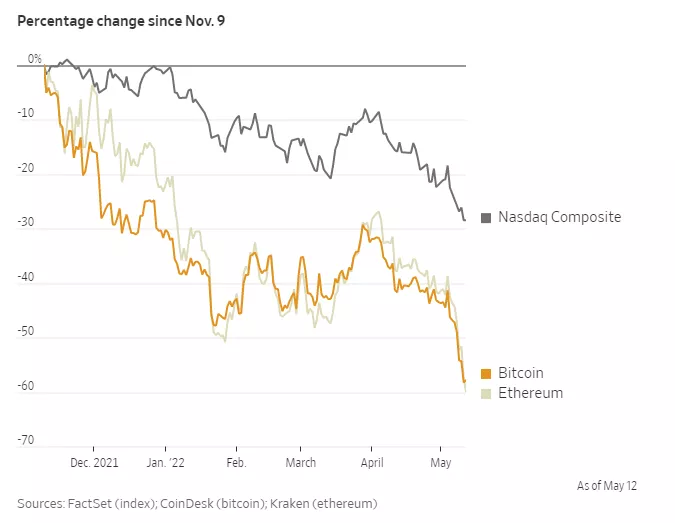

Last November, bitcoin and Ethereum reached the highest point in history, and now they are 58% and 60% lower than the peak at that time, respectively Since November last year, digital currencies with a market value of more than $1 trillion have disappeared. Under the continuous radical "shrinkage" of the Federal Reserve, digital currency is experiencing a "cold winter", and fleeing from risky assets has become the main plot of this week; History is always strikingly similar. Last year, the panic collapse of 519 cryptocurrency was still vivid, and the bloody storm of more than 430000 people broke their positions was staged again.

In late trading in New York on Thursday, May 12, the main contract of CME bitcoin futures BTC was reported at $28485, down 2.43% from late trading in New York on Wednesday. The intraday trading was in the range of $30100-25350, breaking the psychological level of $30000 three times in a week; The main futures traded at USD 2190.00-cmr.50 on Wednesday, down from USD 1916.00-cme.

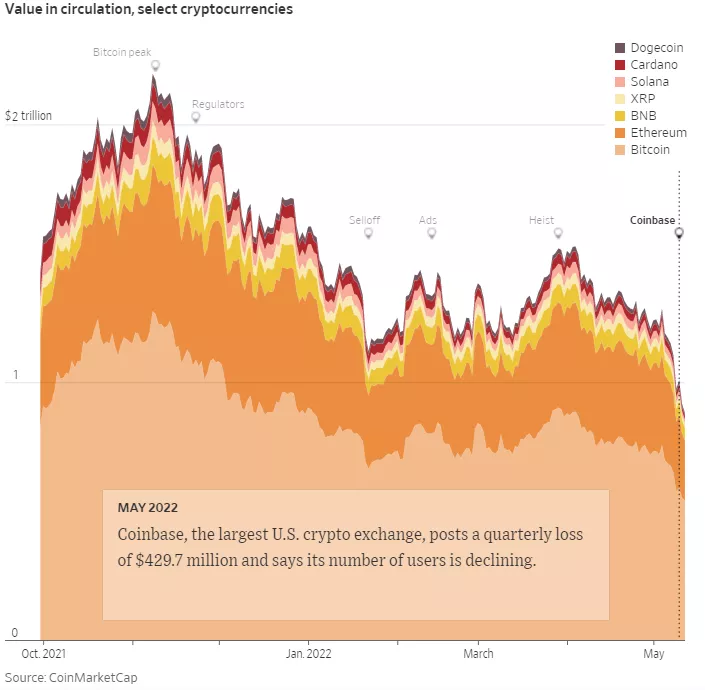

According to coinmarketcap, the entire cryptocurrency market lost more than $500 billion in value last week alone; Since November last year, digital currencies with a market value of more than $1 trillion have disappeared. What caused more market shock was the "death stampede" encountered by the third largest stable currency ust in the cryptocurrency market and its sister token Luna.

