It was reported on May 27 that last night, Broadcom officially announced its intention to acquire VMware. Based on the closing price of the common shares of Broadcom on May 25, Broadcom will purchase all the outstanding shares of VMware with about US $61billion (equivalent to RMB 411.1 billion) in cash and stock transactions. Broadcom will also assume $8billion of VMware's net debt.

▲ Broadcom announced to acquire VMware with about US $61billion in cash and stock

This is the second largest acquisition in the world so far this year, second only to Microsoft's acquisition of Blizzard, a video game giant, with us $68.7 billion.

The terms of the transaction have been unanimously approved by the boards of directors of the two companies, but must be approved by regulators and shareholders. Broadcom expects the acquisition to be completed in its fiscal year 2023.

As of the closing, VMware shares rose 3.17% to US $124.36, with the latest market value of US $52.4 billion; Broadcom shares rose 3.58% to $550.66, with the latest market value of $224.8 billion.

▲ change of share price on the day when Broadcom officially announced the M & a transaction

This is also Broadcom's biggest bet so far: Despite the economic turmoil, the prosperity of enterprise software demand will continue, and bundling different low-key products may generate huge returns.

Before the transaction negotiations, VMware's share price had fallen by about half from its peak in 2019 and by 20% from the beginning of the year. However, VMware's high profit margin and stable recurring revenue enable Broadcom to provide funds for large-scale acquisitions and then quickly repay its debts. The M & a transaction shows that the M & a market of large enterprises may be thawing after the stock market crash at the beginning of this year.

After the transaction, Broadcom software group will change its name to VMware and incorporate Broadcom's existing infrastructure and security software solutions into the expanded VMware portfolio. This transaction will nearly triple the scale of the software department of Broadcom, accounting for nearly 49% of the revenue of Broadcom.

When the M & a transaction is completed, VMware's virtualization software will become a key asset of Broadcom. Broadcom will also take this opportunity to become an important participant in data center technology and cloud computing.

But as an old chip giant, what is the intention of Broadcom to win a cloud computing company at such a high price?

VMware, which has just left Dell for half a year, has not yet adapted to the identity of an independent software company and will be taken over by its new owner. How will Broadcom eliminate the concerns of VMware partners, and whether it can support a more promising future?

Even pat Kissinger, the former CEO of VMware and the current CEO of Intel, was puzzled by Broadcom's proposed acquisition of VMware: "I have devoted eight years of my life - my soul - to VMware. Therefore, I was a little surprised to learn this."

"If it helps VMware become a more attractive and innovative growth story, that's good. If it doesn't, that's bad." Kissinger said.

What are the transaction details worthy of attention in the official announcement of Broadcom's acquisition of VMware? Is this transaction no longer in suspense, or is there still the possibility of change? Why did Broadcom buy a cloud computing company at such a high price? Why did VMware resolutely sell itself after just half a year of independence? What risks might this deal bring to VMware?

This article will conduct a comprehensive analysis.

01.

M & a commitment: software assets complement each other and enhance multi cloud products

Broadcom introduced in the press release announcing the merger and acquisition of VMware:

VMware is a leading provider of multi cloud services for all applications. It has created virtualization technology. This innovation has actively changed the computing based on X86 servers. VMware then created a software defined data center, played a leading role in virtualizing network and storage, and became a leader in hybrid cloud and digital workspace.

Today, VMware's multi cloud product portfolio spans application modernization, cloud management, cloud infrastructure, network, security and workspaces anywhere, forming a flexible and consistent digital foundation on which the largest and most dynamic enterprises in various industries build, operate, manage, connect and protect their most important and complex workloads for the benefit of customers.

By combining the complementary Broadcom software portfolio with the leading VMware platform, the merged company will provide enterprise customers with an expanded critical infrastructure solution platform to accelerate innovation and meet the most complex information technology infrastructure needs.

Raghu Raghuram, CEO of VMware, said, "by combining our assets and talented team with Broadcom's existing enterprise software portfolio (both under the VMware brand), we have created an extraordinary enterprise software company."

▲VMware CEO Raghu Raghuram

The combined solution will give customers, including all vertical industry leaders, greater choice and flexibility when building, running, managing, connecting, and protecting applications on a large scale in a diverse distributed environment, no matter where they run: from the data center to any cloud and edge computing.

