Coinmarketcap estimates that the massive sale of cryptocurrencies wiped out more than $200 billion in wealth in just 24 hours. The collapse of terrausd stable currency drove the overall decline of cryptocurrency, which also hit major tokens hard. Bitcoin has fallen as much as 10% in the past day, hitting its lowest level since December 2020, and ether has fallen as much as 16%.

The market crash showed signs of further spread on Thursday, as cryptocurrency related stocks in Asian markets also fell sharply. Hong Kong listed financial technology company BC Technology Group closed down 6.7%. Japan's MONEX group, which owns TradeStation and coincheck trading platforms, closed down 10% on Thursday.

With central banks around the world actively tightening monetary policy to deal with inflation, investors fled risky assets, and digital currency was not spared. S & P 500 index futures fell 0.8% on Thursday, following the decline of MSCI Asia Pacific Index.

In the era of abundant liquidity, the stock and cryptocurrency markets are in high spirits. They can sit firmly in the cloud without taking the initiative to compete for the favor of investors, and look prosperous.

However, after the Fed vowed to press 40 years of high inflation, the falling hammer is draining the water at a rare speed, completely panicking this generation of investors and leaving quickly in order to settle their bags.

Therefore, the current situation is that the higher than expected rise of us April CPI data on Wednesday not only made the three major indexes of US stocks record the largest five-day cumulative decline since March 20, 2020, but also made the cryptocurrency market "face the cold winter".

Bitcoin, the largest market value, fell by more than 14% in the 24 hours ending at 14:00 on Thursday, falling below $27000 and breaking the psychological threshold of $30000 three times a week. What caused more market shock was the "death stampede" encountered by the third largest stable currency ust in the cryptocurrency market and its sister token Luna.

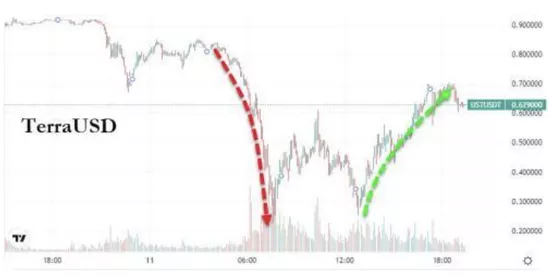

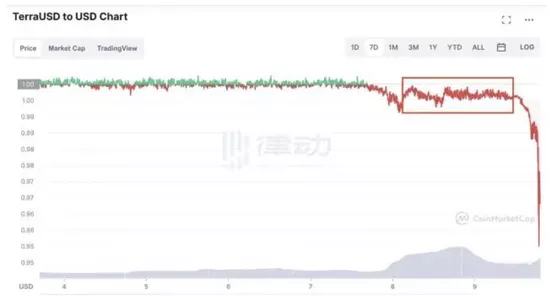

From last weekend, ust and Luna suddenly began a spiral crash. On Wednesday, May 11, UST, which should have anchored the value of US $1, once fell to an all-time low of 26 cents per piece, then rebounded to 49 cents, plunging 44% within 24 hours.

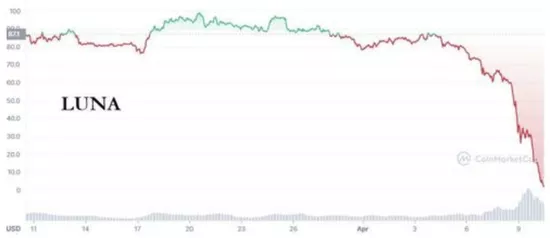

Luna's performance was even more "tragic". It once fell by about 99% to 81 cents in the past seven days. Although it then rebounded to $3.67, it still fell 87% in the 24 hours on Wednesday, May 11.

The link between ust and the US dollar has always been regarded as an important attempt in the field of cryptocurrency, but it ushered in a rout in such a dramatic way. Is it just because of the withdrawal of funds from risky assets due to the tightening of liquidity? Or did someone take advantage of the situation to "watch you" in the dark and start a Soros style sniper?

The short regiment launched the "encirclement and suppression operation"

UST, also known as terrausd, is an "algorithm stable currency" launched by terraform labs headquartered in Singapore in 2018.

Algorithmic stable currency is one of the three modes of stable currency. It maintains the balance between the number of stable currency and sister tokens through algorithm, so as to maintain the value of stable currency anchored to us dollar, which is the fundamental principle that ust claims to be linked to us dollar.

