Less than half a month after welcoming the second CFO, the byte beat was transmitted to the market for suspicion On May 8, some media reported that bytewo (Hong Kong) Co., Ltd. had changed its name to Tiktok group (Hong Kong) Co., Ltd., effective on May 6, 2022. Some media further speculated that bytewo's move was "the establishment of Tiktok group or its listing in Hong Kong"

Text / Feng Xiaoting

In this regard, fuel finance and economics conducted a verification, and the relevant person in charge of Tiktok responded, "no comment.".

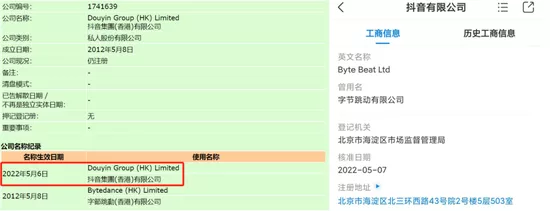

On the same day, fuel finance inquired the online search center of the Hong Kong Companies Registry and found that the above renamed company was established on May 8, 2012. After verification, although there is no fact of establishing a new company, the change of company name is true, and it is not an isolated case. According to the tianyancha data, the main company of bytewo group has changed its name from the original "bytewo Co., Ltd." to "Tiktok Co., Ltd." and the approval date is displayed as May 7, 2022.

Photo / left: Hong Kong Companies Registry; Right: tianyancha app source / screenshot

At the same time, among the 35 core enterprises of bytewo group, Beijing bytewo Technology Co., Ltd. has also been renamed as Tiktok vision (Beijing) Co., Ltd., while other application subjects such as today's headlines and flybook have not changed their names.

It is noteworthy that although the name of the main company of most products has not been changed, the renamed "Tiktok Co., Ltd." seems to be the main company of byte beating group.

From the business information, we can know that whether it is today's headlines of the news aggregation platform, the day and night light year responsible for game R & D and distribution, the volcanic engine focusing on building an enterprise level technical service cloud platform, the flying book providing enterprise cooperation and management services... Or even newly hatched products, such as quantum leap, a subsidiary in the field of knowledge services, Xiaohe health in the field of great health, The companies belonging to the byte beating group are all controlled by "Tiktok Co., Ltd.".

Although the listing rumors have never been officially recognized by bytewo, the change of the main company of bytewo group from "bytewo" to "Tiktok" and the appointment of Julie Gao as CFO at the end of last month after the CFO position was vacant for five months have made it clear that bytewo intends to promote Tiktok's listing in Hong Kong.

Huqimu, chief researcher of Tianyi digital economy think tank, also believes that for byte beat, listing in Hong Kong is a good plan. "I think byte should promote listing in Hong Kong step by step. The first step is to get the domestic Tiktok business listed in Hong Kong, which is less difficult to operate. However, it does not rule out that other businesses including tiktok business will be installed in Listed Companies in Hong Kong in the future."

For byte beating, it is also imperative to restart the listing plan. The 10-year-old byte beat seems to have become a behemoth, but after years of financing, there are many investors waiting to exit behind byte beat.

Although with the change of regulatory environment, the listing resistance of byte beat becomes smaller, the unicorn enterprise ant group, which was valued at nearly 3 trillion yuan but is now on hold, and Didi, which has not been rid of the regulatory storm since its listing in less than five days. The current situation of the two Internet companies also adds many uncertain factors to the listing path of byte beat.

Byte rekindling, spark rekindling

In the face of external suspicions about the listing plan, the relevant person in charge of Tiktok said that he "would not comment" on fuel finance. A number of employees also said they were unaware of this.

However, as a "behemoth" with an annual revenue of more than 300 billion yuan and a valuation of 2.6 trillion yuan, it is also mysterious that it has not yet landed in the secondary market. After all, looking at China's Internet, only Alibaba and Tencent, which have the same volume and byte beating, have not appeared in the secondary market. Therefore, the question of "hidden in the market", when to list and which exchange to log on, has always been concerned by the capital market.

