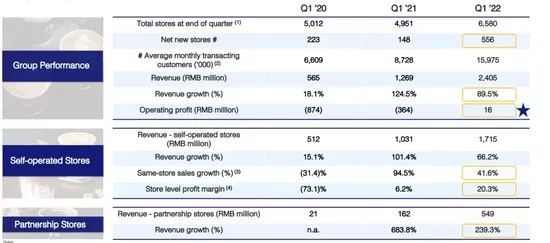

When the consumer market is no longer booming and new consumer brands are anxious about revenue, Ruixing announced the news of profit. On May 24, Ruixing coffee released its unaudited financial report for the first quarter of 2022. In the first quarter, Ruixing's total net income was 2.404.6 billion yuan, a year-on-year increase of 89.5%. Under the United States accounting standards (GAAP), Ruixing's operating profit in the first quarter was 16.1 million yuan, which showed a loss of 364 million yuan in the same period in 2021. This is also the first time that Ruixing has achieved positive quarterly operating profit.

However, Kuang Yuqing, founder of lens research, told the daily economic news that Ruixing still has more than 1 billion mezzanine capital to be converted into shares. "After all the mezzanine capital is converted into shares, Ruixing will cause a huge one-time loss. After this loss, Ruixing will really enter the profit channel."

Chengdu Xingrui coffee store

In any case, as a locally grown coffee brand, Ruixing has brought digital, large-scale and other demonstration effects to the emerging domestic coffee market in recent years. Local coffee brands represented by manner and even big Mac like Starbucks are also replicating the Ruixing model to varying degrees in order to seize the increasingly hot coffee market.

The profitability of Western brands such as tims China and Starbucks in the domestic market seems to be the norm, but compared with local coffee brands, it is obvious that Western coffee brands have been frequently criticized in the Chinese market in recent two years, especially this year, because of their price strategy and brand image.

The competition in the domestic coffee market seems to have reached a critical point.

What does Ruixing's profit mean to China's local coffee market? Will its profits be normalized? Is there a high possibility of more "Ruixing" in the domestic market? Are foreign brands anxious?

A milestone: profitability

"Net income increased by 89.5%, and the same store sales of self operated stores increased by more than 40% compared with the previous year. We also achieved our first quarter operating profit since its establishment. This is an important milestone." Guo Jinyi, chairman and CEO of Ruixing coffee, said at the first quarter performance meeting.

According to the financial report released by Ruixing this time, the revenue of its self operated stores in the first quarter was 1.717 billion yuan, the profit at the store level in the first quarter was 348.5 million yuan, and the profit margin at the store level was 20.3%.

In the same period of 2021, these two figures were 64.1 million yuan and 6.2% respectively. The store's revenue surged by 23.9 billion yuan over the same period in 2021.

Li Chengdong, founder of dolphin club, told the reporter of daily economic news that Ruixing's profitability (reason) lies in controlling various costs. "Originally, in the state of rapid expansion, the costs of rent, manpower and marketing were high. Now these expenses are controlled better than before. In addition, the closing of loss making stores, controlling the proportion of self operated stores and expanding the number of affiliated stores are all the elements of their profits."

Ruixing attributed the increase of net income to four points in the financial report: the increase in the number of products sold, the increase in the area of stores, the increase in the number of monthly trading customers and the increase in the average selling price of the company's products.

Guo Jinyi highlighted the contribution of new products at the business meeting. He said that the first quarter was originally the weakest quarter for self operated stores. But this time, Ruixing launched 34 new products, especially "coconut cloud latte", which sold more than 4.95 million cups in the first week after its launch.

In addition to making profits, Ruixing is still opening stores quickly. In this quarter, it opened 556 new stores, most of which were affiliated stores.

Joint stores brought two benefits. First, they contributed a lot to the total revenue: their revenue accounted for about a quarter of Ruixing's total revenue in the first quarter; The second is to strengthen the density and breadth of Ruixing store network. As of March 31, 2022, the total number of stores has reached 6580, of which 4675 are self operated stores.

In contrast, according to the first quarter financial report of Starbucks as of April 3 (the second quarter of 2022), during the reporting period, Starbucks had 97 net new stores in China, accounting for about 30% of the global net new stores. By the second quarter of fiscal year 2022, the total number of Starbucks stores in China had reached 5654.

In terms of total quantity, the number of Ruixing coffee stores has reached the first in China. What complements each other is the growth of the number of users. According to the financial report data, the average number of monthly trading customers of Ruixing coffee in the first quarter was 16 million, an increase of 83.0% over the same period in 2021.

Li Chengdong also said that Ruixing's customer unit price has almost doubled in the past two years. According to the financial report data, the unit price of Ruixing's products has increased from 9.97 yuan in the fourth quarter of 2019 to 15.24 yuan at present.

From the financial report, the epidemic has little impact on Ruixing. However, the reporter learned from Ruixing that in mid May, many of Ruixing's stores in Shanghai were still closed. It is also reported that Ruixing temporarily closed about 950 stores every day from April 1 to May 23.

Guo Jinyi is cautiously optimistic about the challenges brought by the epidemic. He said at the performance meeting that the market pressure brought by the epidemic will continue to have a negative impact on the business in the short term, but Ruixing can offset this impact by deeply cultivating its advantages such as finance, operation and brand awareness.

Some cold water: the remaining financial problems still need to be solved

Ruixing seems to have "transferred", and everything is developing in a good direction. However, it must be mentioned that Ruixing's previous counterfeiting has brought legacy problems, such as delisting.

Since the second half of last year, Ruixing's solutions to counterfeiting incidents have continued to hit the market.

