It is reported that Elon Musk pointed the spearhead at Twitter's robots and claimed that he would not continue to promote privatization without understanding the robot problem. But in fact, the $13 billion in debt brought about by the acquisition is the real source of pressure.

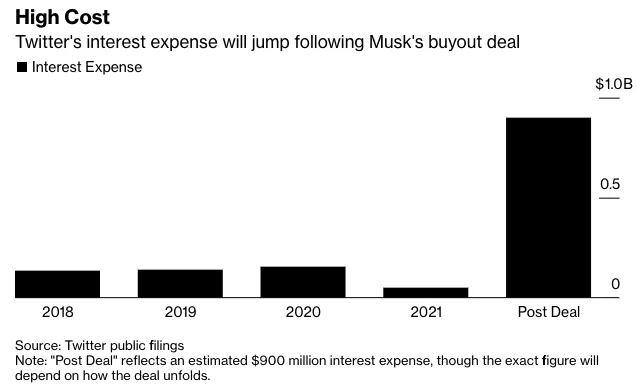

On April 20 local time, just at the end of "Elon Musk day", many banks rushed to introduce such a loan scheme. Its annual interest rate is close to $1 billion, making the company on thin ice.

For sober credit analysts, it is not surprising to think twice about such a deal.

The acquisition was partly funded by leveraged loans and high-yield bonds. CreditSights, a credit research firm, estimates that this will increase Twitter's annual interest burden to about $900 million, * * while Bloomberg expects it to be $750 million to $1 billion.

Such huge data is in front of us, which is enough to show the money burning speed of twitter, which will undoubtedly bring greater transformation pressure to musk, find new sources of income and strive to reduce costs. Even so, Wall Street analysts expect Twitter's earnings to hit a record in 2022, but these good expectations will also be affected if the predictions of the U.S. recession come true (musk said on Monday that the recession has happened).

"For a company like Twitter that has never shown strong profitability, this is a bad capital structure." "It's been on the market for a long time, but it's never really figured out how to fully monetize users," said John McClain, portfolio manager at Brandywine global investment management

Musk himself was skeptical about the deal, saying this week that he would not move forward unless twitter proved that robots accounted for less than 5% of its users.

Debt is only one of Musk's three major channels of financing He found 19 equity investors and completed $27.25 billion equity financing with them. He also used Tesla shares to obtain a $6.25 billion mortgage loan, but currently plans to replace this approach by introducing preferred stock investors. Potential participants include Apollo global management and Sixth Street.

After working day and night, bankers abandoned Easter and Passover weekends and worked out a financing plan before Musk's deadline of April 20. But this has led twitter into a deeper debt quagmire - the company's interest cost over the past 12 months has been only $53.5 million**

Even if musk doesn't get into debt, there will be little room for him to make mistakes. As with common leveraged transactions, if there is any problem, twitter will be difficult to repay its debt, and musk and its investment partners will lose the money invested in it.

"The leverage is very high and the free cash flow is about to become negative, which will undoubtedly increase the risk of the transaction." Jordan chalfin, senior analyst at CreditSights, said "Twitter really needs to strengthen its capital structure and increase its profitability to cover both capital expenditure and interest expenses."**

Concerns about the US recession are also growing. Since most of Twitter's revenue comes from advertising, which is vulnerable to the economic environment, it will make the company's debt burden even heavier. "Under the bad macroeconomic background, the first marketing budget to be compressed by enterprises is advertising expenditure." Bloomberg analyst Robert Schiffman said.

Meanwhile, the difficulty of selling corporate debt has grown in recent weeks. The impact of interest rate hike on junk bonds is the most serious. Since the bank agreed to twitter transaction, the average yield reflecting borrowing costs has also increased by more than 1 percentage point to about 7.6%. The leveraged loan market is also cooling.

Analysts believe that Twitter's EBITDA (earnings before interest, tax, depreciation and amortization) in 2022 is $1.67 billion. Twitter expects its capital expenditure to be $925 million. Deducting this expense from EBITDA and considering the new interest expense of twitter, we will see the burning speed of twitter.

Chalfin said that if musk successfully promotes the growth of twitter, its debt will remain controllable in the long term, and the company will realize neutral cash flow in 2023 and positive cash flow in 2024. If musk fails to fulfill his promise and reverse the company's decline, this debt will become a big problem.

It is reported that Twitter still has $6.3 billion in cash and short-term investment, which is enough for it to "burn" for a few more years.