In April, the closure of the epidemic in Shanghai affected the normal operation of various links of the semiconductor industry chain to a certain extent. Under the repeated epidemic, the demand side was further suppressed, the sales volume of new energy vehicles with relatively strong demand slowed down marginally, and the delivery time of some semiconductor products was also prolonged due to factors such as supply side interference. With the marginal weakening of the demand side, the supply side is also partially affected by the epidemic. Superimposed on the high performance base brought by the upward boom of the industry in 21q2, the performance of semiconductor related companies may be under pressure in 22q2.

For the intelligent internal reference in this issue, we recommend the report "multidimensional impact of the epidemic on industrial operation, pay attention to the progress of subsequent resumption of work and production" of China Merchants Securities to analyze the latest semiconductor industry under the influence of factors such as the impact of the epidemic.

Author: Yan fan, Lu Zhiqi, Cao Hui, Wang Tian

1、 Multidimensional impact of the epidemic on industrial stability

1. Demand side: repeated intensification of the epidemic and structural adjustment on the demand side

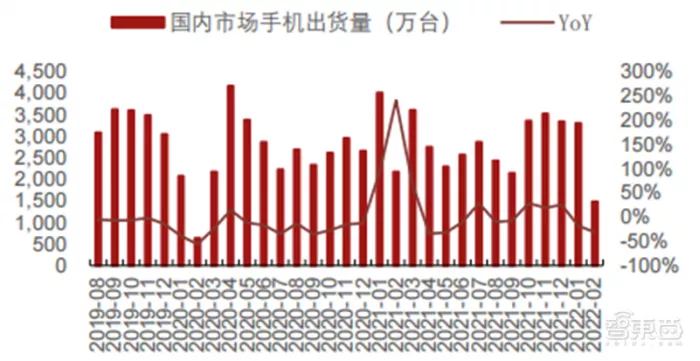

Smart phones: the repeated domestic epidemic has further weakened the demand for mobile phones. Since March, due to the impact of COVID-19, the war between Russia and Ukraine, inflation and other factors, it is expected that domestic mobile phone demand will continue to weaken. According to the latest report of counterpoint, in the first quarter of 2022, the sales volume of smart phones in China decreased by 14% year-on-year to 74.2 million, the growth momentum weakened, and the quarterly sales volume was close to the level of the first quarter of 2020 affected by the epidemic.

▲ monthly shipments of smart phones in China (10000) (to February)

▲ shipment volume and proportion of 5g mobile phones in China (to February)

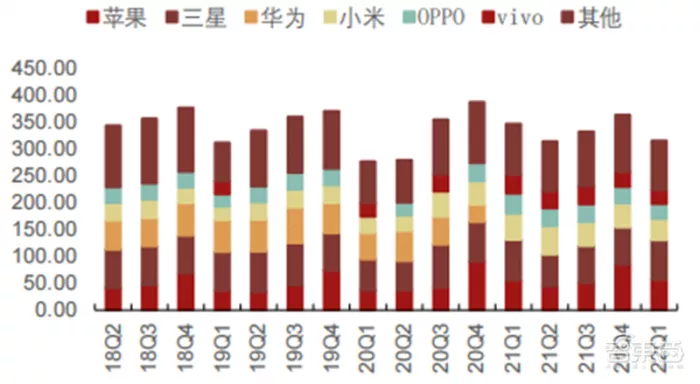

▲ changes in global smartphone shipments (million units) and market share

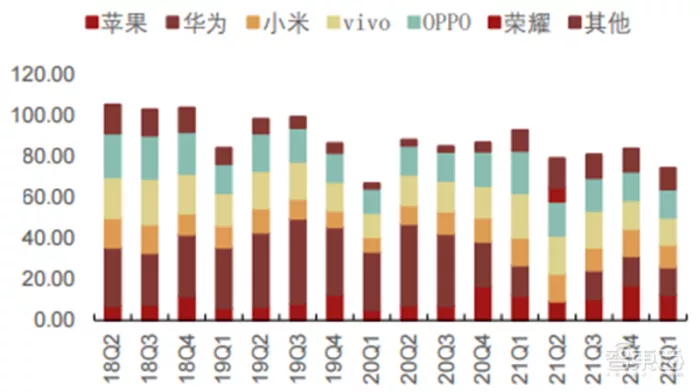

▲ changes in China's smartphone shipments (million units) and market share

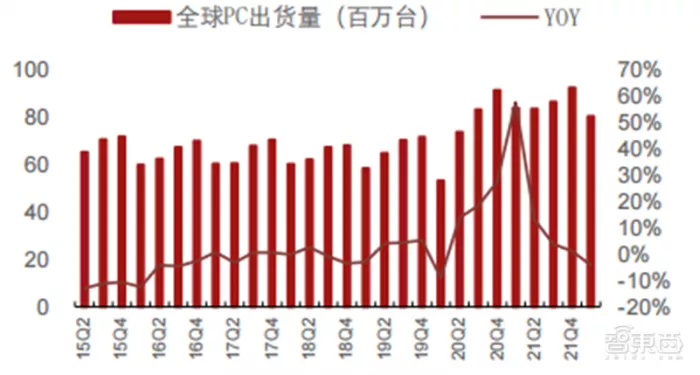

PC: the prosperity of the industry driven by the home economy has come to an end, and the growth rate of global shipments has turned negative in Q1 of 22 years. According to IDC data, the year-on-year growth of global PC shipments in 20q2-21q1 accelerated, but the year-on-year growth rate in 21q2 began to decline significantly. The growth rate has maintained a downward trend since 21q2. The global shipments in 22q1 have begun to decline, with a negative growth rate of - 4.14% year-on-year / 13.12% month on month. Domestically, China's notebook computer shipments in March were 1.33 million units, with a year-on-year increase of - 26.14% / month on month increase of + 14.43%, and the year-on-year growth rate fell again.

▲ global PC quarterly shipments (million units) and growth rate (%)

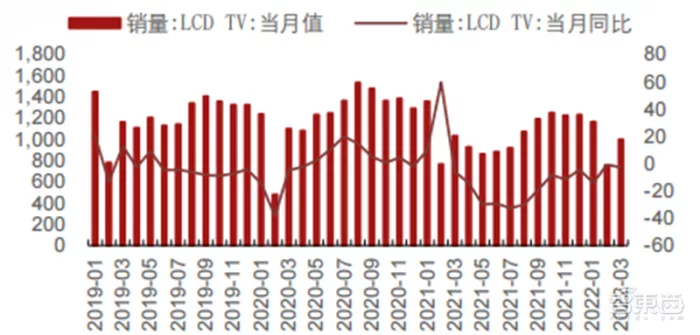

TV: in March, the sales volume of LCD TV in China was 9.995 million units, with a year-on-year increase of - 2.92% and a month on month increase of + 32%. The sales volume improved after the Spring Festival, and the month on month growth rate improved significantly. From a year-on-year point of view, the downward trend of sales volume is still continuing.

