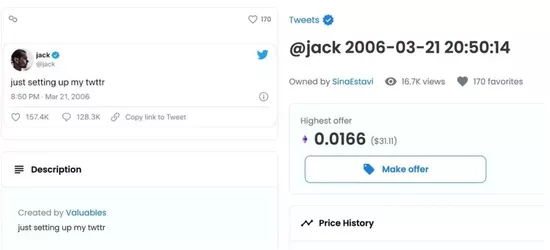

In the eyes of many people, 2021 is the first year of NFT. In this year, the first tweet NFT of twitter founder Jack Dorsey was sold at a price of $2.9 million. The NFT works of artist beeple were sold at a sky high price of $69million. Head projects such as boring ape and cryptopunk swept the market; This year, capital, celebrities and large enterprises entered the NFT market one after another. The annual sales volume of the NFT market reached US $24.9 billion. The original niche NFT track broke the circle with a market valuation of more than US $40billion, attracting thousands of ordinary people to start the "gold rush".

Text /juny

However, how fierce the tide of NFT surges, how fast it ebbs and suffers disputes.

More than a month ago, Jack Dorsey's tweet NFT was put on sale again. Although the expected price was $48million, the highest bidding price after the first round of quotation was only $280. This is not the problem of this tweet, but the overall ebb tide of the NFT market. Last month, the trading volume of NFT market dropped by more than 90% compared with the peak in September last year, and the prices of a large number of NFT projects have plummeted recently and continued to break through the floor.

Auction of Jack Dorsey's tweets on opensea

A large number of NFT projects that were once famous have been "sacked". The NFT of Snoopy Doug, an American rapper and media celebrity, was sold at a price of $32000 in early April. The NFT is now being auctioned. At first, the asking price was $25.5 million, and then it was reduced to $16.35 million. However, the highest bid so far is only about $1850.

The cooling of the market is only a superficial phenomenon. As NFT has been hyped to the peak and the transaction scale has expanded rapidly, people have also found that there are too many irregularities and uncertainties in the "savage growth" NFT market.

Fraud and plagiarism, system vulnerabilities, platform insider trading and other problems have emerged one after another. While NFT trading platforms represented by opensea have made a lot of money, more and more industry insider scandals have surfaced recently.

The anger of the originator: a large number of "unique" digital collections come from plagiarism

The most important reason why NFT can make rapid rounds in a number of Web3 racetracks is that it has the characteristics of verifiability, uniqueness, indivisibility and traceability, which makes NFT applicable in a wide range of scenarios and can solve a large number of problems involving ownership in real life.

The place where NFT began to "prosper" was the art field where the ownership problem was the most prominent. A painting, a piece of music and a video can now exist in the form of NFT. Creators will directly own the ownership of their own works. There is no need to worry about the popularity of counterfeits. There is no longer an intermediary to make a difference. It seems that the rights and interests of creators have been maximized.

But is that really the case?

As NFT has been hyped more and more, a large number of incidents of plagiarizing and stealing works have been exposed one after another recently.

Recently, some American musicians collectively attacked the music website hitpiece on social media, angrily accusing the website of selling their music works into NFT without their permission. On opensea, the world's largest NFT market, the works of some artists are also made into NFT for sale by anonymous users.

When the Dutch artist Lois van Baarle searched her name on opensea, she found that more than 100 pieces of her works of art were being sold, and none of them were made by herself; American artist aja Trier found nearly 90000 NFTs based on her IP works on opensea when she had never conducted any NFT operations herself.

Picture from AJA triertwitter

"My work has been stolen before, but there has never been such a large-scale and flagrant plagiarism before NFT." Aja Trier said in an interview.

The emergence of this situation is closely related to the "inert casting" mechanism of opensea and other NFT trading platforms. In order to attract more people to enter the NFT market for transactions, opensea allows users to list NFTs for sale without writing them into the blockchain. The seller does not pay fees before the NFT is sold. The creation process can be completed with just a few clicks.

This makes many speculators want to list as many works as possible. They even invented an automated robot to capture artists' online galleries online, search with keywords on Google pictures, and then automatically generate NFT works.

Recently, deviantart, an organization composed of an artist group, scanned millions of NFTs being sold publicly, and has found more than 290000 unauthorized plagiarism cases.

The core problem behind this is that the standard for NFT's original confirmation is who is the first to upload the work to the blockchain, but the first to cast the work into NFT and upload it to the blockchain may not be the original work.

"Many people say that the arrival of NFT is the good news for the creators, but it is also a nightmare for me and many people around me. Our works are always on the blockchain, but it does not belong to me. Plagiarists and trading platforms hardly have to bear any responsibility." Aja Trier said.

Immature NFT network: assets are missing and insider trading is rampant

The nonstandard NFT market angers not only the creators, but also many NFT investors.

Opensea is currently the largest NFT trading platform in the world. Users can cast NFTs on this platform, and can also trade and auction various types of NFTs, including pictures, music, games, and even linked to physical assets. To understand it simply, opensea is like Taobao, which specializes in selling NFT, except that all transactions are digital virtual assets.

However, as a young trading platform that has only been established for more than four years and suddenly ushered in a peak last year, opensea system is not stable and safe at present, and insiders are even engaged in insider trading.

According to the U.S. Department of justice disclosure on June 1, New York federal prosecutors and FBI investigators arrested Nathaniel Chastain, a former product manager of opensea, and charged him with wire transfer fraud and money laundering related to NFT insider trading. If convicted, he will be sentenced to up to 20 years' imprisonment.

