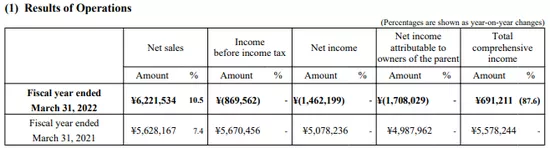

Just now, the most tragic scene in the history of venture capital appeared - this afternoon (May 12), son Zhengyi announced the latest financial report of Softbank group in Tokyo, Japan: as of March 31, the net loss of Softbank group in fiscal year 2021 was 1.7 trillion yen (about 90 billion yuan). More importantly, the net loss of vision fund in fiscal year 2021 was as high as 2.64 trillion yen (about 140 billion yuan).

Even on a global scale, this is the largest loss in the history of venture capital, unique.

With a dignified face, son Zhengyi announced that he would officially slow down investment: Softbank would adopt a conservative investment pace. He also gave a specific figure: compared with last year, the amount of investment this year will be halved or a quarter.

The world's largest venture capital institution is facing the most difficult times. The market value of the project has shrunk, the fund-raising has become difficult, and the collective investment has slowed down - Sun Zhengyi's current experience is also what most domestic VC / PE are experiencing.

The biggest hole in history: vision fund lost 140 billion

Son Zhengyi announced a moratorium on investment

Vision fund for success and vision fund for failure.

Recalling a year ago, son Zhengyi proudly announced in Tokyo that the net profit attributable to the shareholders of Softbank's parent company was 4.9879 trillion yen (about 294.8 billion yuan), setting a record for a Japanese listed company. "Softbank group has achieved more profits in one quarter than any Japanese enterprise in history."

Among them, the biggest return comes from the South Korean version of Alibaba coupang. On March 11, 2021, coupang was successfully listed on the New York Stock Exchange, and its share price soared by 40% on the first day of listing. Softbank, as the largest shareholder of coupang, naturally made a lot of money. This is another classic investment of son Zhengyi after Alibaba, with a Book Return of $24.5 billion.

However, the good times will not last long. Coupang's share price fell all the way after its listing. It fell by an amazing 40% in the first quarter of this year. At present, the market value is only $17 billion, which also reduced the original investment income of Softbank to less than $6 billion.

Such a scene also appeared in other star projects: in the fourth fiscal quarter (January to March 2022), the share price of Singapore online car Hailing service giant grab fell 51%, and the share price of Indian digital payment start-up paytm fell 60%, which also led to the loss of vision fund of US $2.4 billion and US $1.3 billion respectively... The share prices of almost all participating companies have been lower than the offering price, resulting in heavy losses.

This afternoon, son Zhengyi disclosed a tragic data at the financial report meeting: as of March 31, the net loss of vision fund in fiscal year 2021 was 2.64 trillion yen, about 140 billion yuan.

Affected by this, Softbank group's net loss in fiscal year 2021 was 1.7 trillion yen (about 89.328 billion yuan), which can be called the largest hole in the history of global venture capital.

Sun Zhengyi and his team have long smelled the danger. According to Bloomberg, a managing partner of Softbank vision fund also expressed the same attitude as son Zhengyi at a meeting in Los Angeles in March this year: it plans to reduce investment. The situation is stronger than people, and the investment madman rarely declares to lie flat.

Sun Zhengyi and Softbank have always been regarded as one of the wind vanes of the primary market. He once said: "spring will come sooner or later, we will continue to sow, and the seeds are growing steadily."

Today, however, son Zhengyi announced that Softbank would adopt a conservative investment pace - the investment volume this year will be halved or a quarter compared with last year.

Ali accounts for 22% of net asset value

Softbank tearful sale, emergency cash out

Cash out to survive has become the most urgent work of son Zhengyi.

It is reported that Softbank is trying to raise cash and is evaluating assets that may be liquidated. If everything had been going well, son Zhengyi would have received a huge sum of $66 billion from NVIDIA, but in the end, the acquisition of arm failed in February this year.

Time waits for no man. Softbank soon launched preparations for arm's independent IPO, saying it may list arm on NASDAQ before March 2023. It is reported that Softbank is planning to choose Goldman Sachs as the lead underwriter of arm's independent IPO, which may be valued at $60 billion (about 381.7 billion yuan). Son Zhengyi just said that if the market is not good enough when arm prepares for IPO, it may wait and delay for another 3-6 months.

Recall that in 2016, son Zhengyi spent $32 billion on arm, creating the most sensational acquisition of that year. At that time, he said that arm would be the future of Softbank group. Unexpectedly, arm has now become the hottest potato in sun Zhengyi's hand.

Meanwhile, Softbank withdrew from the self driving Unicorn cruise. GM announced on March 19 that it would buy the equity of its subsidiary cruise held by Softbank vision fund for $2.1 billion, thereby expanding GM's equity in cruise to 80%. GM also said it would invest an additional $1.35 billion in cruise to replace the commitment made by Softbank vision fund in 2018.