Hock Tan, President and CEO of Broadcom, mentioned that he expected VMware's talented team to join Broadcom, cultivate an innovation culture, and bring greater value to its merged stakeholders (including two groups of shareholders).

Tom Krause, President of Broadcom software group, also believes that the merged company will be able to serve the needs of different enterprises more effectively and safely. At the conference call after the announcement of the merger, he said that Broadcom's software assets for distributed enterprises can seamlessly complement and enhance VMware's multi cloud products in the fields of operation management, value stream, Devops management and security to cope with the entire application life cycle.

Within three years after the completion of the transaction, Broadcom expects to increase its estimated EBIT by about US $8.5 billion through this acquisition.

02.

Transaction details: VMware can seek quotations from other buyers within 40 days

According to the terms of the agreement unanimously approved by the board of directors of both parties, VMware shareholders can choose to exchange cash of US $142.50 per share or 0.2520 ordinary shares of Broadcom for 1 VMware share. This price is 33% higher than the share price of Broadcom before the negotiations began last week.

The shareholder election will be distributed proportionally, resulting in about 50% of VMware's shares being converted into cash consideration and 50% of VMware's shares being converted into Broadcom's common shares.

According to the closing price of Broadcom common stock on May 25, the total price per share was $138.23, which was 44% higher than the closing price of VMware common stock before the M & a news began to circulate on May 20.

After the completion of the transaction, according to the outstanding shares of each company as of the date of this agreement, the current shareholders of Broadcom will own about 88% of the shares of the merged company, and the current shareholders of VMware will own about 12% of the shares.

Michael dell is currently the largest shareholder of VMware. He and private equity company Silver Lake hold 40.2% and 10% of VMware's outstanding shares respectively. They all agreed to vote for the agreement. As long as the VMware board of directors continues to recommend the proposed transaction with Broadcom, they will vote for the transaction.

In this acquisition transaction, Broadcom obtained a new debt financing commitment of US $32billion from a banking consortium.

Broadcom is expected to maintain its current dividend policy and provide shareholders with 50% free cash flow in the previous fiscal year. In view of its strong cash flow generation capacity and the intention of rapid deleveraging, Broadcom is expected to maintain its investment grade rating.

The transaction is expected to be completed in the 2023 financial year of Broadcom, subject to the approval of the regulatory authorities and other normal transaction conditions, including the approval of VMware shareholders.

The M & a agreement stipulates an "inquiry" clause. VMware and its board of directors can solicit, receive, evaluate and negotiate better quotations from other buyers within 40 days as of July 5.

Considering the huge offer of US $61billion, only a few enterprise technology companies have the resources to conduct such transactions.

03.

With a generous investment of US $61billion, Broadcom has more ambitions than software

The acquisition of VMware is consistent with the strategy of Broadcom software business.

Broadcom was founded in the United States in 1991, and was later acquired by Singapore Avago with about US $37billion in 2016. After the completion of the acquisition, Broadcom became the fifth largest semiconductor company in the world. Its headquarters were moved to Singapore and later moved back to the United States.

In november2017, Broadcom planned to acquire Qualcomm, the world's largest mobile phone chip supplier, for us $130billion, but this transaction was stopped by US President trump in 2018 on the grounds of national security.

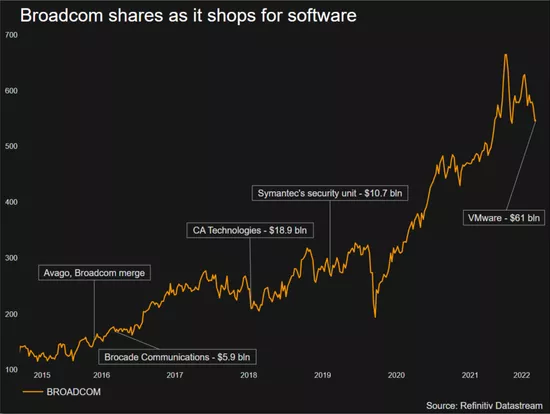

Subsequently, Broadcom turned its goal to the software field: in 2018, it purchased CA technologies, an American enterprise software supplier, for nearly US $19billion, and a year later, it purchased the security business of Symantec, an American network security group, for us $10.7 billion, making a major leap in the software industry.