▲ LCD TV sales volume (million units) and year-on-year (%)

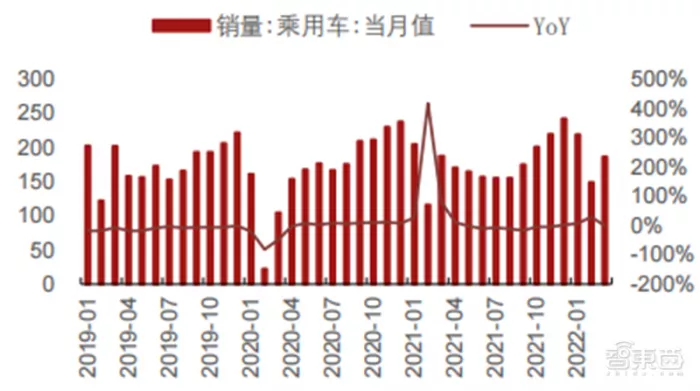

Automobile / new energy vehicle: the sales volume of passenger vehicles in March was basically the same year on year, the sales volume of new energy vehicles in March improved month on month, and the sales volume in April was greatly affected by the epidemic. According to the data of China Automobile Industry Association, the sales volume of passenger cars in China in March was about 1.86 million, with a year-on-year increase of - 0.53% and a month on month increase of + 25.3%. The sales volume of new energy vehicles was about 461000, with a year-on-year increase of + 104% and a month on month increase of + 38%. According to AFS data, affected by the lack of core, the global automobile production capacity will be reduced by 10.272 million units in 2021, and the production in the Chinese market will be reduced by about 1.982 million units, accounting for 19.3%.

▲ monthly sales volume of passenger cars in China (10000 vehicles) and year-on-year growth rate (March)

▲ monthly sales volume of new energy vehicles in China (10000 vehicles) and year-on-year growth rate (March)

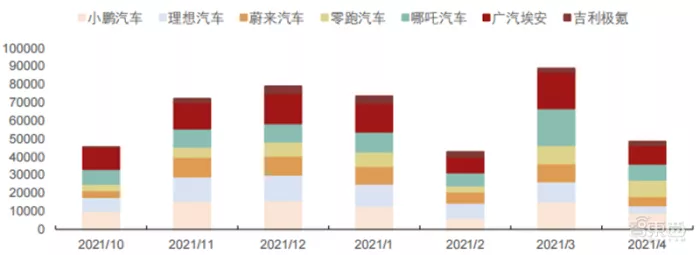

However, affected by the epidemic, the sales volume of new energy vehicles in April was not optimistic as a whole. In April, the sales volume of each new energy vehicle manufacturer decreased month on month. The sales volume of each manufacturer were Xiaopeng automobile (9002 vehicles), ideal automobile (4167 vehicles), Weilai automobile (5074 vehicles), Zero run automobile (9087 vehicles), Nezha automobile (8813 vehicles), GAC AIAN (10212 vehicles) and Geely krypton (2137 vehicles), with a month on month decrease of - 42%, - 62%, - 49%, - 10%, - 57%, - 50% and 19% respectively, In addition to the positive growth of Geely krypton with small sales volume, the sales volume of other manufacturers decreased significantly. Mainly due to the impact of the epidemic, manufacturers have great pressure on the supply side and delivery side, especially those whose production base is located in the Yangtze River Delta. Take the ideal car with the largest decline as an example. The Changzhou base of ideal car and more than 80% of its suppliers are located in the Yangtze River Delta, and some suppliers are unable to supply or stop production completely. After digesting the existing spare parts inventory, it can not continue to maintain production, which has a great impact on the production of ideal cars in April, resulting in the delay of new car delivery of some users.

▲ monthly sales of intelligent pure trams (vehicles)

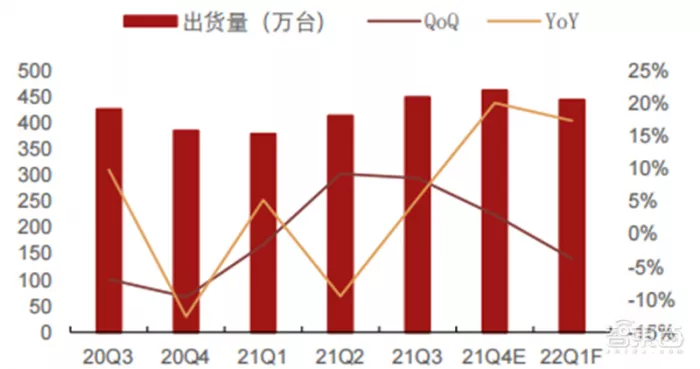

Server: global server quarterly shipments grew steadily year-on-year. The revenue of server index stock Xinhua (the leader of global server BMC chip) reached NT $433 million in March 2022, with a year-on-year increase of 66.3%. According to DIGITIMES, the global server shipment of 22q1 was 4.406 million units, with a year-on-year increase of + 18% and a month on month increase of - 5%. In 2022, Q1 still had the problem of short and long feet in the supply of low-end IC (such as PMIC) and MOSFET and other components. In addition, due to the lunar new year, the server shipment speed was slow. Although some orders from the previous quarter were deferred, the global server shipment decreased by 4.5%. It is expected that there is still a gap in Q2 server IC and components, and the sealing control will affect the shipment progress of some supply chains. However, the demand of large data centers in North America is strongly supported, and it is estimated that the global server shipment will increase by nearly 9% in the quarter.

▲ quarterly global server shipments and their growth rate (2022q1)

2. Inventory side: the increase of inventory level continues, and the turnover days rise significantly

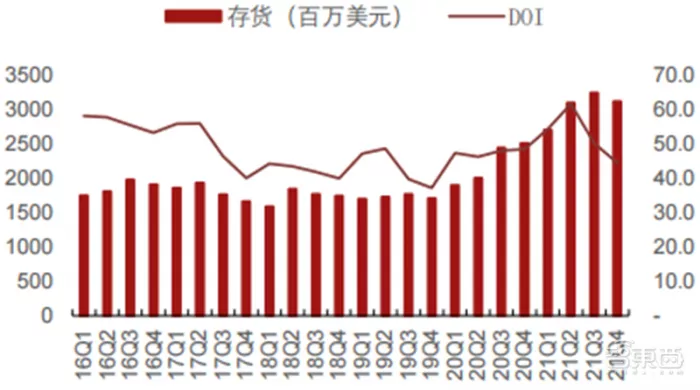

In terms of global semiconductor inventory, the inventory of major foundries in 22q1 continued to grow month on month, and the number of inventory turnover days continued to increase, at an all-time high; The absolute amount of overseas IDM / fabless inventory increased 22q1 month on month. While the operating cost increased, the number of inventory turnover days increased. Overall, the inventory turnover days of overseas IDM and fabless have begun to pick up gradually.

▲ inventory of major IDMS overseas

▲ main overseas fabless inventory

▲ main overseas foundry inventory

▲ inventory of major overseas packaging and testing manufacturers

Distributors: the inventory of major distributors in 22q1 continued to increase, and the inventory turnover days and inventory amount entered the upward channel. According to the data of inventory and inventory turnover days of major global electronic component distributors, the inventory level of global agents has gradually decreased since 18q3 ~ 18q4, and the inventory turnover days have been relatively stable or increased slightly; Since 2021, the inventory level of the world's well-known agents has been rising month on month. The total inventory of 22q1 distributors and large factories has increased by + 25% year on year / 3.9% month on month. In March, the revenue of Da Lian was NT $80 billion, with a year-on-year increase of + 17.5% and a month on month increase of + 31.0%. The revenue picked up seasonally, improved significantly month on month, and the year-on-year growth rate was still relatively high.

