Star Technology "unicorn" enterprises entered the "cold winter" early. In late May 2022, it was established for 11 years, with a financing of 9.85 billion yuan and a valuation of more than 50billion yuan. The once capital darling and the unicorn "Ruoyu technology" in the flexible screen industry fell into a crisis of employee dismissal, wages and debts, and near collapse, which attracted widespread attention.

"I suggest that everyone actively help Ruoyu technology solve the shortage of funds and help Ruoyu technology introduce strategic investors." in April this year, an article entitled "saving Ruoyu" written by liushuwei, a researcher at the Central University of Finance and economics, was disseminated on social media. She pointed out that although Rouyu has technical strength, it is in financial difficulties internally.

it happens that there is a similar case. The artificial intelligence (AI) unicorn "Yuncong technology", which lost 2billion yuan in three years, landed on the sci tech Innovation Board at the end of May, with the latest market value of 23.9 billion yuan, 29% less than the pre IPO valuation; Guangzhou Huizhi microelectronics, a chip Unicorn with an annual loss of 300million, has submitted an IPO prospectus to the Shanghai Stock Exchange. It is reported that its valuation may be greatly reduced by about 78%. However, the unlisted AI "unicorn" has already lost more than half of its valuation due to its image and openness.

At the same time, foreign technology "unicorn" is also entering the winter.

According to Forbes, in late May this year, the financial technology Unicorn bolt announced large-scale layoffs, accounting for more than one third of the total; Meesho, an Indian e-commerce Unicorn valued at 5billion dollars and invested by Softbank, confirmed that it was cutting spending and raising funds to pay off its debts; Instacart, the second largest unicorn and fresh grocery distribution platform in the United States, announced in March this year that its valuation was reduced by nearly 40%, that is, from US $39billion to about US $24billion, a decrease of nearly 100billion yuan

"Now, the unicorn foam is bursting. You are beginning to see many cases of bloody listing." Zhang Jun, chairman of China Europe capital, pointed out pointedly that the foam in some industries is too big, and the hype game of beating drums and passing flowers should be stopped.

In fact, the world today is in a great change that has not been seen in a century. The growth of "unicorn" slows down under the influence of such superimposed factors as the COVID-19, the US inflation rate hike, the depressed stock price and the VC fund-raising cycle.

However, the "unicorn" hyped by capital shows its true shape. The story of unprofitable and non business model technology unicorn is being punctured, and enterprises full of foam are facing a big defeat. At the moment, what the market needs more is a pragmatic, highly innovative technology company with technical barriers.

Jingwei venture capital said in an exclusive interview with titanium media app a few days ago that today, venture capital institutions need to tap enterprise value, find earlier projects, more promising hard technology tracks and better entrepreneurial teams, so as to prevent unicorn's valuation from shrinking and the primary and secondary valuations from hanging upside down.

Unicorn suffered a big defeat, and technology enterprises are facing a "wave of screening"

Ten years ago (2013), venture capitalist Aileen Lee coined the term "unicorn" to describe those unlisted start-ups valued at $1billion or more.

At that time, companies with such high valuations were rare, so they deserved a special title - but since then, everything has changed dramatically. The upsurge of the Internet of science and technology has rapidly spread to all parts of the world, and the upsurge of entrepreneurship has intensified. Capital is pouring into these start-ups at an unprecedented speed.

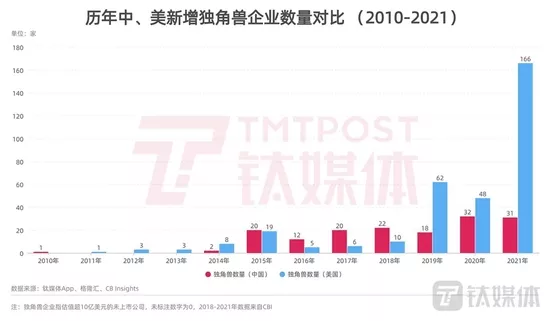

The number of "unicorns" has grown wildly in the past decade. According to the statistics of titanium media app, the number of Unicorn enterprises in China and the United States increased from about 3 in 2012. By 2021, the number of Unicorns will reach nearly 200.

At present, there are 1328 technology "unicorn" companies in the world, with a total value of more than US $1.8 trillion.

However, the phenomenon of "unicorn" being abused and hyped is frequent. The truth of those technology unicorns full of capital foam is broken because they do not have a stable profit model. The valuation of "water injection" has been greatly devalued, and the enterprise is facing a "big failure".

The first "unicorn" to be punctured was Wework, regarded as the "next Alibaba" by son Zhengyi, founder of Softbank group, and a US sharing economy giant.

Founded in 2008, Wework was highly praised by capital. Its founder Adam Neumann claimed that Wework was a sustainable "community company". Son Zhengyi even invested billions of dollars in Wework, with a valuation of up to $65billion, becoming the third largest technology "unicorn" in the United States.

