The US stock market is collapsing. Now it seems that Elon Musk's acquisition of twitter may also collapse, will it Musk unexpectedly announced on Friday that he was shelving the deal to buy twitter because he needed to find out whether the fake / spam account on twitter was less than 5% as the company had long claimed

This reason is strange, because Internet robots are nothing new. Musk has repeatedly said that eliminating spam account robots will be the key to making twitter more valuable. But this man is elusive and tireless. Shortly after the first tweet was released, he returned to Twitter and told his fans that he was "still committed to completing the acquisition".

Musk announces suspension of twitter transaction

For many people, this feeling of hesitation is man-made. Musk quickly reiterated its acquisition commitment, which for some investors means that Musk's move is only to renegotiate the price, not to withdraw from the transaction.

Price reduction

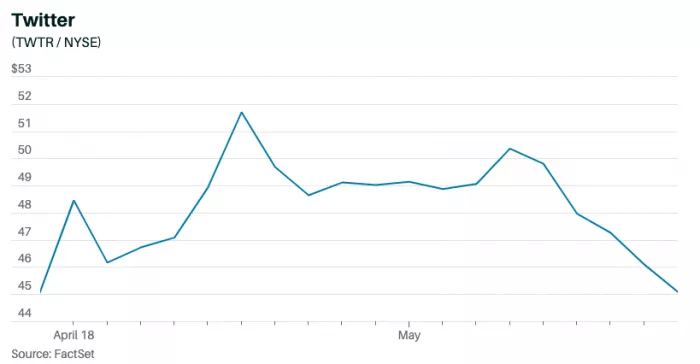

Musk has every reason to return to the negotiating table. Since musk disclosed its initial stake of more than 9% in twitter on April 4, the sharp decline in technology stocks has changed the value of almost all companies As of Friday, the NASDAQ has fallen about 22% since then, while Twitter has fallen only 10% However, twitter shares closed at $40.72 on Friday, down 9.7% from the previous trading day. The market believes that investors should say goodbye to Musk's offer of $54.20 per share, which may be right.

He obviously wants to keep the price down, because Tesla's share price has fallen sharply in the wave of stock market selling in the past few weeks. Wade Bush securities analyst Dan Ives said in a telephone interview. "The market is different now than it was 30 days ago. When Tesla lost $300 billion in market value, the story changed." Currently, musk is using his Tesla shares to raise some cash and pledge shares for loans.

"Musk is trying to make a better deal," said Gary black, co-founder of future fund active, an exchange traded fund. "As the market becomes more and more skeptical, musk has put forward a questionable reason to renegotiate the deal."**

Twitter share price trend

David trainer, CEO of new structure, a stock market research firm, said: "it is not surprising that this transaction has been put on hold. The speculative power to artificially push up the stock price over the past few years is weakening, which has changed the calculation method of transactions such as musk / twitter."

Whether man-made or not, the robot problem may make musk choose to quit. His agreement with Twitter stipulates that he can pay a $1 billion breakup fee and leave only if he has undisclosed problems with the company.

Twitter has insisted for years that robots account for less than 5% of its users, but if that number is higher, musk may try to cancel the deal. The question is not whether he can afford the deal. He is the richest man in the world, even though Tesla's share price plunged 33% after he announced his stake in twitter.

How does twitter respond

However, the twitter board is in a difficult position. After realizing that there was no "knight in white" bid to save the company and resist Musk's hostile takeover, the Board reached an agreement with musk Spam or fake user accounts are a well-known problem Twitter has been trying to solve over the past few years

In any case, twitter management may not want the deal to fail. The day before musk revealed his intention to buy, the company's share price was only $39.31. If the subsequent decline of the stock is as large as that of the NASDAQ index, the current share price will be about $32, 21% lower than Friday's closing price.

Renegotiation may be the best way out. In order to basically match the decline of the NASDAQ index, the new offer may be around $44. This is 12% higher than Twitter's share price before musk proposed the acquisition. It is almost certain that this is much higher than the share price that twitter can reach without Musk's bid.

Shareholders may be disappointed, but they will still make profits The bigger winner will be musk, who always seems to get what he wants.