In May, the April sales volume of the new forces of car making was released. A total of 9087 zero running cars were delivered in April, realizing a year-on-year increase of more than 200% for 13 consecutive months, winning the sales crown of the new forces of car making and "leading" for the first time. Its delivery volume also exceeded the 10000 mark in March, reaching 10059 units. In contrast, Xiaopeng automobile delivered 9002 units in April, with a year-on-year increase of 75%; Weilai only delivered 5074 vehicles, ranking fourth, and the ideal delivery of 4167 vehicles, ranking fifth. In the third place, Nezha automobile, which is in the second echelon with zero running automobile and counterattacks the main front to the first echelon, delivered 8813 units.

Produced by "storm eye" of phoenix.com

Author Shi Yue

Editor Ren Qing

Zhu Jiangming, chairman of Zero run automobile

Core tips:

- The sales volume of Zero run in April exceeded that of Wei Xiaoli, and reached the top of the new power of car making with the achievement of 9087 units. High light can not cover the huge losses. In the past three years, zero running cars have lost 4.8 billion, with an average loss of 65000 per car sold.

- Insiders told fenghuang.com that the delivery volume of Zero run cars in March and April was satisfactory, which was directly related to the nearly 20000 undigested C11 orders accumulated before. At the end of 2021, there were 22500 C11 orders for Zero run cars, and only 3965 orders were delivered, which also means that there are nearly 20000 orders, which should be digested in the first half of this year.

- At this stage, zero running is more a make-up course, and it has not achieved a real outbreak. It focuses on self-research in the whole field, but the three-year R & D investment is less than one quarter of that of Wei Xiaoli, and the quality and reliability of self-developed products are also questioned. Its self-developed chip Lingxin 01 adopts a 28nm process process, with a computing power of only 4.2tops, but the computing power of Tesla FSD chip has reached 72tops, and several intelligent models such as Weilai et7 and Zhiji L7 have been equipped with hundreds of tops chip NVIDIA Orin X.

Delivery problem: "how does a snake swallow an elephant"

In May, the April sales volume of the new forces of car making was released. A total of 9087 zero running cars were delivered in April, realizing a year-on-year increase of more than 200% for 13 consecutive months, winning the sales crown of the new forces of car making and "leading" for the first time. Its delivery volume also exceeded the 10000 mark in March, reaching 10059 units.

In contrast, Xiaopeng automobile delivered 9002 units in April, with a year-on-year increase of 75%; Weilai only delivered 5074 vehicles, ranking fourth, and the ideal delivery of 4167 vehicles, ranking fifth. In the third place, Nezha automobile, which is in the second echelon with zero running automobile and counterattacks the main front to the first echelon, delivered 8813 units.

The core reason why "Wei Xiaoli" gave way to "Zero run" and Nezha is that "Wei Xiaoli", which focuses on the medium and high-end market, is more seriously affected by the current round of epidemic, and the three companies have encountered production suspension and production restriction to varying degrees

Taking Xiaopeng P7 as an example, the car is equipped with 31 sensors including 5 high-precision millimeter wave radars, 12 ultrasonic sensors, 4 automatic driving look around cameras and 10 automatic driving high perception cameras. With such a large number of components, it is naturally more vulnerable to the influence of the supply chain - according to Li Bin's original words, one part of a car can't be produced.

In the first quarter of this year, the cumulative delivery of zero runs was 21579 units, a year-on-year increase of 410%.

In fact, although the delivery volume decreased month on month in April, it is of great significance to become the sales champion of new forces for the first time, especially considering that the latter is at the key node of impacting the IPO.

On March 17 this year, Zero car officially submitted its listing application to the Hong Kong stock exchange. "Zero car" and "Nezha" are in fierce competition to see who can become the fourth new car making force to enter the capital market after "Wei Xiaoli"**

Insiders pointed out to fenghuang.com technology's storm eye that the delivery volume of Zero run vehicles increased significantly in March and April, which may be directly related to some undigested orders accumulated before .

According to the prospectus submitted by Zero run automobile, by the end of 2021, Zero run automobile had a total of 22500 C11 orders, of which only 3965 orders were delivered, which also means that there are nearly 20000 orders, which should be digested in the first half of this year .