It was clear from the official response that byte beat was considering listing two years ago. On October 26, 2020, Reuters quoted the so-called "insiders" as saying that byte beat was considering promoting the separate listing of Tiktok business in Hong Kong and had communicated with investment banks on underwriting matters. In this regard, the relevant person in charge replied, "we are considering the listing plan of some businesses, but it has not been finalized."

As soon as this remark came out, the byte jump on the semi floating surface attracted particular attention. As a result, every time a new round of financing, internal organization adjustment or other news comes out, it will be accompanied by rumors that "byte beat is considering the IPO and listing plan of all or part of its business".

However, without exception, once the rumors about the listing of byte beating are spread, the internal response of byte beating will respond low-key with words such as "false news" and "no comment", and will not disclose too much information. At that time, the vacancy of CFO has been regarded as the reason for the suspension of listing plan. In 2020, Zhou Shouzi's participation was also interpreted by the outside world as the acceleration of byte beating IPO process. Surprisingly, byte beating officials soon responded in suspicion that "there is no listing plan at present".

However, a series of measures taken since Liang Rubo took over as CEO of byte beating in 2021 seem to inform the outside world that byte beating intends to restart the IPO plan. Previously, insiders told fuel finance that byte beat intends to consider the listing plan of Tiktok business.

The above industry insiders also linked the name change with the architecture adjustment launched by byte beat last year, "Tiktok has an indisputable position in byte beat." In November last year, the CEO Liang Rubo took office was accompanied by a new round of organizational adjustment. Liangrubo issued an internal letter saying that in accordance with the principle of "closely cooperating businesses and teams are merged into business segments, and universal medium-sized platforms are developed into enterprise service businesses", six business segments are established, namely, Tiktok, vigorously education, flying book, volcanic engine, Asahi Lightyear and tiktok.

Especially important is that byte beating combines today's headlines and Tiktok of the two trumps. "Headlines, watermelons, search, encyclopedia and domestic vertical service businesses are merged into Tiktok. This segment is responsible for the overall development of domestic information and service businesses and provides users with better content and services."

It is also in the above-mentioned internal letter that a message was conveyed to the outside world that "Zhou Shouzi, head of tiktok, will no longer serve as CFO". On April 25 this year, when the position of byte beating CFO was vacant for five months, byte beating ushered in the second CFO high standard (Julie Gao).

The appointment of Gao Zhun is directly interpreted by the industry as a step away from promoting the listing. Gaozhun is known as "IPO specialist" in the industry. Relevant data show that gaozhun has provided legal services for the listing of more than 100 companies and other capital market financing projects, including meituan, jd.com, pinduoduo, Xiaomi, etc.

In his internal letter, Liang Rubo mentioned that as a senior lawyer, Gao Zhun had provided legal consulting services for many technology companies, including listing, M & A and financing, "Since 2016, Julie has cooperated with us in the acquisition and financing projects of the company and is familiar with our mission, culture, team and business. Julie has a lot of experience and Thinking on corporate governance and enterprise development, and has provided consultation and help to many companies at different stages. I believe her joining will bring great help to the company."

Organizational structure adjustment, new CFO taking office, company name change... All signs of byte beating point to "byte beating / Tiktok or going public".

Bumpy road to listing

As the protagonist in the rampant listing rumors, byte beating is eager to be listed.

As early as October 2020, byte beat disclosed the news of the IPO process. "We are considering the listing plan of some businesses, but it has not been finalized." At that time, Kwai was also preparing for its IPO in Hong Kong. On the evening of November 5, 2020, Kwai officially submitted its IPO prospectus to the Hong Kong stock exchange to start the listing process first. On February 5 of the following year, Kwai sounded the gong sound of listing on the Hong Kong stock exchange, winning the title of "the first share of short video" in one fell swoop. At that time, the Kwai was very popular, and its market value easily exceeded HK $trillion on the first day of listing.

One month after the listing of Kwai, Zhou Shouzi resigned as the executive director and President of the International Department of Xiaomi and announced that he would join byte hop as CFO.

There was a Kwai listing outside, and the first CFO was in place inside. Byte beating once again attracted outside speculation about the company's listing. Subsequently, there was continuous news that the listing process in Hong Kong had been started, and the rumor was still fermenting.

