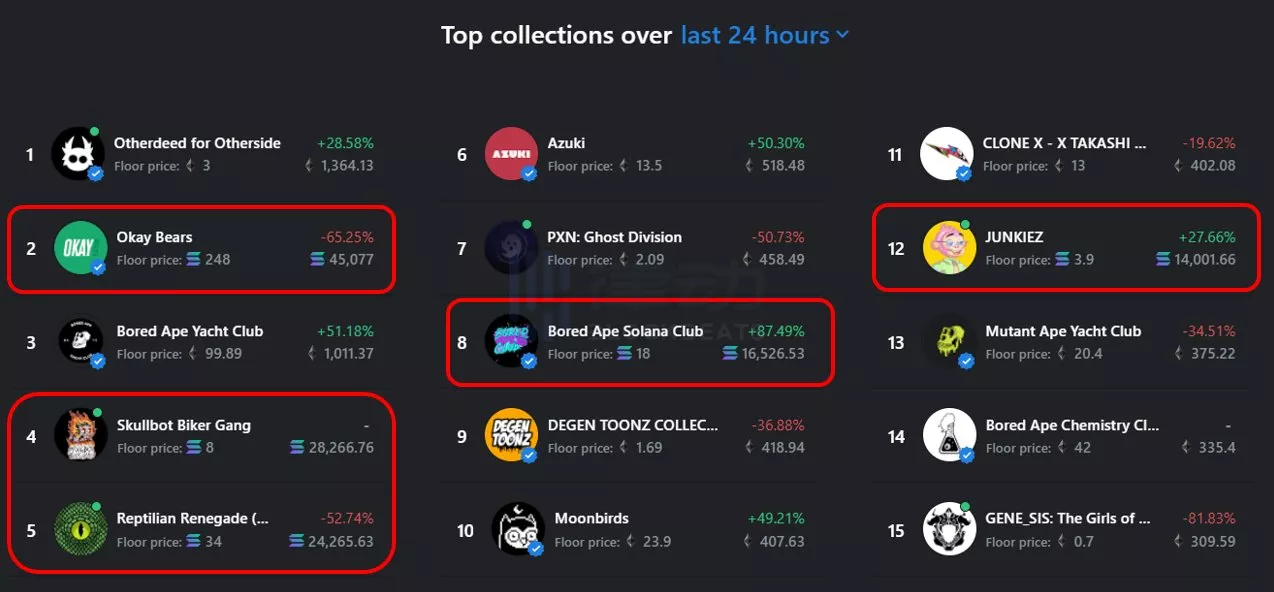

Orangie sent this tweet. Orangie is an NFT KOL on Twitter with over 160k followers, and while he still uses MAYC as his avatar, it's clear he's turned his attention to Solana NFT. With the explosion of Okay Bears, more and more NFT players are taking notice of Solana as a public chain.

Solana NFT makes a name for itself at OpenSea

In the NFT market, Solana's supporters have traditionally touted the advantages of "fast transactions", "almost no fees", "low barriers", and so on. At the same time, however, there have been many criticisms of Solana NFT: "rug pulls everywhere," "frequent downtime," "not as decentralized as ethereum," etc., and even derision of it as a "poor man's blockchain" chosen as a second best option for NFT players who can't afford Gas.

So what does the real Solana NFT market look like? In this article we will look at how the NFT market has changed in recent months and explore the potential and prospects of the Solana NFT market by comparing it to the Ethereum NFT market.

NFT market: 'The cliff is in place'

The NFT craze has been soaring since 2020, from the emergence of Cryptopunk and BAYC, to the emergence of PFP NFT projects such as Doodles, Azuki, Moonbirds, etc., while many stars such as Neymar, Jay and Eminem have entered the scene to make NFT gradually enter the public eye and become known at a very fast pace.

NFT project owners have also tried to innovate in several ways. From the very first avatar NFT projects that created social scenarios, different styles of painting catered to different investors' preferences; to the later Pass NFTs that offered rights to analytics tools or Alpha community rights; various new ways of playing such as issuing tokens, building IPs, and "shovels" that continued to generate revenue were constantly devised.

Change in total market capitalization and trading volume of the NFT market (source: NFTGO)

During the nearly year-long 'NFT Summer', NFT's total market capitalization peaked at over $38.6 billion, and the new social narrative and powerful wealth creation effect attracted capital from all walks of life, making the NFT market hotter than ever, with investors looking to get a piece of the 'dot com' story.