The industry believes that the reason for maintaining more stock orders is that the production capacity can not keep up. "On April 30 last year, Zero run automobile obtained the production qualification of new energy vehicles. In other words, the actual time for Zero run to build a car is only one year."

In a random interview with some potential users of electric vehicles recently, phoenix.com technology found that nearly half of consumers have not heard of zero running cars so far.

To some extent, this is also one of the embarrassing situations faced by Zero run car holding the inspirational script - although the delivery volume has been greatly improved in the short term, on the whole, there is still a very obvious gap between Zero run car and Wei Xiaoli in terms of products, brands or the appeal of the founders themselves .

Highlights and losses

Zero run automobile was founded in December 2015. Zhu Jiangming, then vice chairman and CTO (Chief Technology Officer) of security giant Dahua Co., Ltd. (002236. SZ) and co-founder of Dahua, founded Zero run automobile in Hangzhou together with Dahua Co., Ltd. and its main founders. At the time of establishment, Dahua Co., Ltd., Fu Liquan and Zhu Jiangming held 33%, 32% and 20% of the shares respectively.

With the strength background of Dahua shares and the east wind of new energy development, the financing process of Zero run automobile is relatively smooth - according to tianyancha data, Zero run automobile has raised a total of RMB 11.866 billion from pre-A financing in January 2018 to C2 financing in August 2021. The investors include Sequoia China, CRRC, Hangzhou state owned assets, Shanghai Electric, etc.

Since 2019, Zero car has launched three models, including pure electric coupe S01, pure electric mini car T03 and pure electric medium-sized SUV C11. In July 2019, Zero car delivered the first mass production model S01, T03 in May 2020 and C11 in October 2021.

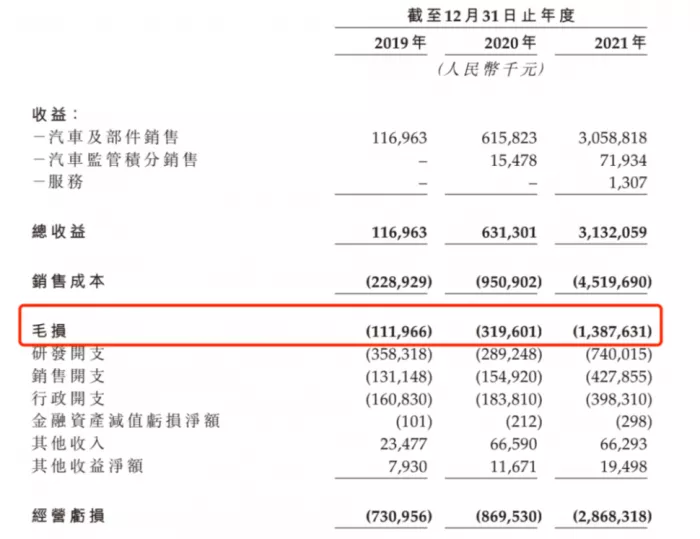

In terms of profitability, according to the prospectus of Zero run automobile, the revenue of Zero run automobile from 2019 to 2021 was 117 million yuan, 631 million yuan and 3.132 billion yuan respectively, with a year-on-year increase of 439.32% and 396.35% in 2020 and 2021 respectively, and achieved leapfrog growth every year.

In the three years from 2019 to 2021, the total revenue of zero running vehicles reached 119.9 million yuan, 631.3 million yuan and 3.132 billion yuan, and the cumulative total revenue in the three years reached 3.882 billion yuan.

However, under the high light, there are unavoidable accumulated losses - during the three-year period 2019-2021, the losses attributable to the equity holders of Zero run automobile reached 901.1 million yuan, 1.1 billion yuan and 2845.7 million yuan respectively, and the cumulative total loss in the three years was as high as 4.846.8 billion yuan. After adjustment, the net losses in the same period were about 810 million yuan, 935 million yuan and 2.629 billion yuan respectively.

Continuous losses make the book data of zero running cars not very good-looking. As of December 31, 2021, the total current assets of Zero car was about 8.955 billion yuan, and the year-end cash and cash equivalents were about 4.338 billion yuan, which was far lower than the 55.4 billion, 43.544 billion and 50.160 billion cash reserves of "weixiaoli" by the end of 2021.

