Recently, the topic of "substantial increase in new energy vehicle premiums" has become a hot search again. However, compared with the "rise" six months ago, some new energy vehicle owners have made different voices. "I thought my car insurance costs would also rise this year, but I didn't expect the prices to drop a lot." In an interview with the reporter of the daily economic news, a BYD yuan Pro owner said that he had just renewed his insurance last month. On the premise that the insurance type and amount had not changed, the cost had dropped by more than 1200 yuan compared with last year.

Image source: provided by the owner

In contrast, the situation of Liu Ming (a pseudonym) is different. Liu Ming, who is also the owner of new energy, told the reporter that his Xiaopeng P7 had no insurance in the whole year last year, but the price for renewal this year was "inexplicably" increased by 1600 yuan. The insurance customer service staff explained that "this year, Tesla, Xiaopeng and Weilai users are the same".

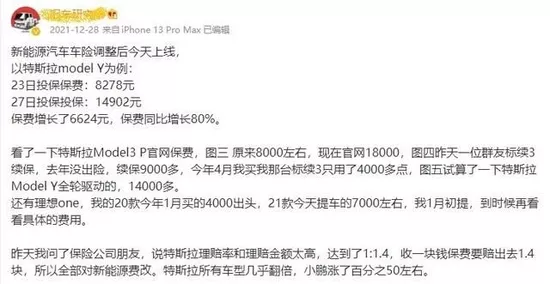

This is not an individual case. The reporter found that since the new energy vehicle exclusive insurance product was officially launched at the end of 2021, the vehicle insurance expenses of some new energy vehicle owners have fluctuated, and even the premium of a certain vehicle model has increased by more than 80% in a few days, which has attracted car owners to ridicule it as a "betting insurance experience".

Source: Sina Weibo

But even so, due to the higher loss ratio of new energy models, higher after-sales costs, and manufacturers' commitment to maintenance accessories The channels are highly concentrated, and the new energy vehicle insurance business is still a bit "chicken ribs" for insurance companies. Especially in the auto insurance reform, after the new energy auto insurance is separated from the fuel auto insurance business, it needs to bear the compensation amount independently, so the industry as a whole is facing greater underwriting loss pressure.

However, some auto companies show strong interest in the new energy auto insurance business. Not only ideal automobile, Xiaopeng automobile, Tesla, velai and other new car manufacturers have successively arranged auto insurance business; Traditional auto companies, including GAC group, SAIC Group, BYD and Geely holdings, have also been involved in the insurance industry. What changes will be brought to the development of new energy auto insurance business by the successive entry of auto companies? Will the owner's insurance cost rise or fall in the future? These problems are becoming the focus of nearly 10 million new energy vehicle owners in China.

The car price of 250000 yuan has become a watershed for premium floating

In fact, the exclusive terms for commercial insurance of new energy vehicles (Trial) (hereinafter referred to as "the terms") issued by the China Insurance Industry Association in December 2021 and the benchmark pure risk premium table for commercial insurance of new energy vehicles (Trial) (hereinafter referred to as "the benchmark premium table") issued by the China actuary association are the main reasons for the premium fluctuation of new energy vehicles.

Prior to this, new energy vehicles had no exclusive vehicle insurance products, and could only use the same vehicle insurance terms as traditional fuel vehicles. Among them, there was no guarantee for the "three electricity" system of new energy vehicles and special use scenarios, and the "three electricity" system was clearly included in the scope of vehicle damage insurance in the terms. At the same time, the risk of vehicle spontaneous combustion, which has attracted much social attention, has also been fully guaranteed. Some people believe that the increase of automobile insurance coverage is bound to be reflected in the premium price.

However, it should be noted that the premiums of not all new energy vehicles show an upward trend. According to the benchmark premium table, from the perspective of pure risk rate, for vehicles with a price of less than 250000 yuan, the pure risk rate will only decrease but not increase; The new energy vehicles with more than 250000 yuan will be increased step by step, but not more than 3% in principle. In terms of insurance types, the fees for vehicle damage insurance were reduced by 60.2%, unchanged by 21%, and increased by 18.8%; Third party insurance charges were reduced by 25%, unchanged by 62% and increased by 13%. According to the analysis of insiders, about 50% of new energy vehicle premiums will be reduced, about 30% will be flat and 20% will be increased.

