Elon Musk and Cathie wood criticized passive investment on Twitter and participated in this controversial and inconclusive debate The discussion was initiated by venture capitalist Marc Andreessen, who said that companies like BlackRock have a huge voice in many enterprises because of the voting rights of passive index tracking tools.

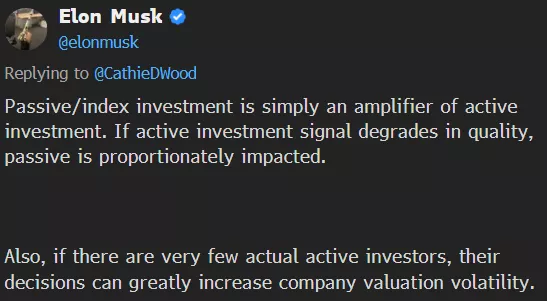

Tesla CEO musk responded that passive investment had "gone too far". Wood, founder of ark Investment Management LLC, pointed out that investors in the S & P 500 index tracking tool may have missed the opportunity to obtain high returns before Tesla was included in the index.

"Historically, the accelerated shift to passive funds over the past 20 years will be seen as a large-scale capital allocation error," Wood said.

Wood is one of the best-known active fund managers, but she has suffered setbacks in the past year, with her flagship ark innovation ETF falling nearly 45%. At the same time, vanguard group or BlackRock, a pioneer in indexation, are major shareholders of companies such as Tesla.

The debate over active and passive funds has been going on for decades. Active fund managers advocate their performance potential and their role in creating efficient markets tracked by passive funds. Others said that the proactive style is difficult to consistently beat the index, and that active funds charge a high fee compared with cheap tracking tools.