In addition, in terms of gross profit margin, an important development indicator of new energy vehicle enterprises, although zero running vehicles have significantly improved from - 95.7% in 2019 to - 44.3% in 2021, there is still a big gap from "becoming a regular". In contrast, Tesla's gross profit margin of its overall automotive business in 2021 was 29.3%, while weixiaoli also reached 20.1%, 12.5% and 21.3% respectively.

Revenue growth and net loss have expanded year by year. The initiator is the "global self-study" that Zero run automobile has always emphasized.

It is difficult to achieve results through self-study in the whole field

According to the prospectus of Zero run automobile, Zero run automobile claims to be the only new automobile manufacturing force with the ability of "global self-research" in China, and the new automobile manufacturing forces in the market are mainly "full stack self-research".

The main difference between the two is that "global self research" means that all hardware and software are independently developed, "full stack self research" means that the hardware is handed over to a third party, and car enterprises only develop applications and algorithms.

At the Guangzhou Auto Show held in November 2021, Zhu Jiangming, chairman of Zero run automobile, also explained in detail the "global self-study" implemented by Zero run automobile for many years, with special emphasis on: "we can obtain our core competitive advantage through global self-study."

Thinking of the earlier July 2021, Zhu Jiangming also made bold remarks at the Zero run 2.0 strategy press conference that Zero run cars should "surpass Tesla in three years", "launch eight new cars in four years" and "sell 800000 cars in 2025", it is not difficult to see that the whole region naturally seems to give the founder, who is famous for his mouth gun, great confidence.

However, the industry generally does not buy Zhu Jiangming's heroic words. The main reason is that Zhu Jiangming is more like a layman in the field of car manufacturing than a widely recognized expert in the field of security.

The most classic case is that Zhu Jiangming once thought that the produced cars could be sold as long as they passed the inspection at the China automobile center, but he didn't know anything about the "production qualification" and "product qualification" that car enterprises need. This directly led to the failure of the factory built by Zero run automobile with an investment of more than 1 billion yuan in Jinhua to be put into operation. The problem was not solved until Zero run automobile acquired Fujian Fuda Automobile Industry Co., Ltd. three years later and obtained the qualification

Through this, more "jokes" have been extended - because the qualification problem is pending, Zero run automobile can only find Changjiang automobile to contract to produce its first model Zero run S01. However, in the later media test drive activities, because Zero run did not apply for a license plate for the test drive vehicle, a media editor was stopped by the traffic police when participating in the test drive and was found to use a fake temporary license plate, The media editor who led to the test drive faced the penalty of 12 points deduction and detention, which immediately caused an uproar.

In the collective interview after the press conference of zero running C11, a media raised a sharp question - Dahua has advanced artificial intelligence, vision and other technologies, but why is the intelligent driving level of zero running C11 still slightly lower than that of industry leaders**

Zhu Jiangming did not respond positively to this, but the answer is obvious to some extent - the technical advantages of Dahua in the field of security can indeed meet the technical needs of machine vision and reversing radar required by zero running cars, but the problem is that building a car is not just about having cameras and sensors.

In this regard, Yu shengmei, an industry analyst, further pointed out that the Zero run feature is the technical gene, while the security field is a partial b-end market. Cross border vehicle manufacturing is equivalent to entering the C-end market facing consumers directly. It is positive that Zero run can achieve rapid sales growth, but there is still room to improve its product and market insight**

Under the premise of "global self-research", Zero run vehicles need more R & D investment.

But the fact is that from 2019 to 2021, the R & D investment of zero running vehicles was only 358 million yuan, 289 million yuan and 740 million yuan respectively - it's hard to believe that Zhu Jiangming's R & D investment of "the field of driving assembly and battery has developed from collecting external batteries to making their own modules, packs and BMS (battery management system), and the vehicle machine system, cloud platform and intelligent driving have realized self-development", but its R & D investment is less than one quarter of that of Wei Xiaoli, It is not even as good as the ideal of not starting to sell cars in 2018, when the R & D expenditure of the latter was 790 million yuan.

Take its self-developed chip Lingxin 01 as an example. The latter adopts the 28nm process technology, and its computing power is only 4.2tops, which is a huge difference compared with the 72tops of Tesla FSD chip. The latest intelligent models such as Weilai et7 and Zhiji L7 have been equipped with hundreds of tops chip NVIDIA Orin X

In addition, the first mass-produced CTC battery chassis integration technology in China released by Zero run on April 25 was also pointed out to have some exaggerated publicity.