On this basis, the car owners' habits will also affect the insurance price of automobile insurance. Ping An auto insurance related staff told reporters through wechat: "this year, insurance companies have strict requirements on the insurance of electric vehicles. The number of accidents in the past, the number of handling violations, whether there have been speeding violations, and even the gender of the insured have an impact on the price of auto insurance."

The person in charge of automobile insurance of a dealer in Beijing also told reporters through wechat that the previous vehicle accident records only affected the renewal price of the next year. "However, the number of accidents now affects the insurance premium in the next three years. Many car owners with rising premiums do not know this." The official said.

On the other hand, Zhang Xiang, an automobile industry analyst and President of the new energy automobile technology research institute of Jiangxi new energy technology vocational college, said in an interview with the reporter on wechat that after the terms were introduced, the new energy automobile insurance was separated from the traditional fuel automobile insurance, which was also one of the reasons for the premium increase of some new energy automobile models. "Previously, the large base premium of fuel vehicles can cover the compensation amount of new energy vehicles, which accounts for a small proportion. After independent division, the new energy vehicle insurance business needs to bear the compensation amount independently, so it can only maintain its relatively high total compensation amount by increasing the premium." Zhang Xiang said.

Tesla is listed as a "high risk" model

It is worth mentioning that during the reporter's interview, a number of insurance company staff told the reporter that the premiums of some new car manufacturers' models will rise significantly, and even may refuse to be insured.

"The premium of 9 of the 10 Tesla cars this year is higher than that of last year, and so are Xiaopeng and Weilai." A Pacific Auto Insurance staff told reporters through wechat that Tesla is one of the "high-risk" models in this year's auto insurance. If the owner had more than two accidents last year or had poor daily driving habits, some insurance companies would directly refuse to insure.

In fact, the models of Tesla, Xiaopeng, Weilai and other new car manufacturers are indeed the "key care" objects for the rise of new energy vehicle premiums. After the introduction of the terms, Tesla has said that the national average increase of its vehicle premium is about 10%. The average premium increase of high-performance models is within 20%. Xiaopeng automobile also publicly responded to the issue of premium increase, saying that the average premium increase of its full line models ranged from 2.9% to 18.2%.

Photo source: photographed by reporter dongtianyi (data map)

In this regard, Wang Hao, the founder and CEO of Coppola automotive consulting services (Qingdao) Co., Ltd., said in an interview with reporters that the reasons for the higher premium of Tesla and other new car manufacturers' models are mainly the following three points: first, the zero integer ratio of new car manufacturers' models is higher; Second, the overall number of new car manufacturing enterprises' products is small; The third is the "monopoly" behavior of new car manufacturing enterprises on maintenance and parts supply channels.

"These factors lead to the insurance company's expectation of the maintenance cost of new energy insurance is not optimistic, so the insurance company can only add the expected cost to the premium, so the fee is increased." Wang Hao said.

Wang Hao told the reporter that the cost of the three electricity system in new energy vehicles accounts for about 70%~75% of the vehicle price, and the cost of later maintenance is higher. Take the battery assembly of Tesla Model 3 for example, its separate procurement cost is about 180000 yuan. In addition, some new car manufacturers also adopt the structure of all aluminum body, which leads to the high cost of accessories, which also makes the vehicle insurance cost need to be increased accordingly.

Through the service and maintenance data of 19million vehicles from 2016 to 2021, we predict, a data analysis company, found that the maintenance cost of electric vehicles is 2.3 times that of fuel vehicles. The reason for the high maintenance cost of electric vehicles lies in their novelty. Maintenance personnel not only need professional knowledge and certification, but also their hourly labor cost is 1.3 times higher, and the maintenance time is 1.5 times higher than that of traditional fuel vehicles.

