Lei Jun, a model worker, is doomed to "lie down and win" On July 9, 2018, Xiaomi broke its listing and did not return to the issue price of more than HK $17 until 2020. At that time, Lei Jun sent a microblog: "just beat it", which made him feel proud. However, in January this year, Xiaomi fell below the issue price again. Xiaomi closed at HK $11.080 yesterday, far from the issue price.

Author Chen Wenqi

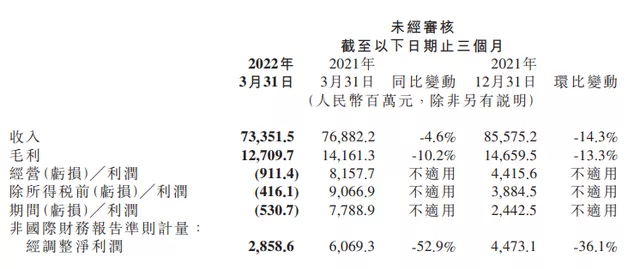

The first quarterly report of Xiaomi just released has brought a lot of "bad news":

Q1 revenue was 73.352 billion yuan (RMB, the same below), a year-on-year decrease of 4.6%; Among them, the mobile phone business revenue was 45.8 billion yuan, down 11.1% year-on-year.

The adjusted net profit of Q1 was 2.859 billion yuan, a year-on-year decrease of 52.9%;

Q1 gross profit was 12.71 billion yuan, a year-on-year decrease of 10.2%.

The current situation of Xiaomi can be summarized as "Davis double kill". The revenue and net profit have both decreased. The decline in performance has led to the decline in the valuation given by the market and the decline in the stock price.

However, it has to be said that external factors account for a large proportion in Xiaomi's encounter this round, and even Tencent's Q1 net profit fell by 23%. After all, Lei Jun has experienced great storms and waves. Xiaomi still ranks third in the global smartphone shipment. The spirit of "life and death is bearish, do not obey" and its years of user, market and technology accumulation will be the chips for Xiaomi to turn over again.

Millet share price trend

Core financial data

Mobile phone pressure

The most concerned business in the financial report is undoubtedly Xiaomi's basic disk - mobile phone.

Smart phones are still Xiaomi's largest source of revenue, accounting for 62.4% of the total revenue this quarter, but the proportion decreased by nearly 5 percentage points compared with the same period last year. The gross profit margin of the business decreased from 12.9% in 2021q1 to 9.9% in this quarter. The financial report explained that the decline was mainly due to the promotion activities in the first quarter**

The decline of Xiaomi's mobile phone business revenue has something to do with the overall market of the industry.

In the first quarter, the smartphone market continued to be weak, the supply of SOC inventory on the supply side was still in the adjustment period, and the demand side was depressed due to the impact of the epidemic and the international geopolitical situation

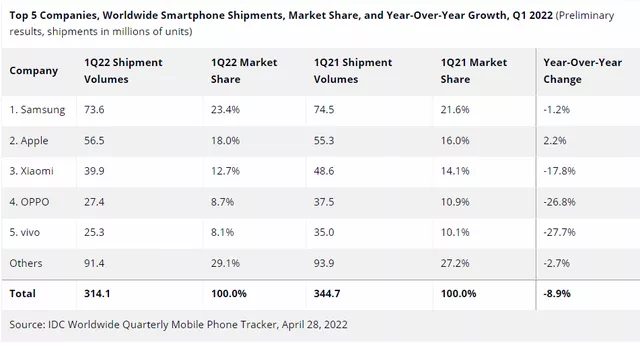

According to the data of IDC, a third-party Market Research Organization, the global smartphone shipment in Q1 in 2022 decreased by 8.9% year-on-year, falling for three consecutive quarters to 314.1 million Among them, the global shipment volume of Xiaomi was 39.9 million, keeping the third place with a market share of 12.7%, but the shipment volume decreased by 17.8% year-on-year and the market share decreased by 1.4%

"The main impact in the first quarter was the impact of the shortage of entry-level chips. There was a great demand for entry-level mobile phones in India and many other regions. The supply eased in the second quarter, but macroeconomic and geopolitical uncertainties still exist." Wang Xiang, President of Xiaomi, said at the telephone conference.

2022q1 global smartphone market shipments and market share chart source: IDC

This is not just the plight of Xiaomi family. The development of the domestic mobile phone market has entered the deep-water area, and innovation has fallen into a bottleneck. In addition, the epidemic situation in important domestic cities has repeatedly affected consumer decisions, and multiple factors continue to impact the overall market of the mobile phone market

According to IDC data, Q1 smartphone shipments in the Chinese market were about 74.2 million, a year-on-year decrease of 14.1%. Among them, the shipment volume of Xiaomi was about 11 million units, a year-on-year decrease of 18.4%, ranking fifth with 14.9% market share.

