On the morning of May 14, Beijing time, Faraday future (NASDAQ: ffie) today submitted its form 10-K annual report as of December 31, 2021 to the U.S. Securities and Exchange Commission (SEC). According to the document, Faraday's operating expenses will be US $354 million in 2021 and US $64.94 million in 2020; The net loss was US $517 million, compared with us $147 million in 2020.

As of December 31, 2021, the company's cash balance was $505 million. The cash balance as of March 31, 2022 was $276 million. The decrease in cash was partly due to the planned repayment of $97 million in notes and interest payable from December 31, 2021 to March 31, 2022.

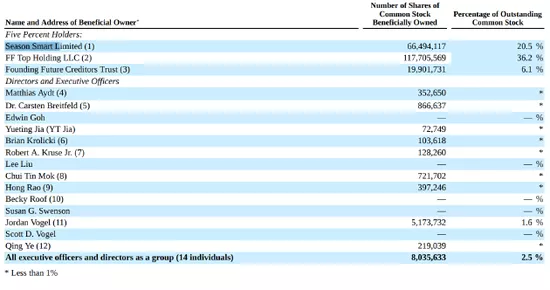

The annual report also shows that FF top holding is the largest shareholder of Faraday in the future, holding 117705569 ordinary shares, accounting for 36.2%. FF top holding is controlled by Faraday's future management. The information shows that the creditors of the future FF holding group hold 80% of the shares, while the management group of the future FF holding group holds 100% of the shares.

Season smart Limited is the second largest shareholder and holds 66494117 ordinary shares of Faraday in the future, accounting for 20.5%. Season smart Limited is an indirect subsidiary of Evergrande group. In addition, the founding future credits trust holds 19901731 shares, accounting for 6.1%.

Among directors and senior executives, Jia Yueting personally holds 72749 shares, accounting for less than 1%. CEO Dr. Carsten breitfeld holds 866637 shares, accounting for less than 1%.

Jordan Vogel, the chief independent director, holds 5173732 shares, accounting for 1.6%. Vogel was originally the chairman and co CEO of property solutions acquisition Corp, a "special purpose acquisition company" (SPAC).

Last January, Faraday announced the merger with property solutions acquisition Corp. After the completion of the transaction, the merged new company will be listed on the Nasdaq stock market with the stock code "ffie".

Overall, Faraday's future directors and executives (14 in total) hold 8035633 shares, accounting for 2.5%. As of December 31, 2021, Faraday has US $505 million in cash in the future.