However, in 2019, Wework entered the real capital market and took off its bright coat. It was found that this "unicorn" was just a "trapped beast" dragged down by a debt of up to $47billion. In the end, Wework fell to the altar, Adam was fired by the board of directors, and the business and personnel were adjusted on a large scale, and listed with a 60% decline in valuation.

As of June 4, the market value of Wework was only $5.2 billion. Son Zhengyi said that Softbank lost more than 720.8 billion yen (about 47.7 billion yuan) on the Wework project.

And the former star "unicorns" who have already appeared on the market have a hard time.

According to the statistics of mindmarters, among the 140 former star "unicorns" publicly traded in the United States, the share price has plummeted by 30%-90% in the past six months. According to the report, the main reason for the decline in share prices is that these star enterprises faced huge losses during the reporting period, including Uber (with a total loss of $29.1 billion), Wework (with a total loss of $12.2 billion), snap (with a total loss of $8.7 billion), LYFT (with a total loss of $8.5 billion) and airbnb (with a total loss of $6.4 billion).

In China, the story of the declining valuation of "unicorn" enterprises such as Yitu, Yuncong, Geling Shentong and ofo has been well known in the industry. The medical unicorn "Ping'an medical insurance technology", which is valued at $8.8 billion, has also recently confirmed the optimization of layoffs. At the same time, the news of the sale of business assets came out.

The latest case is that the former star unicorn, "Chinese version of twilio" and the domestic intelligent communication cloud company "ronglianyun" fell off the altar due to fraud. The market value plummeted and the investment institutions also sold out urgently.

In February, 2021, Rong Lianyun, who lost 800million yuan in three years (2018-2020), "the first share of Chinese SaaS enterprises listed in the United States", successfully landed on the New York Stock Exchange. On the first day of listing, the share price soared by 200% and the total market value reached 7.9 billion US dollars (about 50.6 billion yuan).

Subsequently, the stock price fluctuated violently, and the stock price did not perform well. In addition to the impact of the external environment such as the downward shift of capital market risk, the pressure on the sale of zhonggai shares, the 315 point holding subsidiaries and the continuous loss of its own performance, a bigger reason is that Rong Lianyun may have fraud.

On May 3 this year, Rong Lianyun was warned by the Chinese company of global giant KPMG, the company's own audit institution, that there may be fraud similar to Ruixing. Subsequently, KPMG announced its resignation. Rong Lianyun announced the replacement of independent directors and set up an independent special committee to investigate misconduct and trading violations.

Rong Lianyun said that 5%-10% of revenue in the second quarter of last year and 15%-20% of revenue in the third quarter may be affected. This is equivalent to a false sales amount of about 80million yuan, reducing the growth of 40%-50% in the two quarters previously announced by the company to 15%-35%.

On the 28th of last month, the New York Stock Exchange issued an inquiry letter to Rong Lianyun, requiring the company to submit its 2021 financial report as soon as possible, as well as the pending internal investigation results of the illegal transaction. The New York Stock Exchange will pay close attention to its status. Once the annual report is not submitted on time or the status is in doubt, ronglianyun may be suspended and delisted.

As of June 4, Rong Lianyun's share price plummeted to less than $1, and its market value fell to $138million (about 900million yuan), more than 80% lower than the highest level.

Affected by this, its investors are also worried. According to wind data, Sequoia Capital, as an angel investor of the company, sold more than 25 million shares of ronglianyun during the one-and-a-half years of listing, with the shareholding ratio of 20.75% at the time of listing and now only about 8%.

Exaggerating sales, introducing capital, huge losses, overvaluation, industry foam, no stable and sustainable profit model, PPT financing All these have become investors' doubts about the "technological unicorn" and an important reason for the "unicorn" enterprises to fall into the altar.

Now, capital investment in "unicorn" is slowing down. According to CB insights, in the first quarter of 2022, only 113 Unicorn companies were born in the world, with a 15% decrease on a month on month basis (October December 2021); From January to March this year, the global overall financing amount was $143.9 billion, a decrease of 19% over the previous quarter; The total scale of enterprises with a single round of financing of more than US $100million was only US $73.6 billion, a month on month decrease of 30%.

Devin Liu, vice president of Yiti capital, an investment institution headquartered in Shanghai, said that in the first half of this year, most investment transactions were put on hold, and investors became more and more wary of overvaluation.

The problem of the so-called "unicorn" devaluation has affected the venture capital industry.

According to the latest financial report of Shenzhen private equity company Tongwei venture, the revenue in the first quarter of 2022 plummeted by nearly 78% due to the decline in the valuation of its portfolio companies.

As major shareholders of Alibaba and Didi, Softbank group of Japan released financial report data for fiscal year 2021, which showed that they lost 90billion yuan in one year, and the loss of its venture capital fund vision fund reached 140billion yuan.

At the beginning of June, the well-known investment institution tiger Global Fund also announced that this year's loss reached 52%, further expanding from the 44% loss as of April.

