On May 20, 2022, NiO was "re listed" on the Singapore Stock Exchange and became the first Chinese concept stock enterprise to be listed in the United States, Hong Kong, China (also "re listed") and Singapore. The opening price today was US $16.90/share.

It is worth mentioning that since 2020, considering the risk of delisting from the United States, many enterprises have gone to Hong Kong to seek "secondary listing", which is more convenient and fast. In the past few years, the Singapore Stock Exchange has also made efforts to attract more Chinese enterprises to list, but due to geographical location and liquidity concerns, the enthusiasm of enterprises was limited at that time. But the listing of Weilai automobile has undoubtedly set a precedent.

Xie caihan, chief representative of the Beijing Representative Office of the Singapore Stock Exchange, said in an interview with the first financial reporter that the "secondary listing" of China concept stock enterprises can disperse risks, and there are more and more relevant consultations. She said that the advantage of the "three places listing" is that in case of delisting from the US exchange, enterprises can choose Hong Kong or Singapore as the main listing place and maintain the "secondary listing" state of another place.

Wei Laimei, Hong Kong and new "three places listed"

According to the reporter, Weilai held a bell ringing ceremony at the Singapore Stock Exchange on the 20th. It is the first high-end enterprise listed on the NYSE and the leading enterprise in the smart car market. The company is engaged in the design, development, cooperative manufacturing and sales of high-end intelligent electric vehicles, and focuses on the innovation of automatic driving, digital technology, electric power assembly and battery.

"Today is a new milestone for Weilai. Weilai has further improved the layout of the global capital market through its listing in Singapore." Li Bin, founder, chairman and CEO of Weilai, said in the video speech. He said that taking advantage of Singapore's advantages as an international innovation and technology center, Weilai plans to establish an artificial intelligence and autonomous driving R & D center in Singapore and cooperate with local scientific research institutions to continue to expand and improve the company's global R & D capacity.

Wei has accelerated technological breakthroughs and innovations in recent years, such as its power exchange technology, battery rental service (baas), and self-developed automatic driving technology and automatic driving subscription service (adaas).

The listing of the company is undoubtedly a boost to the status of the Singapore Stock Exchange. In recent years, the competition among major exchanges has become more and more fierce, and China concept stock enterprises have become the main target.

Pol de win, executive vice president of Singapore Stock Exchange and head of global business initiation and development department, said on the 20th: "as Weilai uses Singapore to expand its contacts with global investors and as a springboard to expand its business in the region, we are fully prepared to cooperate with Weilai and help it achieve a blueprint for growth and sustainable development."

Different from the IPO listing, this time Weilai is an introduction listing, does not issue new shares, nor does it involve financing, but the company's shareholders apply for listing their old shares for trading, which is similar to Xiaopeng automobile, which was previously "re listed" on the Hong Kong stock exchange, but the significance still needs to be deeply read.

Previously, the securities and Exchange Commission (SEC) has added 88 Chinese concept shares, including Weilai and Xiaopeng, to the "pre delisting list". Weilai's listing in Singapore is similar to that in Hong Kong, which can increase trading locations, further mitigate geopolitical risks and provide international investors with more choices; On the other hand, it can deepen the layout of the global capital market and broaden overseas financing channels and platforms in the future. Singapore is an important international financial center. In recent years, Chinese enterprises have paid more and more attention to expanding the Southeast Asian market.

Zhonggai enterprises accelerate the launch of "plan B"

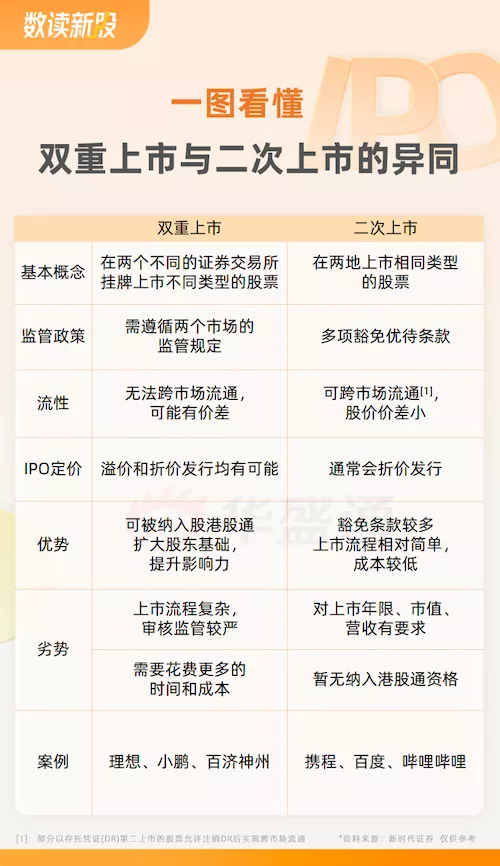

In fact, more and more China concept stocks have adopted the "plan B", that is, going to the Hong Kong stock exchange for "secondary listing" or "dual main listing". According to the reporter, the Singapore Stock Exchange, which was not the first choice earlier, is also taken into account by more and more enterprises.