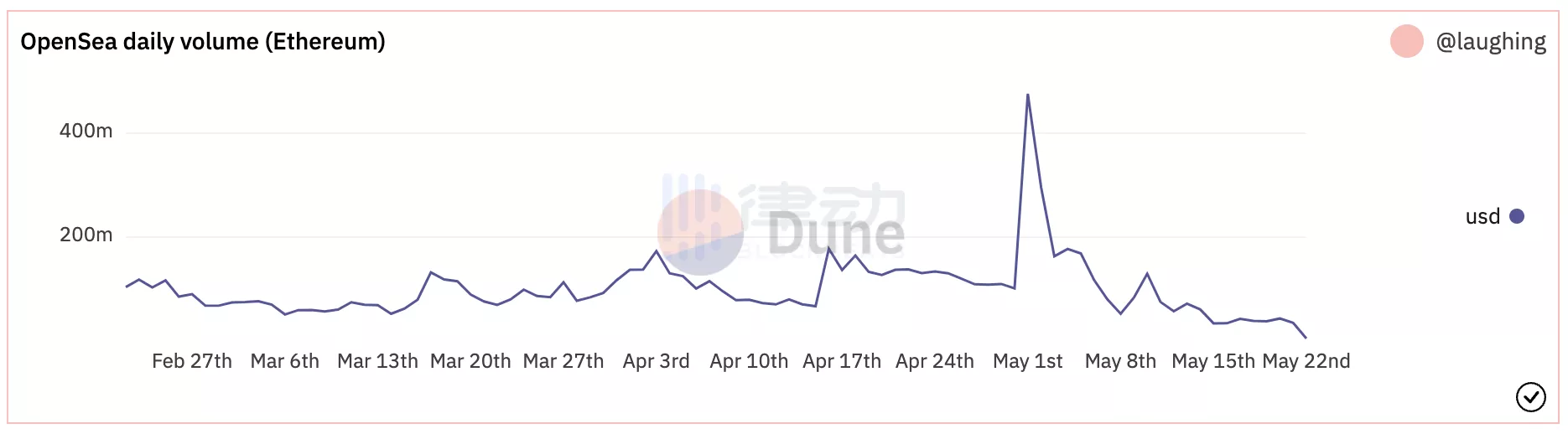

ETH-based NFT trading volume on OpenSea continues to decline (source: Dune)

As the month of April and May rolled around, the entire crypto market was already showing weakness in anticipation of the Fed's rate hike, and the launch of Yuga Labs' "Otherdeed for Otherside" series at the beginning of May had drained the last vestiges of liquidity from the NFT market. NFT is no exception, and on-chain data on Dune shows that ETH-based NFT trading volume on OpenSea continues to decline, with daily trading volume in recent days less than a tenth of its peak.

"The bear market is really coming".

The shrinking of assets is only one aspect of the process of entering a bear market; what NFT investors fear more is a sudden loss of liquidity.

It is true that, compared to FT (Fungible Token), NFT (Non-Fungible Token) liquidity is the most important topic, "Token at least a key market to sell back a little bit, NFT can not sell really zero". The liquidity plunge is reflected in the current NFT trading market: almost all NFT trading volume has fallen, unknown NFT projects only a few transactions a day or even zero transactions, investors desperate to cash out of the price continues to undermine the price K-line trend, the consensus established in the early days have collapsed, the project side can do nothing about it.

In such a dramatically changed environment, optimistic investors are betting on the future of the NFT market and are eagerly awaiting potential incremental funding, but the danger is that despite the high hopes for the NFT market, its user and funding growth has slowed significantly.

Compared to the enthusiasm of investors, the chilling growth figures of the NFT market seem like a cliff in front of all NFT projects.

Solana NFT Market: 'Slamming on the Gas'

The lack of incremental funding in the NFT market has made it difficult for most NFT projects to get out of the 'red sea' where the stock is fighting for money. While the blue-chip projects at the top can still breathe after eating up the market dividends with their first-mover and head start advantages, those new projects recently released on the ETH chain face the dilemma of death at birth, and non-head NFT projects that existed in the market before are headed for collapse.

Even so, instead of slowing down in the face of the NFT market cliff, the NFT projects in the Solana chain are stepping on the gas.

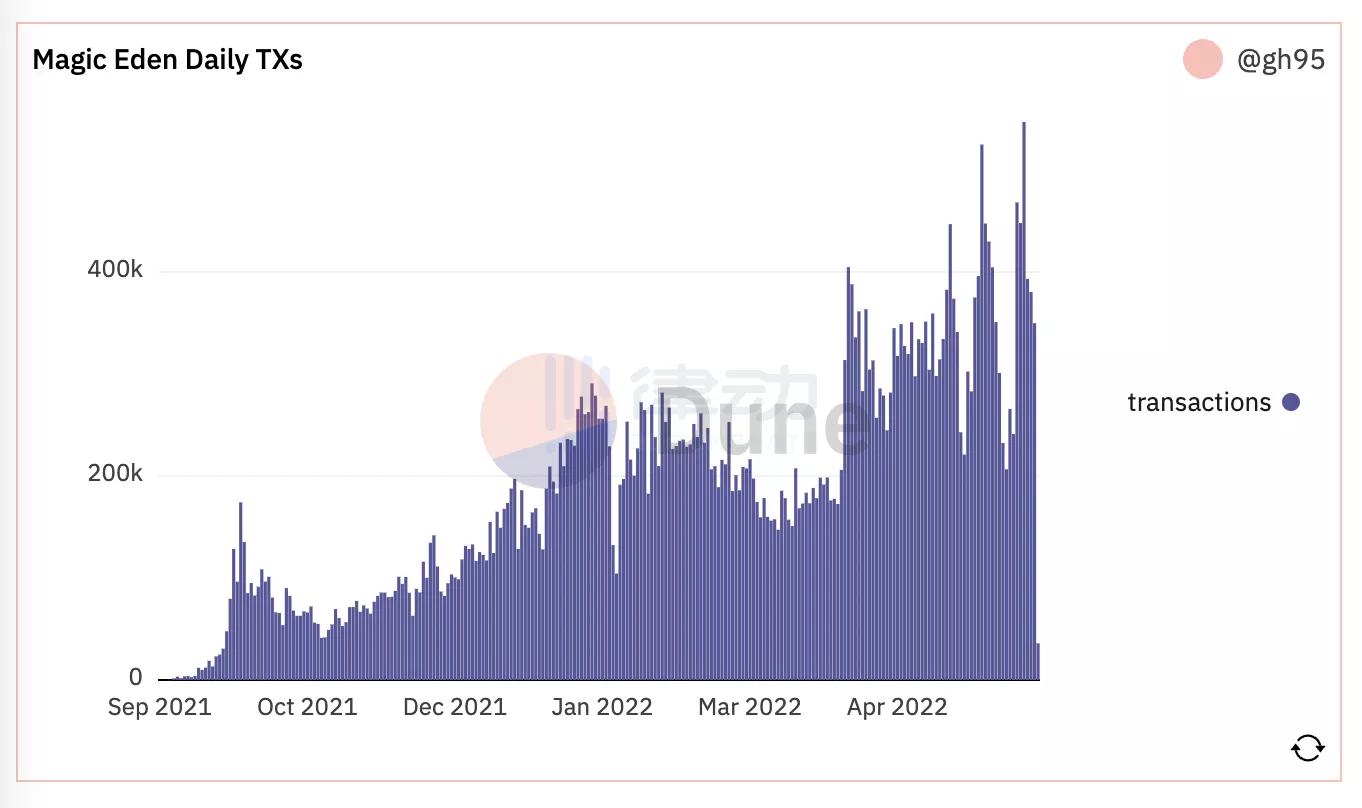

Solana-based NFT deals on Magic Eden grew significantly in April and May (source: Dune)