In this transaction, Softbank actually made a little money. Statistics show that Softbank previously invested about $1.2 billion in cruise, and the sale of $2.1 billion is equivalent to making $900 million (about 5.7 billion yuan). As a trader who raised Cruise's valuation to $30 billion, son Zhengyi was helpless to give up the automatic driving company second only to Google waymo.

In mid April this year, the US Securities and Exchange Commission document showed that Softbank vision fund sold 50 million coupang shares, with a total value of $1 billion. This is the second time in at least a few months that Softbank has sold its shares in the Korean e-commerce giant. The price of the shares sold was only $20.87 per share, nearly 30% lower than the issuing price of coupang in September last year, which can be described as a tearful sale.

Looking back on his past investment career, sun Zhengyi has written the legend of counter attack countless times, and the Chinese people are most familiar with his classic World War I against Ali. Today, son Zhengyi also revealed the latest figures: Alibaba accounts for 22% of Softbank's net asset value and 49% of vision fund.

But there are many painful lessons. The failure of investment in Wework in that year is an indelible memory of son Zhengyi. For this reason, he publicly apologized for the first time at the annual general meeting of Softbank in 2020; Since then, the bankruptcy of Greenhill capital, the invested project, also made sun Zhengyi bow down and admit his mistake again.

I don't know how long it will take son Zhengyi to get out of the snowstorm this time.

Son Zhengyi is not alone

Domestic VC brake: wait for the valuation to drop

Coincidentally, a similar scene of sun Zhengyi is also being staged in the domestic venture capital circle.

Let's look at two sets of data first——

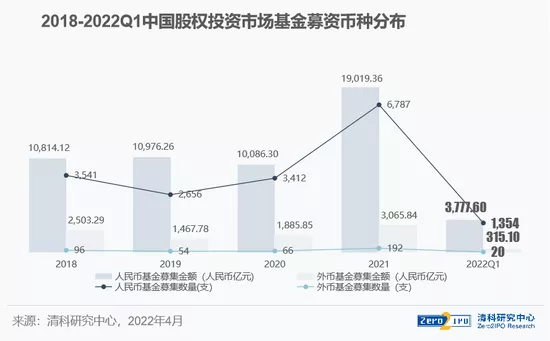

In the first quarter of this year, there were 1374 newly raised funds in the market, of which the situation of foreign currency funds was worrying. In the first quarter of this year, a new round of raising occurred for 20 foreign currency funds, a year-on-year decrease of 57.4%; Disclosed that the amount raised was about 31.51 billion yuan, a year-on-year decrease of 62.6%.

In other words, the US dollar fund-raising decreased by about 60% in the first quarter of this year, unprecedented.

The investment side also slowed down - the domestic equity investment market slowed down significantly in the first quarter of this year - a total of 2155 investments occurred, down 27.5% year-on-year; The disclosed investment amount was 19.822 billion yuan, a year-on-year decrease of 47.1%, which can be called a half cut. Just like son Zhengyi, domestic VC / PE brake.

There are many reasons behind this, and the sharp decline of China concept shares since this year has become an unspeakable pain for VC / PE, which has greatly affected the confidence of the primary market, especially the US dollar fund. Data show that as of March 11 this year, there were 271 Chinese concept stocks listed in the United States, with a total market value of about US $972.4 billion, falling below the US $trillion mark.

Not only China concept stocks, but also the A-share and Hong Kong stock markets have seen a rare breaking tide this year. For example, AI Unicorn Ge Lingshen Tong, who has high hopes, officially landed on the science and innovation board in March this year, but broke off at the opening. The latest market value is only 4.8 billion yuan, which is really sad.

As for new consumption, it is the hardest hit area. Take Naixue's tea as an example. When it was listed in June last year, the issuance market value reached HK $34 billion, and has been declining all the way since. So far, the latest market value of Naixue's tea is HK $7.8 billion, but when it was raised in round C, it was valued at more than 10 billion yuan.

Cherish the bullets in your hand - this is a consensus reached silently by VC / PE. When the primary market came to the cold cycle trough, the dilemma of fund-raising and exit quickly transmitted to the investment side, and everyone slowed down.

Previously, an unnamed investor reported to the investment community that the boss directly stopped the existing investment. "I have been doing research for this period of time, and there is no opportunity for new projects to go to the investment committee." In the four months since 2022, the company has not had a project meeting and has not opened for a whole quarter.

Such cases are not uncommon. It is reported that Tencent investment also began to limit the selling speed this year, "if you can't sell, you can't sell". What's more, a US dollar fund boss who has worked for decades revealed to his friends that he had wealth and freedom and decided to take this opportunity to retire.

As Liu Xiaodan, founder of Chenyi investment, admitted at the LP conference a few days ago, under the background of drastic adjustment of the capital market, it is inevitable for Chinese investment institutions to reshuffle.

No winter will not pass, no spring will not come. I just don't know how long this cold winter will last.