Counter point data show that the average change cycle of Chinese users has exceeded 31 months. In 2017, the cycle was about 22 months.

From a competitive point of view, only the glory of low base continues to maintain high growth, maintaining an annual growth of 291.7% on the way to recover lost land, Apple With its strong brand influence, it firmly occupies the fortress of the high-end market.

2022q1 China mobile phone market shipment and market share source: IDC

*"The domestic epidemic has a great impact on our production and logistics organization, * the epidemic in Shanghai superimposes our sales and stores in Shanghai. Many stores are basically closed, and the epidemic has also had a relatively negative impact on consumers' purchase desire. Therefore, the overall demand is not particularly strong, and the impact on sales is still very large. At the same time, due to the logistics cost (increase) , there are also some logistics problems caused by control, which have some impact not only on China's local market, but also on the global market. " Wang Xiang said.

Xiaomi's mobile phone business has entered the stage of "supplementing quantity with price". It is urgent to improve ASP (average selling price) . Lei Jun calls the impact on the high-end "the battle of life and death for Xiaomi's development" also conforms to this logic

Focusing on the high-end strategy, in order to achieve the goal of "winning the first market share of domestic high-end mobile phones within three years", Xiaomi has made frequent moves to expand offline, overseas, self-developed chips and build smart factories.

From the perspective of mobile phone sales data, the latest financial report shows that Xiaomi's global shipments of high-end smart phones priced at 3000 yuan or more in Chinese Mainland and 300 euros or more abroad are nearly 4million. In the high-end market between 4000-6000 yuan, Xiaomi ranks first among Android manufacturers in terms of market share.

This also led to the improvement of Xiaomi mobile phone ASP (average selling price): in 2022q1, Xiaomi global smartphone ASP increased by 14.1% to 1189 yuan. Throughout last year, the ASP of Xiaomi mobile phone was 1097.5 yuan, an increase of 5.6% over 2020.

However, the difficulty of Xiaomi breaking through the inertia of "cost performance" in the short term cannot be ignored. According to counterpoint data, in 2021, the global smartphone ASP increased by 12% year-on-year to US $322, about 2178 yuan. In contrast, Xiaomi's data of 1189 yuan is still far behind

Overall, Xiaomi's mobile phone business is basically under pressure in the medium and short term of the industry downturn. Analysts and manufacturers regard 618 as an important node to stimulate the demand for replacement. Guotai Junan said: "we look forward to a new round of consumption recovery in the domestic 618 Shopping Festival after the epidemic is controlled." Lin Shiwei, CFO of Xiaomi, also mentioned the boosting effect of 618 on mobile phone shipments.

However, for the smartphone market, which has been depressed for many years, a shopping festival may be just a drop in the bucket. Wang Xi, an IDC China analyst, pointed out in a report: "without additional positive incentives, China's smartphone market capacity may fall below the 300 million mark in 2022."**

Xiaomi digital series flagship model Xiaomi 12 Pro source: Xiaomi official website

Overseas setbacks

The uncertainty of the international geopolitical situation has brought setbacks to the development of Xiaomi's overseas business. In 2022q1, Xiaomi's international market revenue was 37.5 billion yuan, accounting for more than half of the total revenue. Among them, the Indian market is particularly noteworthy.

India was once an overseas market that Xiaomi was proud of. Since the end of 2017, it has surpassed Samsung to become the mobile phone brand with the largest shipment in the Indian market. But in the past two years, the honeymoon period has come to an end.

It is reported that in the past six months, the Indian authorities have conducted tax reviews on Xiaomi for many times. In April, they seized $725 million in Xiaomi's bank account in India on the grounds that Xiaomi "illegally remitted money overseas in the name of royalties".

On the issue of the Indian market, Wang Xiang said: "we are a very legal and compliant enterprise. All taxes and expenditures strictly comply with the laws and regulations of the host country, and all data have been audited by a third party. Therefore, we believe that there is no problem of violation. While we have frank communication with relevant parts of India, we also appeal through legal channels."

Although the Indian court lifted the assets freeze on May 6, the cracks in the relationship may be difficult to repair in a short time

There have also been personnel changes within Xiaomi India. According to Indian local media India today, Manu Kumar Jain, the global vice president of Xiaomi and the leader of the Indian business, was summoned by the court and asked to cooperate with the company's foreign exchange compliance investigation. One guess is that he has worked and lived in Dubai and will no longer be in charge of Xiaomi's Indian business. Neither Xiaomi nor manu have made a clear statement on the change, but manu's LinkedIn and twitter data have erased the identity of the head of India, leaving only the position of global vice president.

During the telephone conference, Wang Xiang said that he had made personnel adjustment and sent some "young and energetic colleagues" to manage Indian Affairs.

