Recently, A Seemingly "outrageous" News In The Semiconductor Circle Has Become Well Known. Due To The Lack Of Core, Some Enterprises Have Bought A Large Number Of Washing Machines And Removed The Chips For Their Own Products. In Fact, This Is Not Anecdotal News. It Comes From The 2022q1 Financial Report Meeting Held By International Lithography Giant ASML (hereinafter Referred To As ASML) On April 20. Peter Wenningk, CEO Of ASML, Said That A Large Industrial Company Has Begun To Take Out Chips From Domestic Washing Machines For Chip Modules Of Its Own Products.

Peter Weinninger Did Not Specify Which Company It Was, But Said The Company Had Revealed The Dilemma To It Just Last Week. "The Demand We're Seeing Right Now Comes From Many Parts Of The Industry... We've Seriously Underestimated The Breadth Of Demand, And I Don't Think It's Going To Go Away," Said Peter Weinninger

Remove washing Machine, Not Outrageous

Although The Incident Of "buying Washing Machine And Dismantling Chips" Seems Outrageous, Combined With The Current Soaring Price Of Some Chips, From An Economic Point Of View, It May Be Much Cheaper Than Taking Goods From Some Second-hand Channels. HuaweiYu Chengdong, CEO Of Consumer Business And CEO Of Smart Car Bu, Said When Talking About The Lack Of Core In Cars Recently: "a Chip Of 10 Yuan And 20 Yuan Has Been Fired To 2500. It's Too Expensive And I Can't Accept It".

The Price Of Ordinary Household Washing Machines Ranges From Hundreds To Thousands, But If The Company Can Buy Washing Machines In Batches From Recycling Centers Or Second-hand Home Appliance Equipment Manufacturers, The Company Can Win This Batch Of Goods At A Considerable Discount. At The Same Time, There Is More Than One Chip In A Washing Machine. In This Way, The Cost Of Obtaining Chips From Second-hand Washing Machines Is Indeed Much Lower Than That Of Some Black Intermediaries Who Hoard Goods.

Theoretically, Many Chips In Household Washing Machines Can Indeed Be Applied To Many Manufacturing Industries, Including Automobiles, And The Recycling Technology Of Semiconductors Has Been Very Mature. The Chips In The Washing Machine Include Microcontroller (MCU), Power Chip And Motor Drive. It Is Needless To Say That MCU Is Important For Electric Vehicles. Due To Its Programmability, MCU Can Still Be Redesigned And Used When It Is Removed From The Washing Machine.

In Addition, Manufacturers Do Not Have To Consider The Chip Life Of Second-hand Household Appliances. Almost All Of These Chips Used In Washing Machines Are Made On Mature Process Nodes. Although These Chips Are Far Less Fine And Small Than 5nm And 7Nm Chips, Due To The Mature Process And Wide Application, The Service Life Of These Mature Process Chips Is Very Long, Far Exceeding That Of mobile PhoneThe Life Of Chips Such As, Computer Processor And Memory Is Basically More Than 15 Years.

From Lack Of Core To Structural Lack Of Core

Behind The Washing Machine Chip Removal Event Is The Well-known Core Shortage Event. Although The Core Shortage Is Still The Main Problem Faced By Many Industries, The Current Industry Core Shortage Situation Is Actually Very Different From The Core Shortage Situation Discussed Since The Second Half Of 2020. Many Market Research Institutions And Industry Analysts Believe That "structural Core Shortage" Is More Appropriate To Describe The Current Core Shortage Situation.

At The Beginning Of Last Year, When Chips Were In The Greatest Shortage, The Industry Described The Situation Of Core Shortage At That Time As "core Shortage Tide". Almost All Types And Processes Of Chips Were Faced With The Problem Of Overall Shortage. At That Time, There Was A Quite Vivid But Very Real "paragraph" About What Was "core Shortage Tide". A Chip Factory Entrusts A Wafer Foundry To Produce A Chip. However, The Production Capacity Of The Wafer Foundry Is Already Insufficient, And It Needs To Purchase Equipment From The Equipment Manufacturer To Expand The Production Capacity. However, The Equipment Manufacturer Said That He Does Not Have Enough Chips To Produce Equipment, So The Industrial Chain Has Fallen Into A "dead Cycle", Which Is Why Even Second-hand Chip Equipment Is In Short Supply Up To Now.

