Xiaomi group released its first quarter results on February 19, 2025. According to the financial report, the revenue of Xiaomi group in the first quarter was 73.35 billion yuan, a year-on-year decrease of 4.6%; The loss during the period was 531 million yuan, with a profit of 7.789 billion yuan in the same period last year; The adjusted net profit was 2.86 billion yuan, a year-on-year decrease of 52.9%. There are two main reasons for the sharp decline in Xiaomi's profit performance.

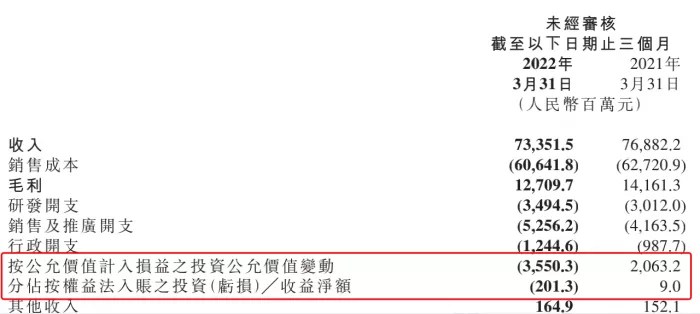

On the one hand, Xiaomi's smartphone business revenue in the first quarter was 45.8 billion yuan, a year-on-year decrease of 11.1%; Smartphone shipments also decreased by 22.1% from 49.04 million in the first quarter of 2021 to 38.5 million in the first quarter of 2022. On the other hand, the change in fair value of Xiaomi's investment in the first quarter made the company lose about 3.55 billion yuan, compared with a profit of 2.063 billion yuan in the same period last year.

"In the first quarter, the epidemic in Hong Kong and Shanghai closed many offline stores of Xiaomi. At the same time, the epidemic also had an impact on users' consumption desire and logistics transportation, resulting in the decline of Xiaomi's smartphone sales." Wang Xiang, partner and President of Xiaomi group, said at the financial report meeting that it is still uncertain whether the external factors affecting the first quarter will improve in the second quarter, and Xiaomi will keep observing. However, the supply side will be significantly improved, and Xiaomi will maintain close communication with its partners at any time.

As of the closing on May 19, Xiaomi reported HK $11.08 per share, down 4.97%.

The mobile phone business went down, and the stock crisis affected investment

In the first quarter of 2022, Xiaomi sold more than 20% fewer mobile phones than the same period last year.

Xiaomi explained in its financial report that the continuous shortage of core parts supply, the repeated COVID-19 and the global macroeconomic environment have had a great impact on the demand and supply of the overall smart phone market. According to canalys data, in the first quarter of 2022, the smartphone market shipment in Chinese Mainland fell by 18.2% year-on-year, and Xiaomi's smartphone shipment in the mainland market fell to the fifth place, with a market share of 13.9%.

At the financial report telephone conference, Wang Xiang, the partner and President of Xiaomi group, said that Xiaomi's medium - and high-end smartphones accounted for more than 50% of the offline channel shipments in Chinese Mainland. The epidemic has an impact on Xiaomi's production, sales, logistics and offline stores, and Xiaomi's costs and expenses have increased. At the same time, the shortage of low-end chips in the first quarter was very serious, which also affected the sales of mobile phones to a certain extent.

However, good online channels and high-end strategy have partially alleviated the downward trend of Xiaomi's mobile phone business.

According to third-party data, Q1 Xiaomi accounted for 32.3% of smartphone online channel shipments in Chinese Mainland in 2022, ranking first.

At the same time, according to canalys data, Xiaomi high-end smartphones priced at 3000 yuan or more in Chinese Mainland and 300 euros or more overseas shipped nearly 4million units worldwide, and ASP (average selling price of smart phones) increased by 14.1% year-on-year. According to third-party data, in the first quarter of 2022, Xiaomi ranked first among Android smartphone manufacturers in terms of smartphone market share in the price range of RMB 4000-6000 in Chinese Mainland.

It is worth noting that, in addition to the decline in mobile phone sales, the sluggish market performance of Zhongyu shares in the first quarter is also the main reason affecting Xiaomi's business performance.

In the first quarter, the change in the fair value of Xiaomi's investment included in profit or loss at fair value changed from a gain of 2.1 billion yuan in the first quarter of 2021 to a loss of 3.6 billion yuan, mainly due to the fair value loss of listed equity investment in the first quarter of 2022. Among them, the two companies invested by Xiaomi, Jinshan cloud and iqiyi, dragged down Xiaomi's overall investment performance.

According to the market value during the first quarter, Jinshan cloud and iqiyi evaporated a total of about $1.298 billion.

The mobile phone industry as a whole goes back to ten years ago

In fact, the decline in mobile phone sales is not limited to Xiaomi.

A confirmatory data is that according to the statistics of cinno research, the overall sales volume of China's smartphone market fell by more than 20% year-on-year in February. Oppo, vivo and Xiaomi decreased by 45.7%, 38.6% and 20.1% respectively year-on-year.

On May 16, the China Academy of communications and communications released a report that from January to March, the overall shipment of mobile phones in the domestic market was 69.346 million, a year-on-year decrease of 29.2%. Smartphones, which accounted for about 98% of mobile phone shipments in the same period, also recorded a basically consistent decline.

Similarly, according to wind data, in March 2022, the domestic mobile phone market shipped 21.46 million units, a year-on-year decrease of 40.5%. If this statistical caliber is pulled back to ten years ago, it will be found that in March 2012, the domestic mobile phone market shipped 39.586 million units. This means that the overall shipment level of the domestic mobile phone industry is now lower than that of the same period a decade ago.

According to IDC, an industry analysis agency, from 2017 to 2020, the shipment volume of China's smartphone market fell by 4.9%, 10.5%, 7.8% and 11.2% continuously, with an increase of 1.1% only in 2021.

The market generally believes that the main reason for this phenomenon is that the overall macro environment superimposes the impact of the epidemic, resulting in the current poor overall consumer sentiment in the smartphone market. According to the data of the National Bureau of statistics, in April, the total retail sales of social consumer goods decreased by 11.1% year-on-year and 0.69% month on month, of which the retail sales of goods decreased by 9.7% year-on-year.

Therefore, mobile phone manufacturers began to cut orders from the upstream supply chain. Tianfeng securities Apple "At present, both high-end and low-end brands are cutting orders, and the mobile phone industry is undergoing structural adjustment," analyst Guo Mingyu said China's major Android mobile phone brands have cut about 170 million orders so far (accounting for 20% of the original shipment plan in 2022).

It is conceivable that if the external uncertainties still cannot be significantly improved in the second quarter, Xiaomi, including the mobile phone industry as a whole, will further enter a longer decline cycle.