the price of electric power has been raised successively since the first quarter of 2021. According to the data of ovicloud, the average online price of all kinds of household appliances in 2021 increased by 22.95% year-on-year, and the average offline price increased by 17.07% year-on-year.

Since March 2022, several home appliance brands have raised prices successively. Among them, Haier announced that it would raise the prices of air conditioners and other products by 8% to 10% from March 16. Midea also announced that the prices of various categories will be raised successively from March 16. Among them, the prices of air conditioners will be raised from March 16. The price adjustment range is 8% for household air conditioners, 5% for refrigerators, more than 5% for washing machines and 20% for small household appliances.

On the other hand, the situation faced by home appliance manufacturers is that the popularity of domestic home appliances has been very high. According to the data of the National Bureau of statistics, air conditioners, washing machines and refrigerators have high power saturation, and the ownership of 100 households is close to or has exceeded 100. This also means that we have entered the era of stock competition. According to the data of Aowei cloud, by November 2021, the cumulative retail sales of China's home appliance market was 702.2 billion yuan, with a year-on-year increase of only 4.9%. Excluding the factors affected by the epidemic in 2020, if compared with the same period in 2019, the growth rate decreased by 7.4 percentage points.

The price rise of household appliances may directly inhibit or delay consumers' demand for household appliances, resulting in a lack of stimulation for the originally weak household appliance consumption, which is obviously not good for the whole household appliance industry.

"In the case of bad market conditions, Midea, as an industry giant, can appropriately allocate risks to the whole industrial chain by virtue of its influence and bargaining power over the whole household appliance industry, so as to keep its profitability above the industry average. However, when the whole industry starts to slow down, Midea's rapid development is impossible." Some home appliance industry analysts told Sina Technology.

High end transformation blocked

In order to cope with the domestic home appliance market with poor growth rate, Midea has accelerated the high-end, sea going and to B transformation and upgrading in recent years to support its future development space. However, as far as Midea is concerned, the business development in these directions is also facing challenges.

At present, Midea's high-end lines are mainly Colmo and Toshiba. Take Colmo as an example. According to the financial report data of Midea in 2021, the overall annual sales of Midea Colmo series products reached 4 billion, a year-on-year increase of 300%. The growth rate is gratifying, but it accounts for only 1.1% of the total revenue of 343.4 billion in the United States.

It is one of the means of Midea's transformation to carry out high-end and replace the "small profit and quick turnover" price war mode with the high value-added mode of "pushing up and selling fine". However, from the current performance, it is obviously still difficult to quickly create the second growth curve of Midea's business growth through high-end.

Midea's overseas business layout is relatively early. According to its financial report, Midea's overseas business contributed 35.5% of its revenue in 2015 and remained at 42% from 2017 to 2020; In 2021, Midea's overseas business revenue was 137.65 billion yuan, a year-on-year increase of 13.7%, accounting for 40.3% of the total revenue.

In the context of overall revenue growth, the revenue contributed by Midea's overseas business, for example, has declined slightly. According to this growth rate, by 2025, Midea will be difficult to achieve the goal of $40 billion in annual revenue from overseas business. In addition, the overseas competition of Chinese household electrical appliance enterprises, including Haier, Gree and TCL, will undoubtedly increase the operating expenses of enterprises for channel expansion and marketing.

To B business, which is still in rapid growth, is also one of the directions of Midea's transformation. At the Midea Group Management exchange meeting, "firm to B transformation" was mentioned again.

In 2016, Midea launched a takeover offer to KUKA, which is also the starting point of Midea's to B business transformation. By 2021, Midea Group has established five business segments: smart home, industrial technology, intelligent building, robot and automation, and digital innovation. In addition to smart home, the other four business segments are to B business.

According to Midea's financial report, Midea's to B business excluding internal transactions had a revenue of 75 billion yuan in 2021. But this business, which contributes 22% of the total revenue, is still in the process of seeking profit. In the eyes of Midea executives, "to B business is still in the foundation stage, and there is no revenue and profit target in 2022."

"Although the revenue of to B business is stable and the moat is high after it is established, the early development focuses on investment and the development is slow. The early pursuit of commercialization is not conducive to long-term development." Industry insiders said. When the 2C HVAC and consumer electrical appliance business, which contributes more than 80% of the revenue, began to enter the stock market, and the new to B business can not realize the profit, "slow down and become the main melody of Midea's enterprise development."

Is layoffs an inevitable choice

Based on the pessimistic judgment of the industry, "reasonable income and return to profitability" has become the new goal of Midea. "Although the income and cash flow in 2021 are good, we still need to shrink, further focus on efficiency and optimize the structure, products and organization." Midea executives pointed out in their speech at the communication meeting.

The adjustment of organization and personnel structure is one of the important means for Midea to seek change and deal with future uncertainty.

On April 25, Midea issued a notice on the requirements of "closing, suspension and transfer" for some non core businesses, which was led by Zhong Zheng, CFO of the group, who was responsible for promoting the adjustment of relevant businesses. For this "business downsizing", Midea responded at that time, "in view of the judgment of the internal and external environment, the company orderly contracted non core business, suspended non operational investment, and took multiple measures to further consolidate growth potential and improve operating performance."

Under the business adjustment, layoffs are a by-product. On pulse and other social media, there have been revelations about Midea's layoffs. According to the disclosure information, 100% of Midea's new business was laid off or required to be transferred, and about 10% of other departments such as mothers, infants and pets were laid off. Another employee of Midea's kitchen and bathroom division broke the news, "at present, the 10% layoff target of the Department's R & D department has been set, and the second round of layoffs has begun."

On May 19, Midea Group responded to the news of layoffs. "In view of the judgment on the internal and external environment, the company has orderly contracted its non core business, suspended non operating investment, and taken multiple measures to further consolidate the growth potential and improve its operating performance." Midea did not admit that the company was downsizing, but it also admitted that the company was doing business contraction and adjustment.

From the perspective of Hongbo's pessimistic judgment on the future ahead and the notice of "closing down, stopping and transferring" some businesses, "slimming" has become an inevitable choice for Midea. I have a premonition that the cold winter is coming, and Meidi has spent the winter for herself in advance.