"There is clearly a shop, but you can only squat outside the shop and watch the joint. It's the same as a special transaction!" Yesterday, a mobile phone dealer from Beijing in the circle of friends said roast. The life of mobile phone manufacturers is really difficult. Just these two days, the China Academy of communications and communications released data. In March, the domestic mobile phone shipment fell sharply by 40% year-on-year, and in the first three months of 2020, the shipment fell by about 30% year-on-year.

▲ screenshot of the author's circle of friends

▲ at the gate of a shopping mall in Beijing, the mobile phone salesperson conducted offline transactions with customers

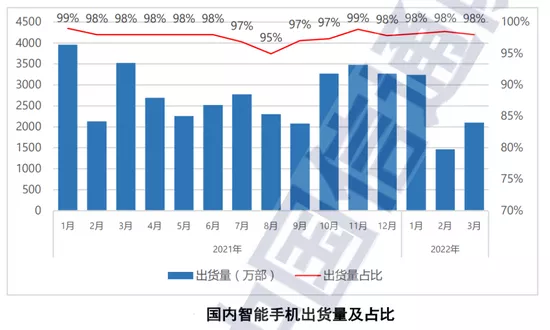

▲ domestic smartphone shipments, source: China Academy of communications and communications

On the other hand, the information of cutting orders came frequently from the supply chain. Guo Mingqi, an analyst at Tianfeng securities, revealed that China's mainstream Android mobile phone manufacturers have cut about 170 million mobile phone orders, accounting for about 20% of the shipment plan in 2022.

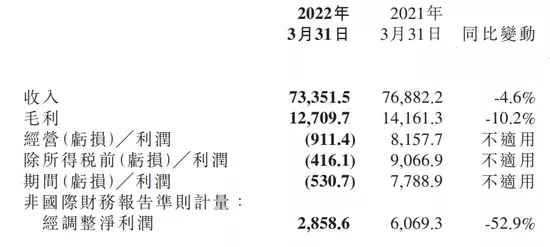

On the evening of May 19, Xiaomi released the first quarter financial report of 2022. The year-on-year decrease of 4.6% in revenue and 52.9% in net profit also showed that the life of mobile phone manufacturers was really hard.

▲ Xiaomi's revenue and net profit in the first quarter of 2022, unit: RMB million, source: Xiaomi's official financial report

Looking at the whole mobile phone industry, the inventory of mobile phone chip design manufacturers "hit new highs", the price of chip foundry increased overnight in order to sell production capacity in advance to avoid risks, mobile phone terminal manufacturers began to use "dolls" to clean up their material inventory, while mobile phone retailers were faced with shopping malls closed due to the epidemic, but sighed

This summer, mobile phone manufacturers may encounter an unprecedented "severe winter", comparable to the first quarter of 2020 when the epidemic just broke out, and this catastrophe swept the whole consumer electronics industry chain.

After having a dialogue with many practitioners and going deep into all links of the industry, we can deeply feel the "chill" brought by this severe winter, and it seems that winter is far away from spring.

Qualcomm's inventory soared by 70%, and global mobile phone sales may cut by 200 million

If mobile phone manufacturers can "lie about the military situation" and hide their real plight, the shipment and inventory performance of mobile phone chips can be the best example to expose the lie.

At present, in Apple In addition, from high-end to low-end, the mobile phone chip market is almost monopolized by Qualcomm and MediaTek, and the shipments of these two manufacturers can also be used as a "barometer" of the mobile phone market.

Turning to Qualcomm's first quarter financial report, we can clearly see that Qualcomm has ushered in the highest inventory in the first quarter in its history, with an inventory amount of US $4.55 billion (about RMB 30.6 billion), a year-on-year increase of 70% and a month on month increase of 18%.

▲ Qualcomm's inventory in recent five quarters, source: macrotrends

If we simply calculate according to the average price of $100 a set of chips for high-end smartphones, these inventories can produce about 45.5 million flagship phones.

From Qualcomm's inventory situation in recent quarters, it can be seen that Qualcomm's inventory has increased significantly since the fourth quarter of 2021, with a year-on-year increase of 50%.

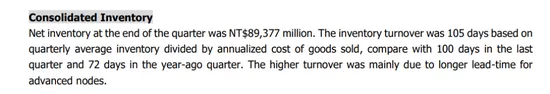

MediaTek, which accounts for the largest shipment of smart phone chips in the world, is also not optimistic about its inventory. In the first quarter of 2022, the inventory amount of MediaTek was close to NT $90 billion (about 20.3 billion yuan), and the inventory cycle was more than 100 days, compared with about 70 days in the same period last year.

