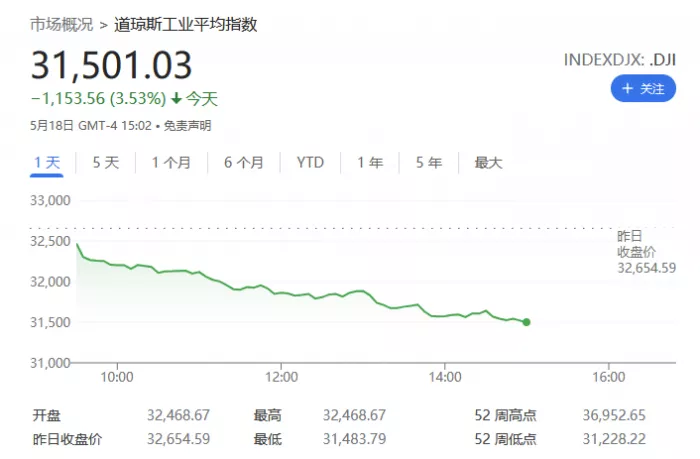

In the early morning of the 19th Beijing time, US stocks plunged late Wednesday, with the Dow down 1100 points. Several retailers reported disappointing results. Investors re examined the hawkish remarks of Fed chairman Powell and continued to pay attention to the economic situation and inflation prospects of the United States. US housing starts fell 0.2% in April.

The Dow fell 1166.78 points, or 3.57%, to 31487.81; The NASDAQ fell 576.09 points, or 4.81%, to 11408.43; The S & P 500 index fell 166.87 points, or 4.08%, to 3921.98. After continuing Wal Mart, several retailers still reported disappointing results on Wednesday. Retailer target shares fell more than 25% after the retailer reported earnings that were much lower than expected.

Shares of Lloyd's, a home improvement retailer, fell amid mixed results.

Cisco Systems will release its performance report after Wednesday's close.

US stocks closed higher on Tuesday. The US retail sales data were better than expected, and the overseas fight against the COVID-19 was optimistic and there were signs of easing the blockade, which boosted the stock market. When the Tiandao index closed up 1.3%, it rose for the third consecutive day. The S & P 500 index rose 2%. The NASDAQ closed up 2.8%.

On Wednesday, investors re examined the remarks of Fed chairman Powell. Powell said on Tuesday that with the Fed's decisive action to raise interest rates to reduce inflation, Americans may suffer "suffering".

Powell said that no one should doubt the Fed's determination to curb the hottest inflation in decades. If necessary, the Fed will raise interest rates above neutral levels.

"What we need to see is that inflation is falling in a clear and convincing way, and we will continue to push forward until we see this. If we need to raise interest rates above a widely understood neutral level, we will not hesitate," he said

"Powell's remarks on Tuesday did not immediately hit investors' risk appetite. The NASDAQ rose more than 2.5% yesterday and the S & P 500 rebounded 2%. However, the rise and fall of stock index futures suggest that it may be difficult for market demand to remain strong in the next few trading days," said Ipek ozkardeskaya, a senior analyst at UBS

Given Powell's hawkish comments and the poor results of retail giant Wal Mart, investors should be prepared for the next disappointment, analysts said.

"It seems that Powell is currently insisting on raising interest rates by 50 basis points in the next few meetings, but if inflation does not come down, he has not completely ruled out the opportunity to raise interest rates by a single 75 basis points in the coming months. With this in mind, we cannot confidently say that the recent stock market rebound is the beginning of a bullish reversal, but should be regarded as an adjustment fluctuation," said Charalambos pissouros, head of research at JFD group

Henry Peabody, manager of MFS asset management fixed income fund, said he suspected that at some point, the liquidity of the market might be challenged, but so far this has not happened.

In terms of economic data on Wednesday, the US Department of Commerce reported that the number of new housing starts fell by 0.2% in April to an annual rate of 1.72 million units. The March data were revised downward to 1.73 million sets. The median forecast of the economists surveyed was 1.76 million units.

Data show that in the face of continued supply challenges and the steepest rise in mortgage interest rates in decades, the number of new housing starts in the United States fell in April. The construction permit, an alternative indicator of the number of new housing starts in the future, decreased to an annual rate of 1.82 million units.

With inflation at a multi decade high, U.S. builders are facing high raw material prices, as well as challenges in acquiring land and recruiting personnel. Coupled with concerns that soaring interest rates could crowd out potential buyers, residential builders' confidence index fell to its lowest level since June 2020 this month.

According to Freddie Mac, the average 30-year loan interest rate rose to 5.3% last week, up from 2.94% in the same period last year and the highest level since 2009.

Focus stocks

Target, the second-largest U.S. Department store retailer after Wal Mart, fell sharply. The company reported on Wednesday that quarterly comparable sales rose 3.3% year-on-year. Net profit was only $1.01 billion, less than half of $2.1 billion in the same period last year, and earnings per share was $2.16, significantly lower than analysts' expectation of $3.07. Target said the rare surge in costs and logistics bottlenecks had seriously affected profits.

Tesla CEO musk announced on social media that the company will hold the second "Ai day" on August 19, during which many cool updates will be released. On last year's AI day, Tesla released its supercomputer Dojo and the concept humanoid robot.

Brad Smith, vice chairman and President of Microsoft, said at the Bruegel think tank event on Wednesday that the company's cloud service department has begun to change so that similar services can better compete. Smith said the changes include allowing cloud service providers to windows As a complete desktop operating system, it provides longer-term price protection and modifies the license terms.

The website of the official registry of the Russian government shows that Google's subsidiary in Russia has filed for bankruptcy. It is reported that the company said that since March 22, the company has foreseen the situation of insolvency and is unable to fulfill its payment obligations, including paying wages and severance pay.

Netflix, a streaming media giant, announced on Tuesday that the company cut 150 jobs, accounting for about 2% of the total number of employees in the United States and Canada, mainly in the United States. The company stressed that this adjustment is mainly driven by business demand and has nothing to do with personal performance.

Twitter shares fell. It is reported that three more senior employees have left twitter, indicating that internal unrest is spreading. At present, the acquisition has stalled.

Coinbase will slow recruitment and reassess personnel demand.

Rivian shares fell. Pricing disputes may affect the production of electric trucks ordered by Amazon.

Lloyd's earned $3.51 per share in the first quarter, higher than expected.

Sea's net loss in the first quarter expanded to $580 million.