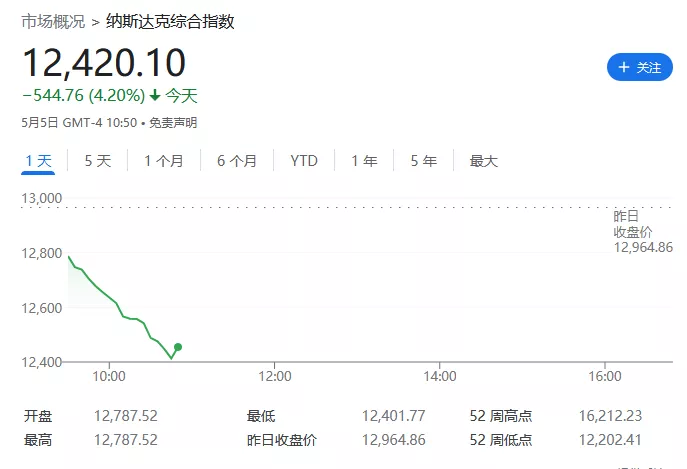

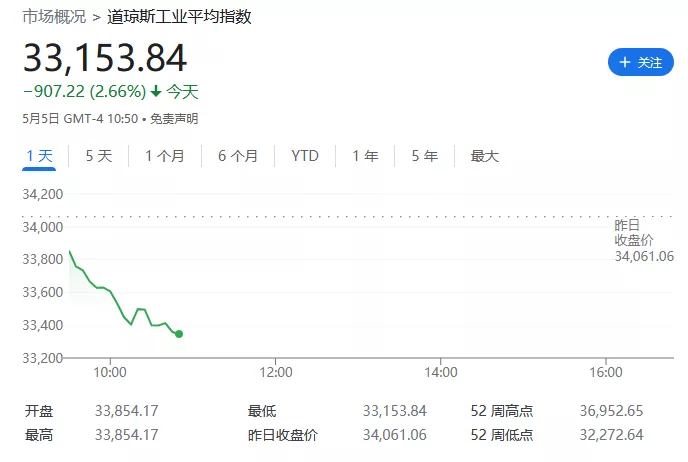

**The Dow fell 701.48 points, or 2.06%, to 33359.58; The NASDAQ fell 547.09 points, or 4.22%, to 12417.76; The S & P 500 index fell 119.61 points, or 2.78%, to 4180.56. The NASDAQ fully reversed yesterday's gains. David Wright, a short seller on Huaer street, believes that this bear market has just begun, "the macroeconomic and geopolitical turmoil is worrying investors.

No other country in the world would bet so much wealth on stocks. We are at the peak of complacency. At present, the market is in the biggest bear market of our life. The bear market has just begun, and there is a wave of big market behind it. "

US stocks rose sharply on Wednesday, with the Dow closing 932 points higher. The NASDAQ rose 401 points. The S & P 500 index rose 125 points, or 3%, the largest one-day increase since May 18, 2020.

On Wednesday, the Federal Reserve raised interest rates by a single 50 basis points at its first meeting since 2000 and announced that it would shrink its table from June 1.

Fed chairman Powell's speech on Wednesday pushed us stocks up sharply that day. Powell said that the Fed is unlikely to raise interest rates by 75 basis points at its next meeting. His remarks dispelled the concerns of the market about faster interest rate hikes in the future, and showed a high degree of flexibility in the path of interest rate hikes, which boosted market sentiment.

But Powell's position is by no means dove. He only promised to raise interest rates by 50 basis points in a row, and said that the Fed needs to slow down the pace of interest rate hikes when hot inflation cools or the job market deteriorates. Even so, it will raise interest rates by 25 basis points each time.

"We need to really see our expectations come true - inflation is virtually under control and starts to fall, but we won't stop there. We'll go back to raising interest rates by 25 basis points each time," Powell said

Karim chedid, head of investment strategy at BlackRock, said: "in fact, Powell ruled out the possibility of raising interest rates by 75 basis points. I think this is what the market reacted to, that is, a rebound after the release of pressure. Inflation data is very important now. If it flattens as expected by the Federal Reserve, the market will accept it."

Marcella Chow, global market strategist at JPMorgan asset management in Hong Kong, said the Fed's 50 basis point interest rate hike on Wednesday was in line with expectations, thus eliminating some investors' concerns about the Fed's more aggressive measures.

On the news of overseas central banks, the Bank of England announced a 25 basis point interest rate increase on Thursday, the fourth consecutive interest rate increase since December last year, raising the interest rate to the highest level since February 2009.

