Has the science and technology myth under the tide of digital Sina fallen to the altar so quickly? Since August last year, NFT (non fungible token) has become a rising star in the art collection market, a social currency in the trend circle and a new favorite in the investment community.

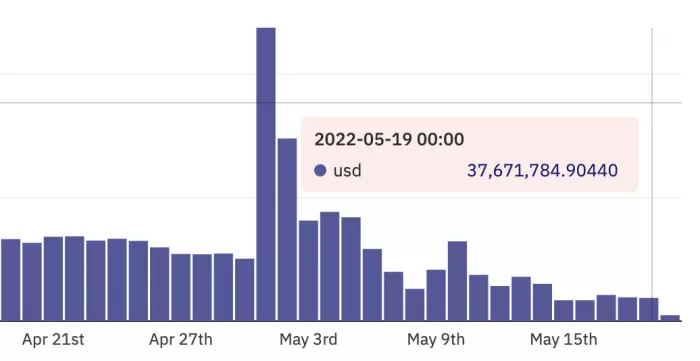

However, in May, NFT became a hot topic again, accompanied by keywords such as "trading volume diving", "IQ tax burst" and "selling". According to opensea, the world's largest NFT trading platform, the global NFT trading volume was about US $37.67 million on May 19, down about 92% from the data on May 1.

Global NFT trading volume of opensea on May 18. Image source: NFT data platform duneanalytics

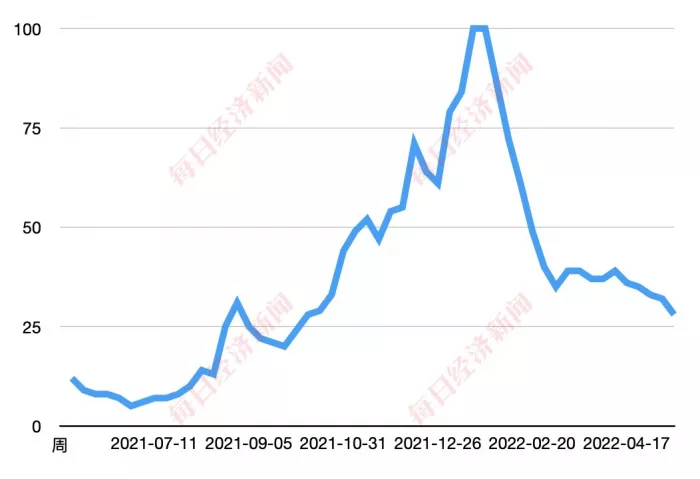

According to Google data, NFT's global heat index has gradually declined since mid January this year. In the second week of May, NFT's global heat index decreased by nearly 70% compared with mid January.

NFT global heat index data source: Google Trends

Some people firmly believe in the value of NFT, while others question the illusion of its technology; Some people believe that the foam has burst, while others believe that it is only a cyclical fluctuation at present. The current NFT industry is like a complex of contradictions.

Even for practitioners, the answer about the value and future of NFT is not conclusive. For a new industry born in a new era, the speed and frequency of changes are unpredictable. If NFT has real value, how will it face the uncertain market environment? How to maintain its own value after experiencing exponential growth? And what is its true value to the general public?

On May 17, when the NFT industry continued to be affected by the turmoil in the currency circle, the reporter of daily economic news (hereinafter referred to as "NBD") made another telephone interview with ran Wei (hereinafter referred to as Michael), co-founder of Shanghai ningfengtian Technology Co., Ltd. Previously, he worked in the social field and payment industry for many years, and then served as the chief technology officer of the NFT art platform tr lab, launching the artist Cai Guoqiang's first NFT work. Now he turns to the direction of meta universe to start a business.

Ran Wei, co-founder of Shanghai ningfengtian Technology Co., Ltd. Source: provided by respondents

In the two dialogues, he talked about NFT's foam, value and application, current difficulties, future of the industry and other topics, and gave his own thoughts.