MediaTek attributed the longer inventory cycle to the longer production cycle of advanced technology products, which translates into the slower supply of TSMC.

▲ explanation on inventory in the first quarter financial report of MediaTek

But obviously, this statement is not consistent with the views of people in the industry. Not long ago, a source told foreign media that the inventory level of MediaTek mobile phone chips has increased from about 100 days to 160-180 days, and the main reason behind this is the weak demand of Chinese mobile phone manufacturers.

When it comes to TSMC, we have to mention that in the field of chip OEM, the financial reports and actual actions of chip OEM enterprises also truly reflect that the consumer electronics industry represented by mobile phones is ushering in an unprecedented winter.

In May this year, it was reported in the industry that TSMC had begun to increase the price of mature process capacity in the first quarter of 2023, so as to promote chip design manufacturers to seize the time to place orders for all the capacity that had not increased the price in the second half of 2022.

You know, generally, TSMC's price increase notice is issued one month or quarter in advance. TSMC has never determined the price increase more than half a year in advance.

So why is TSMC so anxious? Industry insiders believe that TSMC's operation is obviously avoiding risks. Once the prosperity of the consumer electronics industry still does not improve and continues to decline next year, that is, 2023, TSMC has avoided risks in advance and transferred the inventory pressure to the chip design company.

It seems that the inventory pressure of chip design companies will not weaken in the short term, but will increase.

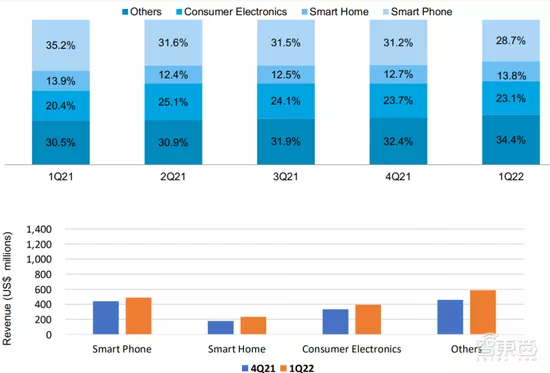

On May 13, SMIC international, the largest chip foundry in China, also released its first quarter financial report. The financial report showed that the proportion of Smartphone Application revenue in the first quarter of 2022 decreased by 6.5 percentage points year-on-year.

▲ changes and comparison of terminal application revenue of SMIC

Zhao Haijun, CEO of SMIC international, said that global mobile phone sales fell by at least 200 million in 2022, and most of the affected mobile phone brands were Chinese mobile phone brands. "A lot of orders have been cancelled," he said

At present, the production capacity of smart phones has decreased significantly from 29% to 50% of the international production capacity.

Zhao Haijun also mentioned that not only smart phones, but also customers in PC, home appliances and other fields are cutting orders. The blockade of the epidemic made it impossible for enterprises to deliver goods normally, and the closure of stores also hindered offline retail. The continuation of the conflict between Russia and Ukraine also significantly reduced customer demand in these two markets.

Although SMIC has carried out closed-loop management for the epidemic in Shanghai, the whole "long supply chain" is greatly affected by the epidemic, and there is still some uncertainty in the supply capacity in the second quarter.

It can be seen that from mobile phone chip design to chip OEM, the situation of the chip industry has clearly explained a problem. The development prospect of the mobile phone industry in the short term is not optimistic.

For the fatigue of the consumer electronics market, Ma Xiaomin, senior director of product marketing of Qualcomm, told Zhidong at a media communication meeting that Qualcomm is a chip manufacturer for global customers, and its business is not limited to smart phones. Even from the perspective of mobile phones alone, the overall impact is still controllable.

And Ma Xiaomin said that although the impact of the epidemic on China's mobile phone market is real, Qualcomm believes that this is a short-term process, and there is a great opportunity for the mobile phone market to rebound from June this year.

However, some chip company practitioners told Zhidong that the trend in the chip field shows that the prosperity of the whole consumer electronics industry is declining, and there is a high probability that the industry will still show a downward trend for a long time in the future.

Foxconn's largest factory has been unsealed, but the epidemic is still full of uncertainty

Not only the upstream mobile phone chip industry, but also the midstream mobile phone OEM industry is also deeply affected by this severe winter.

On the one hand, the order cutting behavior of mobile phone manufacturers will inevitably involve the whole middle and upper reaches of the industrial chain, and the orders will be cut simultaneously, as will the OEM orders.