In 2021, it also tried to acquire SAS Institute, a data analysis software giant. The transaction valued SAS at $15-20billion, but the transaction ended in failure.

The key figure behind Broadcom's becoming a "M & a maniac" is its president and CEO chenfuyang, who has built Broadcom into one of the world's largest chip manufacturers through a series of M & A transactions, and is now bringing his "script" to the software industry.

▲ hock Tan, President and CEO of Broadcom

Chenfuyang has said publicly that he is looking for franchise business and business that can obtain higher profits without huge additional investment. VMware's long-term position in the field of virtualization and its operating profit margin of more than 30% naturally fall within its scope.

"Chen Fuyang runs Broadcom a bit like a private equity company." Jordan chalfin, senior analyst at CreditSights, said, "he is famous for slashing costs."

Broadcom continued to cut the cost of acquiring business, reducing the sales and marketing budget of Ca and Symantec business from about 29% of revenue to 7%. Bernstein analysts believe that according to the records after the acquisition of Ca and Symantec's enterprise security business by Broadcom, Broadcom may aim to save more than $5 billion in costs and improve VMware's profit margin and profitability.

▲ several major M & A nodes and stock price changes of Broadcom (source: Reuters)

Although investors and analysts were skeptical at the beginning, Broadcom's software strategy has always been profitable.

The acquisition of VMware will enhance the software scale and growth opportunities of Broadcom. The revenue of the two companies in fiscal year 2021 is expected to exceed $40billion, and the software revenue will account for about 49% of the total revenue of Broadcom.

Brent thill, an analyst at Jefferies, believes that Broadcom's chips and VMware's virtualization software may have some vertical synergies.

Neil Jain, a partner of the digital service company West Monroe, believes that it has greater synergy with Broadcom in terms of VMware's software portfolio, security and carbon black terminal and Symantec terminal business.

Some analysts speculate that Broadcom's acquisition of VMware is to build its software functions for a more cloud centric future, and is also hedging the risk of chip shortage impacting the semiconductor industry.

▲ network chip of Broadcom

Garret hinds, software analyst at Macquarie, said that Broadcom was "a reasonable choice to acquire VMware at an appropriate price". However, he believed that as VMware continued to transform to SaaS, it had sufficient ways to realize shareholder value independently.

He predicted that Broadcom may eventually sell or reduce its investment in some categories of VMware, and professional services may be the first goal. "It may be sold to channel partners or it service companies," he said. "Although this will improve the overall profit margin target, customers may complain."

04.

Half a year after independence, the dream of "Switzerland in a new cloudy industry" was broken

For VMware, the direct benefits of this acquisition may not be as obvious as those of Broadcom.

Keith Townsend once worked as an enterprise data center architect at VMware. He thinks that Broadcom has no record of large expenditure on R & D, which may be a bad omen for the launch of new VMware products. Customers urgently need the innovation of VMware and other companies.

VMware was founded in 1998, before the cloud computing boom, and its customers were still operating their own data centers.

As the world's largest virtual machine giant, its virtualization software can make a computer work like multiple machines, fundamentally improving computing efficiency. For decades, VMware's virtualization software has played a key role in self managed data centers, involving computing, storage, networking, and security.

Reviewing the development process, VMware has three major innovations: first, virtualization, the technical foundation of cloud computing today; Second, the software defines the data center, enabling enterprises to realize many features of the public cloud on the private cloud; Third, in the distributed multi cloud environment, enterprises can be controlled independently to deliver applications at the optimal cost and faster.

Today, VMware has about 35000 employees and more than 500000 customers worldwide, and is a partner with major cloud providers such as Amazon, Microsoft and Google. Its decision to directly cooperate with the three major cloud computing giants in the United States has promoted the creation of a hybrid cloud era.

Raghu Raghuram, the current CEO of VMware, is the core hero of VMware's transformation to cloud computing business and SaaS. Next week's June 1 is the first anniversary of his appointment as CEO.

If the latest transaction goes smoothly, Broadcom will become the third owner of VMware.

Previously, it was purchased by enterprise software and storage company EMC for us $625million in early 2004. In 2007, EMC sold part of its shareholding in VMware through its initial public offering (IPO) on the New York Stock Exchange. Later, Dell acquired EMC with us $67billion in 2016, and VMware also came under Dell's command.

