Recently, technology stocks have ushered in a cold winter. Such a selling wave has never been seen since the bursting of the Internet stock market foam in 2001. Last week, the Nasdaq composite index, dominated by US technology stocks, fell 3.8% for seven consecutive weeks. This is the longest consecutive decline in the index in the past 21 years.

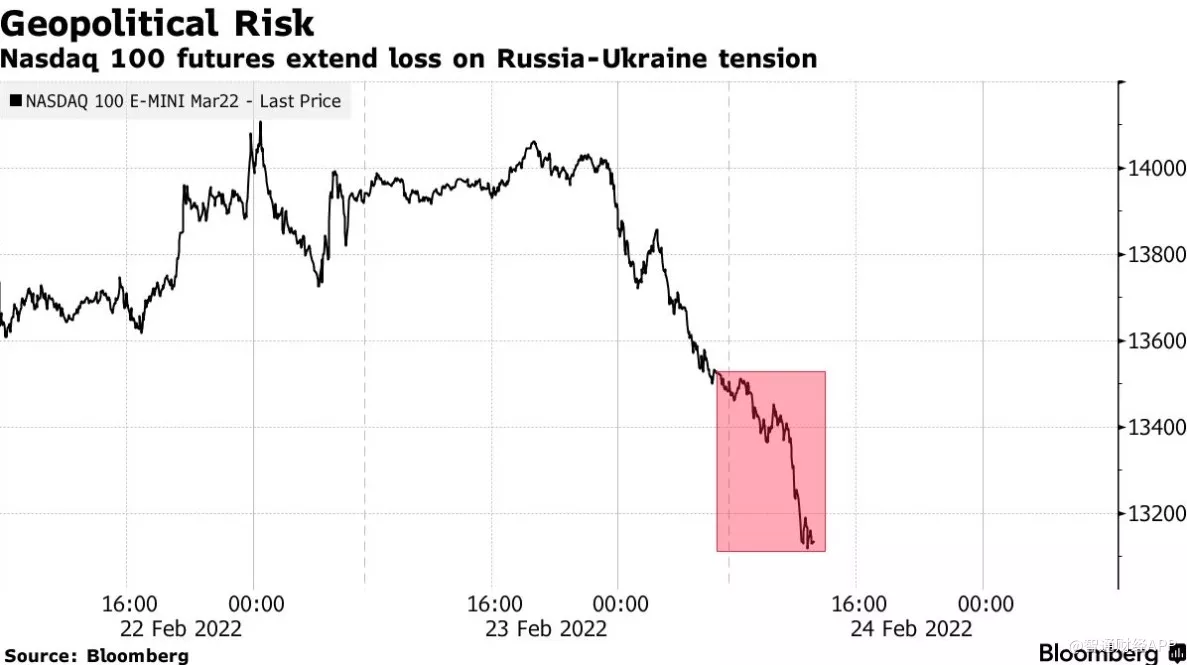

According to media analysis, the factors causing the sharp decline of science and technology stocks include the record inflation in the United States, the Federal Reserve raising the benchmark interest rate, the conflict between Russia and Ukraine and other factors. In the past few years, the share prices of technology stocks and high growth stocks in the United States have risen sharply, but recently, the above factors have had a huge impact on the investors of these two kinds of stocks.

The Federal Reserve said that it would continue to raise the benchmark interest rate to deal with inflation in the future, which makes us stock investors worry that the gradual rise of capital cost and the decline of consumer confidence will impact the profit margin of listed companies.

On November 19 last year, the NASDAQ index set a high point. Compared with this high point, the current index is down 29% and closed at 11354.62 on Friday. The S & P 500 index fell less miserably, but it also entered a bear market on Friday (meaning it has fallen 20% from its peak).

Unexpected Cisco

Last week, Cisco Systems became the worst performing technology stock, down 13%. The main reason was that the company predicted that its revenue would fall in the second quarter, which surprised Wall Street.

Cisco's network equipment is very common in American companies, and the company's share price is regarded as a harbinger of the performance of the American economy.

Cisco said in the earnings analyst teleconference that in view of the current uncertainty, the management is more pragmatic about the current business environment, more cautious in performance expectations, and look at it step by step.

Declining stocks

Last Thursday, PC giant Dell released its latest financial report, and then the share price fell, falling as much as 11% in a single week. Shopify, which provides software for e-commerce companies, fell 10% in a single week. In addition, due to the downgrade of stocks by Wall Street analysts, workday, a cloud computing software developer, plunged 9%, and OKTA, a security software developer, fell as much as 14% in a single week.

Stocks linked to American billionaire musk also fell sharply. Musk is preparing to buy twitter for $54.2 per share (total $44 billion), but the transaction is suspended because of the other party's false account and robot account. Last week, twitter shares fell $38.29 to close at $38.29. Tesla shares also fell 14% (musk needs to sell Tesla shares to raise acquisition funds).

Among the major technology giants, Apple It fell 6.5% in a single week and suffered eight consecutive weeks of decline. Google's parent company, alphabet, fell 6% and Amazon fell as much as 5% in a single week.

In the current second quarter, the NASDAQ index has fallen by 20%. One week before the end of the second quarter, it is expected to have the worst quarterly decline since the fourth quarter of 2008 (during the financial crisis).