NFT implicated in the fall of currency circle cliff

"But it doesn't mean that the industry itself is wrong"

From the perspective of the external environment, the three major indexes of US stocks fell recently, and the impact on cryptocurrency is undoubtedly an important factor causing the recent turmoil of NFT. Among them, the "value decoupling" of UST, the third largest stable currency in the cryptocurrency market, and its sister token Luna, announced the intensity of this round of turbulence. According to coindesk data, ust and Luna have fallen significantly since May 10. On May 16, UST, which should have anchored the value of US $1, once fell to an all-time low of 6 cents per piece, down 94%. As of 5:45 p.m. on May 20, Luna fell to $0.000152 per piece, almost to zero.

NBD: what do you think of the current turmoil in the NFT trading market

*Michael: * first of all, the periodic fluctuation of NFT in monthly units has actually occurred several times. The decline of cryptocurrency market does have a great impact on NFT. Usually, when retail investors have redundant idle encryption assets and the secondary market is in a bull market, people tend to buy NFT with encryption assets with relatively stable value. However, when the entire cryptocurrency market shrinks, people will panic to sell their NFT and replace it with cryptocurrency with more stable value.

So I think as long as the cryptocurrency market recovers as a whole, the NFT industry will also recover. But now the price of bitcoin is also affected, so the whole NFT market is in panic.

As of 17:45 on May 20, Luna's single market value. Image source: screenshot of coindesk official website

NBD: at present, even the stable currency is falling. When the credit of cryptocurrency is damaged, will players worry about its value and stability in the future

*Michael: * I think we can use the stock market analogy. Before 2018, many people thought that the stock market was more stable than cryptocurrency, but in the past two years, at least in the US stock market, the cryptocurrency market dominated by bitcoin was more stable than US stocks.

From past experience, every time the encryption market experiences fluctuations, its performance will be more standardized, whether at the regulatory level, capital standardization or market stability. For example, after the cyclical fluctuations in 2011, 2015, 2017 and 2021, the market performance of bitcoin is better. Now some countries also begin to accept cryptocurrency as the legal payment currency.

The shock of this round actually comes from some newer tracks, such as decentralized finance, algorithmic stability, currency market and so on. The massive growth of these tracks began a year or two ago. But for bitcoin and stable coin, which have been established for many years, I think they can be restored.

Like the Internet crash 20 years ago, but the Internet itself did not completely die. Looking back now, there is an irrational rise in the Internet market in 1999 and the cryptocurrency market in 2017, which will lead to a retaliatory decline. However, this does not mean that the industry itself is wrong, nor does it mean that the new technology itself has problems.

Now NFT is mostly financial speculation

The liquidity illusion is highly fraudulent

With more than $20 million pixel avatars and more than $90 million art works, the ceiling of NFT has been raised in the wave of fanaticism. Even at the bottom of the pyramid, the popularity of mass consumption NFT remains the same. For example, during this year's Winter Olympics, Bing Dwen Dwen NFT, with a unit price of $99, once soared hundreds of times in the secondary market. Today, the value of the once popular IP series NFT has fallen to varying degrees. In the face of crisis, the IP halo is not protective.

The NFT "merge" project created by NFT artist Pak has a turnover of US $91.8 million. Image source: screenshot of nifty gateway

NBD: what kind of NFT is a valuable NFT

*Michael: * to be honest, I can't understand it now. Let's go back 20 years and look at the Millennium crash in the US stock market. In that stock market crash, 90% of the Internet companies died, and the stocks of Amazon, Google and oracle that survived also fell back and forth, but in the end, these companies that insisted on doing value interconnection survived and became today's industry standard.

The experience of these companies can give us an enlightenment, that is, if NFT itself is valuable, enterprises in it need to do technological innovation, underlying infrastructure and broaden application scenarios. Instead of now, a large number of financial players operate NFT in a financial way, so it is really difficult for us to see its value.

If you want to simply regard NFT as a financial instrument, I prefer homogeneous assets such as special currency and ether currency, because the liquidity fantasy of non-homogeneous assets will give people a strong sense of fraud.

