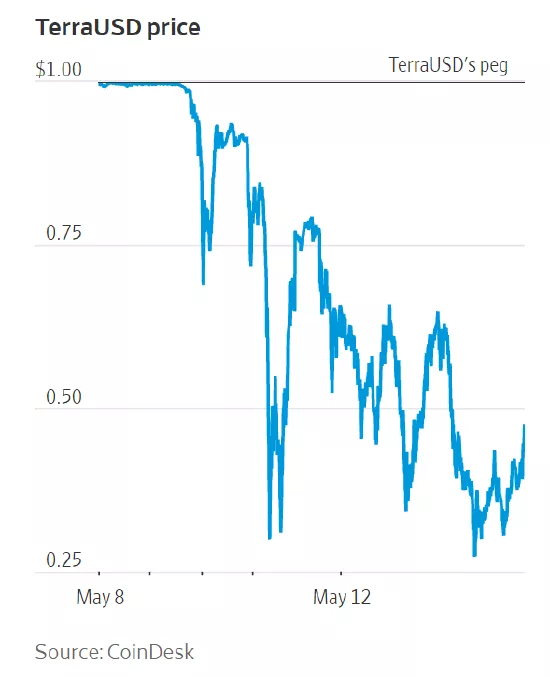

The cryptocurrency terrausd has a task: keep its value at $1. Since its launch in 2020, it has basically achieved this and rarely deviated significantly from its expected price. This makes it a stable haven where traders and investors can store money. But this week, the stability of the currency collapsed, plunging more than a third on Monday and 23 cents on Wednesday.

Terrausd plummeted

The crash cost investors billions of dollars. The volatility further affected other cryptocurrencies, leading to a sharp decline in bitcoin prices. Tether, another stable currency, fell slightly to 96 cents on Thursday and then re pegged to the dollar.

The share price of coinbase global, the largest cryptocurrency exchange in the United States, fell more than 75% this year. The company said on Tuesday that it was losing users and trading volume.

The cryptocurrency market has matured in recent years. As a financial system running parallel to major banks, it has evolved its own "bank" and "loan" functions. These characteristics have attracted more Wall Street participants and venture capital, making cryptocurrency start-ups earn a lot. Cryptocurrency has spent some of its money on advertising and lobbying, depicting a growing market.

However, the collapse of terrausd has raised urgent questions about the ambition of cryptocurrency developers to establish a new form of finance. It shows that, despite the hype, the nascent cryptosystem is still prone to the kind of destabilizing bank runs that occur in the non digital world.

Do Kwon, the sincere creator of terrausd, instructed to spend huge amounts of money trying to save his project. On twitter, he tried to unite his followers.

"Terra's return to normalcy will be a sight to look forward to," he wrote on Wednesday morning, when his stable currency was trading at half its expected value. "We will stay here. We will continue our business."

Do Kwon, CEO of terraform labs, Seoul

"Stable currency" is the pillar of cryptocurrency financial system. Although the followers of cryptocurrency still need to keep in touch with the traditional financial currency endorsed by the government, such as paying rent, buying cars and paying bills in the traditional financial system. But they only want to trade and invest in the cryptocurrency world, not in dollars, euros or pounds. Therefore, stable coins act as a reserve currency and an asset with recognized value.

Both professional traders and individual investors use stable currencies. As of Tuesday, they had invested about $180 billion in stable currencies. Traders can sell bitcoin to terrausd and then use terrausd to buy another cryptocurrency ether without having to contact us dollars or bank accounts.

Encryption companies are trying to convince Congress that the stable currency is a safe place for investors to invest. But the collapse of terrausd has shaken this assumption and the idea that there may be any safe place in cryptocurrency technology.

The stable currency tries to solve a difficult problem: how can we keep something stable in a volatile financial system?

Some stable currencies try to achieve this by holding secure assets such as treasury bills in a reserve account: for each stable currency created, a $1 treasury bill will be deposited in that account. When the stable currency is redeemed, the $1 treasury bill will be withdrawn from the account.

Terrausd has a more complex approach. This is a stable algorithm, which relies on financial engineering to maintain the link with the US dollar. Many cryptocurrency traders believed in this technology, and terrausd's popularity soared. However, although the scale of terrausd has expanded to more than $18 billion, it collapsed within a few days.

Traders said that the catalyst for the snowball decline starting from the weekend and on Monday was a series of large withdrawals from anchor protocol. Anchor protocol is an encrypted bank created by the developer of terrain labs, Kwon's company. These platforms allow stable currency investors to earn interest by lending coins.

In the past year, anchor has stimulated people's interest in terrausd by providing a high return of nearly 20% of terrausd deposits. This is much higher than the deposit interest of traditional bank dollar accounts and the interest rate obtained by crypto investors from other more traditional stable currency loans.

Anchor, like other encrypted lending agreements, lends terrausd to borrowers in need. Critics, including cryptocurrency investors who attacked Kwon on social media, questioned whether such yields were sustainable. However, according to the platform's website, investors had deposited more than $14 billion in anchor as of late last week.

But last weekend's big deal devalued terrausd from $1. This instability prompted anchor investors to sell terrausd. This in turn led to more investors withdrawing from anchor, resulting in a chain effect of more withdrawal and more selling. According to the agreement's website, anchor's terrausd deposits fell to about $2 billion as of Thursday, down 86% from the peak.

"There's a bank run," said Michael boroughs, managing partner of Fortis digital value LLC, a crypto hedge fund.

"Once people lose confidence, we've seen this before in money market funds and commercial paper trading, they will race to quit," said Joe abate, a research analyst at Barclays.

The terrausd crisis is a blow to the reputation of Kwon, who graduated from Stanford University. Kwon worked at [Apple] before studying encryption technology( https://apple.pvxt.net/c/1251234/435400/7639?u=https%3A%2F%2Fwww.apple.com%2Fcn%2Fmusic%2F ) Apple Inc. and Microsoft Corp. He is outspoken on social media and often attacks critics of the crypto community.

Terrausd's troubles may cast a shadow of doubt on all stable currencies, or at least turn customers to their competitors.

Treasury Secretary Janet Yellen told senators on Tuesday that the collapse of terrausd exacerbated the government's concern that the stabilization currency, including two technical means of traditional currency endorsement and algorithm support, may be trampled by investors and need a regulatory framework.

Martin hiesboeck, head of blockchain and encryption research at digital money platform support, said that many investors rushing to transact terrausd may not know what they are doing.

"You can have a group of developers write an algorithm, and they may know 100% how it works," hisbock said. "But ordinary investors don't read the code. They don't read the details."