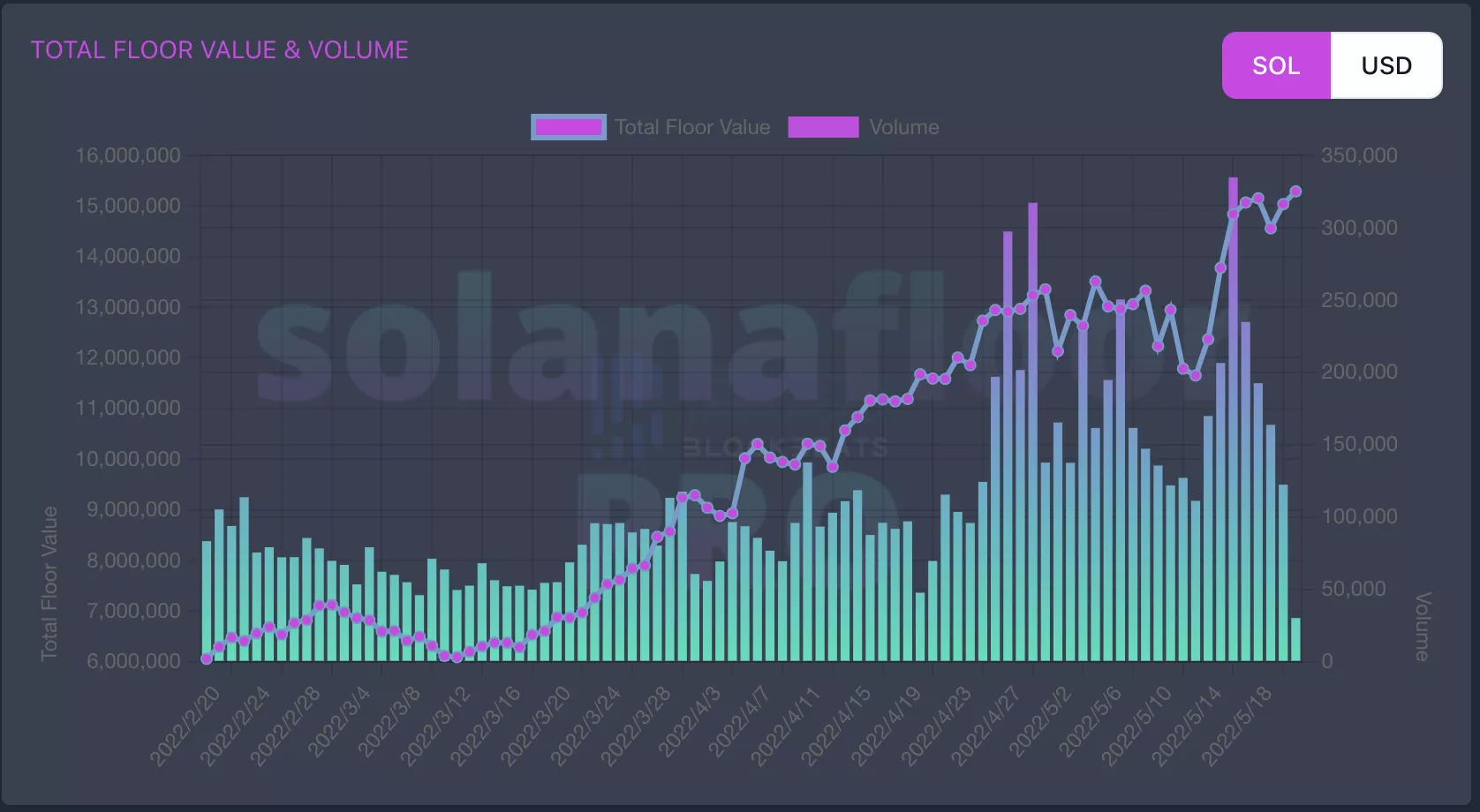

Solana NFT Total floor prices have continued to rise over the past few months (Source: SolanaFloor)

Data from Dune Analytics shows that the number of NFT transactions on Magic Eden, the number one NFT trading platform on the Solana chain, increased significantly in April and May. data on SolanaFloor also shows that the total floor price of Solana-based NFTs has continued to rise over the past few months. At one point, Magic Eden's daily trading volume even surpassed that of OpenSea as Solana NFT continued to heat up.

There is no doubt that these numbers are one of the few positive signs in the NFT winter, and at least some evidence that the NFT market is still hot in the Solana chain, and that it is continuing to grow. Among them, an NFT project called Okay Bears is shining.

Okay Bears' floor price has skyrocketed since its release (Source: Sol Sniper)

On April 27th, Okay Bears was publicly offered on Solana NFT marketplace Magic Eden for 1.5 SOL and has since skyrocketed to a floor price of over 260 SOL at one point. In less than a month, Okay Bears has generated impressive trading numbers: over 20,000 cumulative trades, over 1.4 million SOLs in cumulative volume, and the second highest total market cap in Solana NFT.

Okay Bears quickly exploded in popularity due to the huge wealth effect it generated in a very short period of time, and it added fuel to the Solana NFT market heating up, proving that there is a 'wealth creation machine' here as well.