At this time, VMware is in a critical period of transformation, and its business focus is gradually shifting to SaaS mode and container solutions. With the increase of SAAS and subscription revenue year by year, VMware has developed into one of the leaders in the cloud computing field, and its fiscal year revenue exceeded $10billion for the first time in fiscal year 2020.

In April, 2021, Dell announced that it would divest its 81% equity of VMware, a cloud computing software manufacturer, to shareholders, believing that this would help create long-term value for the company; In November of the same year, Dell completed the divestiture of its 81% stake in VMware.

At this point, VMware has once again become an independent software company.

Raghuram said in an interview with foreign media earlier this month that the separation of VMware and Dell has made it a "Switzerland in the new multi cloud industry". VMware can not only cooperate with cloud and software suppliers, but also with infrastructure providers including Dell competitors such as HP and Lenovo.

According to a partner of VMware, VMware will be the most valuable product in the Broadcom product lineup and has the most potential to help or harm the company, depending on its management.

05.

It's no accident to be acquired. The matter is not settled yet

It is not entirely surprising that VMware was acquired again.

Deutsche bank analyst Brad Zelnick believes that VMware has lost its appeal among public investors because it is difficult to compete with newer cloud technologies.

Mizuho group analyst Gregg Moskowitz mentioned in a research report on Monday that in view of their concerns about VMware's overall growth profile and sustainable execution ability, they are cautious about VMware: "in fact, VMware has been underperforming for a long time. Previously, these stocks fell by 51% in the past four years."

▲ VMware stock price changes in the past year

In the fiscal year ended January 29 this year, its subscription and SaaS product portfolio revenue accounted for 1/3 of its total revenue of $12.85 billion, an increase of 22% over the same period last year. However, Moskowitz believes that the transformation process from selling authorized software to selling data center operators is "fluctuating". In the past five quarters, VMware's subscription and SaaS businesses have underperformed Wall Street's expectations in four quarters.

For VMware, if shareholders and regulators approve the deal, it will provide stability for VMware and help it support underperforming businesses. But at the same time, VMware's long desired independence will come to an end.

As for other bidders, Brad Zelnick wrote in a research report on Sunday: "we think it is very unlikely that other parties are interested. However, considering VMware's more than 5000 patent portfolios, it is logical that Amazon, Google and even Microsoft may be involved."

Thomas Blakey, an analyst at keybanc, also believes that given VMware's "relatively traditional position" in the multi cloud field, it is unlikely to accept bids from other strategic acquirers. However, he said in a research report on Sunday that VMware's relatively low valuation may lead to non strategic competitive offers.

At the same time, in terms of fit, VMware may be a suitable target for Cisco, a network equipment giant. Cisco can expand its business scope by utilizing VMware's virtualization technology, and has sufficient cash and debt financing capacity to complete the transaction.

According to the press release issued by both parties to the transaction, VMware does not intend to disclose any competitive offer unless its board of directors decides on a proposal superior to Broadcom. According to a document of the securities and Exchange Commission of the United States, if VMware finds a better offer before the deadline on July 5, it will owe us $750million in "breakup fees" to Broadcom.

The deal comes as the Biden administration stepped up its efforts to increase competition in all sectors, from agriculture to technology.

Josh white, assistant professor of finance at Vanderbilt University, believes that the Federal Trade Commission (FTC) may worry that Broadcom will use this acquisition to bundle services or raise prices. White, a former financial economist at the securities and Exchange Commission, added that ultimately, the FTC would like to know whether such a merger would affect overall competition and prices, especially in this inflationary environment.

06.

"Don't screw up VMware's channels!"

VMware partners are closely monitoring the progress of the acquisition transaction to understand the long-term intention of Broadcom. They sent a clear message to Broadcom: do not screw up the company's channels.

"This is not just a piece of software, a product. VMware is the core part of the environment from the beginning. It is too important to be destroyed." A cautious partner said, "they should treat it as one of the most important products."

"Regardless, partners must work with VMware." An executive of a solution provider who has been selling VMware for more than 10 years said that since VMware products are widely used in the industry, whether the owner is EMC, Dell or Qualcomm, they must cooperate with VMware. "If they screw up, it will be a big deal."