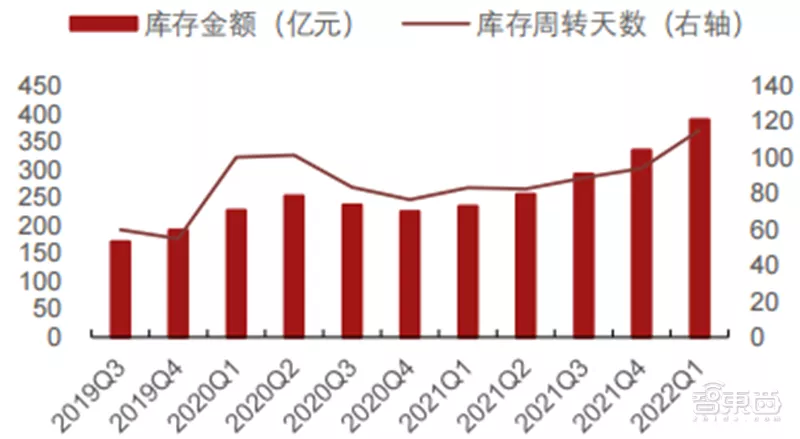

▲ inventory of major distributors

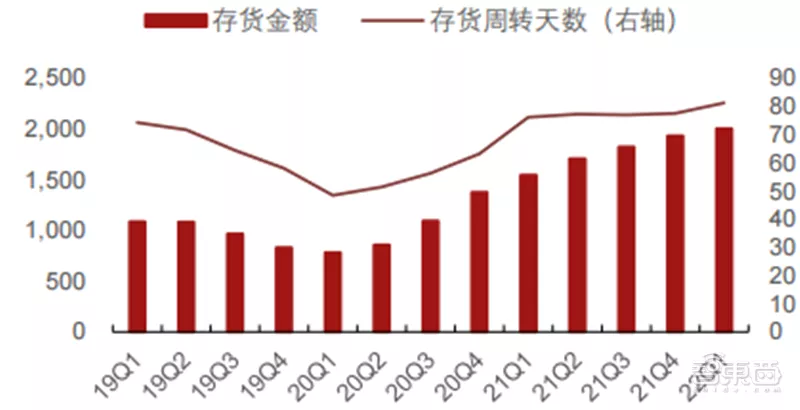

Among domestic manufacturers, the inventory of IDM and design manufacturers has an obvious upward trend. The turnover days are 63.2 and 88.7 of 21q4 respectively, rising to 65.6 and 115.4 of 22q1. The inventory turnover days of design industry are mainly due to the increase of inventory amount, and the sales end remains stable; The main domestic agent factories have not released the first quarterly report, but according to the financial report data of TSMC, the inventory level of agent factories has increased, and the inventory and turnover days show an upward trend in 22q1; The turnover days of the sealed and tested end gradually stabilized, and the overall turnover days of the industry remained at about 115 days.

▲ inventory of domestic IDM manufacturers

▲ inventory of domestic design manufacturers

▲ TSMC inventory

▲ inventory of domestic sealing and testing manufacturers

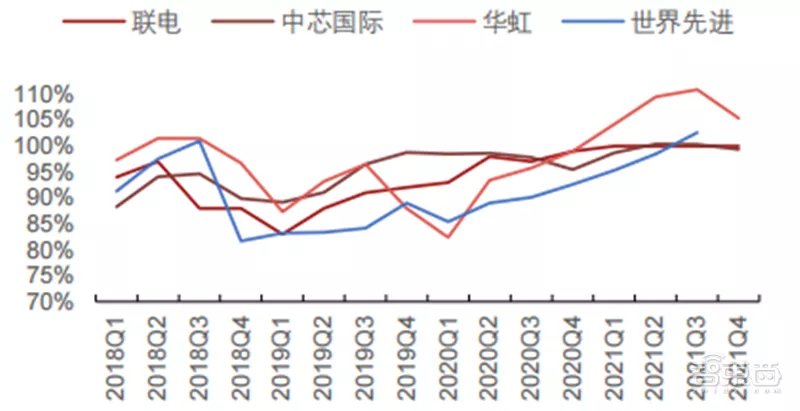

3. Supply side: the short-term capacity is impacted by the epidemic, and the annual capacity utilization is expected to be high

From the 21q4 data, the capacity utilization rate of mainstream wafer factories remained full, and the product ASP maintained a quarterly rise. 1) Capacity utilization rate: the capacity utilization rates of liandian and Huahong 21q4 remained at full load, and the capacity utilization rate of SMIC 21q4 was 99.4%, close to full load. Although the capacity utilization rate of 21q4 decreased slightly month on month, it was mainly affected by seasonal factors, including year-end maintenance and so on. According to liandian 22q1 method, the wafer has exceeded 100% for several consecutive quarters; According to the Huahong 21q4 law, it is expected that the supply of products will exceed the demand in 2022, and the capacity utilization rates of 8-inch and 12 inch will remain full load; According to SMIC 21q4 law, it is expected that there will still be a structural shortage of production capacity in 2022;

2) ASP: due to the continuous shortage of production capacity, the mainstream OEM 21q4 ASP maintained a month on month improvement trend. Meanwhile, TSMC is expected to raise the price of all products by 20% in March 2022, liandian is expected to raise the price of 22q1 by 5% month on month, and SMIC is expected to improve ASP in 2022; TSMC 22q1's gross profit margin was 55.6%, with a month on month ratio of + 2.9ppts / year-on-year ratio of + 3.2ppts, close to the previous guidance upper limit of gross profit margin (53.0% - 55.0%). The month on month increase of gross profit margin is mainly due to continuous cost improvement, increase of product value and more favorable exchange rate. The company expects the long-term gross profit margin to reach 53% or above. On the whole, the downstream demand of 22q1 is expected to remain structurally strong. At present, the overall production capacity is tight, and the prosperity of the industry will remain.

▲ utilization rate of advanced capacity of each foundry

Shanghai's "global static management" mainly affects the manufacturing link. The head manufacturers adopt closed-loop production, and the impact is controllable As an important hinterland for the development of the national semiconductor industry, Shanghai's semiconductor output value accounts for 22% of the global output value. The epidemic situation in Shanghai has a relatively limited impact on design, software, EDA and other links, and has a great impact on manufacturing. However, the head manufacturers adopt the closed-loop production mode, and the impact is controllable. According to it times, during the period of static management, more than 98% of the production capacity of Jita semiconductor port plant was maintained in normal operation, and Hongcao plant was also steadily promoting various "epidemic prevention and production protection" measures; Huahong semiconductor recalled necessary personnel back to five factory areas and adopted closed management of only entry and no exit to maintain production and operation; TSMC's plant in Songjiang District, Shanghai also implements the "two points and one line" closed-loop management of plant and dormitory; Among the large semiconductor enterprises in Shanghai, except SMIC, which had two classes of stagnation, others were in normal production.