Solana vs Ethereum: 'The Battle of the Public Chains'

As one of the earliest public chains, Ethereum was once known as the "King of Public Chains", with a thriving ecosystem and a variety of DAPPs blossoming. There is no shortage of challengers among other public chains, and Solana is one of the many "ethereum killers" that have taken their turn.

Trading speed and transaction fees

Solana has been striving to be the "fastest high-performance public chain" since the very beginning.

It uses proof-of-history mechanism (PoH), Tower BFT algorithm, Turbine propagation protocol, Sea Level Engine (Sealevel) and other technologies to build a completely different system architecture, which gives it a higher speed and lower cost than other blockchains.

While Bitcoin can process about 7 transactions per second (7 TPS) and Ether can process 30 transactions per second, Solana can currently process 65,000 transactions per second, and its TPS rivals that of Visa and Mastercard, making it a rapid industry leader in terms of speed and global scalability. While Eth 2.0 could see significant performance improvements in the future, its go-live plans have been repeatedly delayed.

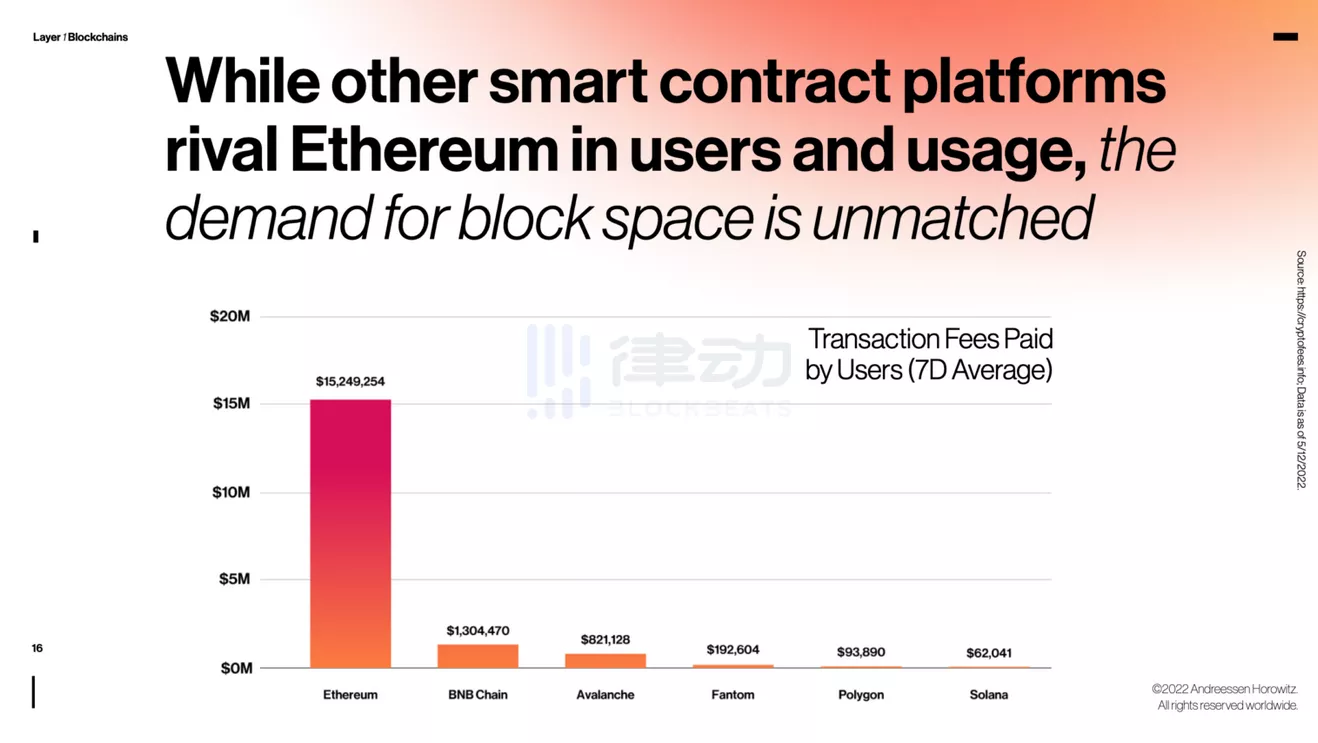

Average transaction fees by chain (source: A16Z)

In addition to the speed of transactions, Solana's transaction fees are much lower than Ethereum's. A transaction on Ethereum typically costs $10+ in Gas Fee, while a transaction on Solana costs just $0.00001.