Worried about the impact of business relations, an executive of a large solution provider with important VMware business asked for anonymity. He said with emotion: "I could have made 100 guesses about the company that bought them, but I didn't think it was Broadcom."

"The whole thing is unbelievable to me." He said, "I think this is what happens when your valuation becomes a target for people to buy because of the deterioration of market conditions, whether you are born or not."

Another sales leader of a VMware partner who asked not to be named also expressed surprise at the acquisition of Broadcom: "everyone thinks that VMware will be independent, either as a listed company or let a bunch of private stocks buy it out."

"(VMware's) communication needs to be clear that nothing is changing, or it is being done in a different way now," the executive believes that Broadcom needs to ensure the integrity of the VMware partner business. "VMware is much larger than Ca and brocade. Therefore, Broadcom had better be prepared."

A VMware partner said that they would like to hear from Broadcom that it would invest in VMware instead of using it as a safety net when the supply chain of the semiconductor industry is deteriorating.

"VMware is the center of the world for many organizations' technology stacks." According to the CIO of a long-term VMware partner, "all vendors are building and using it for reporting, management and control, as well as all security tools and all the content designed around it. If they make mistakes, the downstream impact may be astronomical."

According to IDC's semi annual software definition infrastructure tracking report in June 2021, VMware is the undisputed leader in software definition infrastructure, with 48% market share, which exceeds the sum of nutanix, IBM, Huawei and Microsoft.

The Chief Information Officer (CIO) of a long-term partner of VMware on the West Coast said that his trust in Broadcom was shaken since Broadcom acquired the software company Ca, which owns nimsoft, which provides it monitoring and help desk solutions.

"When we bought nimsoft, it was a huge investment." He recalled, "when Broadcom acquired Ca and nimsoft, we thought, oh, Broadcom was famous for making good products, and then they immediately said, 'we don't know why we bought this, and we won't do anything to upgrade or change it.'" as a result, the company was forced to give up this product, paying a heavy price of time and money.

Another partner of VMware said that he was a partner of Symantec. When Broadcom acquired Symantec's security business, they did not notice any change. "The situation has not become worse, but they have not made the situation better."

Some channel partners want to know why Broadcom acquired VMware. "If Cisco buys them, that makes sense." The partner said, "Dell, when they own them, we like them very much. At least it is channel driven. This is full of risks. When a company is a channel led organization, executives from top to bottom are making business decisions that take into account the channel. I just don't see Broadcom as a channel leading company. They often do a lot of direct things."

Another partner believes that Broadcom's acquisition of VMware may be aimed at making it more conducive to channels.

"If you take a positive attitude," said a VMware partner, "if they acquire VMware, agree with their current cooperation arrangements, and will improve the partnership throughout the life cycle, they can bring other technologies under their command to support their cooperation."

He believed that if the leadership of Broadcom said that they would establish a cooperation project, develop it by using VMware's partnership, and then superimpose other products on it, "that would be a real victory".

07.

Conclusion: the shock of technology stocks may aggravate the wave of acquisitions

Global supply chain turmoil, European wars and rising prices are likely to cool business and consumer activities. Large scale acquisitions occur at a time of heightened anxiety. However, this uncertainty also creates opportunities for companies such as Broadcom that are keen to expand their business territory through mergers and acquisitions.

"They are very self disciplined," said Tony Wang, a Broadcom analyst at t. Rowe price, one of Broadcom's largest external shareholders He added that considering the more attractive valuation of technology stocks after the market sell-off this year, he was not "surprised" by the acquisition of VMware. He said that in recent years, when the technology valuation was high, Broadcom restrained the impulse of large-scale acquisition.

With the stock price of technology companies falling, the target companies look relatively cheap, and more acquisitions may be on the way. Chenfuyang, CEO of Broadcom, is obviously one of the most radical buyers.

If this transaction is completed, Broadcom will pocket one of the world's most valuable software companies, which will be a key step for Broadcom to surpass its hardware stack foundation and transform into a major player in diversified IT infrastructure software.

However, even if the acquisition is completed, Broadcom may not be able to become a software company or cloud computing company "overnight".

As analyzed by Bola rotibi, software development director of CCS insight, a research and consulting company, there are significant integration risks. Broadcom must prove that it can integrate chips, software and service stories to dispel the doubts of partners and customers.

Source: Reuters, CrN, protocol, Financial Times