▲ proportion of Shanghai semiconductor output value

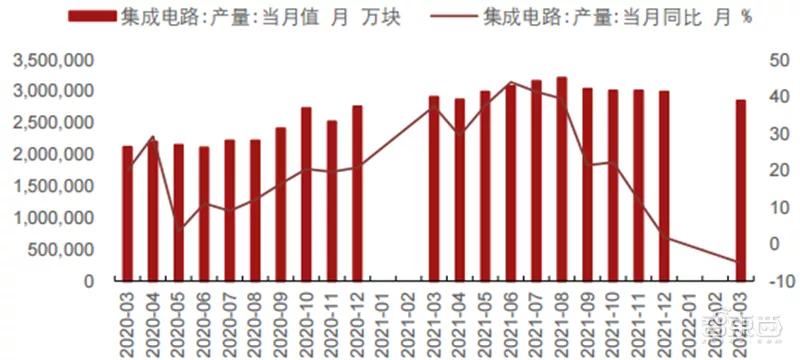

However, in terms of overall supply, China's IC output shrank for the first time in March. According to the data of the National Bureau of statistics, the output of integrated circuits in March was 28.5 billion, with a year-on-year decrease of - 4.2%. The output of chip manufacturing decreased sharply, shrinking for the first time since the beginning of 2019, mainly due to the supply interruption caused by the weak demand for consumer electronics and the impact of the epidemic in Shanghai and other regions.

▲ monthly output and growth rate of integrated circuits in China

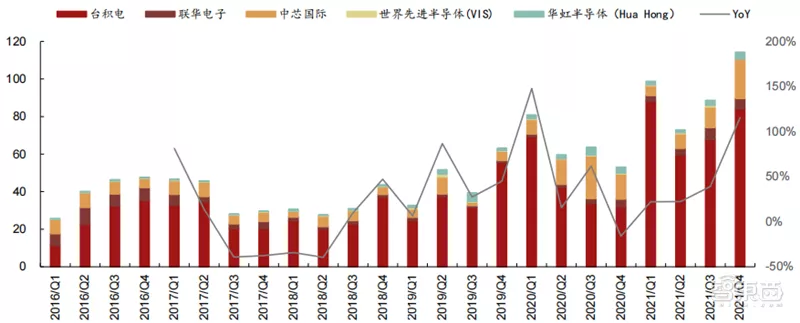

**According to the latest semi report, global semiconductor manufacturers are expected to increase the production capacity of 8-inch wafer factories by 950000 pieces / month from 2020 to 2024, an increase of 17%, reaching a record high of 6.6 million pieces per month. In terms of capital expenditure, the capital expenditure of 21q4 global mainstream OEM factories has increased significantly month on month, of which SMIC 21q4 capital expenditure is about US $2.1 billion, close to the expenditure in the first three quarters of 2021, Although the annual capital expenditure of Huahong and UMC was affected by the delivery date of equipment, Huahong 21q4 capital expenditure maintained a month on month increase, and part of UMC capital expenditure was transferred to 2022.

22q1 TSMC's capital expenditure reached US $8.46 billion. Looking forward to 2022, TSMC's capital expenditure guideline is US $40-44 billion, a significant increase of 33-46% year-on-year. SMIC is expected to increase from US $4.5 billion in 2021 to US $5 billion in 2022. UMC is expected to increase from US $1.8 billion in 2021 to US $3 billion in 2022. The mainstream OEM continues to expand production.

▲ quarterly capital expenditure of wafer factory from 2016 to 2021 (USD 100 million)

Japan's semiconductor equipment shipments reached a new high again. 1) North America: since 2021, the monthly shipment of semiconductor equipment has exceeded US $3 billion, and picked up again in December to US $3.92 billion. 2) Japan: after reaching the peak of 30 billion yen in May 2021, it made a slight correction. It gradually began to recover from July 2021 and rose to 314.9 billion yen in March 2022, setting a new high again. The growth rate fell slightly compared with the peak in December 21 and January 22, with a year-on-year increase of 30.8% in March. 3) Semi said that in 2021, the total global semiconductor equipment expenditure reached US $90.7 billion, a year-on-year increase of 42%. Meanwhile, semi expects that the equipment expenditure is expected to reach US $107 billion in 2022, a year-on-year increase of + 18%.

China's semiconductor equipment imports continued to pick up. According to the data of the General Administration of Customs of China, since 2021, the import volume of China's semiconductor equipment has maintained a year-on-year increase every month, showing a significant decline since July 2021. The month on month ratio of August / September / October 2021 was almost flat, and the year-on-year growth rate gradually increased after slowing down in August, reaching a year-on-year growth rate of + 42.7% in December 2021. The year-on-year growth rate declined in January 2022, but it has rebounded significantly since February. By March, it has rebounded to 2.63 billion yuan, with a year-on-year increase of - 10.7% and a month on month increase of + 12%.

▲ import volume and growth rate of China's semiconductor equipment

As a leading indicator of semiconductor prosperity tracking, global semiconductor equipment sales increased rapidly in 2021 According to semi data, global semiconductor manufacturing equipment sales surged in 2021, up 44% from US $71.2 billion in 2020, reaching a record high of US $102.6 billion. For the second time, China became the largest market for semiconductor equipment, with sales increasing by 58% to US $29.6 billion, increasing for the fourth consecutive year. South Korea is the second largest equipment market, with sales up 55% to $25 billion. Taiwan, China increased by 45% to US $24.9 billion, ranking third. The surge in sales of semiconductor equipment reflects the positive attitude of the global semiconductor industry towards capacity expansion. The semiconductor industry is expected to continue to expand its scale to meet the needs of various emerging high-tech applications.

4. Price side: product price differentiation, chip delivery time lengthened again

In terms of storage prices, DRAM prices have continued to rise this year, and the DXI price index has broken through the previous high. This month, the price index callback, with a significant decline. It is expected that DRAM will still be oversupplied in the second quarter

According to trendforce Jibang consulting, the overall DRAM average price fell by about 0 ~ 5% in the second quarter. Due to the slightly high inventory of the buyer and the seller, and the impact of the recent Russian Ukrainian conflict and high inflation on the demand side, such as PC, laptop and smartphone, which weakened consumers' purchasing power. At present, only the server side is the main source to support the memory demand, so there is still an oversupply of DRAM in the second quarter.

Meanwhile, it is estimated that the price of NAND flash will increase by 5 ~ 10% in the second quarter. Due to the slightly high inventory of the buyer and the seller, as well as the impact of the recent Russian Ukrainian conflict and high inflation on PCs, laptops and smartphones, the demand side continued to weaken. However, under the influence of the raw material pollution incident of kioxia and WDC, the overall supply was significantly revised down, which became the key to the 5-10% increase in the price of NAND flash in the second quarter.

In April 2022, the channel prices of power devices MOSFET and IGBT remained stable as a whole. According to the data of positive energy electronic network, some popular power MOSFET and IGBT single tube channel prices are selected as a reference. From 21q1, the channel prices of power devices begin to enter the uplink channel. Some power mosfetasp has doubled from about 2 yuan to about 4 yuan, and some IGBT single tube ASP has increased from about 20 yuan to about 100 yuan, with a huge increase. After entering March 2022, the prices of some medium and low voltage MOSFETs (2n7002lt1g is ansenmey's 60V MOSFET) continued to decline, and the prices of high voltage MOSFETs (such as irfp460pbf and irf840pbf are Weishi's 500V MOSFET) were relatively stable; IGBT products (ikw40n120h3 is Infineon 400V IGBT, ikw75n60t is Infineon 600V IGBT) continue to rise no longer and enter a relatively stable state. In general, the prices of 22m4 MOSFET and IGBT remain relatively stable.

MCU channel price: the price of 21m4 is mostly downward. Among the popular MCU products in the channel in April 2022, taking STM32 MCU products of Italian French semiconductor and gd32 MCU products of Zhaoyi innovation as examples, the prices of most products of St fell, and the overall channel prices of MCU products of GD mostly fell.