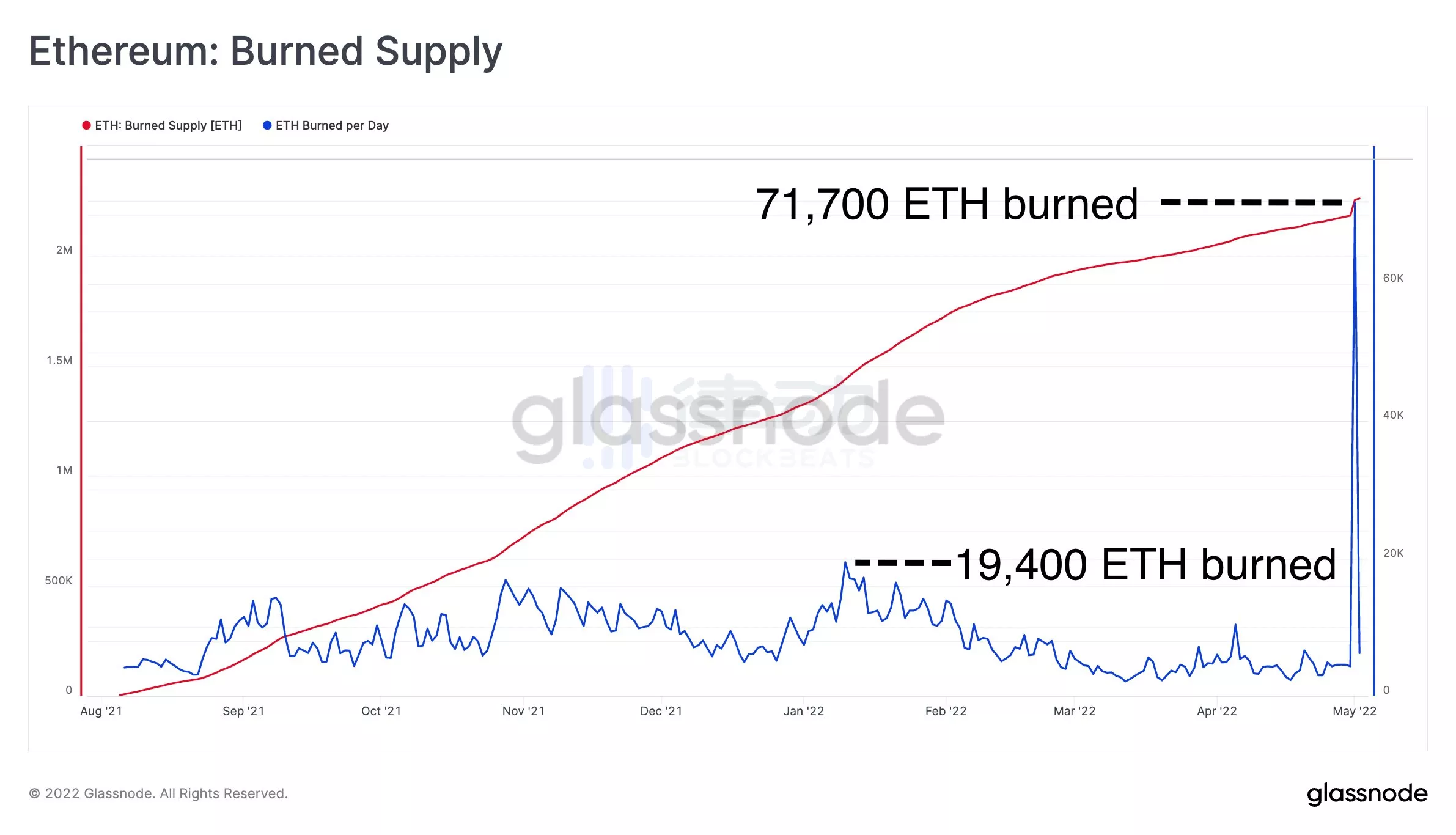

Over 70,000 ETH were burned on May 1 (source: glassnode)

Taking the Yuga Labs Otherside project offering as an example, data from Glassnode and Data Always shows that during the Otherside launch on May 1 During the Otherside launch on May 1, about $227 million in fees were spent on Ethereum that day, and more than 70,000 ETH were burned with an average user fee of $197.

Yuga Labs says it will refund users for Gas Fees spent on failed transactions

Following the launch of the Otherside, Yuga Labs posted a [tweet] on Twitter (https://twitter.com/yugalabs/status/1520612362986078208?ref_src=twsrc%5Etfw%7Ctwcamp% 5Etweetembed%7Ctwterm%5E1520612362986078208%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.coindesk.com%2Fbusiness%2F2022%2F05% 2F17%2Fapecoin-migration-draws-interest-from-avalanche-flow%2F), stating that it will refund users for Gas Fee spent on failed transactions. "It is clear that ApeCoin needs to migrate to its own chain in order to scale properly." As you can see, facing the high fees on Ethereum is unbearable even for leading projects like Yuga Labs, and even more so for NFT players.

Degree of decentralization

Blockchain's 'triadic paradox'

Vitalik Buterin, the founder of Ethereum, has suggested that there is a "trilemma" (aka impossible triangle) in blockchain development, which refers to the fact that it is hard to guarantee decentralization, security, and scalability at the same time. Compared to Ethereum, Solana sacrifices some of its decentralization while guaranteeing security and high performance.

From a verifier node development perspective, Solana can currently process up to 65,000 transactions per second, and the high throughput means that the hardware requirements to run the verifier are extremely high. The high threshold makes the Solana Foundation the only entity developing core nodes on the Solana blockchain, which means it can control the network, thus making it less decentralized.The Solana network has gone down several times, and the top-down solution has drawn a lot of skepticism: it appears to be a 'centralized bank with a more advanced database' rather than the so-called decentralized blockchain.