On the other hand, mobile phone OEM is a labor-intensive industry. One of the main culprits of this severe winter, the COVID-19, has the most serious impact on the flow of people.

A person close to Foxconn's Zhengzhou plant said that some time ago, during the period of serious epidemic in Zhengzhou, Henan Province, Foxconn's Zhengzhou plant was once in the scope of closure and control, and production will certainly be affected, but at present, the area has been unsealed.

Henan Zhengzhou factory is Foxconn's largest [iPhone] in the world( https://apple.pvxt.net/c/1251234/435400/7639?u=https%3A%2F%2Fwww.apple.com%2Fcn%2Fiphone%2F ) The number of employees in the agent factory is up to 300000, which is equivalent to a small county. From May to June every year is the key period for the mass production of new iPhones. Therefore, once the epidemic intensifies and affects the production in the factory, it will inevitably have a certain impact on the release of new iPhones of apple.

▲ location of Foxconn Zhengzhou plant on the map

Although most areas of Zhengzhou have been released from the closure, according to the latest epidemic information, there are still confirmed cases in Zhengzhou in the aviation port area where Foxconn Zhengzhou factory is located. Therefore, it is still not easy to decide whether the subsequent epidemic will affect iPhone production.

▲ source: Zhengzhou local treasure

Similar to Foxconn's situation, there are also contract manufacturing enterprises of Lixun precision. Previously, relevant reports of Zhidong mentioned that many subsidiaries of Lixun precision are located in Shanghai and Kunshan, which are in the area significantly affected by the epidemic (the epidemic in Shanghai bites half the sky of Apple's supply chain).

However, at present, most of the domestic labor-intensive industrial parks adopt closed management, which is uniformly organized by the trade unions in the park to delimit isolation areas, living areas, work areas, etc. Therefore, the impact of the epidemic on production is still within the controllable range.

It can be seen that the mobile phone OEM industry is extremely sensitive to the impact of the epidemic. Once the epidemic intensifies and the mobile phone OEM business is blocked, the upstream parts manufacturers and terminal mobile phone manufacturers are really "powerless".

Mobile phone companies cut 30% of orders, offline shopping malls closed, and channels were seriously blocked

If the field of mobile phone chips and OEM reflects the severe winter encountered by the mobile phone market more laterally, then a series of actions of mobile phone manufacturers themselves have become the most direct representation of the severe winter.

Although mobile phone manufacturers will not admit that they are chopping orders, let alone publish chopping data, some industry information still comes out from the crack of the door.

Not long ago, it has been reported in the industry that in this wave of order cutting, Apple's order cutting is mainly concentrated in medium and low-end models such as iPhone se, with a reduction of about 20% - 25%. Samsung's order cutting volume reached about 30% in May alone, but the source did not explain whether it is the proportion of monthly orders or the proportion of annual orders.

▲ new iPhone se

On the side of domestic manufacturers, recent industrial chain information shows that oppo and vivo have cut orders by more than 20%, while Huawei and Xiaomi have cut orders by about 20%. There is no information about cutting orders from the glory side.

Although these data have not been officially confirmed, it is certain that cutting a single thing is not groundless, and the actual range is not small.

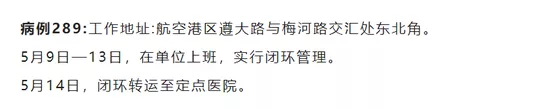

In addition, according to the sales data of the domestic mobile phone market in the first quarter given by the domestic market research institution cinno, the sales volume of oppo decreased by about 37%, the sales volume of vivo decreased by about 29% and Xiaomi by about 22% year-on-year. In contrast, the decline in sales volume is close to the order cutting range given by the industry.

▲ sales of Q1 mobile phone market in mainland China in 2022, source: cinno

On the one hand, mobile phone manufacturers are cutting orders. On the other hand, manufacturers are also cleaning up inventory by various means, or accelerating the replacement of inventory of new and old products.

In the past two days, there was news in the industry that the new mobile phone equipped with Qualcomm's 2021 flagship chip Xiaolong 8 just released by Xiaomi at the end of last year had been discontinued at the end of April, while Xiaomi will start to promote the flagship new phone equipped with Qualcomm's latest Xiaolong 8 + chip in the second half of the year.

Oppo and vivo also have some "overwhelmed" operations. In less than two months, the two manufacturers have released five or six new machines respectively, and most of these new machines are concentrated in the price range of 1000 yuan to 2000 yuan, which are more "walking machines".

Some new products are not significantly updated in configuration with the previous generation products of the same series, and they are also relatively close in appearance design.