Some investors told titanium media app that VC (venture capital institutions) are increasingly worried about capital tightening, which will reduce the enterprise valuation. Especially for start-ups that have grown into "unicorns", their business model is dominated by losses and their income prospects are dim. With the increasingly severe business environment and financing environment, the footsteps of enterprise elimination may be approaching, and chinese Unicorn companies are facing a "wave of screening".

One phenomenon is the change of the scientific innovation board. Recently, the CSRC has issued several announcements showing that it attaches importance to the protection of investors' rights and is strengthening the actual business and operation of the IPO of the sci tech innovation board. At present, Yitu, lidar unicorn "Hesai technology", voice AI unicorn "yunzhisheng" and agricultural UAV unicorn "Jifei technology" are all facing huge losses, and have finally withdrawn their IPO applications for the science and innovation board.

He Bei, CEO of Sinian Zhijia, told titanium media app that capital needs to look at the fundamentals of these Unicorn companies to see whether there is a real profit model, rather than the capital speculation caused by the industry.

Zhang Jun believes that many venture investors lack deep expertise in the field of science and technology, resulting in high valuations. With the poor external environment, the valuation of the technology industry is now falling back to the "normal state".

The market calls for more pragmatic technology enterprises

"Unicorns do not exist. This is a truth that every child understands. This is a fact.... we are here to earn value for investors, not to save all mankind. Please put aside these childish fantasies and talk about saving the world and unicorns."

In the TV series "initial players: the rise and fall of Wework" released in March this year, when Adam was fired by the board of directors, the new CEO of Wework said these words at the first employee meeting.

He criticized Adam's behavior of fabricating lies and false appearances to Wework employees, which cost the company $40billion in just one year.

Although this is a film and television work, there are some exaggerations. However, it still reflects from the side that as the market ushers in a new round of reshuffle, "unicorn" can not fully reflect the real value of the enterprise. What the market needs to develop more is hard technology companies that are pragmatic, highly innovative and have core technical barriers.

Ren Bobing, executive director of Innovation workshop, said in an interview with titanium media app that he is now in a new cycle of entrepreneurship. Compared with the previous wave of Internet investment, the competition of the hard technology track is different. It is more benign and healthy. The real "moat" is the top technology products and team strength. Investment institutions need to speed up the early or very early layout, and may also participate in the whole incremental market.

"We are more concerned about whether each enterprise can improve its unique product power and competitiveness, rather than looking at the impact of the market on them. As long as we can ensure that each financing is at a correct and reasonable valuation and maintain a correct and reasonable rhythm." Ren Bobing told titanium media app.

During the two sessions this year, the government work report proposed that efforts should be made to cultivate "specialized, special and new" and "small giant" enterprises, so as to focus on building expertise, strengthen industries with supporting facilities, win the market with innovation, and give strong support in capital, talents, Incubation Platform construction, etc. At present, there are more than 40000 "specialized, special and new" enterprises nationwide, and 4762 "little giant" enterprises, which have become a strong support for the supply chain of the industrial chain.

Renbobing pointed out that in each vertically segmented high-tech field, the "specialized and special new" projects have their own unique market space, and will have a very different revolution in the market, product paradigm, competition paradigm and market increment space compared with the past.

For the next decade of science and technology enterprises, Jingwei venture capital believes that it is necessary for investment enterprises to have real "hard barrier" opportunities in technology, such as truthful patents and technical barriers. Moreover, based on technological R & D and barrier construction, the invested enterprises should have the ability to integrate upstream and downstream industries.

As for Jingwei's investment logic, in January this year, Zhang Ying, the founding management partner of Jingwei venture capital, put forward the idea of "ecological investment, scene after investment, and strategic brand". Among them, ecological investment means that Jingwei invests "base area" projects in the core link of the industrial chain, and then extends them up and down, so that various investment fields can converge into an ecology, which extends to the new energy industrial chain, medical care, large consumption, cutting-edge technology and other racetracks, and forms a more extensible network investment structure in the sub areas to help and promote the development of enterprises.

"For example, in the field of newly built cars, Jingwei has gained both ideal and Xiaopeng. With this ecology, there will be better cooperation, which is an important factor to help the growth of science and technology enterprises." Jingwei venture capital told titanium media app that the main reason for proposing "ecological investment" is that the characteristics of hard technology companies need to form an investment ecology. As the longitude and latitude focus more on the early stage, they will try their best to cast early and cast small, and discover early. From the edge to the mainstream, they will look for new tracks that may look marginal now, but will become very important in the future.

In an interview with titanium media app, huangsongyan, managing director of linear capital, stressed that it is now a big reshuffle. Those companies that used to be ordinary and have no characteristics will be "washed out", while those with characteristics and capabilities will show their edge, showing a stronger situation.

Under the node of the new decade, the tech Unicorn foam really needs to be squeezed.

By linzhijia