On April 28, the nth day after the domestic equity market entered the "bear market", the major A-share indexes strengthened, with the Shanghai index up 2.09% and the Shenzhen composite index up 3.96%. More than 3700 stocks rose in the two cities, with lithium batteries, photovoltaic, chips, military industry and other sectors leading the rise. Among them, the gem index was the most dazzling, up 5.52%, the largest one-day increase since February 2019.

But before that, after the gem encountered 3500 points of resistance in December 2021, it turned sharply downward in the middle of the month and entered a downward trend. In the past five months, the gem index callback exceeded 36% and the maximum pullback was close to 40%.

The last time there was a similar sharp rebound was on July 29, 2021. The gem rebounded by 5.32%, but after that surge, the gem opened a market that continued to fluctuate between 3200 and 3500 points.

Although the sustainability of the future rise of the gem is still not optimistic, in contrast, this round of retaliatory rebound of more than 5% in a single day occurred after a sharp correction of nearly 40% in the early stage, which has a certain margin of safety.

01

Starting gem

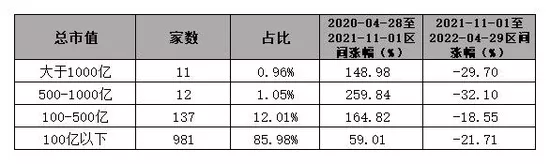

First of all, get a comprehensive understanding of the gem. As of April 28, 2022, there are 1141 stocks on the gem. It should be explained in advance that the gem refers to selecting 100 constituent stocks from the GEM stocks as the benchmark, which does not represent the overall picture of the gem. First of all, starting from the market value, as of the closing of the day, there were 11 enterprises with more than 100 billion on the gem. Giant giants such as Ningde times (300750. SZ) and Mindray medical were still rare on the gem, with only 12 enterprises with 50-100 billion, while nearly 981 Enterprises with less than 10 billion, accounting for nearly 86%:

Data source: choice

Then the time node is divided into two sections. From April 2020 to November 2021, the market is mainly upward; Since November 2021, the market has entered a downward trend. Comparing the gem enterprises with different market values, the overall performance of the market value of 10-100 billion is better; Poor performance of enterprises with a market value of less than 10 billion; The gem enterprises with a market value of 10-50 billion have more advantages in the "bull bear" conversion period. Although the increase is less than the large market value, they are also more resistant to decline.

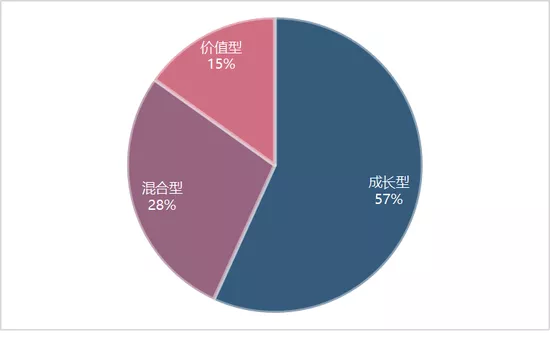

From the perspective of stock style, 57% of GEM listed companies are growth oriented, which makes gem enjoy high growth and bring high risk premium to investors.

Data source: choice

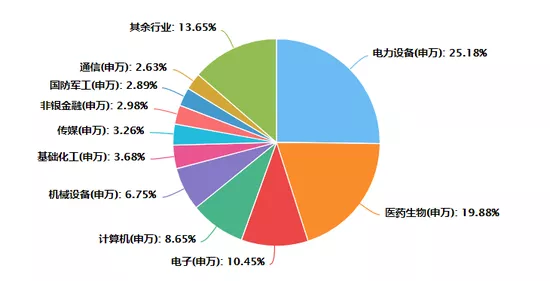

The second is the distribution of gem industries. According to the 29 categories of shenwanyi industry classification, mechanical equipment (intelligent manufacturing, artificial intelligence direction), computers, electronics and pharmaceutical biology basically account for half of the gem. These four sectors are characterized by emerging industries, high growth and high valuation.

Data source: choice

Since the gem is characterized by high growth and high risk, from the perspective of growth and risk return, as of the third quarter of 2021, the average weighted return on net assets (ROE) of the gem is 9.45% and the median is 6.39%; At present, the average weighted roe of the gem has decreased to 1.03% and the median value has decreased to 1.34%. It can be seen that the yield of the gem is not very ideal at such a special time node.

