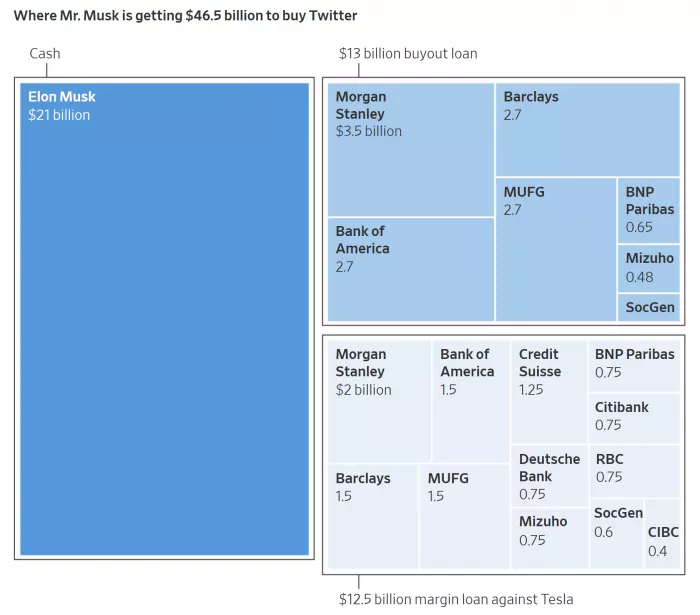

On Friday, Twitter shares closed at $49.02 on the New York Stock Exchange. Meanwhile, the market isn't exactly bullish on Tesla CEO Elon Musk's $44 billion buyout offer. WCCFTech notes that Musk is planning to take Twitter private at an offer of $54.20 per share. However, the infographic shared by the foreign media shows that he will use various sources of funding to complete this acquisition.

(Photo from: WSJ)

Specifically, Musk will pay about $21 billion out of his own pocket, with the remaining $22 billion expected to be cashed in either in the form of a loan (requiring a pledge of $62.5 billion worth of stock).

Musk would need to draw on a $12.5 billion pledged loan to cover the liquidity gap required to acquire Twitter (about 20%), and this collateral would have to be free of any other form of financial instrument (options can be excluded for now).

Before the terms of the Twitter deal were officially finalized, it held only about $3 billion in liquidity on hand. But in the past few days, Musk has sold 9.645 million shares of Tesla stock (into about $8.5 billion).

After the latest round of liquidation, Musk now holds 162.963 million shares of Tesla stock (worth $141.901 billion), referencing Friday's closing price.

It should be noted, however, that more than half of its total holdings have committed to guaranteeing the existing personal credit.

If Tesla's share price falls below $83.7 billion, Musk won't be able to provide enough pledges for the loan, which would spill over into the overall financial arrangements for buying and taking Twitter private, Bloomberg calculates.

Of course, he could still use his existing liquidity of about $3 billion, plus the $8.5 billion he recently received from the sale of Tesla stock, to pay down existing debt, even if the combination isn't perfect.

If Musk ends up with the previous financial option, he will have to sell additional Tesla stock to raise $21 billion (all or the bulk of it).

For reference, Musk had sold over 13.5 million shares of Tesla stock at the end of 2021 to pay over $11 billion in taxes.

But in exchange for $14.1+ billion in funding, the move also sent the company's stock down more than 26% between early November ~ late December 2021.