On April 23, 2021, byte beat, which has always adopted the method of no comment, issued a statement on its official headline, saying that "there have been many news about the listing of byte beat company recently. I hereby state that after careful research, it is considered that the company does not meet the listing conditions for the time being and has no listing plan at present."

Soon after the clarification of the listing plan, it was a series of regulatory problems caused by Didi's listing in the United States in July that year. According to the Wall Street Journal at that time, after being told to focus on solving data security risks, byte beat took a different decision from didi and decided to shelve the overseas IPO plan indefinitely.

Now it seems that the announcement of shelving the IPO plan in April 2021 is forward-looking. In July 2021, the Internet Information Office significantly revised the network security review rules, strengthening and improving the supervision of digital platforms with 1 million users before listing overseas.

However, with the shelving of the IPO plan, we have to face the pressure of capital realization. At the same time, there is also the situation of shareholders' reduction and cash out.

In October last year, Bloomberg reported that Haina International Group, a US based option trading company, was seeking to sell $500 million in shares. The company is one of the earliest and largest investors. The report quoted unidentified sources as saying that another shareholder recently sold his shares and valued the company at $360-370 billion.

Haina International Group, which wants to reduce its holdings and cash out, is only one of the shareholders who has cooperated in the nine financing processes promoted all the way since its establishment.

According to tianyancha data, since it obtained the angel round financing of millions of yuan in March 2012, it has completed 9 times of financing at an average annual financing speed. Several rounds of financing mean that byte beating has been supported by several well-known global investors and stands behind the power of a large number of capital. Such as tiger Global Fund, Sequoia Capital China, Softbank vision fund, KKR, Chunhua capital, Pan Pacific Investment, M31 capital and other luxury capital lineups.

Financial source / sky burn screenshot

Now, from Gao Zhun's appointment as CFO to the change of the company's name, the two major actions in just half a month make the IPO plan "ready to come out".

Byte listing, time problem

2022 is the 10th anniversary of the founding of byte beat and the first anniversary of the current CEO Liang Rubo taking charge of byte beat.

Over the past decade, the rapid growth rate of the economy has been obvious to all. Sitting on two phenomenal content products, the bytes of today's headlines and Tiktok traffic entry jump, just like an app factory, constantly incubating apps that cater to various outlets under the methodology of "making great efforts to produce miracles".

Although Zhang Yiming does not recognize the definition of "app factory", he believes that byte beating is a "very romantic company" and "pragmatic and romantic". But the fact is that for quite a long time, byte beat and other Internet companies have not been generally divided into multiple business divisions according to their business lines, and only three core functional departments, namely technology, user growth and commercialization, are responsible for retention, innovation and realization respectively.

The real change in the definition of "app factory" comes from an organizational structure adjustment led by Liang Rubo in November 2021. Since then, byte business began to merge similar items and establish six business segments. It is also after this adjustment that the status of Tiktok has become particularly important. According to the adjustment, headlines, watermelons, search, encyclopedia and domestic vertical services have been incorporated into Tiktok.

Since then, Tiktok has shouldered the beam of byte beating. In fact, from the perspective of revenue, today's headlines and Tiktok are also byte beating cash cow businesses, both of which contribute more than 80% of byte beating revenue, of which the latter accounts for as much as 60%.

However, the growth of the main business dominated by advertising business in China is also close to the ceiling. According to informed sources, the annual revenue in 2021 was about US $58 billion, an increase of 70% year-on-year, and the growth rate was slower than the 111% growth in 2020. In the years before 2020, the revenue growth rate of byte beating remained above 200%.

It is also a fact that China's Internet advertising industry tends to be weak. According to China Internet advertising data report, in 2020 and 2021, the annual revenue of Internet advertising was 497.1 billion yuan and 543.5 billion yuan (excluding Hong Kong, Macao and Taiwan), with a year-on-year increase of 13.85% and 9.32%, but the growth rate decreased, with an increase of - 4.35% and - 4.53% respectively.

Byte runout also takes a variety of ways to deal with it.

