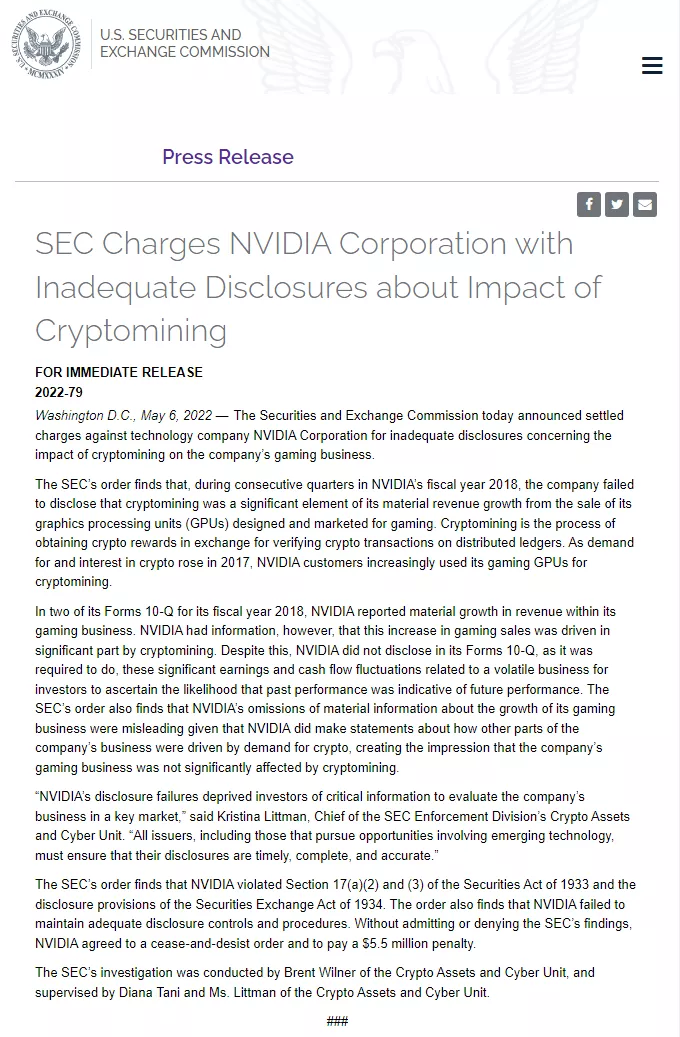

The securities and Exchange Commission (SEC) has just disclosed: NVIDIA has issued a high ticket to the company because it deliberately kept investors in the dark and concealed the fact that it sold many game GPUs to cryptocurrency miners** According to the terms of the settlement released on Friday, because the report emphasized the significant growth of "game" related revenue, but deliberately concealed the extent to which it depended on the cryptocurrency mining market, the SEC determined that NVIDIA constituted a serious misleading to investors.

Screenshot (from sec official website | report PDF)

As part of the settlement agreement, NVIDIA did not admit misconduct, but still agreed to correct any illegal "undisclosed information" behavior.