Since the short-term yield can not be guaranteed, what about growth? The following growth statistics mainly compare the growth of revenue and net assets per share in recent three years. Among them, the revenue of 1141 gem enterprises has increased by an average of 72% in recent three years, with a compound annual growth of about 15%, while the diluted earnings per share is relatively bleak, with a compound annual growth of only 4%.

In order to eliminate outliers, segmentation is carried out. The growth of companies with a market value of more than 50 billion yuan is still quite obvious, with a revenue growth of 209% and a compound annual growth of 42% in the past three years; Diluted earnings per share increased by 109% and compound annualized by 24%. For companies with a market value of 10-50 billion, the revenue has increased by 157% in recent three years, with a compound annual growth of 30%; Diluted earnings per share increased by 93% and compound annualized by about 20%. It can be seen that the growth of companies with small market value is less than that of companies with large market value.

In contrast, the industry of enterprises with a market value of more than 50 billion still has strong scale advantages and competitive barriers. Although the performance growth may slow down in the event of the epidemic or other black swan events, there will be no significant decline or loss in the overall performance and diluted earnings per share.

02

Gem valuation depression

At present, the implied risk premium level of wandequan A is close to the quantile level of 90% in 8 years; The market breaking rate is close to the position of the bear market in 2011, and the median rise and fall range on the first day of opening reached an all-time low; The all a static P / E ratio is lower than the market low after the epidemic, but there is still a gap with the end of 2018. A number of valuation indicators gradually hit a low level.

From the P / E ratio of the above gem composite index, excluding the abnormal values near 2015, it can be basically concluded that the approximate valuation level range of the gem is about 27x-80x (the average value is about 50x). From the above historical valuation, in the past 12 years, there were only two times when it was lower than the current valuation level, namely 2012 and 2018.

At present, there are many overall pullbacks on the gem, and the valuation has entered a low level. However, compared with historical data, the P / E ratio of the current gem composite index is indeed below the average, but there is still room for further correction. It still needs a shock buffer time after the decline.

Data source: choice

And from the following vertical point of view, the valuation of the gem composite index is still higher than other indexes. Generally speaking, the stocks on the gem are mainly small and medium-sized, and the proportion of science and technology and biomedicine is relatively high. The characteristics of these two plates are high risk and high return. However, at present, the profitability of the gem is not ideal after this correction, and the growth differentiation of individual stocks is relatively serious, and the growth of companies with large market capitalization is better.

Whether the gem is in the "golden pit" depends not only on the callback range, but also on the historical data, which can only be used as a reference and can not completely push the future with the past.

Here, take the gem index as an example (including 100 constituent stocks). In the early stage, in addition to the impact of the macro environment, the sharp correction of the gem index was mainly affected by the poor performance of Ningde era (300750. SZ), the largest heavyweight stock in its composition, and sunshine power (300274. SZ), the fifth heavyweight stock in its composition, in the first quarter of 2021. The performance of high-power and heavy stocks was lower than expected, which superimposed the uncertainty risk of the general environmental epidemic, which led to the decline of the market's expectation of the performance and profit growth of the gem, and the continuous correction led to the spread of panic, resulting in the breakdown of the gem by 2200 points.

Next, we need to consider whether the future growth of the constituent stocks of the gem can return to expectations.

Most of the gem are high-tech industries. At present, the power equipment sector still has a large weight (more than 35%), and new energy related (Ningde era, sunshine power, Yiwei lithium energy), while advanced manufacturing (Huichuan technology, leading intelligence, etc.), medical care (Aier Ophthalmology, Mindray medical, aimeike, tiger medicine, etc.) and semiconductors (Zhuosheng micro, Sanhuan group, etc.) have a small weight.

The question is whether the performance growth rate of the power equipment sector will be as high as that at the beginning of 2021 in the medium, short and even long term in the future. In fact, the recent performance of Ningde times and sunshine power has given risk tips.

In the past year, undervalued companies such as medical beauty leader aimeike (300896. SZ) and ophthalmology leader Aier Ophthalmology (300015. SZ) still have growth, but the performance of the secondary market is very weak; There is also the advanced manufacturing and semiconductor sectors. Affected by the epidemic and inflation, the performance growth slowed down, resulting in mediocre market performance in the past year, but they still have strong growth potential in the medium and long term.

This article is written by Liu Chaoran from the magazine of excellence