By The Second Half Of Last Year, Many Mobile Phone And Computer Manufacturers Began To Say That The Shortage Of Chips Was Not So Serious. At The Beginning Of This Year, Similar Voices Appeared In Some Wafer Foundry Factories. In February This Year, Zhao Haijun, CEO Of SMIC International, Said That The Global Foundry Industry Had Changed From "overall Core Shortage" To "structural Core Shortage", That Is, From "core Shortage Tide" To The Shortage Of Certain Types And Process Chips, More Specifically, There Is No Shortage Of High-end Processor Chips For Mobile Phones And Computers With Advanced Processes, While The Demand For Automotive Semiconductor Chips With Mature Processes Is Still In Short Supply.

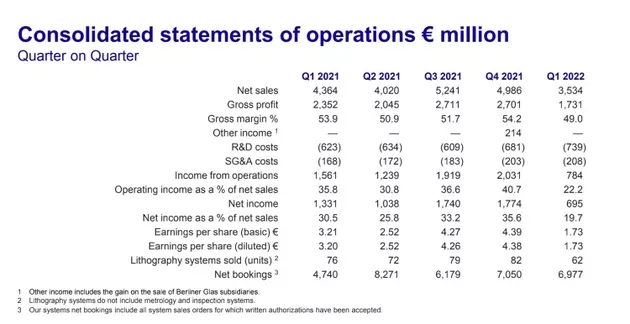

In Terms Of Chip Equipment, The Change Of The Wind Direction Of Core Shortage Can Also Be Seen In The Financial Reports Released By Asmai In Recent Two Days. First, The General Environment Of Global Core Shortage Remains Unchanged. Asmai Said That It Still Needs To Increase The Production Capacity By More Than 50% In Order To Meet The Surge In Orders. Under The Condition That The Basic Price Of Global Core Shortage Remains Unchanged, Asmai's Latest Financial Report Basically Meets Expectations. Asmai's 2022q1 Revenue Is 3.534 Billion Euros, With A Year-on-year Decrease Of 19% And A Gross Profit Margin Of 49% This Quarter From 54.2% In The Previous Quarter.

Asmai Said That The Decline In Revenue And Profit Margin Was Mainly Affected By The Rapid Delivery Strategy. In Order To Meet The Demand For The Rapid Expansion Of Production Capacity Of The Wafer Factory, Although The Company's Shipment Speed Became Faster, The Wafer Factory Needed To Complete The Verification Before Confirming The Revenue, Resulting In Deferred Revenue. Therefore, Even If Asmai Shipped Nine EUV Lithography Systems This Quarter, It Only Confirmed The Revenue Of 591 Million Euros Of Three Of Them.

Source: Asmai

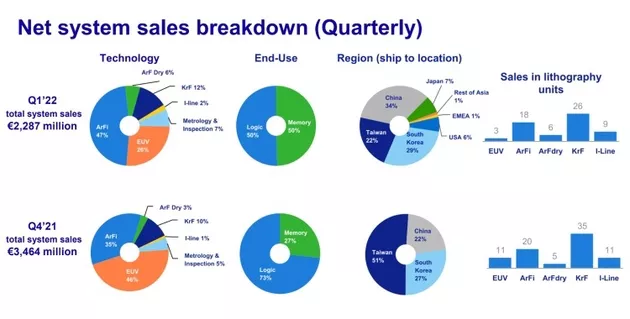

Secondly, It Can Be Found From The Source Region Of ASMA's Revenue That The Revenue Share Of Chinese Mainland Rose From 22% In Q4 Last Year To 34% In Q1 This Year, Becoming ASMA's Largest Customer In This Quarter. It Should Be Known That Chip Companies In Chinese Mainland Can Not Purchase EUV, Which Means That The Market Demand For Mature Process Lithography Equipment Is Extremely Strong. What Is Most Lacking In The Market Is Mature Process Chips.

