On May 5, the first trading day after the May Day holiday, as of the closing, the share price of Ningde times fell by 8.15%, and the total market value evaporated by 100 billion yuan. On the same day, Zeng Yuqun, chairman of Ningde times, also responded to the sharp fluctuation of Ningde times' share price at the online performance conference. The compound growth rates of the company's revenue and net profit from 2015 to 2021 were 56% and 52% respectively. The valuation should refer to the early level of world-class high-tech enterprises.

This round of stock price decline also ushered in a wave of bottom reading in the capital market. As of the closing on May 5, the turnover of Ningde era reached 22.2 billion yuan, also setting a record high.

On April 29 before May Day, Ningde times disclosed the first quarter financial report. The lower than expected profit seems to be the main reason for the decline in the stock price.

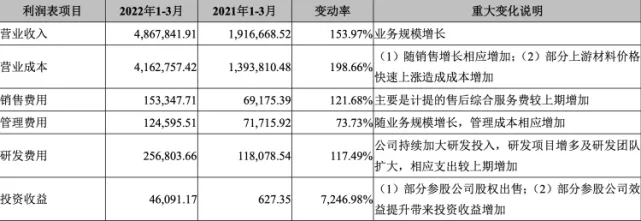

On April 29, the first quarter financial report released by Ningde times showed that in the first quarter, the revenue of Ningde times was 48.68 billion yuan, a year-on-year increase of 153.97%; The net profit attributable to shareholders of listed companies was 1.493 billion yuan, a year-on-year decrease of 23.62%.

As for the direct reason of increasing income without increasing profit, Ningde times also said in the latest investor relations activity record that the price rise of raw materials such as lithium carbonate exceeded expectations, and the client price transmission was relatively cautious. Superimposed on the decline of sales volume in the first quarter due to seasonal factors, it can explain the main reasons for the change of net profit attributable to parent company.

In short, the rising cost of raw materials and the decline of the car market in the whole first quarter led to the decline of profits in the first quarter of Ningde era.

In the near future, Ningde times has been hit by the financial report of 2021, the profit performance of the financial report of the first quarter, the rising cost of raw materials in the upstream and the fluctuation of the downstream new energy vehicle market affected by the epidemic.

From the first quarter financial report, the rising cost of raw materials led to the year-on-year increase of 198.66% in the operating cost of Ningde era in the first quarter, reaching 41.628 billion yuan. The rising cost of raw materials also directly led to the decrease of cash flow of Ningde era in the first quarter.

Figure source: screenshot of the first quarter financial report of Ningde times

In view of this situation, Ningde times also said that from the current market feedback results, the market share of the company is still increasing, and the recovery of gross profit margin is a continuous process. The operation should be considered from the long-term dimension, not only considering the situation of a single quarter, but focusing on improving the core competitiveness of the company.

Investors are also concerned about whether the profit in the second quarter will be restricted by the cost of raw materials.

Ningde times also said that the prices of raw materials such as lithium carbonate were relatively high in March and April, which had an impact on the cost in the second quarter, but the progress of price adjustment negotiated by customers was relatively smooth, and the gross profit margin will be gradually and reasonably repaired.

Tianqi lithium, which released its first quarter financial report on the same day as Ningde era, achieved a net profit of 3.328 billion yuan in the first quarter, an increase of 14 times year-on-year, under the sharp rise in the cost of lithium carbonate.

The sharp rise of upstream raw materials has led to a sharp rise in the profits of upstream supply chain enterprises, which also made Zeng Yuqun's firm determination and speed of mining. "I didn't expect that lithium carbonate could rise from 30000 to 500000... If we still maintain 500000 yuan, we will certainly accelerate the development progress and get lithium carbonate out. After the disclosure of financial results at the end of April, Zeng Yuqun once made a roast about the soaring cost of lithium carbonate at an internal meeting.

In contrast, BYD, which just released its first quarter financial report, made a net profit of 808 million yuan in the first quarter, a year-on-year increase of 240%. BYD, which also has pressure from the rising cost of upstream raw materials, improved its profit in the first quarter because of the good performance of the new energy vehicle market.

The very different situation of the upstream and downstream industrial chain of power battery also implies that with the outbreak of the new energy vehicle market, the upstream and downstream industrial chain of power battery benefiting from this is not a situation of prosperity and loss for all.

The dilemma of Ningde era is restricted by the cost of upstream raw materials. At the same time, there is not much room for the price increase with the downstream main engine factory. Ningde times stressed that the price negotiation with downstream enterprises has been negotiated. Whether the stop loss of profit decline really plays a role depends on the financial figure performance of Ningde times in the second quarter.

At present, the scale effect is the biggest trump card of Ningde era, which is also where the current dilemma of Ningde era lies.

From the different performance of upstream and downstream industrial chain enterprises in the capital market, for the Ningde era with a huge volume of power battery market, under the effect of scale, it is a profit model that needs to be brought into sustainable play.

Therefore, while seizing mines and ensuring the supply of raw materials, Ningde era should increase technology research and development. At the same time, it is also strengthening its competitiveness through various modes such as technology authorization and promoting overseas markets.

This does not mean that Ningde era will build its own cars like BYD, and Ningde era has also made it clear that it will not build cars.

At the performance conference, in order to revive the confidence of the capital market, Ningde times also disclosed a series of news: it is determined to build a factory in North America; It is planned to officially release Kirin battery in the second quarter of this year; It is committed to promoting the industrialization of sodium ion batteries in 2023.

Kirin battery is the third generation CTP (high efficiency group) technology of Ningde era. Zeng Yuqun also mentioned that under the same electrochemical system, the energy density of Kirin battery is 13% higher than that of large cylindrical battery.

At present, the landing of new technological capabilities is an important way to transform technological competitiveness into market value in Ningde era.

In fact, in addition to technological capability innovation, Ningde era also needs business model innovation. Taking the power exchange business as an example, Ningde era is not a pioneer. For Ningde era, how to radiate the commercial value of power exchange through innovative business model is also one of the means to accelerate the diversification of profits in Ningde era.

Ningde times Xiamen power exchange station source: Ningde times official website

Under the pressure of large-scale dividend and large-scale, what Ningde era needs is to release the long-term value of a high-tech enterprise.

*Source: Official Website of Ningde times