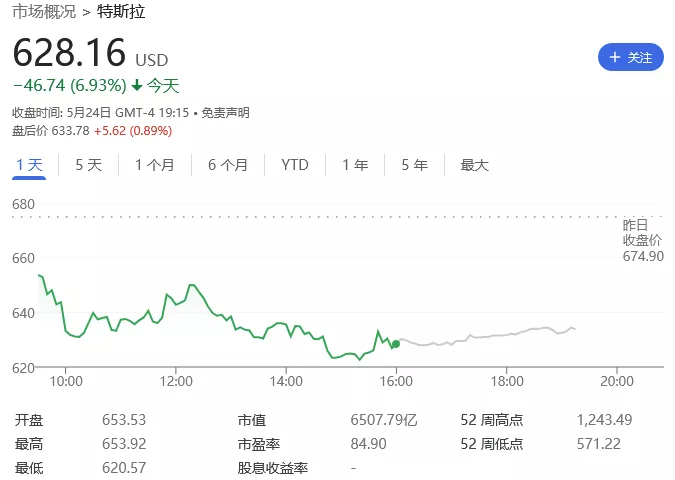

Tesla shares fell 6.93% to $628.16 on Tuesday, lower than when they were included in the S & P 500 index last year. Tesla was included in the S & P 500 index on December 21, 2020, when its share price was about $695 per share. Tesla's share price fell amid a broader sell-off in technology stocks. The Nasdaq 100 index has fallen 29% so far this year, officially entering a bear market. Tesla's share price has fallen 39% this year, down about 50% from its all-time high.

Tesla's $44 billion acquisition may have exacerbated the decline in Tesla's share price. This has become what Tesla bull analyst Dan Ives of Wade Bush securities calls a "circus" because musk is trying to suspend the transaction on the grounds that there are many false accounts on the platform.

However, musk signed a contract with Twitter, agreed to pay a $1 billion "breakup fee" and waived the right to conduct due diligence, which is described in the transaction document submitted by twitter to the U.S. Securities and Exchange Commission (SEC). Ives said that all these dramatic events are torturing Tesla investors.

Ives said in a report on Monday: "This circus has always been a major problem for Tesla's share price. In our view, musk has been embarrassed by the way he has handled this deteriorating situation so far. We believe that with the approaching twitter shareholders' meeting and the prospect of approval of the transaction, musk will face a fork in the road. He must decide what to do next in this soap opera, because the patience of Tesla investors is running out 。”

There is also an upcoming "death crossover" that is unfavorable to Tesla's stock price, which is a bearish signal warning that the downward trend of the stock price is consolidating in the technical analysis. "Death crossover" occurs when the 50 day moving average falls below the 200 day moving average. For Tesla, this may happen before the end of this week.

This lagging indicator means that Tesla's shares may continue to fall, which may lead to further weakness, as musk has promised to buy twitter with millions of Tesla shares as collateral.

"If the twitter deal closes today and Tesla's share price falls to $350-400, musk may be forced to sell 13 million Tesla shares," Bernstein analyst Toni sacconaghi said in a report on Tuesday This potential margin call is just another reason why some Tesla investors may be worried about Musk's acquisition of twitter.