Semiconductor Manufacturers Usually Use EUV And DUV For Semiconductor Lithography. The Key To The Difference Between EUV And DUV Lies In The Wavelength Of The Light Source. The Wavelength Of The Light Source Of EUV Is 13.5nm, And The Shortest Wavelength Of The Light Source Of DUV Is 193nm. Generally Speaking, The Shorter The Wavelength, The Higher The Resolution In The Lithography Process Can Be Achieved. How High Is The Accuracy Of EUV? In The Words Of One Researcher: "its Accuracy Is Equivalent To Shooting An Arrow From The Earth To Hit [an Apple] On The Moon( Https://apple.pvxt.net/c/1251234/435400/7639?u=https%3A%2F%2Fwww.apple.com%2Fcn%2Fmusic%2F )。”

Therefore, EUV With Shorter Wavelength Can Meet The Wafer Manufacturing Below 10nm. EUV Has Also Become The Key To Help The Semiconductor Industry Break Through The Chip 7Nm And Lower Process. At Present, It Is EUV Lithography Machine That ASML Cannot Export To China, While DUV Is ASML's Deep Ultraviolet Lithography Business. DUV Can Only Be Used To Manufacture Chips With 7Nm And Above Process. This Is Also Reflected In The Scheduled Orders Accepted By Asmai In This Quarter, Including EUV System Orders Of 2.5 Billion Euros And DUV Orders Of 4.5 Billion Euros.

Source: Asmai

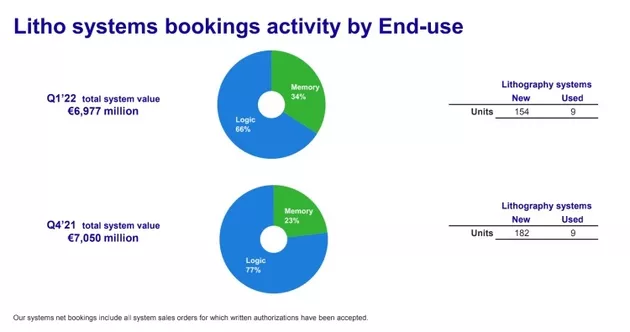

Finally, A Significant Change In Asmai's Revenue Source Is That More Customers Of Its Lithography System Come From Memory Production. The Proportion Of Lithography System Ultimately Used In Memory Production In This Quarter Was 34%, An Increase Of 11% Over Last Year. Asmai Said micron, SK, Hynix And Other Memory Chip Manufacturers Gradually Turn To EUV.

You Should Know That The Usual Memory Chip Manufacturing Process Is 20 To 40 Nm. Generally Speaking, The Production Of Such Chips Does Not Need To Use The EUV System Of 5nm And 7Nm. The Memory Chip Manufacturers Such As Meguiar And SK Hynix Began To Buy EUV, Which May Indicate Two Signals: One Is That The Manufacturers Are Ready For The Technical Upgrading Of Memory Chips, And The Other Is That The Equipment Of Mature Processes Is Really Hard To Grab. Let's Buy The Advanced Processes First.

Source: Asmai

What Peter Wenningke Doesn't Know Is That The Price Of Asmai's Own Lithography Machine Has More Than Doubled In The Second-hand Market, And The Price Of Some Old Equipment Used To Produce Mature Processes Is The Same As That Of The New (if You Can Grab It), Even If It Has Been Used For More Than 20 Years. Perhaps, The World Has Passed The Stage Of The Most Lack Of Core, But Under Various External Environmental Factors, It Still Takes A Long Time To Balance The Supply And Demand Of The Whole Industrial Chain.

Wen Yuhan Hong