The former product manager of opensea had been responsible for screening NFTs on the website's home page. Nathaniel Chastain used the anonymity mechanism of NFT market transactions. From June to September 2021, he used anonymous accounts to buy a large number of NFTs to be put on the market. After these NFTs officially landed on the web, they were sold at two to three times the purchase price and arbitraged.

This is the world's first case of being arrested for NFT insider trading, which also makes many NFT investors panic. Because insider trading is too common in the NFT industry.

Generally speaking, before the new NFT series are put on the shelves or cast on the trading platform, ordinary investors will not know which of them are rare, but the development team has this information. As a new investment product, NFT's information disclosure mechanism is not as complete as the securities market. With the blessing of blockchain technology, many development team members often use anonymous wallets to buy rare NFTs in advance and make profits in subsequent public sales.

In this regard, U.S. attorney general Damian Williams made it clear that "NFT trading may be new, but this type of crime is not new. We will absolutely prohibit the existence of insider trading, whether it occurs in the stock market or in the blockchain."

In addition, in addition to internal problems, opensea has also been targeted by hackers.

Not long ago, the owner of a boring ape NFT work filed a lawsuit with opensea in the federal court of Texas, arguing that the system vulnerability of opensea caused his NFT to be stolen. This is the first formal legal action involving opensea security vulnerabilities, but behind it, there have been a large number of similar victims.

Since January this year, many users have said that their wallets have been illegally invaded by hackers, and the NFTs in their wallets have been sold on the shelves at a very low price, and then resold immediately at a high price. As users are anonymous and untraceable, these assets can hardly be recovered once they are sold.

Some Twitter users said that they discovered this vulnerability in opensea's system in June last year and reported it to the authorities, but opensea did not pay attention to this problem, leading to large-scale attacks. In order to solve this problem, at the end of February, opensea said that it would upgrade the smart contract. As a result, the front foot had just upgraded, and the back foot hackers immediately launched another attack, stealing NFT projects of up to $200million in just nine hours.

In fact, opensea is not the only platform that has been attacked. Various NFT theft incidents have emerged one after another recently.

For example, just two days ago, the boring ape (bayc) NFT was attacked again by phishing, with a loss value of more than 400000 US dollars. This is the third security vulnerability attack in the project in the past two months. At the end of April, the official instagram account of boring ape was just stolen, and the NFT worth $2.8 million was stolen through fraudulent links. Previously, Jay Chou's NFT worth $420000 also disappeared under this fishing attack.

Picture from Investopedia

After the wild growth carnival, it's time to calm down

With the frequent occurrence of various unsafe events, the follow-up of industry scandals and the increase of supervision, people who had been reveling all night for NFT began to calm down gradually, and the whole market began to experience an obvious and continuous ebb tide.

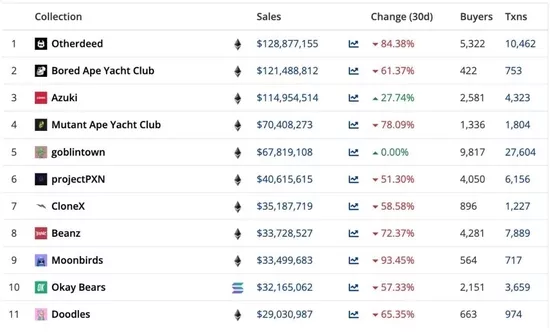

According to cryptoslam IO NFT sales statistics in the past 30 days show that since last month, NFT's overall sales have decreased by 65.43%, from US $4.6 billion last month to US $1.59 billion, and sales of almost all projects have fallen precipitously.

Picture from cryptoslam io

In addition to the fact that Jack Dorsey's tweet NFT devalued by more than 99% mentioned at the beginning of the article, the prices of NFT's blue chip projects have also fallen sharply in the past two months. The average value of boring apes has decreased by 60% since May 1. The average transaction price of mayc series has decreased by 78.12% in the past 30 days. The average transaction price of encrypted punk series has decreased by 55%.

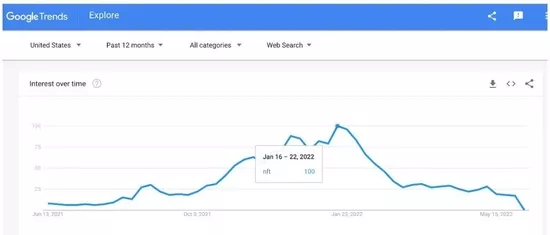

According to the search data of Google trend, the search popularity of "NFT" has recently dropped from the peak in July last year to the level before January 2021, which reflects the sharp decline in people's attention to NFT.

Statistics on NFT search as of June 7, the pictures are from Google Trends

The ebb tide of NFT can be said to be an internal adjustment after a wealth making carnival. In the past year, although a large number of enterprises have entered the battlefield of NFT, the practical application value of NFT has not been exported for a long time. Most people do not buy NFT for the purpose of liking a certain work as a collection, but purely for speculative purposes, expecting to make a lot of money in the continuous turnover.

Under such a mentality, a large number of NFT projects have become a game of drumming and passing flowers, and not being the last person to take over the plate has become the survival law of the game. When NFTs are labeled as speculative products, they will face financial risks that may come at any time.

Irregular management, unsafe trading, and investment attribute in a gray area. After the hype of "everything can be NFT", people may have begun to rethink what the real value of NFT is.