The first is the recognition of punishment. In September 2020, the State Administration of Market Supervision announced the specific punishment amount for the false transaction of Ruixing coffee, totaling 61 million yuan; In December 2020, Ruixing reached a settlement with the SEC and agreed to pay the largest ever fine of zhonggai shares - $180 million to avoid the charge of financial fraud.

Then there is the withdrawal of management rights. On January 27 this year, Ruixing coffee announced that Dazheng capital, together with international top investment institutions IDG and Ares SSG, had completed the acquisition of 383 million Ruixing shares held by Lu Zhengyao and his management team. After the completion of this transaction, Dazheng capital became the controlling shareholder of Ruixing coffee, holding more than 50% of the voting rights of the company, which is equivalent to holding the equity of the original management.

Then replenish ammunition. On April 15, Ruixing announced that it had reached a new round of financing agreement with the company's shareholders, Dazheng capital and pleasure capital, with a total amount of US $250 million.

Kuang Yuqing believes that from the perspective of public information, with Ruixing's macro level problems have been solved. "From the current point of view, the settlement cost is also within the scope it can bear, so at the operational level, its impact is not as big as originally thought."

However, there is still one outstanding item: the conversion of mezzanine capital into shares.

Earlier, media reports said that Wumart founder Zhang Wenzhong had intended to package and acquire the bonds of Lu Zhengyao's creditor enterprises such as CICC, Barclays and Da Mo, and take shares in Ruixing in the form of "debt to equity swap". The news was subsequently denied by the US side.

Kuang Yuqing said that due to the delay of financial fraud, Ruixing still has more than 1 billion mezzanine capital that has not been converted into shares, "so Ruixing still needs to solve the problem of mezzanine capital conversion. If Ruixing chooses to convert mezzanine capital into shares after the profit share price rises, Ruixing will cause huge one-time losses."

Kuang Yuqing said that only after this loss can Ruixing really enter the profit channel. "So there has to be a process. After this problem is solved, the problems at the operational level should not have a greater impact."

Li Chengdong believes that Ruixing's profit normalization is also related to its expansion speed. "If Ruixing continues to expand at a high speed, its profits may not be as easy as expected. I think Ruixing should adopt a reasonable rhythm to balance his profits with expansion. If Ruixing does not make major adjustments, its profits should continue to be normal."

Lin Yue, the chief consultant of Lingyan consulting, showed a cautious attitude towards the sustainability of Ruixing's profits in an interview with the daily economic news. He believes that under the current environment, including the impact of the epidemic and the rising cost of coffee beans, it is unknown whether the franchise stores will continue to make profits and develop.

He also believes that Ruixing's digital and takeout business is relatively mature and has great advantages in resisting the epidemic. In terms of strategy in the future, Ruixing should seize the victory and pursue it.

In the capital market, it has been rumored that Ruixing will return to NASDAQ at the beginning of this year. Chinese food industry analyst Zhu danpeng told the daily economic news through wechat that after Ruixing's top-level design is solved, the attention and favor of capital for Ruixing will continue to rise in the future. "The possibility of Ruixing returning to the capital market is very high."

Chinese local coffee brands inject a booster

In any case, Ruixing's profit is exciting news for some Chinese local coffee brands such as manner, which take the "Ruixing model" as the template. China's coffee market no longer seems to be dominated by Western brands.

Manner Hanguang department store

Li Chengdong calculated an account from the revenue: "Starbucks has about 230 billion revenue in China a year. According to the financial report data, we estimate that Ruixing has about 15 billion revenue in the whole year, which is about 60% of Starbucks. How many years has Starbucks cultivated the Chinese market? Ruixing has only been established for a few years? This catch-up speed is stressful for Starbucks."

According to the financial report for the second quarter of 2022 (as of April 3) released by Starbucks in early May, the first quarter revenue of Starbucks in the Chinese market was US $740 million (about 4.89 billion yuan), a year-on-year decrease of 14%. The same store sales fell 23% year-on-year, and the customer unit price fell 4%.

In this fiscal quarter, Starbucks covered 225 cities in the Chinese market, and 72% of them experienced the impact of the epidemic. In the last week of March, Starbucks China's same store sales fell by nearly 50%.

Starbucks has the most stores in Shanghai. The business of stores in Shanghai under the middle line of the epidemic has been significantly impacted. Li Chengdong believes that the data estimate of Starbucks in the second quarter is still not optimistic.

However, the strength of Western brands in the Chinese market can not be underestimated. Both Starbucks and tims China are profitable in the Chinese market all year round. At present, Starbucks has also realized the importance of online to business. In January this year, Starbucks launched meituan to vigorously develop its online business. In the financial report, the proportion of its digital channel sales has increased to 43% in the first quarter.

Howard Schultz also said in the financial report meeting that the equipment and layout in Starbucks stores are not suitable for the existing business. The first thing to do now is to upgrade the equipment of the stores and alleviate the pressure of store operation. The success of "Ruixing model" lies in the positioning and innovation of stores.

Lin Yue believes that Ruixing's "light and fast" business model has proved successful with its profitability. "This model is not only a powerful weapon for Ruixing to attract franchises and expand rapidly, but also the backing of other local brands in the market following the 'Ruixing model'."

Lin Yue also believes that Ruixing still has many local brands to learn from. "For example, vigorously sinking the third and fourth tier cities, maintaining the activity of users, the speed of new products, the mode of franchise store sharing, etc. These are all fist to meat strategies, and Western brands can obviously feel this impact."

However, industry experts are cautious about whether China's local coffee market can run out of the next Ruixing.

"It's probably not easy to get out of a brand like Ruixing. The coffee market is not saturated, but there is not so much blank, unless there is a more subversive business model, operation format or category innovation," Lin Yue said.