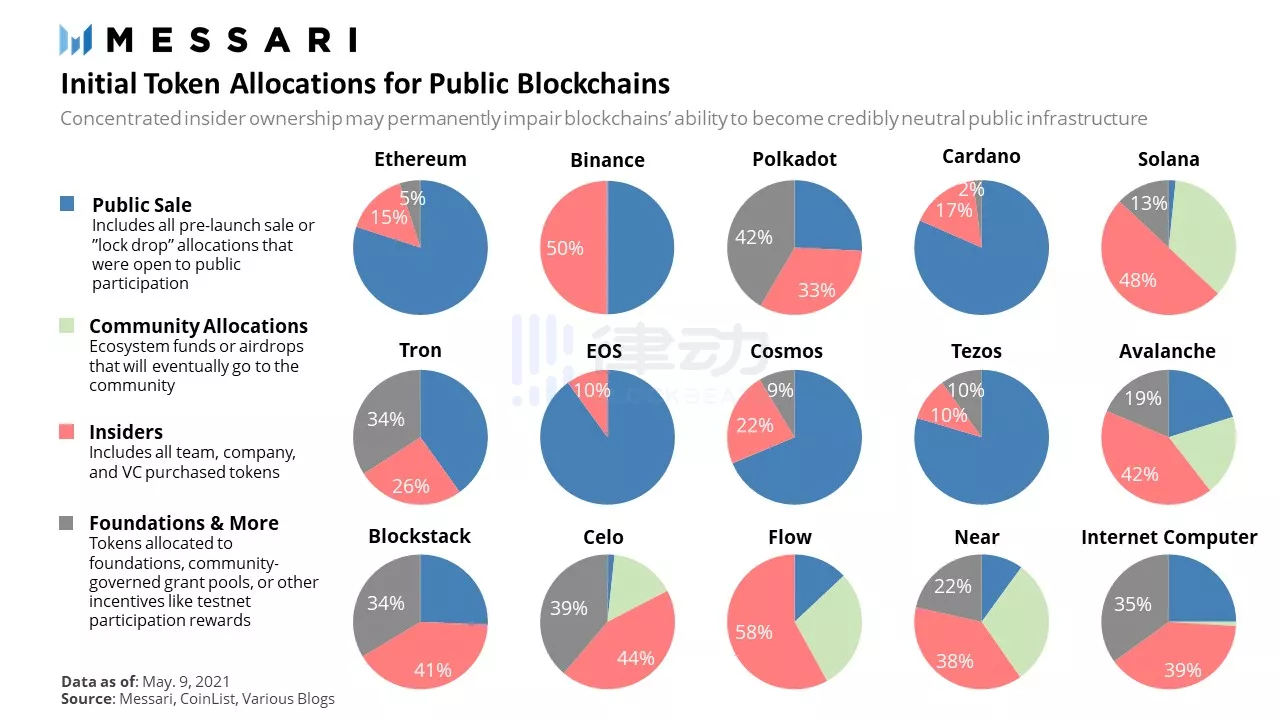

Messari's announced initial token allocation for the public chain

The delegation of tokens to verifiers on different blockchains is an inherent driver for securing the network. Therefore when comparing the decentralization of Solana and Ethereum networks, it is also important to compare the token allocation between the two.

The number of tokens held by Solana insiders is high in proportion to Ethereum. According to Messari's data, approximately 48% of Solana's tokens are owned by insiders, including Solana Labs team members and VCs. In addition, another third of the supply has been allocated to ecosystem development, with only a relatively small number of tokens allocated in Solana's public offering. Ethereum, on the other hand, has distributed approximately 80% of its tokens through its public offering, with insiders holding only 15% of the total supply.

Prospects for Solana NFT: 'Bending the Line'

Nobel Laureate Herbert Alexander Simon once noted: "In today's age of rapid information development, attention will be worth more than information."

Admittedly, with the dizzying array of new NFT projects popping up every day, whoever captures the attention of capital will win.

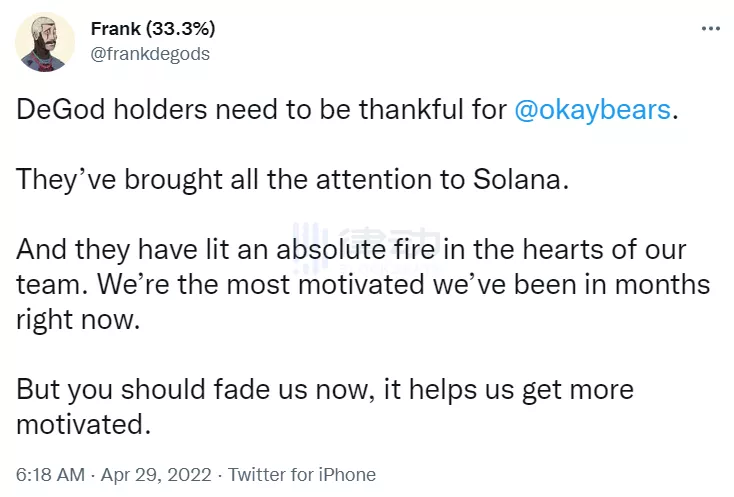

DeGods founder Frank thanks Okay Bears for bringing Solana NFT to the attention of more people

Frank, the founder of Solana NFT's #1 market cap project DeGods, even tweeted his gratitude: "The holders of DeGod would like to express their gratitude to Okay Bears for bringing more attention to Solana. "

NFT on Ethereum has captured most of the market's attention with its first-mover advantage, but Solana NFT still has a chance to "bend the rules" in the face of Ethereum's "winner-takes-all" horse effect.

Magic Eden Helps Solana NFT Grow

Magic Eden leads 'SOLANA SUMMER'

As the number one NFT exchange on Solana, Magic Eden has a lot of interaction with NFTs on Solana. The previous "DeFi SUMMER" and "NFT SUMMER", Magic Eden even wants to launch "SOLANA SUMMER", taking advantage of the popularity of Okay Bears.

