U.S. residents may account for about 30% of the global cryptocurrency market, but this does not mean that the recent downturn will have a huge impact on the country's economy. This is the view of economists at Goldman Sachs. They pointed out that the recent sale of digital assets was "very small" compared with the net assets of residents, which reached $150 trillion last year. The valuation of the cryptocurrency market has fallen to about $1.3 trillion from $2.3 trillion at the end of last year.

"Therefore, we expect that the recent decline in cryptocurrency prices will also have a very small drag on total expenditure," economists led by Jan Hatzius wrote in a report on Thursday.

As cryptocurrencies and stock markets tumbled, economists and market observers were trying to figure out the possible impact on American consumers. A study found that for every dollar lost in the stock market, spending decreased by three cents. After five months of selling, this means a decline of about $300 billion this year. The renewed focus on this trend is because consumer spending accounts for 70% of U.S. GDP and many on Wall Street predict that the economy may soon fall into recession.

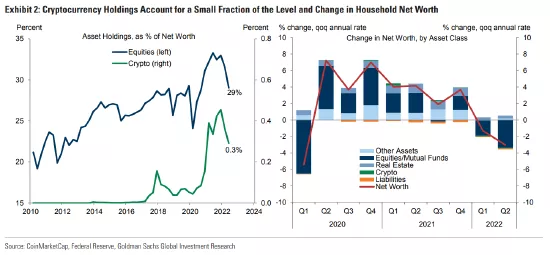

According to Goldman Sachs, crypto assets accounted for only 0.3% of residents' net assets, while stocks accounted for about 33% at the end of 2021. The recent decline in prices could lead to a reduction in net assets of about $8 trillion.

"This shows that stock price volatility is the main driver of changes in household net worth, while cryptocurrency is only a marginal contribution," Goldman Sachs economists wrote