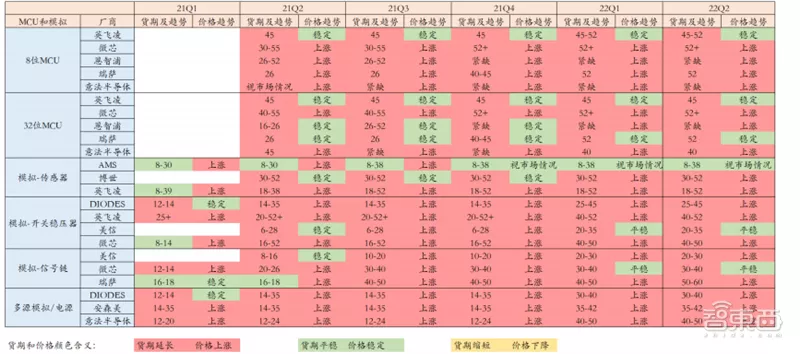

In terms of industry dynamics, the global chip delivery date was extended to 26.6 days in March, and the packaging delivery date increased to more than 50 weeks. According to Susquehanna financial group, the global semiconductor delivery time increased by 2 days to 26.6 days in March. The delivery time of most chips has increased, including power management, microcontroller, analog chip and memory chip. The conflict between Russia and Ukraine, the epidemic and the earthquake in Japan have a short-term impact on the first quarter, but may also have a serious impact on the supply of the whole year. Sondrel, a British chip design company, warned about problems in chip packaging, which revealed that the packaging delivery date had increased from about 8 weeks to 50 weeks or more.

▲ delivery date and price trend of MCU and analog chip

5. Sales side: the shortage of analog and MCU remains, and the epidemic situation intensifies the contradiction between supply and demand repeatedly

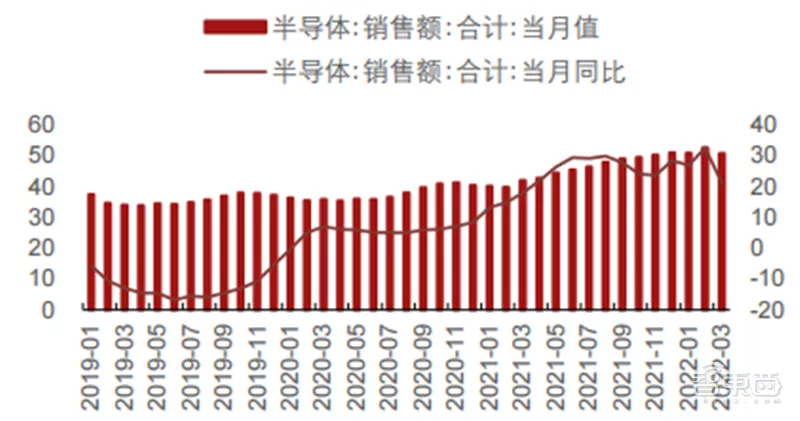

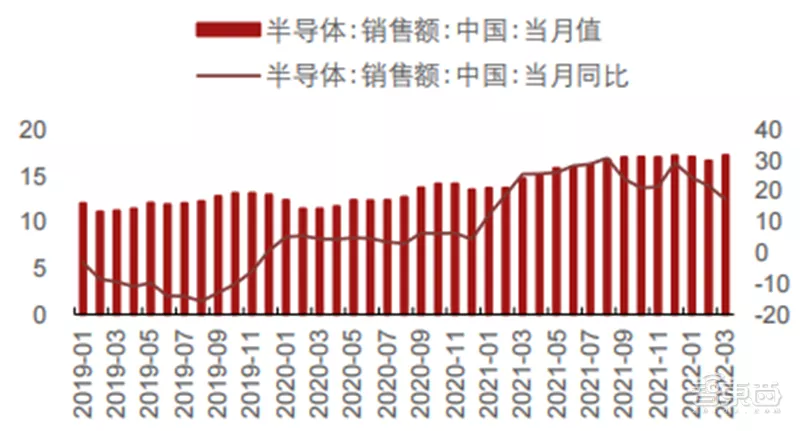

In March, the growth of global semiconductor sales began to slow down, and the growth of China's semiconductor sales continued to slow down. In terms of global semiconductor sales, in March, global semiconductor sales reached US $50.6 billion, with a year-on-year increase of + 20.1% and a month on month increase of - 3.6%. China's semiconductor sales reached US $17.2 billion, with a year-on-year increase of + 17.3% and a month on month increase of + 3.6%. Global semiconductor sales remained strong in the first quarter of 2022, with growth in all major regional markets and product categories compared with the first quarter of last year.

▲ global semiconductor sales ($billion) (March)

▲ China semiconductor sales (billion US dollars) (March)

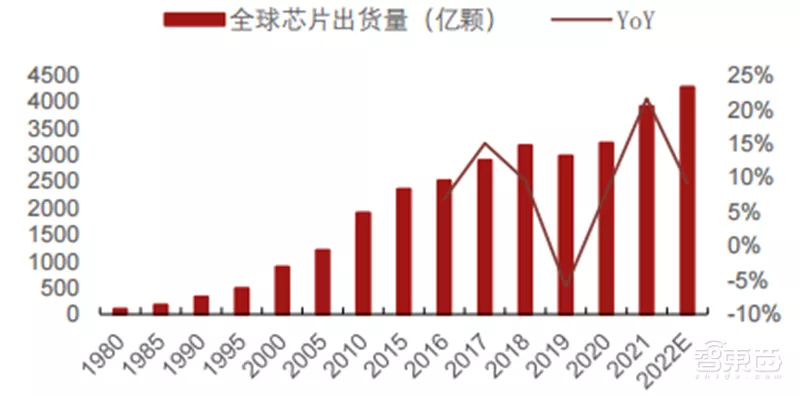

In terms of industry dynamics, IC insights predicts that global IC unit shipments will increase by 9.2% to 427.7 billion this year. Shipments are expected to grow by 9.2% this year after a significant 22% growth during the economic recovery in 2021. Among the 33 major IC product categories defined by the World Semiconductor Trade Statistics (WSTS), 30 are expected to achieve positive growth in 2022, and the unit shipments of three categories (SRAM, DSP and gate array) are expected to decline. It is estimated that the growth rate of total IC units in 12 product areas this year will reach or exceed 9.2%. Meanwhile, icinsights predicts that the compound annual growth rate of IC units will be 7% from 2021 to 2026.

▲ global chip shipments and their growth rate (100 million chips)

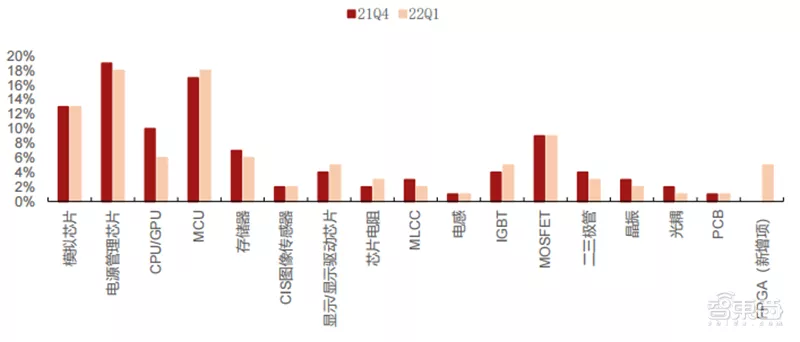

By category, analog chips and MCU remain in high shortage, and the shortage of CPU / GPU decreases significantly. According to the international e-commerce survey data, the overall shortage structure of 22q1 is similar to that of 21q4. Analog chips, power management chips and MCU still maintain a high shortage. 13%, 18% and 18% of enterprises believe that these three types of chips are the most in short supply respectively. The shortage of other component categories is caused by the prosperity of MOSFET (9%), CPU / GPU (6%), memory (6%), FPGA (5%) and IGBT (5%).