It is worth noting that Xiaomi began to emphasize the value of the Latin American market this quarter - which Wang Xiang called "one of the main drivers of our growth" The Q1 market share of Latin American market has increased to 15% from 12% last year, among which Colombia has ranked first

Manu Kumar Jan Lingying Homepage

Where is the new machine

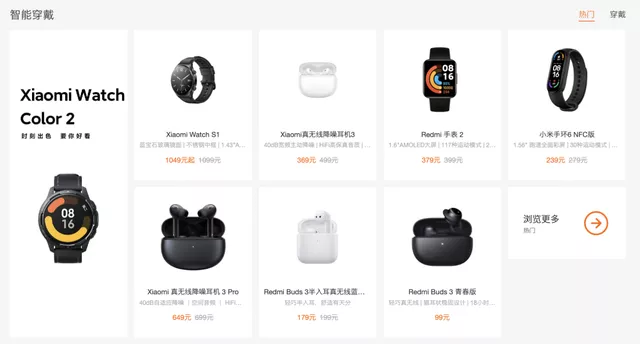

In addition to mobile phones, Xiaomi's other two business revenues come from IOT, consumer products and Internet services.

Q1 Xiaomi IOT and consumer products revenue reached 19.48 billion yuan, an increase of 6.8% year-on-year

The gross profit margin increased from 14.5% in Q1 in 2021 to 15.6% in Q1 in 2022, a record high in a single quarter. This is mainly due to the decline in the price of core components such as display panels;

As of March 31, 2022, the number of aiot connected devices (excluding smartphones, tablets and laptops) exceeded 478 million, with a year-on-year increase of 36.2%.

Xiaomi continued to promote the "mobile xaiot" strategy. Compared with other domestic mobile phone brands, Xiaomi gained the upper hand in the brand strength and market share of IOT devices with the help of first mover advantage and ecological chain strength.

At the telephone conference, Wang Xiang said that the gross profit margin of IOT business will continue to benefit from the decline of parts prices in the second quarter, but overseas, it is difficult to predict due to factors such as logistics, the situation in Russia and Ukraine, exchange rate and inflation.

In fact, the foundation of IOT business is still mobile phone. The recession of mobile phone business will undoubtedly affect the growth rate of IOT business. In the vertical category of ecological chain, the problems of serious product homogenization, low profit margin and scale reaching the ceiling also began to appear

Xiaomi's smart wearable device source: Xiaomi's official website

Xiaomi's Internet business mainly includes mobile game operation, e-commerce, financial technology, advertising and other services. This quarter:

Internet service revenue reached 7.1 billion yuan, a year-on-year increase of 8.2%. Although it accounts for a small proportion of total revenue, gross profit is as high as 70.8%**

Among them, the advertising business revenue reached 4.5 billion yuan, a year-on-year increase of 16.2%; The revenue of game business was 1.1 billion yuan, a year-on-year increase of 3.0%; Overseas Internet business revenue was 1.6 billion yuan, a year-on-year increase of 71.1%;

As of March 2022, the number of global MIUI monthly active users was 529 million, with a year-on-year increase of 24.5%; The number of monthly active users of MIUI in Chinese Mainland was 136million, a year-on-year increase of 14.3%.

According to MIUI daily living and internet income calculation, the ARPU of Q1 is 13.4 yuan, which continues to decline, which also reflects the increasing difficulty of traffic realization

The high-profile car manufacturing business is still in the investment stage, and there is not much new news this season.

In March 2021, Xiaomi announced that it would build cars and invest US $10 billion in the next decade, which is regarded as the most important second growth curve of Xiaomi in the future. When the annual report was released last year, Xiaomi said it would expand its research and development in the fields of automatic driving and intelligent cockpit, and gave a timeline, "the car will be officially mass produced in the first half of 2024"**

"We will continue to invest this year and the expenditure is expected to increase. We currently have 1200 engineers and will continue to increase in the future." Lin Shiwei said at the telephone conference.

Xiaomi's R & D investment in this quarter was 3.5 billion yuan, a year-on-year increase of 16%, a month on month decrease of 9.3%, and the R & D expense rate was 4.7%. Xiaomi's R & D investment has been criticized. In 2018, the R & D investment was only 5.8 billion yuan, accounting for 3.3% of the current revenue. At present, this proportion has increased year by year. By 2021, the R & D investment has reached 13.2 billion yuan, accounting for 4%.

However, the R & D investment expenditure in this quarter is still lower than its sales and promotion expenditure. Compared with Huawei's investment of 142.7 billion yuan in 2021 and the R & D expense rate of 22.4%, it lags far behind in absolute value and proportion.

For the second quarter, Xiaomi did not give a clear expectation. The key words mentioned many times on the phone were "uncertainty". The epidemic situation, macro environment, the situation in Russia and Ukraine and geopolitics made it difficult for Xiaomi and other companies to make accurate judgments about the future.