For example, as soon as oppo sub brands were added, they successively launched two new machines with a price range of about 2000 yuan within one month. The chips are MediaTek Tianji 8000 series chips.

▲ one plus ace racing Version (left) and one plus ACE (right)

Oppo launched oppo K10 series and oppo Reno 8 series with MediaTek Tianji 8000 series chips; Vivo's S15 series and T2 series are equipped with last year's midrange chip Qualcomm Xiaolong 870. Some insiders said that when the inventory pressure is large, "dolls" will naturally increase.

▲ vivo T2 (left) and vivo S15 series (right)

In addition to miov, Huawei seems to focus on "how to provide 5g mobile phones to consumers" recently. Although there is no new phone, Huawei has made its mobile phone "turn into 5g" in various ways, or "change the face" of the old model, so as to realize 5g mobile phone sales through other brands.

For example, on May 13, Dingqiao communication released the 5g flagship smartphone Dingqiao TD tech M40. From the appearance point of view, this phone is very similar to the design of Huawei mate40, with a highly recognizable "star ring" design, which has always been a symbolic element of Huawei and glory.

▲ Huawei mate40 (left) and Dingqiao M40 (right)

According to public information, Xu Zhijun, the rotating chairman of Huawei, serves as a director of Dingqiao communication. The actual controller of Dingqiao communication is a company jointly invested by Huawei and Nokia. Dingqiao communication staff once said that Dingqiao's mobile phone brand is its own brand and belongs to Dingqiao, but the components are purchased from Huawei.

In addition, Huawei also launched a "5g mobile phone case" in cooperation with digital source technology. This mobile phone case can change the Huawei P50 Pro that originally supports 4G into a mobile phone that supports 5g communication. It is understood that the actual controller of digital source technology is Hangzhou SASAC.

▲ 5g communication shell products launched by digital source technology

It can be said that under such a severe winter, Huawei's strategy is also more conservative. Instead of releasing more 4G new phones, Huawei has obtained 5g new features for existing 4G phones through some "flexible" solutions. This is naturally more beneficial to the control of cost and supply chain.

Chinese mobile phone manufacturers are significantly affected, and it is difficult to find a turnaround in the industry

From mobile phone chips to OEM, and then to mobile phone terminal manufacturers, a severe winter sweeping the whole mobile phone market will continue to this summer. Among these phenomena, we can see an obvious feature that Chinese mobile phone brands have become the most seriously affected.

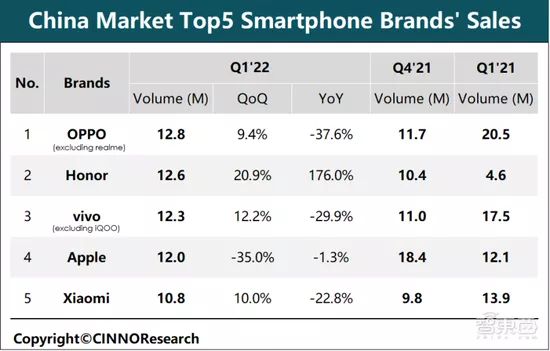

According to canalys data, in the first quarter of 2022, global smartphone shipments fell by about 11% year-on-year, while smartphone shipments in the Chinese market fell by 18%, far exceeding the overall market.

▲ shipments of global smartphone market in the first quarter, source: canalys

Domestic data can also show clues. According to the data of China Academy of information technology, the shipment of domestic smartphone market in the first quarter decreased by 29% year-on-year, while the shipment of domestic mobile phone brands in the first quarter decreased by 33.5% year-on-year, which is also higher than the overall situation.

Why did Chinese mobile phone brands become the most affected?

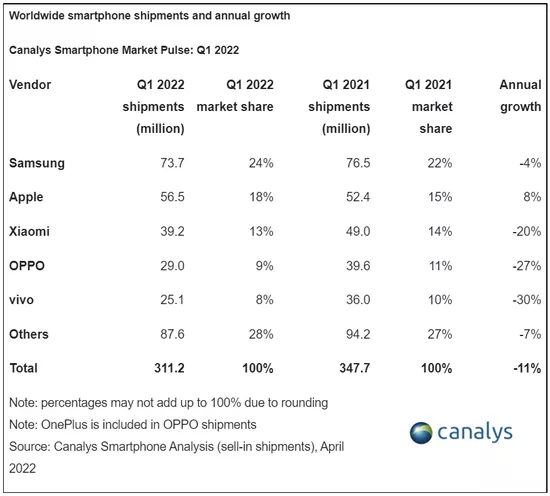

The epidemic situation is one of the most obvious factors. At present, the global epidemic situation has not been effectively controlled. The increasing number of cases in many overseas countries is more than 10000. Since the beginning of March, the outbreaks in Shenzhen, Shanghai and Beijing have also cast a shadow on the overall economic environment.