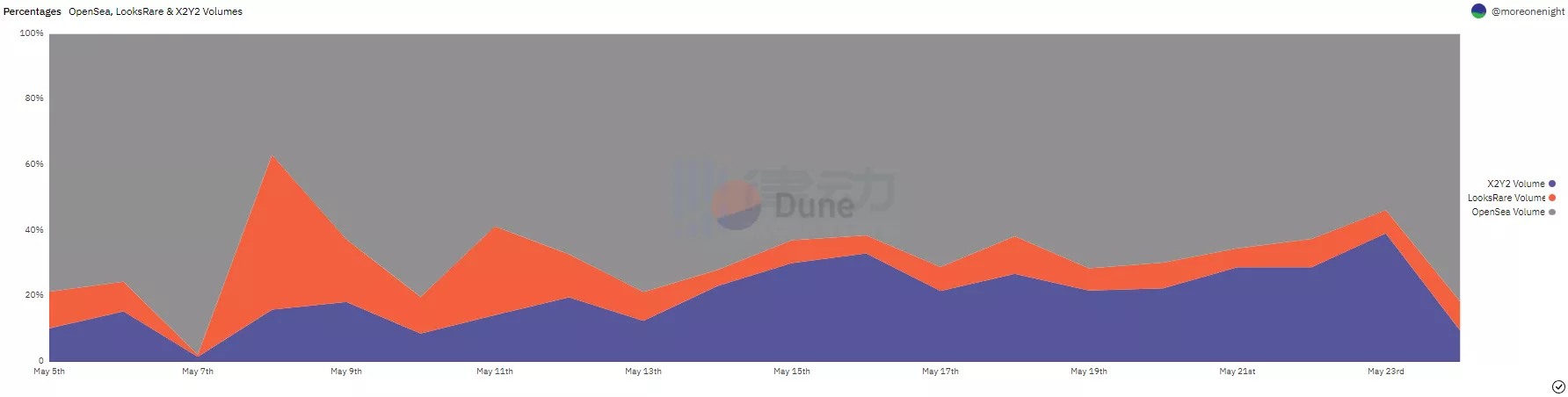

Comparison of trading volumes on the three major ETH NFT exchanges (source: Dune)

In the article "ETH or Solana's NFT: The Chicken and Egg Problem", author Mr. Fox argues that even though NFT trading platforms like LooksRare, X2Y2, and others use low fees, token rewards, and other "vampire attacks" to compete with The main reason they can't win is that the same NFT is more liquid on OpenSea. This is true, and as you can see from the data on Dune, OpenSea's share of ETH NFT trading volume has always remained above 50%.

But can OpenSea still win for Solana NFT? This is not the case.

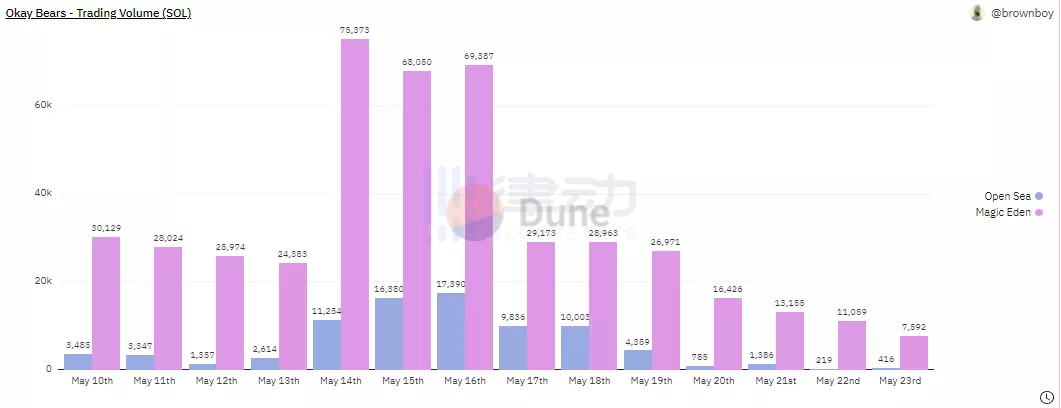

Okay Bears trading volume comparison at OpenSea and Magic Eden (source: Dune)

Since April, OpenSea has been supporting trading on Solana-based NFTs, and at one point Okay Bears topped OpenSea's trading volume when it exploded. But even so, as you can see from Dune's data, the vast majority of Okay Bears are traded on Magic Eden.

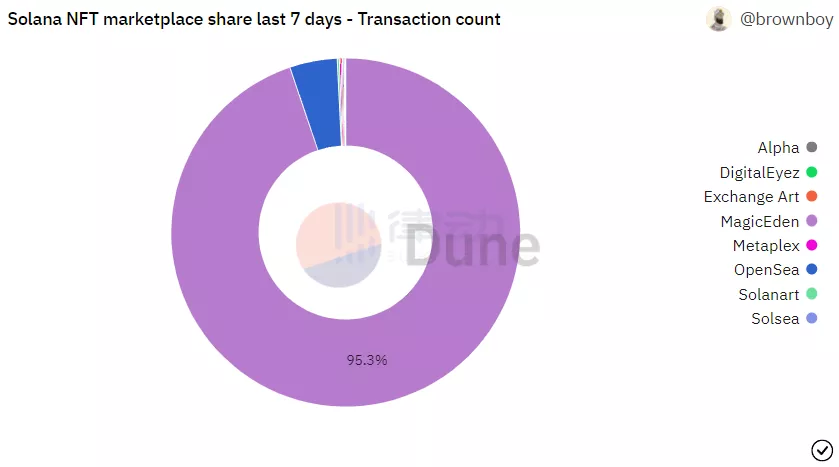

Magic Eden's share of trading volume in the Solana NFT market (Source: Dune)

Not just Okay Bears, but Magic Eden has over 95% of the entire Solana NFT market in terms of trading volume, meaning that for all Solana-based NFTs, Magic Eden on has absolute dominance in terms of liquidity.

It follows that in the 'chicken-and-egg problem', the 'ETH network effect' has brought many NFT users to Ethereum, while Solana NFT is temporarily lagging behind only because it has less of a first-mover advantage than Ethereum. And in terms of liquidity, Solana's native NFT trading marketplace Magic Eden is focused solely on Solana NFT development and is more of a potential 'OpenSea killer', and one step further, it seems to be challenging Ethereum NFT as a whole as well.

'Down market' may be the mainstream market

Pindo has allowed the concept of 'sink market' to break into the public eye. Looking back at 2018-2019, Poundudo first tore a crack from the dominant e-commerce industry of Ali and Jingdong, and then turned this crack into a territory with one high-speed growth. To this day, Poundudo has become a heavyweight player in the e-commerce market that cannot be ignored.

