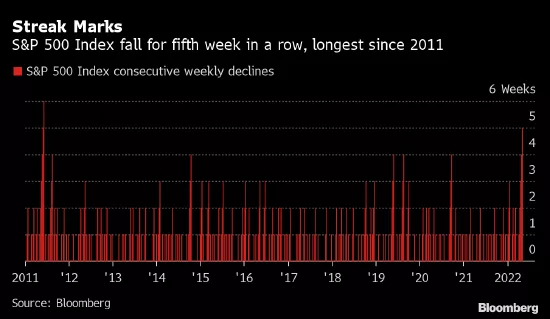

The US stock market fell for the fifth consecutive week, the longest decline in 11 years, as Friday's strong employment report added fuel to lingering concerns about high inflation. The S & P 500 index closed 0.6% lower on Friday and fell 0.2% for the week. This is the first time since 2011 that the index has recorded five consecutive weeks of decline.

Nine of the 11 major industry sectors of the benchmark stock index fell, led by materials, communication services and non essential consumer goods. Energy and utility stocks rose. The Nasdaq 100 index fell 1.2%, the longest weekly decline since 2012, and the Dow Jones Industrial Average fell 0.2%.

"The stock market seems to have been riding a roller coaster as investors continue to debate strong economic signs under interest rate hikes, and interest rate hikes remain a drag on high valuation companies," said Ed Moya, senior market analyst at OANDA.

When U.S. stocks reversed sharply after rising for three days, the decline in just two days exceeded the previous increase. This is also the continuation of the overall downturn of the stock market this year.

Investors are worried that the Fed's rapid interest rate hike in the coming months will lead to a recession in the US economy. Friday's employment report showed that the growth of non-agricultural employment in April was higher than expected, while the labor participation rate fell to 62.2%.