Although the domestic epidemic is not the most serious, the impact of domestic control measures on production and operation is relatively significant. Shanghai and Beijing have been significantly affected in these two rounds of epidemic.

▲ Shanghai (left) and Beijing (right) added local trend charts (monthly), data source: national, provincial and municipal health committees, as of May 20

A store manager of Xiaomi home in Beijing Tiantongyuan told Zhidong that the epidemic has a great impact on offline sales. Shopping malls are closed. Now they all work online. If old customers have demand, they can send express and flash. They also try their best to continue the business, but the reduction in performance is visible to the naked eye.

Before the end of the chat, the store manager did not forget to ask, "brother, what do you buy?"

In addition to Shanghai and Beijing, sporadic outbreaks of social epidemics have also occurred in some other provinces across the country. The previous closure and control in Shanghai has made great efforts, which has had a certain impact on production and operation and people's life, and also caused a great blow to consumer confidence.

Ordinary consumers have reduced the budget of "optional consumption" such as mobile phones and computers, and focused more on the necessities needed for life and work in the epidemic.

Of course, besides Chinese manufacturers, it is also an indisputable fact that the global mobile phone market is experiencing a severe winter. The epidemic situation, the conflict between Russia and Ukraine, global inflation and other factors are the key inducements of this severe winter.

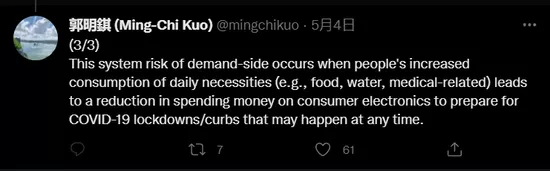

Guo Mingqi wrote on social media that global inflation is also one of the reasons for cutting orders.

Meng Wei, spokesman of the national development and Reform Commission, said that at present, the global COVID-19 has not been effectively controlled, and the supply bottleneck problem still exists. In addition, affected by the war between Russia and Ukraine, the international commodity prices fluctuated at a high level, and the prices of energy, grain and mineral products rose rapidly.

In April this year, the US CPI (consumer price index) rose by 8.3% year-on-year and PPI (producer price index) rose by 11%, of which the prices of food and energy rose by 9.4% and 30.3% respectively; On the other hand, the initial value of CPI in the eurozone increased by 7.5% year-on-year, higher than that in March, and continued to hit a record high.

With the superposition of global inflation and epidemic, the expenditure of ordinary consumers on daily consumer goods has increased significantly, while the expenditure on consumer electronic products has decreased. The demand for electronic products brought by home office is relatively short-term. In the long run, the reduction of user demand in the consumer electronic market has become a general trend.

CITIC Securities expects that the global smartphone market shipments in 2022 will be basically the same as last year, while the domestic market will decline.

▲ global smartphone shipment forecast in 2022, source: CITIC Securities

Guo Mingqi particularly stressed that the problems caused by the decline in demand are far greater than the difficulties encountered in product production, which is a potential systemic risk for all brands and upstream suppliers, especially in the second half of 2022.

"The lack of consumer confidence is a big problem. The order cutting of the whole consumer electronics industry will continue. Orders for almost all categories of consumer electronics products have been greatly reduced this year..."

Conclusion: the severe winter is a foregone conclusion, and it is still difficult to find the bright future

Previously, through in-depth investigation of the mobile phone industry, Zhidong analyzed the reasons for the cold sales in the mobile phone market at the beginning of 2022. In addition to the epidemic and geopolitical factors, the lack of innovation of mobile phones and the growth of user switching cycle are also the main factors leading to the cold in the mobile phone market.

But this time, going deep into all links of the mobile phone industry chain, we see that this severe winter is still intensifying, and even mobile phone manufacturers will experience a "coldest summer". In a short period of time, the weak demand, the impact of the epidemic on the supply chain, the conflict between Russia and Ukraine and global inflation will still be the heart diseases perplexing the mobile phone industry.

In fact, not only the mobile phone industry, but also various industries in the field of science and technology, including PC and automobile, have not been easy in the four or five months since the beginning of 2022. Who can clench his teeth to get through the difficulties, and who will be buried by blizzard in the severe winter? This severe winter will be a test of the hard power of each manufacturer.