What exactly did Poundland do right? Obviously, there's definitely more than one reason, but the sink market plays an absolutely vital role in the middle of it all.

Solana NFT, with its low launch price and low transaction fees, also looks like it's tapping into a "down market" that belongs to Web 3.0.

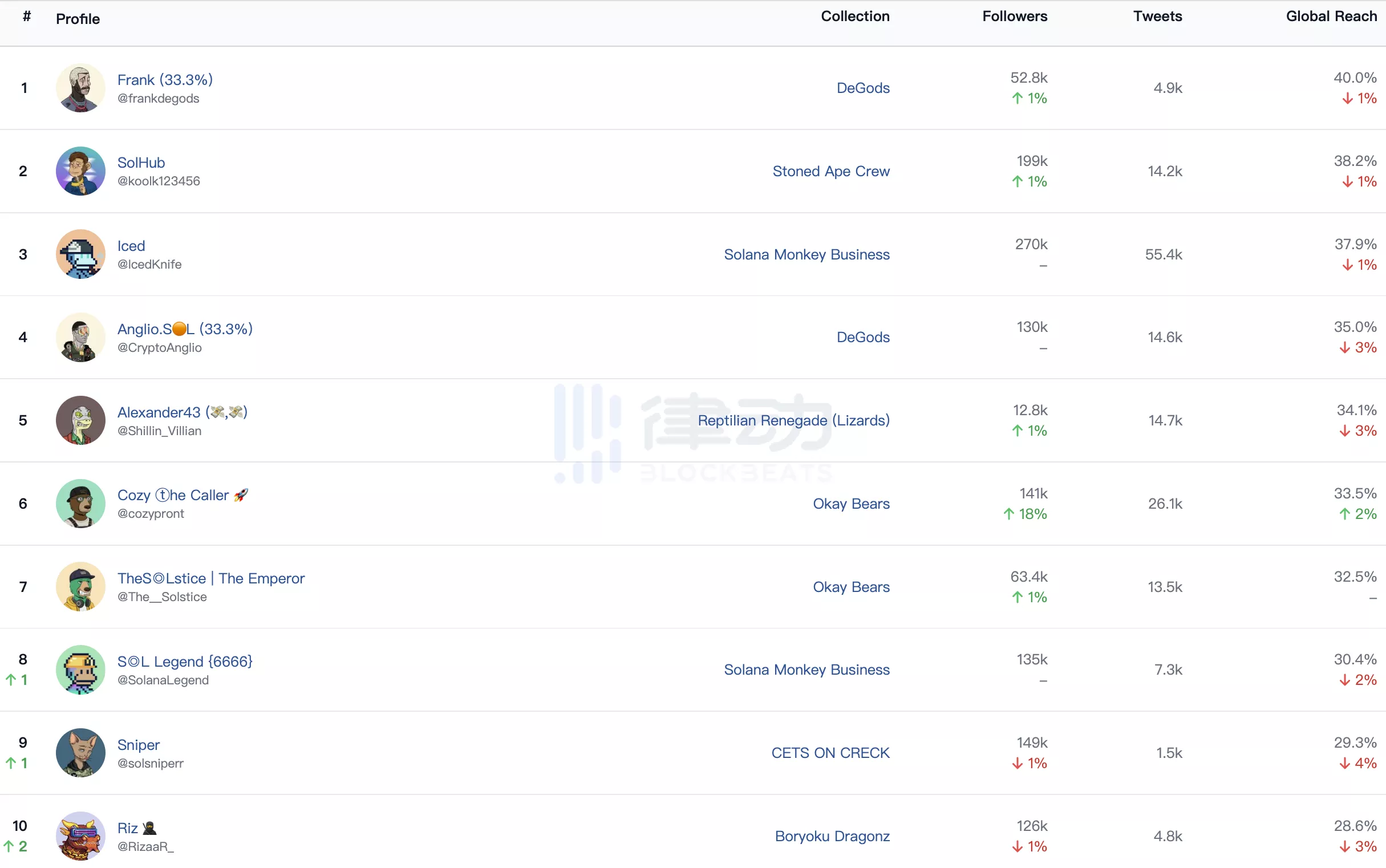

More and more NFT KOLs are investing in Solana NFT (Source: Inspect)

Many fans of Ethereum NFT believe that those who go to Solana to invest in NFT players can't afford the high fees on Ethereum, and even ridicule Solana as a "poor man's blockchain". The fact that saving more on fees to invest in your favorite NFTs is a disadvantage is really puzzling. In fact, many well-known NFT KOLs and giant whales are also investing in Solana NFT.

It's true that NFTs have a certain social and luxury quality, and that people on social media can guess how much the person on the other side of the screen is worth simply by looking at their hexagonal avatar. NFT should not just be a game for the rich or capitalists, but the artistic value behind them needs to be accessible to the masses.

The mass, plebeian "down market" that Solana NFT represents may be the mainstream market of the future for Web 3.0.

Summary

The competition for public chains is 'a thousand horses crossing a single bridge' and the development of NFT essentially depends on the development of the public chain it is based on. Compared to Ethereum, Solana is currently not as decentralized as many would like it to be, but with time I believe this will improve. For Solana NFT, the idea of affordability has taken hold, but it still needs more 'pop-ups' like Okay Bears to prove that it has the same amazing ability to create wealth.

Consensus takes time to coalesce yet, let the bullets fly for a while.

Rhythm BlockBeats reminds that according to the document "Risk Alert on Preventing Illegal Fund Raising in the Name of "Virtual Currency" "Blockchain" issued by the CBRC and other five departments in August 2018, the general public is invited to look at blockchain rationally, not to blindly believe in smallpox promises, to establish the correct concept of currency and investment, and to effectively raise their risk awareness; to the illegal and criminal clues, you can actively report and reflect them to the relevant departments.