Local time asked: on May 4, the SEC listed 88 Chinese concept stocks in the "pre delisting list", including jd.com, pinduoduo, bilibilibili, Weilai, etc., because it was unable to check the audit drafts of these companies. Insiders also told reporters that the list has increased rapidly recently, which is mainly related to the relatively concentrated time points of financial disclosure of listed companies recently.

In theory, before the regulatory authorities of both sides reach an agreement on China US audit and supervision cooperation, most China concept companies will enter the list. It is a normal step for the US Securities Regulatory Commission to implement the foreign company Accountability Act to enter the list and determine it after 15 working days. Entering the list does not mean that the company is bound to delist. Whether the company delisting depends on the progress of audit and supervision cooperation between the two sides. At present, the earliest time point for delisting is 2024, but the risk of accelerating to 2023 cannot be ruled out.

"Vice Premier Liu he recently reiterated the central government's support for companies wishing to list in the United States, which is a positive signal for China concept shares. Earlier this month, foreign media reported that Chinese and American regulators are about to reach a consensus on the audit compliance discussion of Chinese enterprises listed in the United States. According to our benchmark scenario, the two countries are expected to reach some form of agreement before the end of the year." UBS wealth management investment director's office told reporters that the punitive technology supervision cycle may be coming to an end.

Despite the continuous release of positive signals, enterprises still hope to make second-hand preparations. If Hong Kong and Singapore are selected as the "secondary listing" location at the same time, it is like "double insurance", that is, in case of delisting from the United States, one location can be selected from Hong Kong and Singapore for primary listing.

It is worth mentioning that BiliBili (station B), a short video platform listed in the United States and Hong Kong, has changed from "secondary listing" to "dual main listing", which was confirmed by the Hong Kong Stock Exchange in early May, the first case of China concept shares. In contrast, although the listing procedures of "secondary listing" are more convenient, the company cannot be included in the interconnection mechanism, and the enterprises with "dual main listing" on the Hong Kong stock exchange are expected to obtain more southward capital investment from the mainland.

Exchange competition is becoming increasingly fierce

In the past two years, the competition of global exchanges has become increasingly fierce. Due to Hong Kong's geographical advantages, it is undoubtedly the preferred "plan B" for China concept shares.

On November 19, 2021, the HKEx also announced the implementation of relaxing the requirements for the second listing, allowing companies that do not have the same share different rights (WVR) structure and whose business is concentrated in Greater China to be listed in Hong Kong for the second time, and the requirement that they should be "innovative industry companies" was deleted; At the same time, the minimum market value threshold is that the company only needs to be listed for 5 years with a market value of 3 billion yuan, or two years with a market value of 10 billion yuan, which is lower than the current requirements. The new regulations will take effect on January 1, 2022. The new stock exchange is also unwilling to lag behind. In addition to allowing "secondary listing", in June 2018, the Singapore Stock Exchange has launched the Listing Rules of shares with dual equity structure, which is similar to the Hong Kong Stock Exchange seeking reform after the loss of Alibaba.

In 2012, Manchester United intended to seek listing on the new stock exchange, hoping to adopt a dual equity structure. However, at that time, subject to the relevant rules of the company law, Manchester United finally abandoned the new stock exchange and transferred to the new stock exchange.

Chen Qing, managing director of the Singapore Stock Exchange and head of China, previously told reporters that in addition to allowing a dual equity structure, the Singapore Stock Exchange also offered Singapore capital market allowance (GEMS), raised the listing review time of the Kelly board to four weeks as soon as possible, and jointly established a corporate listing channel with NASDAQ.

In fact, the liquidity of HKEx may still be far less than that of the US market, and the liquidity of Singapore market was also one of the concerns of enterprises before. Chen Qing said this time, "IPO is only the first step. In terms of liquidity support, the Singapore Stock Exchange hopes to improve market liquidity through market maker policy and active trader model."

Author / Zhou Ailin