Some people in the industry told Fenghuang technology storm eye that the CTC Technology launched by Zero run this time should be called MTC in a strict sense, because Zero run does not directly arrange 4680 cylindrical cells on the chassis like Tesla, but first covers the cells to a certain extent, and then puts the integrated battery module on the chassis.

In comparison, the technology is more eclectic. The advantage is that it is more convenient for mass production and maintenance, but the disadvantage is that there is no Tesla extreme in space saving, and due to the lack of traditional battery pack cover, the design requirements for thermal runaway protection of the cockpit are also higher.

According to Zhu Jiangming's plan, Zero run car plans to put into operation the lidar scheme by the end of 2023, realize the full scene automatic driving technology in 2024, and realize the anti overtaking and leading of Tesla. It also raises more questions about where the money comes from?

*The design and production of chips, the research and development of algorithms and the implementation of new technologies are almost impossible to "do bigger things with less money". Zero run car wants to "once and for all" and "draw cakes to satisfy hunger" with global self-research. Its lack of overall investment is a reality, and it is highly likely to become an obstacle to its long-term development *.

In addition, the reason why other new energy vehicle enterprises choose the whole stack self-study is essentially based on the reasonable behavior that the current new energy vehicle track is still in the volume stage, in order to shorten the R & D cycle, speed up the mass production rate and quickly seize the market. According to the views of many professionals in the industry, the importance of zero running car self-study in the whole field may be exaggerated, which may be another decision-making mistake of Zhu Jiangming, a "layman" in car manufacturing.

How long can "lose money and earn cry" last

In the current environment where new energy subsidies are coming to an end and raw material prices continue to rise, zero running continues to rely on low-cost models, which means that there is a great probability that it will lose more and more. This makes the route that originally hoped to spread the cost and create scale effect based on the walking volume of T03 can not work for zero running cars

Zero run automobile mentioned in the prospectus that Zero run will focus on China's medium and high-end mainstream new energy vehicle market of 150000 yuan to 300000 yuan in the future. But the first problem in front of zero running is that it is still far from the middle and high-end.

Among the models delivered by Zero run in 2021, 39149 are A00 car T03 with a price of no more than 100000 yuan and a meager profit, accounting for 89% of the sales.

Auto analyst Zhang Xiang pointed out that the reason why T03 sells well is that it accurately locates the A0 car market segment. "Because there were few models, the A0 car was a blue ocean at that time, while the Zero run T03 was very exquisite and had all the functions it should have. T03 pried the market with its high cost performance."

There is a price for "losing money and making a cry". According to the sales volume of 43748 zero running vehicles in 2021, it is a loss of about 65000 yuan per unit on average. Some people on the Internet describe zero running as "losing one if selling one".

In fact, this is the biggest problem of zero running cars - the overall development is seriously unbalanced, and neither side of the low-end, medium and high-end markets has really stood firm

In addition, like many new energy vehicle enterprises, Zero run car has also encountered various disputes along the way. T03 pixel level imitates the plagiarism dispute of Mercedes Benz smart and accuses it of exaggerated publicity of its self-research level. in May 2020, the first batch of owners of Zero run S01 collectively defended their rights. The owners listed four categories of quality problems, including vacuum booster pump failure, battery overheating protection, black screen of main control screen and vehicle shutdown for no reason**

On April 24, just the day before the CTC Technology Conference of Zero run car, another Zero run C11 owner disclosed on the Internet that the body of Zero run C11 newly picked up on the same day had multiple scratches and defects, and the after-sales refused to return the car on the grounds that it had been insured, saying only that a foot pad could be given as compensation. In addition, some netizens also posted on platforms such as the vehicle quality network, saying that the C11 of their new car had problems such as obvious painting of the connection between the front cover and the body, 3mm higher than the body at the right connection of the front cover and lax buckle of the front passenger A-pillar inner liner.

Facing the future, the planning of zero running car is to make the whole model. However, the comprehensive use of various models may make it difficult for each model to stand out. In the SUV field, there are popular products such as BYD song plus DM-I, Tang DM, Nezha u and Xiaopeng G3. In the sedan field, there are also rivals such as BYD Qin plus, Xiaopeng P5 and GAC aion S. at present, there is no Zero run with strong brand advantages and technical strength. It is not easy to stand out.