▲ comparison of "out of stock" shortage between 22q1 and 21q4 industries

However, under the impact of the epidemic, the semiconductor sales channels have been blocked, further worsening the contradiction between supply and demand. For example, Anson beauty, a large auto chip manufacturer, sent a letter saying that its global distribution center in China was forced to close. The letter stressed that ansenmey's global distribution center in Shanghai was forced to close, business development and delivery were affected, and no progress notice on the possible lifting of the closure has been received. Although the company mitigates the impact through distribution centers and production bases in other locations, it is expected that these conditions will continue to affect ansenmey's production and delivery, and there is a possibility that it can not meet all customer needs.

Recently, the downstream demand structure is divided, the demand for consumer electronics such as smart phones and laptops is weakened, the replacement cycle is prolonged, and the automobile, server and industrial markets remain strong. However, the short-term disturbance of the epidemic, especially the sealing and control measures in Shanghai, has a certain impact on the industry demand, supply, sales and other links. The subsequent resumption of work and production needs to be further determined, and the impact is not expected to last for a long time. In the long run, the overall inventory of all industrial chains has increased quarter by quarter and is at a high level. The wafer production capacity at home and abroad is also opening in 22h2, and the relationship between supply and demand will be alleviated, but the production capacity will still be tight in the future.

2、 Industrial chain tracking, design link, boom differentiation

1. Design / IDM: the design link has increased significantly, with a year-on-year increase

In March, the total revenue of Taiwan stock IC design manufacturers was NT $116 billion, up + 32% year-on-year and 27.8% month on month The year-on-year growth rate of Taiwan stock IC design enterprises rose in March after falling in February, generally stabilized, and the boom in design continued.

From the perspective of major stocks of design enterprises in Taiwan, China, MediaTek's revenue in March was NT $59.2 billion, a year-on-year increase of +47% and a month on month increase of +47.8%; Ruiyu's revenue in March was NT $10.4 billion, a year-on-year increase of + 30% and a month on month increase of + 15%. The revenue of Taiwan stock design companies in March was differentiated year-on-year. The overall chain ratio tended to improve after the negative growth in February, and some IC design enterprises, such as spectral Rui, declined.

*At the same time, according to the annual report of domestic semiconductor design companies in the 21st year and the first quarterly report of the 22nd year, the operating and net profit of most design companies in * 22q1 decreased month on month, and the industry boom was further divided. The overall revenue of the design industry was - 10% and 15% month on month, and the net profit was - 15% and 35% month on month, respectively.

Processor: aiot demand fell, and 22q1 performance was under pressure Since 2021, SOC track companies such as Ruixin micro and Quanzhi technology have performed well, mainly because the demand for tablet computers is driven by downstream applications, such as epidemic catalyzed online education and online office, and the demand for upgrading and iteration of intelligent hardware products such as floor sweeping robots, smart appliances and smart watches also drives the demand for SoC chips. From the gross margin trend of Ruixin micro, Quanzhi technology and other companies, it can be seen that the performance growth driven by chip price rise is limited, which is mainly due to the performance growth brought by the growth of the number of downstream SOC chips. The wave of automobile intellectualization represented by intelligent cockpit has increased the demand for high computing SOC. At present, the intellectualization of on-board entertainment system requires SOC main control chip control, including instrument panel, central control entertainment screen, on-board air conditioner, etc.

At present, the processor market needs to focus on the changes of industry pattern. Affected by the wave of core shortage, the supply and demand of MCU is seriously unbalanced, and the price increases greatly. At present, the shortage of MCU presents structural changes, and the tension of consumer MCU has eased with the release of production capacity. At present, the tension of vehicle specification MCU is still showing. The production capacity of Italian French semiconductor, a large manufacturer of vehicle specification chip, is seriously impacted by the epidemic. At present, the production capacity is gradually recovering. However, due to the long verification cycle of vehicle specification chip and weak elasticity of supply end, its production capacity is alleviated slowly. According to the IC Insights report, in 2021, when the supply situation is gradually improving and the economy is gradually recovering, the sales of automobile MCU is expected to achieve an annual growth rate of 23%, reaching a new high of $7.6 billion. Then it will increase by 14% in 2022 and 16% in 2023. Lingtong's revenue in March was NT $367 million, a year-on-year increase of + 29% and a month on month increase of + 15.8%.

Storage: DRAM prices continued to decline, and NAND prices gradually stabilized In April, DRAM spot price continued to decline and NAND price stabilized. Since November 2021, DRAM prices have continued to rise. Among them, DRAM: ddr48g (1g 8) ETT has increased significantly, from $2.24 in November 21 to $2.99 in February 22. Since March, the average spot price of all kinds of DRAM has dropped. In April, the spot price of DRAM continued to decline. The price of DRAM: DDR4 16g (2G 8) 2666 Mbps was - 6.7% month on month, DRAM: DDR4 16g (2G 8) ETT was - 13.3%, DRAM: DDR4 8g (1g 8) 2666 Mbps was - 7.5%, DRAM: ddr48g (1g * 8) ETT was - 13.4%, DRAM: DDR3 4GB 512mx81600mhz was - 7.3% month on month. In terms of NAND, the average spot price of nandflash: 64GB 8gx8 ml was the same as last month, and nandflash: 32GB 4gx8 MLC was + 0.9% month on month.

In March, the price trend of DRAM contract was divided, and NAND remained stable. The average price of DDR4 / 4GB / 256mx16 contract was $2.40, down from - 3.2% last month; DRAM: the average contract price of DDR3 / 4GB / 256mx16 was $2.72, up + 4.6% from the previous month. The average contract price of DRAM in March showed differentiation as a whole. The average contract prices of NAND flash: 128GB 16gx8 MLC, NAND flash: 32GB 4gx8 MLC and NAND flash: 64GB 8gx8 MLC were $4.81, $3.00 and $3.44 respectively, which were the same as those in January and February.

Simulation: 22q1 simulates that the demand is not light in the off-season, and the profitability is differentiated. Pay attention to the adjustment of product structure The application fields of analog chips are relatively scattered, including communication, industry, automobile, consumption, PC and many other fields. Considering that the domestic analog chip enterprises are small in scale and focus on their respective application fields, of course, the growth of different application fields is also slightly different, which leads to the growth differences of analog chip enterprises. Through the prosperity tracking of the sector, we suggest paying attention to power management Domestic analog chip substitution opportunities in the field of home appliances drive IC. In terms of Q4 guidance margin of Taiwan stocks, the shortage leads to the improvement of profitability brought by rising prices. Analog chip enterprises in the field of home appliances mainly focus on the growth of domestic substitution.