On the one hand, carry out diversified business development internally in an attempt to find a new business direction in order to cultivate new profit growth points. In this regard, we have increased investment in education, games, finance, cross-border e-commerce and enterprise services, even in real estate, hardware, medical treatment, catering, automobile and other fields.

On the other hand, through foreign investment to make up for their shortcomings and expand their business boundaries. According to tianyancha data, in recent years, the group has invested in more than 100 projects (including domestic and overseas markets) and more than 400 foreign investment companies, covering a wide range of fields, including enterprise services, entertainment media, artificial intelligence, insurance brokerage, digital technology, education and training, medical services, real estate services, etc.

Although the byte beating business has no boundary, the flow realization cannot grow endlessly.

Under the "double reduction" policy, the education business with initial results has embarked on the transformation of education and training. After stopping the online education business of its education brand "vigorously education" at the end of 2021, the shutdown announcement was successively issued on the official website in February this year.

In the middle of January this year, there was a rumor on the Internet that the investment department of byte beat was abolished. The relevant person in charge of byte beat responded, saying that "the company checked and analyzed the business at the beginning of the year, decided to strengthen business focus, reduce investment with low synergy, disperse the employees of the strategic investment department into various business lines, and strengthen the cooperation between strategic research functions and business. Relevant businesses and teams are still planning and discussing." The implication is that the adjustment of the strategic investment department is true.

Byte beat has made a lot of efforts, but in addition to the advertising revenue brought by the original inherent short video and headline portal, there is little in other areas.

To this end, we have accelerated the layout of the international market and made rapid progress in the overseas market. It is not the consistent style of byte beating to place hopes on tiktok. It is reasonable to restart some business listing plans, and listing in Hong Kong has also become the first choice under this premise.

Hu Qimu told finance and economics that listing in Hong Kong is a good plan for the company. There are two main considerations, "First, the current situation of China equities is not optimistic in the near future, so it is a rainy day to consider returning to the capital market in Hong Kong. Second, from the perspective of domestic policy environment, the state has recently encouraged the healthy development of the platform economy, and the relevant specific policies are expected to be issued in the near future, which means that as a domestic Internet head platform enterprise, the development of byte beat's domestic business will usher in new policy dividends. Byte beat chose to package the domestic Tiktok business Listing is beneficial to both the valuation and the stock price trend after listing. "

Huqimu told Caijing that the listing of byte beat also has certain significance for the industry. "On the one hand, for byte beat itself, its business model has been verified by the market and recognized by investors. On the other hand, for the entire Internet industry, Tiktok listing can boost industry confidence, indicating that both investors and regulators are optimistic about the development of digital economy."

However, in the view of insiders, although the listing road of byte beating seems to have taken another step, it is still difficult to be optimistic if the boots don't fall to the ground. There are lessons from ant group and didi. As the saying goes, "the rabbit dies and the fox mourns, and things hurt their kind". Logically speaking, the same Internet giant should be dormant, but in the rapidly changing Internet era, those who lie for a long time may not be able to go far, and those who lie for a long time may not be able to fly high.

In this regard, Hu Qimu believes that as long as it can operate in strict compliance, there should be no major problems in the listing process. "The state has set up traffic lights for capital. In recent years, it has continuously improved the system of laws and regulations related to Internet information security, and the main assets of Tiktok listed companies are in China, which is in a safe and controllable range."

In short, whether listed or not, byte beating is facing multiple pressures. If it continues to be dormant and not listed, the pressure of capital withdrawal from the primary market will envelop the company. Choose homeopathic listing, how to deal with supervision and how to get a higher valuation. The above are all the problems that need to be faced in front of byte beating.

Recall what Zhou Rubo said at the 10th anniversary annual meeting of byte beat in March this year, "Yiming shared when the company was founded, 'if we take our career as a journey, then we want to see the most beautiful and best scenery. We don't linger on the middle of the journey, and we don't go astray by taking a clever path. Beautiful scenery is a vision, and the way forward is values'. I now add,' mission is the driving force for us to move forward '."

I hope to see the most beautiful and best scenery in the journey of "listing" as they wish.