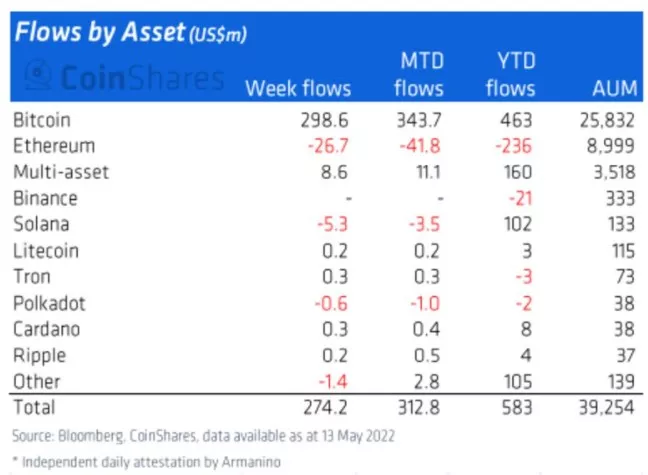

Bitcoin enthusiasts saw some buying opportunities after the stable currency terrausd (UST) collapsed last week and the price of cryptocurrency plummeted. Coinshares compiled data show that at a time when bitcoin plummeted by about 14%, investors increased their focus on bitcoin products by $299 million. At the same time, funds focusing on Solana, ether, Polkadot and other funds have experienced outflows.

James butterfill, the company's investment strategist, wrote that the inflow of funds into bitcoin showed that investors were flocking to its "relative safe harbor". Cash injection is "a strong signal that investors believe that the recent decoupling of ust stable currency and its related widespread selling is a buying opportunity".

Bitcoin, which gave birth to the cryptocurrency industry, is generally considered to be the most flexible digital asset; It is the participant with the longest history, the largest scale and the highest popularity. In addition, it has a group of loyal fans who often claim to be maximizers of bitcoin. They believe that bitcoin is the currency of the future.

These cash inflows come at a time when digital assets are in difficult times. As Terra's cryptocurrency collapsed last week, the price of the cryptocurrency fell sharply. At its peak, the sell-off also swallowed the $76 billion stable currency tether, a key transaction transmission tool in the encrypted ecosystem.

Zhitong finance learned that according to arcane research, the transaction volume of bitcoin futures this week reached the highest level since December last year.

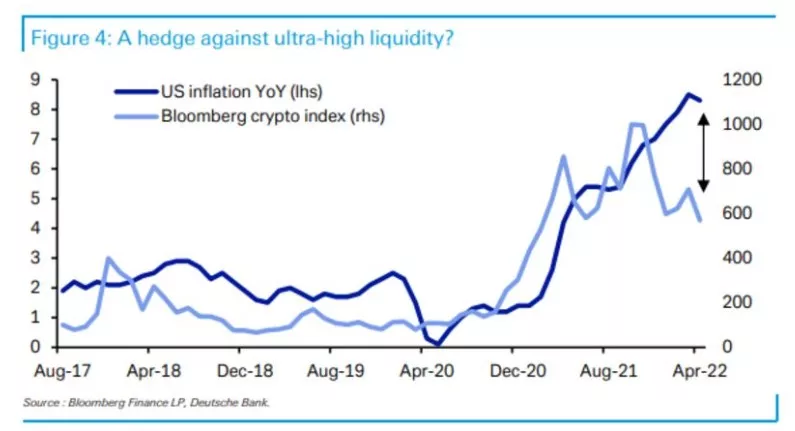

However, Marion Laboure and Galina pozdnyakova of Deutsche Bank said that what happened in the encryption market should not be surprising. Cryptocurrency is increasingly related to technology and the US stock market. U.S. stocks also sold last week, with the S & P 500 down 2.4% in the five days ended Friday. In addition, they wrote in a report that the idea that bitcoin can be seen as a hedge against inflation has been "debunked".

The two wrote: "when the Fed became tough and the prospect of rising interest rates was undervalued, cryptocurrency also followed. In May, despite the easing trend of us CPI, the US stock market still fell sharply."

The situation has calmed down in recent days, but bitcoin continued to decline this week, falling as much as 6.3% to $29072 on Monday. Bitcoin and other cryptocurrencies fell by more than 6% as of the issuance of bitcoin.

Scott Sheridan, chief executive of tastyworks, said that bitcoin is going through a mature process. He likened it to a turbulent period in the stock market, during which enterprises were able to gain a firm foothold. "Bitcoin is going through a very similar period now. It needs to be tested not only to see whether the basic concept of bitcoin is feasible, but also to see whether it can withstand possible fluctuations in the free market. However, I am not entirely sure whether the stage we are in is over," he said