On the other hand, the "monopoly" of the new power brand of car making on the maintenance and parts supply channels has also pushed up the later maintenance cost of vehicles. Wang Hao said that Tesla, Xiaopeng, Weilai, ideal and other brands have established direct sales maintenance centers in major cities, and the parts are directly supplied exclusively by the brand side. As a result, the maintenance channels of the above brand models are almost unique, and the price of parts is also the "one word" of the manufacturers, resulting in higher maintenance costs of insurance accident vehicles.

In addition, Wang Hao believes that the principle of insurance is the law of large numbers. The risk coefficient of the same brand model is close, but the larger the insurance base, the smaller the compensation risk for insurance companies. Therefore, the low market ownership of new car makers is also one of the reasons for their premium growth.

"It is the charging level of the maintenance market that can determine the really reasonable insurance charging standard. The maintenance charging is mainly composed of the cost of spare parts and the charging of man hours. The pricing power of these two items is determined by the number of service channels that can be provided by the OEMs and the market." Said Wang Hao.

What is the intention of accelerating the layout of automobile enterprises

Although the premiums of some new energy vehicles have been raised, in the eyes of most insurance companies, the exclusive vehicle insurance for new energy vehicles is still a "loss business".

According to the data of China bancassurance, from 2016 to the first half of 2020, the overall accident frequency of new energy vehicles was 3.6% higher than that of non new energy vehicles, and the accident rate of household new energy vehicles was 9.3% higher than that of non new energy vehicles. According to the data reported by Shenwan Hongyuan, at present, the average loss ratio of new energy automobile insurance is close to 85%, and the industry as a whole is still facing great underwriting loss pressure.

In this context, some auto companies show a positive attitude towards auto insurance business. According to incomplete statistics by the reporter, ideal automobile, Xiaopeng automobile, Tesla, Weilai and other new car manufacturing enterprises have laid out auto insurance business. Traditional auto companies, including GAC group, SAIC Group, BYD and Geely holdings, have also been involved in the insurance industry.

Source: Daily Economic News

It is believed that, in addition to promising the huge market potential of new energy automobile insurance, automobile enterprises have successively laid out the insurance industry, because automobile insurance is the entrance for automobile enterprises to directly link C-end users, which can not only open the whole life cycle of main vehicles, but also cultivate new business models and growth space.

"Through the innovation of insurance business, automobile enterprises can not only promote the brand image as a selling point, but also establish a capital pool by charging premiums in advance to increase the injection of working capital, so as to improve the production scale." Zhang Xiang said that new car manufacturers can also rely on their advantages in intelligent networking technology to accelerate the promotion of "UBI auto insurance" in China, so as to achieve profits.

UBI auto insurance can be understood as a kind of insurance based on driving behavior. Through the Internet of vehicles and other technologies and mobile Internet technologies, UBI auto insurance integrates the drivers' driving behavior habits, driving technology, frequency and degree of using vehicles, vehicle information and surrounding environment, and makes differential pricing for auto insurance. In October, 2021, Tesla launched the "real time driving behavior (UBI)" automobile insurance product in the United States. Tesla CEO musk said: "insurance will become Tesla's main product, and the insurance business value will account for 30-40% of the vehicle business value."

However, it should be noted that at present, Tesla, velai and other auto companies are only insurance brokerage companies established in China. In the "licensed but unlicensed" stage, their business is limited to providing insurance intermediary services, which is essentially different from insurance companies. Cuidongshu, Secretary General of the national passenger car market information Federation, said in an interview with reporters that at present, the entry of automobile enterprises into the insurance industry is more for the purpose of cooperating with insurance companies to promote digital fine automobile insurance varieties to enhance services.

What will be the impact of automobile enterprises' entry into the insurance industry on the premiums of new energy vehicles, According to Wang Hao, "from the perspective of the business model design of Tesla and other new car making forces gradually moving towards' F2C ', with the enhancement of the control power of the main engine plant over users and the direct or high monopoly of the maintenance service channel in the future, the insurance maintenance cost and the income pricing standard transmitted will make the insurance companies more passive, and the new energy insurance premium will remain at a high level in the short term."