The overall revenue of A-share simulation companies has maintained a steady growth trend. The profitability of various manufacturers is highly differentiated, and the overall net profit has a certain decline month on month. The revenue of domestic A-share simulation companies 22q1 is + 3% month on month and + 28% year on year, showing a non light phenomenon in the off-season. The net profit is - 20% month on month and + 21% year on year. The profitability of some companies still maintains a growth trend month on month, which is mainly the result of product structure adjustment under the condition of tight production capacity.

RF: affected by the prosperity of smart phones in the short term, the long-term position of the industry is still stable Android smartphone shipments are weak, and the short-term performance growth of RF front-end companies is under pressure. Due to the weak demand of the downstream mobile phone industry and the weakening of the short-term prosperity, companies in the RF industry are generally facing pressure. In the long run, there is still great room to improve the overseas 5g penetration rate, and the technical strength and product categories of domestic manufacturers are growing. We are firmly optimistic about the product line expansion ability and growth space of industry leaders in the wave of domestic product substitution. It is suggested to pay attention to the progress of new products of relevant companies.

CIS: the company's performance is under pressure in the short term and pays attention to the expansion process of the automotive field The shipments of mobile phones, PCs and other consumer electronic terminals are weak, and the short-term performance of CIS is under pressure. Smart phones are still the main downstream of CIS. The sluggish short-term demand for smart phones has a great impact on the performance of CIS. In the long run, smart cars are expected to become the next growth point of CIS industry. The volume and price of on-board CIS driven by intelligent cars are rising at the same time. The growth of the industry is expected to continue in the next few years, Frost & amp; Sullivan predicts that from 2019 to 2024, the global automobile CIS shipment will increase from 330 million to 690 million, CAGR + 15.9%; The global automotive CIS market will grow from US $1.65 billion to US $3.37 billion, CAGR + 15.4%. At the same time, under the trend of global capacity shortage, Weill shares, the domestic CIS leader, is expected to replace the overseas leader from 2022 to 2023.

Power semiconductor: the growth rate of Taiwan manufacturers differentiated in March, focusing on the growth opportunities driven by the demand for electric vehicles / new energy In terms of monthly data of Taiwan stocks, in March, Fuding achieved a single month revenue of NT $400 million, a year-on-year increase of + 5.49%, and Maoda achieved a single month revenue of NT $677 million, a year-on-year increase of + 32.88%. The growth differentiation of Taiwan manufacturers in March indicates the differentiation of product structure prosperity, and pay attention to the growth opportunities driven by the demand for electric vehicles / new energy.

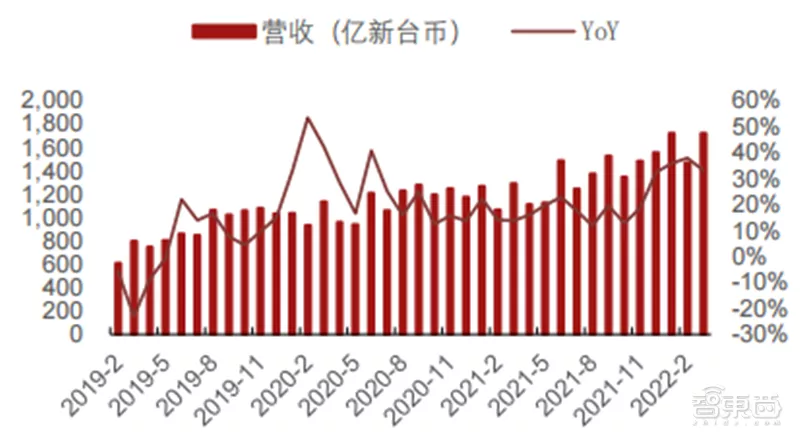

2. OEM: TSMC's performance remains strong, which guides the strong growth of HPC and automobile business

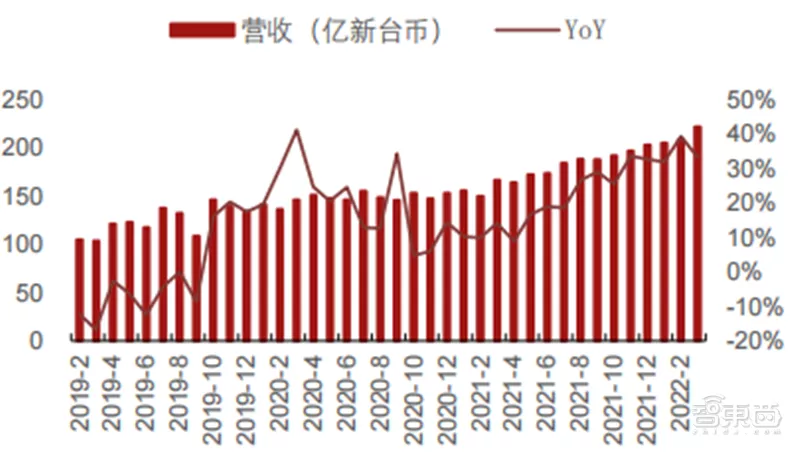

Although the performance of downstream consumer electronics is relatively weak, the demand for IOT, automobile and HPC has brought about structural demand growth. According to the monthly data of the main agent factories of Taiwan stocks, TSMC's revenue in March was NT $172 billion, a year-on-year increase of + 33% and a month on month increase of + 17%. The consolidated revenue of liandian in March was NT $20.81 billion, a year-on-year increase of + 33% and a month on month increase of + 6%.

▲ TSMC's monthly revenue and growth rate (NT $100 million) (March)

▲ liandian's monthly revenue and growth rate (NT $100 million) (March)

Since the beginning of 2020, the monthly revenue growth of world advanced has been maintained at a high level, mainly because the world advanced has only 8-inch wafer factories, and the downstream application products are mainly drive chips and power management chips. Since the beginning of 2021, the capacity of 8-inch wafers represented by drive chips and power management chips has been tight and the OEM price has increased, which has benefited the world advanced most. The world's advanced in March had a revenue of NT $5.07 billion, a year-on-year increase of + 41.4% and a month on month increase of + 19.4%.

In terms of compound semiconductor OEM, the performance is slightly differentiated with the adjustment of power boom. GaAs wafer foundry Wenmao achieved a revenue of NT $1.85 billion in March, a year-on-year increase of - 7.1% and a month on month increase of + 3.2%; Hongjie technology, a 6-inch GaAs wafer foundry, achieved revenue of NT $180 million in March, a year-on-year increase of - 50.86% and a month on month increase of + 0.19%.

TSMC released its financial report for the first quarter of 2022 on April 14. The Q1 revenue in 2022 was NT $491.08 billion (US $17.57 billion), a month on month increase of + 12.1% / year-on-year increase of + 35.5%, exceeding the upper limit of the previous guidelines (US $16.6-17.2 billion). The month on month increase in revenue was mainly due to the strong growth of HPC and automobile business, while the performance of PC, smartphone and IOT was relatively weak. The company expects the long-term gross profit margin to reach 53% and above, and the roe to reach 25% and above. The company expects that the future revenue growth rate will be higher than the overall growth rate of the OEM industry (20%), and the future revenue growth will be mainly generated by four platforms: smartphone, HPC, IOT and automobile. Among them, HPC and automobile business will have the strongest growth. HPC business will contribute to the company's main revenue, but part of the growth rate will be offset by the decline in smartphone demand.

