Luna foundation guard (LFG), the official manager of Terra's bitcoin reserves, issued a statement on Monday recording how it paid millions of dollars worth of cryptocurrency in a failed attempt to maintain a stable currency terrausd (UST) link.

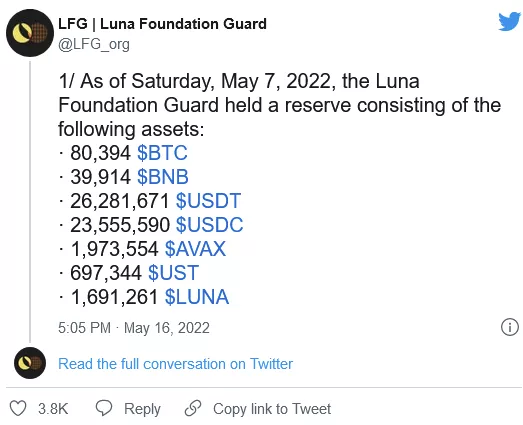

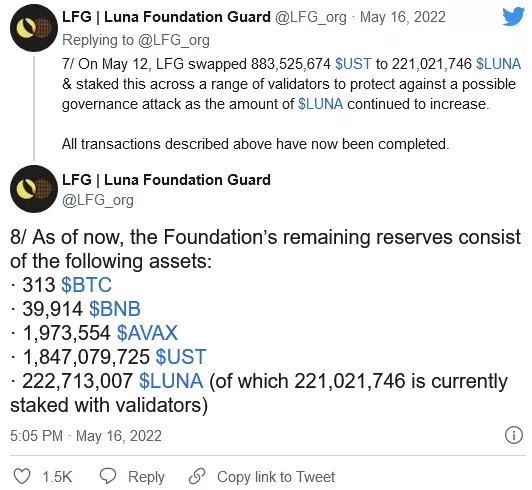

In the statement, LFG pointed out that its BTC reserves were almost completely exhausted - from about 80000 BTC to about 300. The remaining assets are mainly composed of collapsed ust and Luna tokens, which will be used to compensate investors.

This is one of the most disastrous events in the history of cryptocurrency. Last week, when the UST stable currency, which should continue to be worth $1, fell below 20 cents, the $40 billion Terra ecosystem collapsed. Luna token is designed as a shock absorber of ust's "algorithm" dollar pegging mechanism, and its value quickly falls from $80 to less than $0.002.

In a tweet on Monday, LFG said that since Terra's ecosystem began to collapse early last week, it passively sold most of its BTC reserves for UST. LFG said that on May 8 alone, more than 50000 BTCs were transferred to "trade with counterparties" because the price of UST, as a stable currency, initially began to decline. These funds are used to "directly execute on chain swaps and transfer $BTC to a counterparty to enable them to conduct large-scale transactions with the foundation in a short time".

On May 12, LFG said that another 30000 BTCs in its reserves were sold by terraform labs (TFL), the original company behind terra, "making a final effort to defend the value of the currency".

LFG confirmed that due to the unsuccessful efforts to protect the price stability of UST, the remaining part of its reserves, once totaling more than $3 billion, almost completely sank. The remaining assets will be used to "compensate the remaining ust users, first and foremost the smallest holder".

Prior to LFG's statement on Monday, some criticized Terra's reserve funds - which should belong to the "decentralized" Terra community - for being handled by Terra's centralized leaders and investors without transparency.

This is why key figures in the blockchain field, including Ethereum founder vitalik buterin, called on Terra to compensate small holders of ust and Luna before its largest investors.

The price of ust plunged further in Monday's announcement - from $0.15 to $0.07.