Ust is famous for its stability. It keeps the balance between supply and demand by cooperating with the sister token Luna with floating price, so as to anchor its price at $1.

When the market demand for UST increases and the price is higher than US $1, users can send us $1 Luna to the system (Luna is destroyed or removed from circulation) and exchange it for one ust (UST is cast). On the contrary, when the market demand of ust decreases and the price falls below US $1, users can send ust to the system (UST is destroyed or removed from circulation) in exchange for us $1 Luna (Luna is cast), so as to reduce the market supply of ust and restore the anchoring relationship between ust and US dollars.

The operation mechanism of ust is convenient for investors to trade easily and quickly without relying on intermediaries and worrying about the fluctuation of its value, because the algorithm can manage the volatility and ensure investors to obtain greater arbitrage opportunities, which is very popular in the market.

However, it is such an "attractive" target that attracted the "encirclement and suppression action" of the air force, which not only caused Luna to suffer "death stampede", but also led to the heavy setback of bitcoin.

On August 8, the usg-4ct announced that it would set up a strong trading pool under the usg-4ct, a non-profit organization, to be the main place of the usg-3ct trading pool.

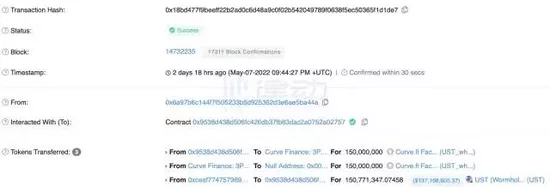

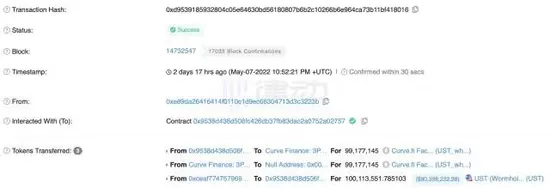

Therefore, in the early morning of May 8, LFG withdrew $150 million of ust liquidity from the ust-3crv pool. It is noted that if you want to drain the liquidity of ust at this time, it only needs about US $300 million.

So they took action.

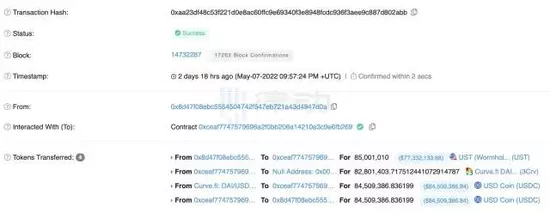

About 10 minutes later, a new address suddenly sold us $84 million worth of UST, which instantly affected the original balance of the 3crv pool.

In order to maintain the liquidity balance of the 3crv pool, LFG withdrew US $100 million of ust from the capital pool.

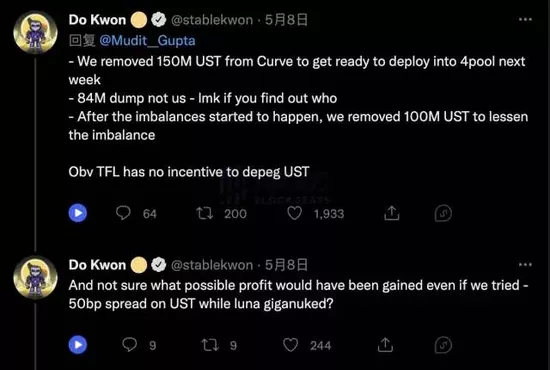

But what LFG didn't expect was that the move aroused thousands of waves, and rumors have been everywhere in the market, claiming that the sale was directed and performed by LFG. Do Kwon, founder of Terra and South Korean cryptocurrency entrepreneur, immediately questioned on Twitter: how much profit can we make by doing this?

Then, however, the air force proved to do Kwon with its own actions that they could benefit from it.

Before long, several giant whale accounts began to sell ust on binance, and each transaction was worth millions of dollars.

Under repeated attacks, ust has begun to decouple from US $1. At this time, the address of the suspected top private jump Trading (UST market maker) began to buy ust in an attempt to stabilize the anchor between ust and the US dollar.

At this time, the story can still be called ust's "small decoupling event". If we hold on to this and don't move forward, at most, it is a small splash in the history of cryptocurrency development, and the possibility of "leaving the circle" is quite small.

But now looking back, "small decoupling" played a prelude to the "epic riots" in the market.

