In 2017, Stefan Krause, a former executive of BMW, left Faraday future, which was in deep trouble at that time, and set up a new electric vehicle start-up called evelozcity (later changed to canoo) at the end of the year** Later, several executives of the company were sued by the former owner on the grounds of digging the foot of the wall and stealing trade secrets, but the two sides finally reached a settlement at the end of 2018. Embarrassingly, after years of hard work, canoo's book capital is about to run out.

(from: canoo official website)

Canoo reported that the remaining funds are only enough for the company to maintain until the next quarter, and it is uncertain whether it can make a living in the future.

Although the electric vehicle manufacturer is producing a variety of EV Models, including mpdv and pickup truck pickup trucks.

But the company is still in Q1 earnings As of the date of this announcement, we have major doubts about canoo's ability to continue as a going concern.

DRIVING PRODUCTIVITY FOR EVERY BUSINESS - Canoo(via)

Based on the design of the minibus that debuted in 2019, canoo built the product line of this series of transportation vehicles, and initially only planned to provide services to customers by subscription.

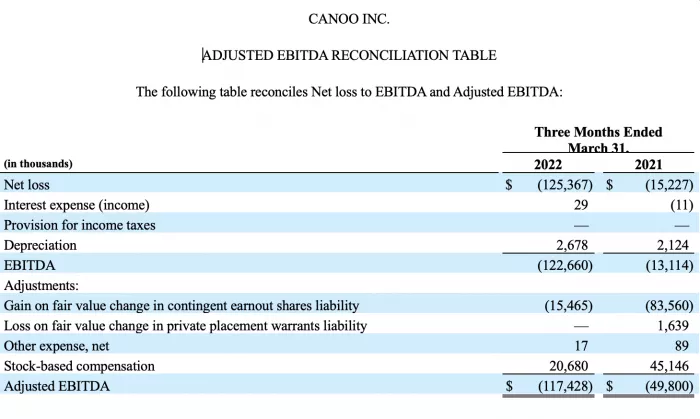

However, as of the end of the first quarter (March 31), it had only $104.9 million in cash and equivalent assets left. In the past three months, its loss has reached US $125.4 million (US $15.2 million in the first quarter of last year alone).

Tony Aquila, chairman and CEO of canoo, said in a statement that the company had $600 million in "available funds" to support the production of EV series models.

It includes the private placement (pipe) funds promised by existing shareholders and the total amount of US $300 million provided by the equity purchase agreement signed with the financing partner Yorkville advisors, as well as the additional US $300 million (Universal shelf) general funds applied by the company.

Canoo has been laying off staff in recent months. In addition, it was reported last year that the securities and Exchange Commission (SEC) was investigating its merger with a special purpose acquisition company (SPAC).

Earlier this week, canoo also filed a lawsuit to recover part of the profits of important investors with Chinese background.