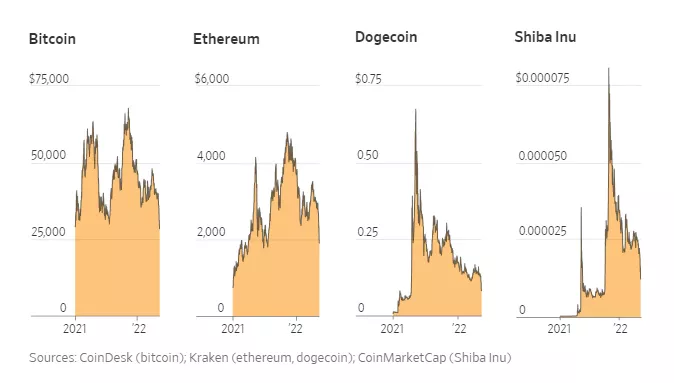

The cryptocurrency market finally fell from the lowest point of more than 30000 yards in 2020 on Friday, and the cryptocurrency market finally fell again from the lowest point of more than 30000 yards in 2020. According to coinmarketcap, bitcoin, the cryptocurrency with the largest market value, rose 9.3% on the same day; Ethereum, the second largest cryptocurrency, rose by about 9% and its trading price was US $2065, which fell by more than 20% in the past week; Other cryptocurrencies such as Cardano and Solana also rose 28% and 20% respectively. Meanwhile, dogcoin rose 18%.

Although cryptocurrency recovered on Friday, compared with the $45000 trading level of bitcoin before the conflict between Russia and Ukraine, it is still far below the record high level set in November last year. In addition, this week is its seventh consecutive week of losses and the longest weekly loss period in its history. Before this year, bitcoin had not experienced such a long consecutive weekly decline.

Last year, cryptocurrency became popular. After years of being regarded as marginal speculative products, cryptocurrency, which has gained more legitimacy and favored by investors, has ushered in spring. Tesla said it bought $1.5 billion of bitcoin, driving up prices; Coinbase was listed last year as the "first share of crypto exchange"; MicroStrategy, a listed company with the largest holdings of bitcoin in the world, firmly believes that bitcoin is "the most ideal property in time and space".

In November, bitcoin and Ethereum reached an all-time high. The value of bitcoin at 5 p.m. on November 9 is $67802.30; Ethereum is worth $4800. Now, it is 58% and 60% lower than the peak at that time, respectively.

Susannah Streeter, senior investment and market analyst at Hargreaves Lansdown, warned:

Some traders may see this month's sharp decline as an opportunity to buy down, but given its huge volatility, cryptocurrency may fall further. The latest slump in the wheel of wealth shows that speculation in cryptocurrency is highly risky and not suitable for investors who have no money to bear losses.

On Wall Street, the stable currency terrausd (i.e. "ust", an algorithmic stable currency aimed at maintaining one-to-one peg with the US dollar) mentioned in an earlier article collapsed after decoupling from the US dollar, and the final trading price was US $0.15; The double whammy is that its sister currency Luna has actually plunged 100% to zero from more than $80 a week ago to Friday. Therefore, Yellen again called for Congress to authorize the supervision of the so-called stable currency at the hearing of the Senate Banking Committee on Tuesday.

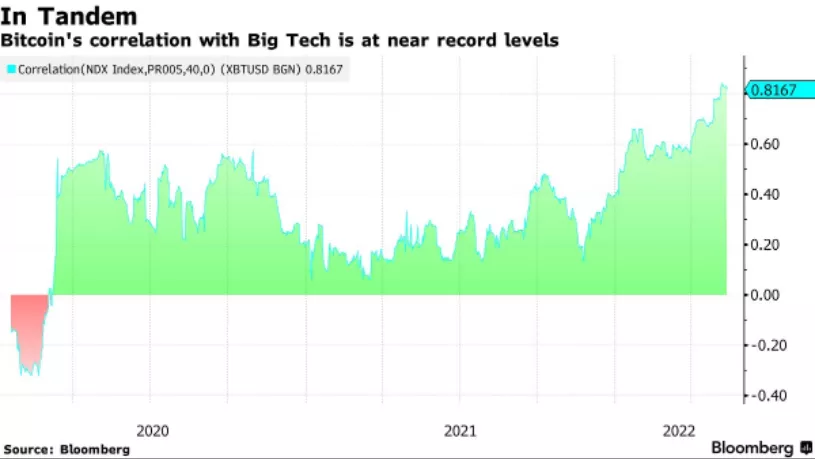

Cryptocurrency also faces other challenges, especially its increasing proximity to the trading trend of technology stocks. According to the data compiled by Bloomberg, the 40 day correlation between bitcoin and the Nasdaq 100 index is currently 0.82, close to a record value (a correlation of 1 means that the transactions of the two assets are exactly the same; a reading of - 1 means that their transactions go in the opposite direction).

To make matters worse, cryptocurrency trading was originally a game for individual investors, but now it is dominated by institutional investors such as hedge funds. However, as prices fell, both individual and institutional investors withdrew. When coinbase reported its first quarter results late Tuesday, it revealed that it was losing users; By the end of trading on Thursday, coinbase's shares were 82% lower than the closing price on the first day of listing last year.