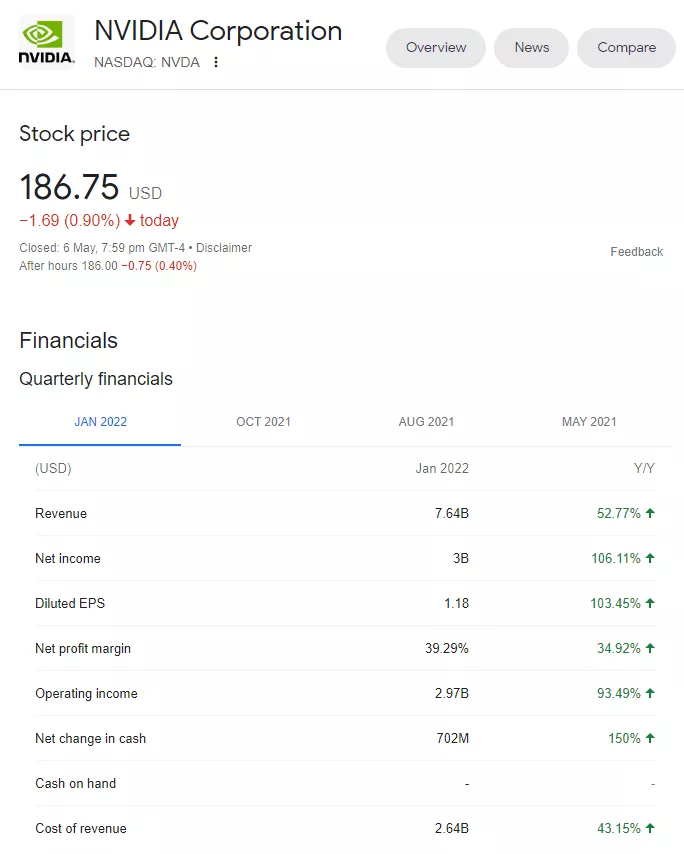

It is reported that the relevant allegations originated from NVIDIA's financial report for fiscal 2018. The SEC pointed out that the company saw an explosive growth in sales related to cryptocurrency mining in 2017, and the return rate of eth was quite envious at that time.

(from NVIDIA official website)

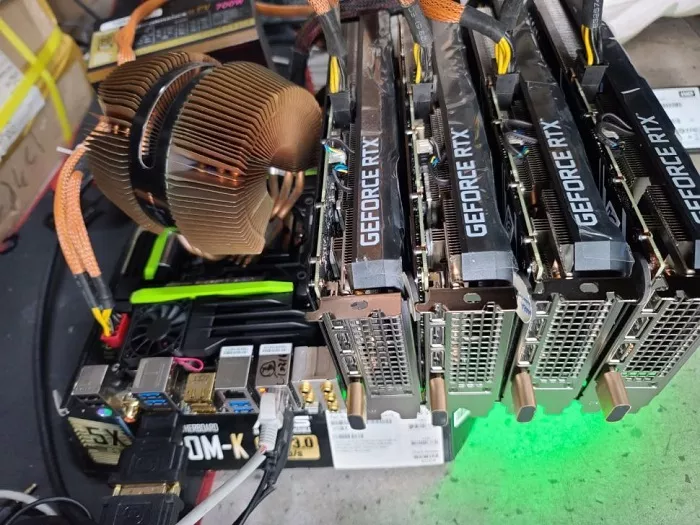

Given that mining has been widely recognized as a major cause of GPU shortage in the retail market, NVIDIA tried to allocate part of the already tight GPU production capacity to a separate CMP mineral card product line to avoid a greater impact on the game graphics card market.

However, the reality is that its employees admit that many game GPUs eventually flow to cryptocurrency mining channels. SEC file disclosed: "the company's salesperson (especially in the Chinese market) reported that the demand for game GPU has ushered in a significant growth stimulated by the surge in mining demand for cryptocurrency.".

(Figure via quasar zone)

Considering the exaggerated volatility of cryptocurrency and considerable investment risk, investors often ask how much NVIDIA depends on the market. After all, even if the temporary sales data is bright, it does not mean that reliable growth can be achieved in the future.

"NVIDIA analysts and investors are deeply interested in the extent to which its' game 'revenue is affected by the cryptocurrency mining market. During this period, they frequently asked executives about the extent to which this part of revenue growth is driven by cryptocurrency mining," the SEC said.

Unfortunately, NVIDIA has been tight lipped about this matter, saying only that cryptocurrency is an important factor in other markets, but it was finally recognized by the SEC as deliberately deceiving investors.

In fact, investors' anxiety is not unreasonable - the last cryptocurrency crash (mine disaster) in 2018 led to a $500 million reduction in the company's quarterly revenue forecast and triggered shareholder litigation.

Finally, Kristina Littman, head of encryption assets and networks at the SEC, concluded:

NVIDIA's disclosure dereliction of duty made it impossible for investors to obtain key information to evaluate the company's business development in key markets.

All listed companies - including emerging technology companies seeking IPO - must ensure that they can disclose relevant information in a timely, complete and accurate manner.