NBD: are non homogenous tokens more prone to foam than bitcoin and Ethereum

*Michael: * yes, the NFT industry has a word called "liquidity illusion". If I have a bitcoin, I don't have to worry about whether the market recognizes its value or whether it has enough liquidity in the secondary market. But if I have a blue chip NFT and a scandal breaks out the next day, even if the value of my NFT does not fall immediately, its liquidity will become very poor. It's hard for me to realize. This is the invisible loss of assets.

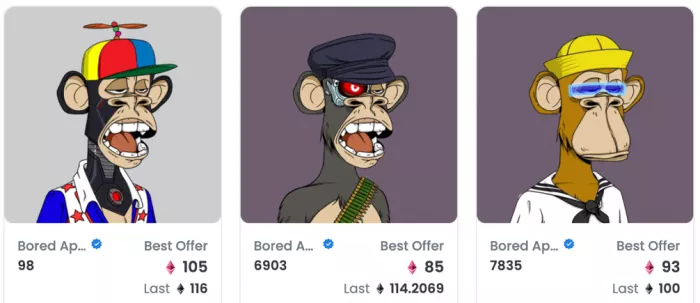

Recent transactions of "boring ape Yacht Club" series NFT. Image source: screenshot of opensea official website

"Boring ape" is just an IP that is operated. There is no financial system behind its value. In fact, it's the same as buying expensive paintings in art galleries. It's difficult for you to judge whether its real value is reflected on paper. As an inappropriate example, when a person can choose between 100 million yuan worth of paintings and 100 million yuan in cash, most people will choose cash, because RMB is a homogeneous token, and its value is more certain.

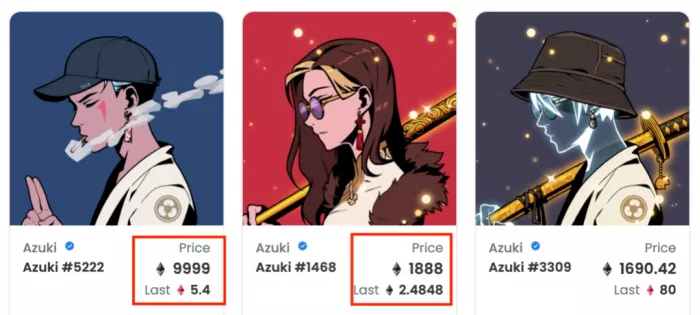

Let me give another example of a non "boring ape". Azuki, an NFT with Japanese style, was also very popular some time ago. Later, a reverse marketing by its founder caused great negative, and its liquidity plummeted. An NFT project with a market value of more than 100 million is so easily affected by someone.

In this market turmoil, azuki was also greatly affected. It once fell to six or seven ethers, and now it has risen back to about 13 (Note: many NFTs in azuki series have sold 1000 ethers). This is a typical example. Once a high-quality project, it has become a second-class project.

So I think the value of most NFTs actually comes from the myth of making wealth in the industry that began two years ago. Their intrinsic value is mainly financial value, not use value.

Price changes of azuki series NFT. Image source: screenshot of opensea official website

NFT needs to find practical application scenarios

It's like finding e-commerce on the Internet

Throughout the past period of time, NFT myths mostly appeared in the field of auction collection. Mass consumption NFT is dominated by Brand Co branding. The lack of use value has always been the attack point of NFT being questioned as the "IQ tax". No matter how revolutionary a technology is, it is like a castle in the air if it can not land in the consumer market and bring about exact industrial upgrading. The next big industry turmoil is bound to occur.

NBD: how can we better show the value of NFT

*Michael: * this market fluctuation has actually exposed some problems accumulated in the NFT industry. For example, we haven't found a scenario that can be applied in practice. Like the new NFT project otherded before the fire, the floor price has fallen by 70-80%. It was developed for a metauniverse game, but the game didn't bring too many surprises to the market after it went online.