The emergency in the early morning of May 8 made panic spread rapidly among ust and Luna investors. A large number of ust locked in anchor protocol (decentralized bank, which can provide up to 20% market interest rate for traders who deposit ust on its platform) flowed into the market, and ust began to fall under pressure.

At this time, LFG wants to "prop up" with bitcoin. It sends twitter to announce that it will "lend" its $700 million bitcoin savings, hoping to maintain the stability of ust through the mutual exchange between ust and bitcoin (rather than ust and plummeting Luna).

However, do Kwon disagreed with LFG on this point. He believed that ust was still stable above $0.95 at that time, which was not decoupling, so bitcoin was not needed.

For do Kwon, 0.95 may be enough to prove the stability of UST, but most people in the market don't think so. What they see is that ust has not returned to the anchor position of $1 for a long time.

The "small lack" of ust is "great risk" in the eyes of investors. At the moment of the sudden increase of risks in the financial market, few people can bear the potential crisis as in the past.

As a result, ust began to sell on a large scale, falling directly below US $0.95 and driving down into the unknown.

At such a juncture, Luna is not enough to support the game. Bitcoin has become the best choice to save the game. Unfortunately, the plan did not work.

Ust hit a new low on Wednesday, May 11, and was further away from the anchored value of $1. What's more serious is that the massive entry of bitcoin gradually spread the black fog over ust and Luna to itself. On that day, bitcoin fell to $29100 for the second time in a week after Monday, the lowest since December 2020.

Even though jump trading and LFG have realized the seriousness of the situation, they stopped selling bitcoin savings in the early morning of May 10 to protect the anchor value, and let the situation continue to deteriorate, the final result is to lose the wife and lose the soldier.

After the two-day slump, not only ust was seriously decoupled from the US dollar, but the market value of "currency circle Maotai" Luna was only US $1.1 billion (it reached a recent high of US $11.95 billion on April 5, and the highest market value in history was US $41 billion), and bitcoin also directly hit a new low in recent two years.

And considering that LFG is a rich man with $3.5 billion bitcoin, market participants are worried about it.

There are concerns that LFG will sell or even have sold most of its bitcoin positions to support the UST price, which will accelerate the decline of bitcoin. Now some analysts have pointed out that LFG's bitcoin wallet is now completely empty.

Although LFG denied this claim and said it did not try to exit its bitcoin position, the market did not seem to buy it. The trend of bitcoin on Thursday is a good illustration.

The mantis catches cicadas and the Yellow finches are behind

The impact of ust and Luna's "out of circle" action is not limited to themselves and the field of cryptocurrency.

First, the trust system on which ust depends has been destroyed.

On October 5, the research director of the block chain, said:

It is rumored that jump, Alameda and other companies have provided another $2 billion to save ust... But the biggest problem here is that even if they can make ust return to $1 through some miracle, the loss of trust is irreversible.

Martin hiesboeck, head of blockchain and Encryption Research of digital currency platform uphold, compared the current situation of ust and Luna with bank run:

People no longer trust it and are now leaving quickly.

Therefore, the short Corps will undoubtedly become the biggest winner in the encirclement and suppression operation, but it is more noteworthy that national regulators are likely to be "left behind". After all, cryptocurrency may be more difficult to get rid of their "shadow" since then.

With the core attribute of "decentralization", the relationship between cryptocurrency and the banking system has been "needle to wheat" since its birth. Therefore, in recent years, the voice of central banks on strengthening the supervision of cryptocurrency has become louder and louder. At the same time, they are also vigorously promoting their own digital currency in order to "face-to-face confrontation".

On the occasion of the confrontation between the two sides, the cryptocurrency sitting firmly in the first tier suddenly came out of the circle in this tragic way, which is basically a perfect regulatory excuse.

How could regulators miss such a once-in-a-lifetime opportunity.

The US Treasury Department said that at the Senate hearing on May 10, US Treasury Secretary Yellen had talked about the regulation of stable currency in the encryption market. Yellen believed that the legislation on the regulation of stable currency was imminent, and the financial stability Regulatory Commission (FSOC) was trying to identify the risks that those digital assets would pose:

This area is growing rapidly and brings huge risks. As we all know, ust experienced a round of decline today.

UBS said in a research report released on Wednesday that the UST incident "may also strengthen regulators' attention to the stable currency usdc and tether. Although they are not systemically important for a wide range of financial payment, clearing and settlement, they are key areas of the cryptocurrency trading industry."