3. Closed beta: revenue growth improved in March and Q1 profitability decreased

The business cycle of the sealing and testing industry is highly correlated with that of the semiconductor industry. The sealing and testing sector is expected to benefit from this round of upward cycle. The main driving forces of performance come from two aspects: on the one hand, the improvement of capacity utilization and capacity expansion, and on the other hand, the improvement of profitability driven by the price rise of sealing and testing. From the high-frequency data of Taiwan stocks, the monthly revenue of Taiwan stock IC sealing and testing enterprises in March was + 16% year-on-year and + 15.6% month on month.

*In terms of overseas stocks, * riyueyue, the world's largest enterprise in the sealing and testing industry, had a revenue of NT $19.8 billion in March, a year-on-year increase of + 13%. The demand side of the company remained strong and the supply exceeded the demand. Riyueyue's orders have been extended to 2022 and the long-term contract has been signed to 2023, and the growth trend is expected to continue; Jiemin's revenue in March was NT $407 million, a year-on-year increase of + 9%, and the year-on-year growth rate of revenue decreased.

At the same time, according to the annual report of domestic semiconductor packaging and testing companies in the 21st year and the data of the first quarterly report in the 22nd year, except for Helin Weina, the operating revenue of 22q1 packaging and testing companies decreased month on month, and the industry revenue decreased by 15% month on month; In terms of profitability, only Changdian technology and XINGSEN technology achieved positive growth in net profit month on month, with month on month growth rates of 2% and 64% respectively. The profitability of other manufacturers decreased, and the overall net profit of the industry decreased by 23% month on month.

4. Equipment and materials: the revenue of 22q1 equipment end is recognized due to seasonal and epidemic effects, and the profitability of material end is strengthened

Due to the structural decline of downstream demand and the impact of the epidemic on logistics, most of the revenue of domestic equipment companies in 22q1 fell month on month, and the revenue growth of silicon wafer manufacturers in Taiwan, China slowed down significantly year on year.

Among semiconductor materials, silicon wafers are the largest market. In terms of monthly data of silicon wafer enterprises, due to the structural decline of downstream demand, the year-on-year growth of revenue slowed down: in March, global wafer realized a revenue of NT $5.73 billion, a year-on-year increase of + 1%; Meimeijing achieved a revenue of NT $6.69 billion, a year-on-year increase of + 8%; Taishengke achieved a revenue of NT $1.3 billion, a year-on-year increase of + 34%; Hejing achieved a revenue of NT $1.03 billion, a year-on-year increase of + 27%.

Domestic mainstream equipment companies have released the first quarterly report of 22q1. Seasonal factors + logistics delay under the epidemic affect short-term income. ① Northern Huachuang: 22q1 achieved a revenue of 2.16 billion yuan, a year-on-year increase of + 50% / month on month decrease of - 39%, and a net profit of 155 million yuan, a year-on-year increase of + 382% / month on month decrease of - 45%; ② Zhongwei: 22q1 achieved a revenue of 949 million yuan, a year-on-year increase of + 57% / month on month increase of - 8%, and a net profit of 186 million yuan, a year-on-year increase of + 1578% / month on month increase of + 16.9%; ③ Shengmei Shanghai: 22q1 achieved an income of 354 million yuan, a year-on-year increase of + 29% / month on month increase of - 34%, deducting the net profit not attributable to the parent company of 23.6 million yuan, a year-on-year increase of - 25% / month on month increase of - 76%; ④ Xinyuan micro: the income of 22q1 was 184 million yuan, with a year-on-year increase of + 62% / month on month increase of - 35%, and the net profit attributable to the parent company was 32 million yuan, with a year-on-year increase of + 398% / month on month increase of + 33%.

From the data, the equipment end fell month on month in the first quarter, increased year-on-year, and the profitability of the material end was further strengthened. 22q1 equipment company's overall operating chain was - 24%, year-on-year + 51%, and its net profit was - 43%, year-on-year + 22%; In terms of materials, the leading Zhonghuan shares have achieved positive growth on a month on month basis, which has become the main driving force for the increase of the industry, while the performance of other manufacturers has been differentiated.

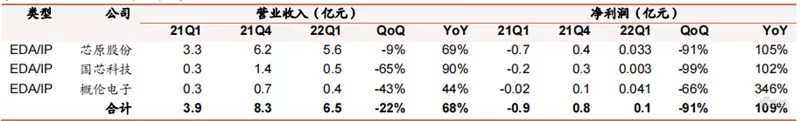

5. EDA / IP: semiconductor "throat" industry, waiting for flowers to bloom

EDA industry is the cornerstone of the integrated circuit industry. It is the general trend to be independent and controllable in China's EDA field. In the future, the domestic substitution of EDA is an important trend. It is suggested to pay attention to the EDA listed company GuLun electronics and the companies to be listed, such as Huada Jiutian and guangliwei. At the same time, according to the data of the first quarterly report of 22 years released by Kelun electronics, the company's 22q1 revenue was 39 million yuan, a year-on-year increase of + 44.0%, and the revenue growth accelerated again; The net profit attributable to the parent company was 05 million yuan, reversing losses year-on-year.

According to the data in the annual report of domestic EDA / IP companies for 21 years and the first quarterly report of 22 years, companies in the industry achieved positive growth in 22q1 year-on-year, with a certain decline month on month. At present, the scale of EDA / IP companies in China is small, the companies are still in the growth period, and the operation is not stable. Considering the global oligopoly pattern of EDA industry and its important supporting role for the whole semiconductor industry, we believe that the independent and controllable driving force will force the rapid development of domestic EDA and realize the safety of domestic semiconductor industry chain.

▲ operation of EDA / IP company

In terms of industry dynamics, the industry giant Xinsi technology was pointed to SMIC to provide chip technology, which was investigated by the US Department of Commerce According to a source familiar with the matter quoted by Bloomberg, Synopsys, a large EDA company, is under investigation by the US Department of Commerce because it is suspected of transferring key technologies to Chinese enterprises sanctioned by the US. The report said that at present, the investigation has not been made public, but investigators are investigating the cooperation between Xinsi technology and China's affiliated enterprises, because there are allegations that Xinsi technology provides technical support required for chip design to Hisilicon semiconductor in order to provide it to SMIC international production. We believe that 1) the sanctions of the U.S. Department of Commerce on the domestic semiconductor industry have penetrated into the EDA link. EDA is related to the whole link of the whole semiconductor industry chain and a crucial neck link. It is also an important tool for the U.S. to impose sanctions on domestic semiconductors. 2) The progress of EDA tools in various links is different in China. EDA tools related to the manufacturing end are still the key and difficult point of breakthrough. Xinsi technology, cadence and mentor, the overseas leaders, have a deep layout in this area and high barriers to entry. This tool is related to the production yield. It is a dynamic game process of domestic manufacturing EDA replacing overseas tools. 3) Focus on EDA enterprises with independent intellectual property rights and products that have withstood the test of domestic and foreign markets, such as GuLun electronics, Huada Jiutian (to be listed), guangliwei (to be listed), etc.

*Zhidongxi * believes that the recent differentiation of downstream demand structure, the weakening of relevant demand for consumer electronics such as smart phones and laptops, the extension of machine replacement cycle, and the relatively strong automobile, server and industrial markets. At the same time, the short-term epidemic disturbance, especially the sealing and control measures in Shanghai, has a certain impact on the demand, supply and sales of the industry. However, with the resumption of work and production, the semiconductor industry is believed to pick up soon.