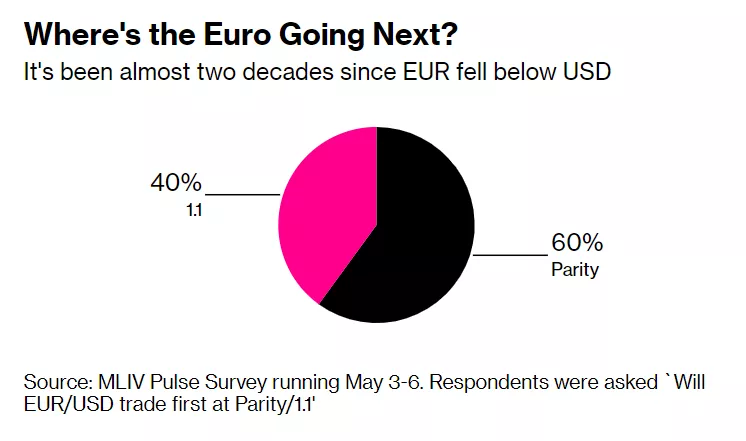

With the strengthening of the US dollar and the slowdown of the European economy, where will the euro go next? With the intensification of the conflict between Russia and Ukraine and the supply chain crisis, and the rising risk of stagflation, foreign exchange traders expect the euro to fall further, making it parity with the US dollar for the first time in nearly 20 years. According to the latest survey of MLIV pulse, 60% of respondents believe that the euro will eventually be equal to the US dollar, and a small number of more than 400 respondents expect the euro to rise to 1.15 against the US dollar. Last Friday, the exchange rate of the euro against the US dollar was about 1.05, close to the lowest level since the beginning of 2017.

However, some of the respondents, including economists and managers on Wall Street, expected that the euro would fall to about 0.48% again, which was more pessimistic than that of the investment bank portfolio.

The concerns of MLIV interviewers highlighted the headache of the European Central Bank in policy decision-making. The European central bank tried to cool down sharply rising prices without stifling economic vitality. 40% of respondents were more worried about the eurozone recession than inflation, and the same proportion were worried about stagflation.

As the eurozone is close to Russia and Ukraine and depends on cross-border trade, Europe is at the center of global concerns about rising prices and slowing economic growth. The eurozone economy grew by only 0.2% in the first quarter, Italy's economy shrank, France's economic growth was flat, and Spain's economic expansion slowed down. Factory production and new orders in the region have fallen sharply, and business confidence is dissipating.

When asked what is the best way to deal with this year's potential recession, the most popular answer is to short the euro, followed by expanding energy exposure by investing in stocks or commodities, followed by long bonds and cash, and then long gold and the dollar.

"If the situation in Ukraine worsens, I think Europe will fall into recession. It may take several quarters, but I think it will eventually," Jamie Dimon, chairman and CEO of JPMorgan, told Bloomberg Television on May 4

According to Bloomberg, some economists lowered the economic growth forecast of the eurozone in 2022 to 2.8% from 4.2% at the beginning of the year. However, after Russia stopped sending natural gas to Poland and Bulgaria, the risk of economic recession increased further. With rising prices, businesses and consumers in Europe are facing unprecedented pressure.

The US dollar strengthened against all major currencies as inflation accelerated and the global growth outlook deteriorated.

On Friday, the United States released strong employment data, which further pushed up US bond yields and gave investors more reasons to invest in the United States. The dollar rose the most against risk sensitive currencies such as the Australian dollar, the New Zealand dollar and the South African Rand.

The Bloomberg dollar spot index rose 0.4%, expanding its gains over the past month to nearly 4%. The dollar rose 1% against the Australian and New Zealand dollars and 0.8% against the Rand. As of press time, the yield of 10-year US Treasury bonds climbed to 3.169%, the highest level since November 2018.

"The dollar continues to strengthen in this environment as US bond yields are still rising and concerns about the global slowdown are growing, as it is seen as a safe haven." Khoon Goh, strategist at ANZ, told Bloomberg.

The median forecast of professional forecasters for the exchange rate of the euro against the US dollar is to rise to 1.12 by the end of the year. At present, none of the banks surveyed by Bloomberg predicts that the euro will reach parity against the US dollar.

ABN AMRO briefly raised this view in March, but raised its expected interest rate a few weeks later. Nomura had previously warned that if presidential candidate marine Le Pen wins the French election, it may push the parity of the French currency with the US dollar. Finally, macron's successful re-election also relieved the euro bulls.

The weakening of the euro is partly due to the strengthening of the US dollar, but the US dollar may begin to show signs of overbought as US Federal Reserve Chairman Powell plays down the possibility of raising interest rates by 75 basis points.

Therefore, although the interest rate premium in the United States has the risk of expansion, the foreign exchange rate depends on expectations. The euro is still bullish this year - tightening monetary policy in the United States will eventually not be enough to further boost the dollar, and the European Central Bank may start raising interest rates as early as July. Meanwhile, leveraged funds are cutting bearish positions. All this could support the euro.