The Bank of England estimates that GDP will grow by 0.9% in the first quarter of 2022, up slightly from 0.75% in March. However, due to the additional public holidays and the reduction of novel coronavirus detection, GDP growth in the second quarter of 2022 is expected to be about zero. The economy is expected to shrink by 0.25% in 2023. The economic growth forecast for 2024 was also lowered from 1% to 0.25%.

The European Central Bank is expected to raise interest rates later this year. Inflation in the eurozone reached a record high of 7.5% in April, almost four times the ECB target, but the ECB has been slow because of concerns about the economic slowdown.

Thursday's financial reports of shopike, shaflow, etc.

In terms of economic data on Thursday, the U.S. Department of Labor reported that 200000 people applied for unemployment benefits for the first time last week, which is expected to be 182000. Worth 180000. After adjustment, the four week moving average of the number of people applying for unemployment benefits for the first time was 188000, an increase of 8000 compared with the revised average of the previous week.

On Friday, the United States will release its April non farm employment report.

Focus stocks

EBay's number of active buyers fell 13% year-on-year in the first quarter, and sales fell 5.9% to $2.48 billion, compared with an average analyst estimate of $2.46 billion. Excluding some items, the earnings per share was $1.05, exceeding the expected $1.04. As of the quarter, eBay had 142 million active buyers, down 13% from the same period last year.

It is reported that Tesla CEO Elon Musk has obtained $7.14 billion from a group of investors including Oracle co-founder Larry Ellison, which will be used for the $44 billion acquisition of social media platform twitter.

On May 5, China Life announced that after the company submitted its annual report on form 20-F for the fiscal year ended December 31, 2021 to the U.S. Securities and Exchange Commission ("sec") on April 29, 2022, the company was preliminarily recognized as an issuer under the accountability act by the SEC on May 4, 2022 (New York time).

Under the Accountability Act, if a company has been recognized as an issuer by the Commission under the Accountability Act for three consecutive years, the SEC shall prohibit the company's shares or American depositary shares from trading on the national stock exchange or OTC market in the United States.

JD responded that it was included in the "pre delisting list" by the SEC: strive to maintain its listing status on NASDAQ and Hong Kong stock exchange. JD said that it has been actively seeking possible solutions. The company will continue to comply with relevant laws and regulations of China and the United States, and maintain its listing status in the Nasdaq market and the Hong Kong stock exchange if conditions permit.

Carmaker strantis released delivery and revenue data for the first quarter of 2022. The company said that its sales in the first quarter increased by 12% year-on-year, supported by strong pricing, automobile portfolio and exchange rate factors. However, the company believes that the chip supply problem this year may only achieve a partial recovery.

Shell's adjusted profit in the first quarter reached US $9.13 billion, higher than the market consensus forecast of US $8.67 billion and a record high. The outstanding performance was mainly due to the rise in crude oil and natural gas prices, strong profits from the refining business and the bright performance of the trading department.

Shopify announced that it had reached an agreement to acquire delivery technology provider deliverr for $2.1 billion.

Volkswagen will invest 10 billion euros to produce electric vehicles in Spain. Volkswagen CEO Herbert dis said on Thursday that he plans to invest 10 billion euros ($10.59 billion) in Spain to produce electric vehicles and batteries.

Yabao announced its financial results for the first quarter of 2022. Data show that Q1 net sales of $1.13 billion, an increase of 36.3%, analysts expect $1.03 billion. Adjusted EPS in the first quarter was $2.38, a year-on-year increase of 116%, and analysts expected $1.65.

Bank of America incorporated the vice president of Goldman Sachs. According to people familiar with the matter, Bank of America has re hired David Larsen, vice president of Goldman Sachs Group, as its managing director. According to Larsen's information on LinkedIn, he served as a director of Bank of America until he left bank of America in 2018 and went to Goldman Sachs as vice president.

Meta platforms plans to slow employee recruitment as revenue growth slows and inflation concerns intensify. After delaying the recruitment of junior engineers in recent weeks, the company plans to stop or slow down the recruitment of most middle and senior positions. It is said that the recruitment department of meta has begun to suspend the recruitment of some positions, but the company said it has no layoff plans at present.

Booking's revenue increased by 136% year-on-year in the first quarter.

Twilio's revenue in the first quarter was better than market expectations.

Morgan Stanley lowered its target price for upstart from $115 to $88.

Bitcoin mining company marathon digital's revenue in the first quarter was lower than market expectations.