The collapse of the terrausd stable currency led to the stampede of many of the most popular cryptocurrencies. The decline continued on Thursday and dragged down some cryptocurrency related stocks In addition, some cryptocurrency ETFs were unlucky and began trading in Australia on Thursday.

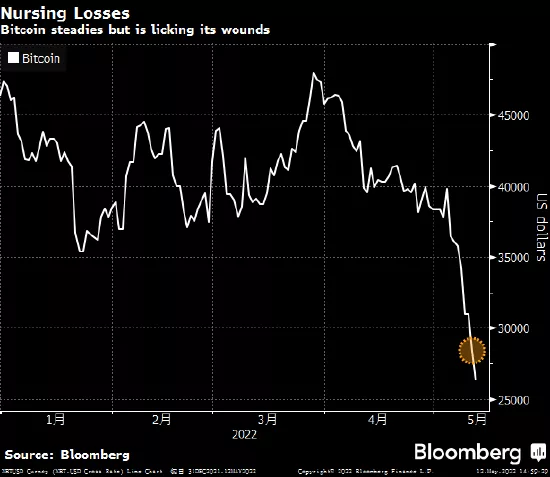

Bitcoin fell 6.1% on Thursday to below $27000, the lowest level since December 2020. At one point, Ethereum fell 12%, and cryptocurrencies such as avalanche and Solana, which support some key decentralized Finance (DFI) protocols, also fell.

Some cryptocurrencies rose more than 10% earlier in the session, but the rebound was unsustainable. Terrausd stable currency is still less than US $1, and the related cryptocurrency Luna also plummeted.

The cryptocurrency industry as a whole suffered a heavy blow this week, and market sentiment remains fragile. Stable currency is a key element of the cryptocurrency market, in which traders deposit their funds when buying and selling other cryptocurrencies. The combined value of various stable currencies is far more than $100 billion. With the increasing loss of confidence, it may form a survival test for the digital asset ecosystem.

Terrausd algorithm stable currency (also known as UST) has been fluctuating between 30 and 90 cents, and it was about 66 cents as of 6:18 London time. According to the founder of a company contacted on the deal, supporters tried to raise $1.5 billion to support the token after the cryptocurrency was decoupled from the dollar.

"The collapse of ust has largely affected the cryptocurrency market," said edul Patel, CEO of cryptocurrency investment platform mudrex. He added that although bitcoin has often rebounded rapidly from crashes in the past, this time it may fall further.

"Is the market frightened by what happened to terrausd? The answer is yes," said Craig W. Johnson, chief market technology analyst at Piper Sandler, on the phone.

Sentiment in the cryptocurrency market has also been affected by rising US inflation, suggesting that interest rates will rise, which is bad for risky assets. "There is extreme fear throughout the cryptocurrency market," said Marcus sotiriou, an analyst at globalblock, a UK based digital asset broker.

UBS James Malcolm, head of foreign exchange and cryptocurrency research, pointed out that the area of about $30000 is a "particularly sensitive area" for bitcoin.

Shares and bonds of coinbase global Inc. fell to a new low on Wednesday, indicating that investors also questioned the prospects of cryptocurrency exchanges in the bear market. The company reported lower than expected revenue yesterday and warned that the trading volume and monthly trading users in the second quarter are expected to be lower than those in the first quarter.

Some cryptocurrency related stocks in Asia also fell. Hong Kong based BC Technology Group Ltd. once fell 7.5% and is expected to hit its lowest closing price in more than four years. MONEX Group Inc. in Japan fell 8.6% and Woori Technology Investment Co. in South Korea fell 6.6%.

Amid the bitter wind and rain of cryptocurrency, Australia's first cryptocurrency based exchange traded funds (ETFs) began trading on Thursday.

Including ETFs 21shares bitcoin ETF, ETFs 21shares Ethereum ETF and cosmos purpose bitcoin access ETF, which made their debut on the local exchange of global market company of Chicago options exchange.

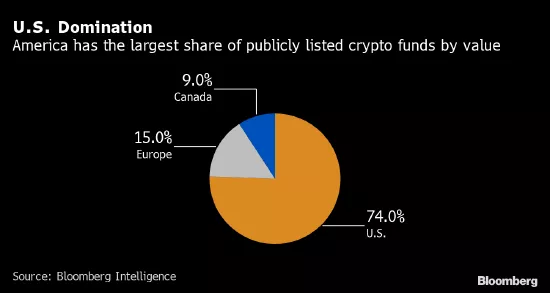

The trading volume of Australia's first cryptocurrency ETFs exceeded a $1 million only two hours after the opening. According to analysts Rebecca sin and James seyffart, this is a good start for Australia because the size of the country's entire ETF market is only a $152 billion and the United States is $6.3 trillion.