Since its birth, the outbreak of NFT industry is mainly based on its strong financial attribute, that is, the attribute of creating wealth, which is one of the reasons why it is difficult to get rid of financial risks in the early stage. As for when NFT can usher in a value explosion, that is, when NFT technology is really applied in the fields of decentralized authentication, meta universe games, meta universe asset management, virtual asset management and entity asset mapping services, as well as those scenes I can't even imagine now.

Just like Internet technology to e-commerce, if you go back to 1999 and tell people that they can order takeout with their mobile phones in the future, they won't believe it. Similarly, the NFT application scenario we think about today may be very elementary in 20 years. I still firmly believe that this industry will find its value, but it requires the joint efforts of many excellent engineers and a large number of people with business acumen. It's hard, so everyone is confused now.

NBD: now there are various NFTs on the market, such as IP co branded NFT. Is this a valuable NFT

*Michael: * I don't think so, but I think the emergence of this kind of NFT has a positive effect. The first is to let more ordinary people begin to experience NFT.

The problem is that the museums and brands that launch these NFTs, how to empower the relevant rights and interests to the people who hold NFTs. Now they buy them and put them in their mobile phones. When I say empowerment, I don't mean selling it on salted fish, it's still a simple financial product.

As an entrepreneur, if I give all the content financial attributes, will those artists who don't understand finance and NFT suffer instead? Am I doing good or bad? Therefore, at present, I am not sure that adding financial attributes to an NFT and combining culture, art and fashion cards must be a good direction.

TR lab launched Cai Guoqiang's first NFT project "eternal moment: explosion of 101 gunpowder painting" in July last year. Photo source: tr lab official website project introduction

You have to go through two or three big cycles of soaring or returning to zero

Capital markets based on "expectation" and "consensus" are often sharp and sensitive. The rise and fall of the stock market rotate, and the birth and death of the industry also have a process. Companies that can provide use value will be left behind by the market. How to judge the future of NFT industry? Perhaps we need to clarify a major premise first, that is to determine whether it has or has no value.

NBD: this market turmoil has a great impact on NFT. How can the NFT industry improve its stability in the future

*Michael: * I'm afraid to make predictions now. But I think we need to continue to attract funds and high-quality talents to enter this industry, and then try and make mistakes. Trial and error means that new projects continue to grow or fall rapidly, and then the market continues to iterate, low-quality projects disappear, and high-quality projects emerge.

At present, NFT has not developed in a clear direction and can really create real value, so it still needs more funds and talents, and then more closely linked with the real world. The reference object is bitcoin. Bitcoin, like today's NFT, once could not find any real value, but after several rounds of reincarnation, when bitcoin is applied to more and more scenarios, there will be more users and the whole industry will become larger. In addition, it is more closely linked to the financial system, and its price is unlikely to increase or fall on a large scale.

But NFT has nothing at present. Now a small group of people are playing. I think the NFT industry may go through two or three great cycles, that is, the industry soars or returns to zero, so as to see what the real value of the industry is.

NBD: for an industry with unclear direction and cyclical fluctuations, how to attract funds and talents

*Michael: * in the early stage, we had to rely on financial means to get a batch of NFT projects out of the circle first. In fact, "boring ape" has almost done it, and a large number of celebrities have bought it. The next step is the financial speculation to create wealth, so as to attract a large number of practitioners to enter the industry, and then experience a wave of washing. 99% of these projects will die, some uncertain practitioners will leave, and the rest will continue to do it and recycle. After several waves of washing dishes, this industry will gradually become an industry that can continue to attract high-quality talents and funds. Bitcoin has gone through this process before.

NBD: but is it all based on the value potential of NFT itself

*Michael: * right. Our assumption is that NFT can create value for the meta universe, or create practical value for future games and future decentralized financial markets.

Personally, I think there are infinite possibilities for the future of NFT. Now the market is still very early. But I'm not talking about the next 12 months or 24 months, maybe the next 20 years. It's hard to say how long it will be in the future, but the future value must exist.